7 Mins Read

Shalom Daniel, CEO of mycelium meat company Mush Foods, tells Green Queen about why the brand’s ingredient is ideal for blended meat applications, why anti-meat investors believe flex meat is the solution, and its mission to halve global meat consumption.

This article is part of our content series exploring the world of hybrid and blended meat products – those blending cultivated or conventional proteins with plant-based ingredients, respectively, and why some think this is the future of reducing meat consumption.

People love a good burger. It could be the umami hit, the succulent mouthfeel, or maybe even the condiments. But you know who doesn’t love a good burger? The planet (and oh, the cows).

But there’s a solution waiting for consumers wanting to reduce their meat consumption: plant-based meat. The problem with the Beyonds and Impossibles of this world, however, is that as alternatives to ‘the real thing’, they command higher expectations from people eating them.

A 1,500-person survey by Kerry Group earlier this year – covering the US, UK, Australia and Brazil – revealed that consumers have greater taste expectations for vegan burgers than conventional ones, adding that great flavour is key to the sector’s success. Last year, an even larger 8,000-consumer poll across the US, UK, France and Germany found that about half of respondents “greatly preferred” the taste of animal protein over plant-based alternatives.

Companies working with blended and hybrid meat say they’re offering a solution. 50/50 Foods, for example, makes a half-beef, half-vegetable burger so people can “have their meat and eat it too”. To explain the appeal, its founder Andrew Arentowicz told me that the company simply put flavour enhancers like roasted mushrooms and caramelised onions – typically used as burger toppings – inside the burgers.

You could argue that this makes cooking easier and cut costs for chefs and home cooks alike, without compromising on the taste. This is echoed by Shalom Daniel, co-founder and CEO of Israel’s Mush Foods: “A blended solution appeals to those who want to consume less meat, [and] to the foodservice industry who looks for innovation and cost efficiencies, and all without sacrificing taste.”

A plug-and-play mycelium ingredient for blended meat

Unlike many blended meat brands, which combine conventional meat with vegetables, Mush Foods is taking a slightly different approach to blended meat.

In March 2022, a small peer-reviewed consumer study – using data from September 2019 with 172 US participants – unearthed some interesting revelations. While people still favour a 100% beef burger over any alternatives, they chose a beef-mushroom blended burger over a yeast-based ‘animal-like’ patty and a pea protein one in a blind taste test. The results became more intriguing when the participants were told about what was in the meat –they chose the yeast protein patty over the blended in an informed taste test. “When consumers know more about the ingredients of the blended burger, the demand decreases,” concluded the study.

This leaves blended meat brands in a bind: consumers like the mix of meat and vegetables, but only until they know that meat and more realistic alternatives exist. Mush Foods is splitting the difference. It makes a mushroom-derived mycelium protein ingredient tailored to be paired with conventional meat that enhances the latter’s flavour profile. “With Mush’s mycelium blends, the natural flavours of the meat truly come out,” notes Daniel.

The startup’s mission is to cut global meat consumption by half. But doesn’t blending a mycelium meat ingredient with animal protein feel counterproductive, I ask Daniel? His reply? Not at all. “If we are realistic, it is unlikely that 100% of the global population will become vegan. In some countries, meat will remain a symbol of growing personal wealth, and that won’t change,” he explains.

“But we don’t need the entire world to go vegan to have a positive impact on our food supply and environment,” he adds. A recent study showed that replacing meat and dairy with plant-based alternatives can reduce emissions by a third, halt deforestation and double overall climate benefits. “Part of this equation is that mushrooms require less water and land than cows for production. Mush is pure mycelium – we are not using pre-existing raw ingredients like pea, soy, wheat, etc., so are not tapping additional crops,” Shalom explains.

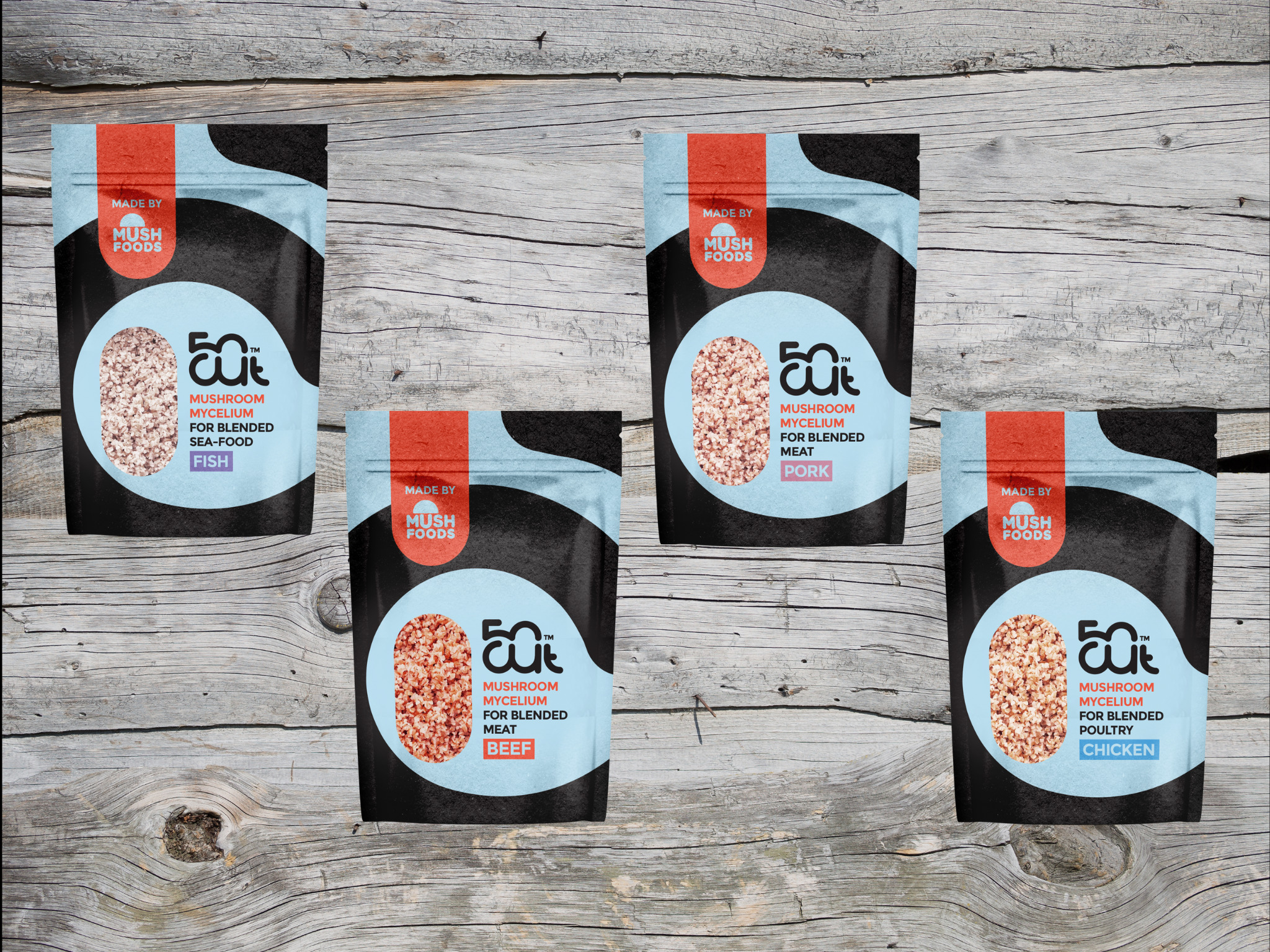

“To create the ideal match for specific animal proteins, we grow different 14 species of mycelium and then custom-tailor the blend to partner chicken, beef, pork and fish. The process involves mixing two to three different species of mycelium to produce the exact moisture level, binding ability, taste, colour and texture to complement the unique qualities of each kind of animal protein. Every blend looks and tastes different, as each of the target animal meats has [its] own characteristics.”

Launch plans and investor support

Mush Foods’ mycelium is grown on organic substrates “without any additives or seasonings”, in a circular process that involves using upcycled food waste from agricultural sidestreams. It released its first product line, 50CUT, earlier this year, offering foodservice operators a plug-and-play ingredient to blend conventional beef with. The range now has six varieties that pair with specific types of meat, including chicken, fish and pork.

The company plans to build pilot plants in the US and launch sales in Q1 next year. For now, it’s working exclusively with foodservice companies as a B2B operator. “We are working efficiently and avoiding expending energy by competing in areas like distribution, retail agreements, branding, etc.,” explains Daniel. “Our approach is to collaborate with big players and bring new versions of product favourites to market, or create new blended product lines.”

Mush Foods is still new to the US market though it is already in discussions with “several notable foodservice companies” and the chef community. It will soon launch pilot tasting events nationwide though the company has no plans to manufacture blended products via a B2C model. “We’ll stick to what we know,” says Daniel. “We cultivate products that the meat and food industries can easily use and blend without having to invest in new capital, change their manufacturing processes, or learn new methods.”

Speaking of investing, the company’s main backers include tech VC leader Viola Ventures, The Kitchen FoodTech Hub incubator, and alt-protein VC firm Milk & Honey Ventures in Israel, and Siddhi Capital in the US, among others. “We’ve found investors – including those who are strongly anti-meat – are committed to the welfare of the planet and animals and see the blended solution as an immediate and achievable means of reducing meat consumption,” says Daniel.

“Mush’s proprietary growing technology allows for mass scalability, thus providing far greater potential in a much shorter time period than any other food tech category.” While it takes over a year to farm cows for meat, and around four months to grow soy, it only takes eight to 10 days to grow mycelium.

Better marketing is paramount

Scalability and affordability may not be as much of an issue – but appeal certainly is. In November last year, a pilot study of 4,000 employees from various financial businesses in New York revealed that Mush Foods’ 50CUT blended beef and mycelium burger ranked the highest out of 11 main dish options. But, as Daniel attests, marketing remains a big hurdle for blended meat. “What’s been done to date hasn’t resonated, whether it be by a smaller CPG or a well-known brand.”

Take German retailer Aldi, for example, which received backlash for launching a BBQ Flexitarian Burger made from beef and beans in 2019 – the product has since been phased out. Tesco, meanwhile, launched a Lean & Greens range combining chicken with vegetables in 2021, but the reviews are not great, either for flavour or misleading messaging.

Even Tyson, the world’s second-largest meat producer, launched blended beef and pea protein burgers and nuggets under its Raised & Rooted range in 2019, only to withdraw the products a year and a half later. “The Raised & Rooted Blend will be discontinued as we constantly evaluate products working alongside our customers and consumers,” a Tyson spokesperson said at the time.

If not a hurdle, per se, consumer sentiment needs serious navigation, says Daniel: “Consumers would not give up on taste and texture of real meat.” Paul Shapiro, CEO of The Better Meat Co, which also makes a mycelium ingredient for use in blended meat products, agrees. “It’s imperative that hybrid meat be marketed as enhanced meat – something better than a product that’s solely animal meat,” Shapiro tells me.

Can Mush Foods give people what they want? “We’re on a mission to provide the same sensational experience [as conventional meat], without any comparison on nutrition,” says Daniel. “Mush Foods fully delivers the goodness and taste of real meat, but with the added benefit of being able to eat less of it.”

Read the first instalment of this series: an interview 50/50 Foods CEO Andrew Arentowicz.

The post Mush Foods CEO on Blended Meat: ‘We Don’t Need the Entire World to Go Vegan’ appeared first on Green Queen.