Unlike its rivals, Canada’s agrifood tech sector is built on public investment, which leaves a “venture capital gap” – and Trump tariffs threaten to further complicate things.

Plant proteins, functional foods, and food waste solutions are the top domains in Canada’s agrifood tech ecosystem, but despite “notable growth”, a lack of private sector funding has left the country “significantly behind” global competitors like the US and Canada, a new analysis has found.

Canada is home to 320 agrifood tech startups and scale-up companies, which have collectively raised $2.9B since 2014 – but puts the nation 13th globally in terms of investment.

And despite food tech firms comprising 75% of the sector, they have only received 56% of the investment share in the last decade, much lower than the global average of 83%.

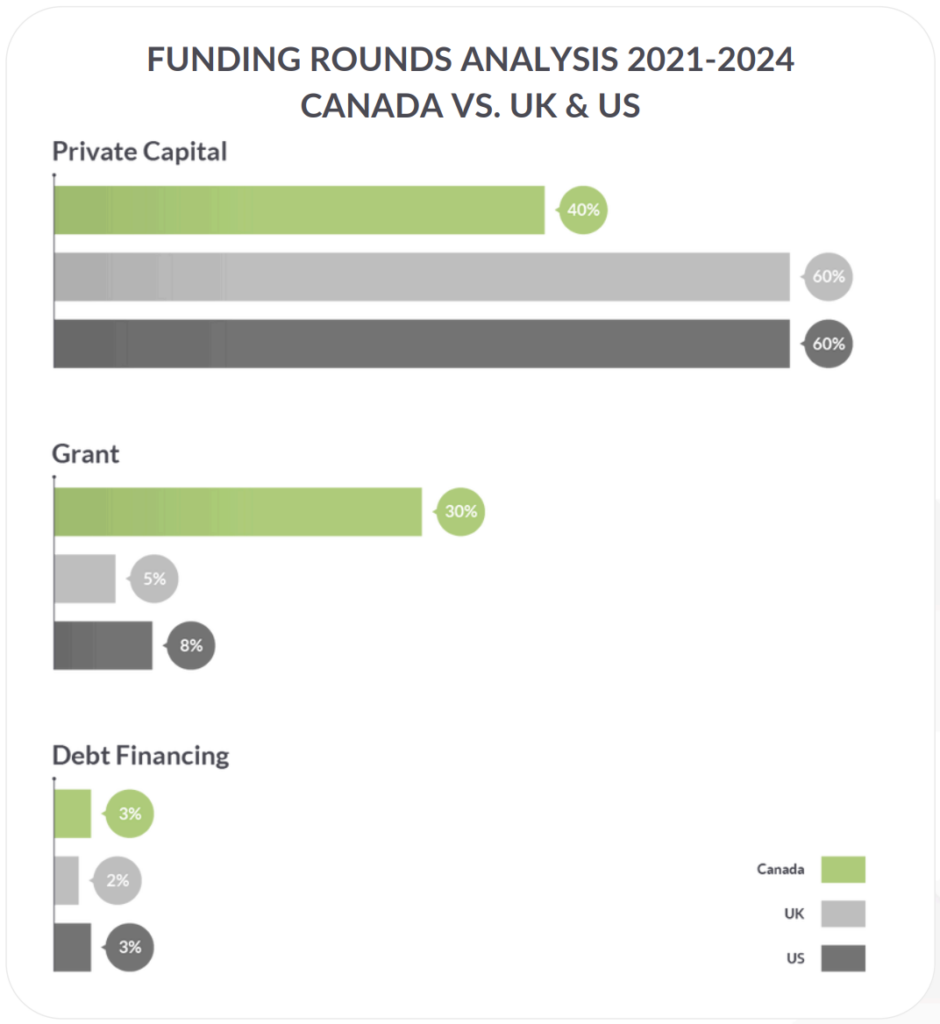

The report by the Canadian Food Innovation Network ascribes this to “limited private capital” – venture capital backs only 40% of food tech rounds in Canada (compared to 60% in the UK and the US), while government grants take up a 30% share, much higher than in the UK (5%) and the US (8%).

Finding the balance between public and private funding “will be key to unlocking the full potential of Canada’s food tech sector” and making the country a global leader, said Cam Crowder, founding general partner at Redstick Ventures.

The inaugural Foodtech in Canada 2025 Ecosystem Report analysed data from food tech ecosystem platform Forward Fooding, covering over 9,950 companies across the world over a 10-year period.

Venture capital gaps have ‘profound implications’

Since 2018, agrifood tech startups in Canada attracted $1.6B in funding from both private and public investors – but this is a far cry from the $8.8B their counterparts secured in the UK, and the $86.6B raised in the US.

One of the issues is the size of larger funding rounds. At pre-seed and seed levels, investment sums in Canada align closely with those of the US and the UK. But the gap widens with Series A and Series B rounds, whose sizes are about half as big in Canada. Series C rounds, meanwhile, are only a third of the size seen stateside.

“This discrepancy may represent a significant barrier for Canadian food tech startups seeking access to growth capital,” the report notes. “These gaps carry profound implications, including challenges in scaling operations, building supply chains, meeting regulatory requirements, and achieving strong exit opportunities.”

This is compounded by the multi-pronged challenges facing the agrifood tech ecosystem in Canada, which include lagging productivity, labour shortages, supply chain complexities, and climate change.

“Rising temperatures, extreme weather events, and shifting precipitation patterns are already hampering agricultural production, disrupting supply chains, and impacting food quality,” reads the report.

“These challenges increase costs for producers and heighten vulnerabilities across the sector, demanding greater investment in climate-resilient practices and technologies to ensure long-term sustainability and food security.”

Plant-based sector a bright spot

Despite the obstacles, Canada’s agrifood tech sector has “significant untapped potential”, which could be unlocked with a greater focus on sustainable foods.

Outside of on-farm innovation, the plant-based sector is “central to the country’s broader food tech ecosystem”. Valued at $1.7B in 2023, this category represents 26% of all food tech firms in Canada, greater than the 14% proportion globally.

Firms making plant-based meat, seafood, dairy and other ingredients have commanded 12% of food tech funding to date in Canada. The country’s landscape provides B2B opportunities for innovation with functional ingredients like pea and soy proteins, the two most popular ingredients for meat analogues.

But the presence of B2C operators remains limited, as they’re often less capital-efficient and represent a greater risk for investors.

These companies face a host of challenges that could impact the sector’s growth trajectory. For example, plant-based foods are often more expensive to produce, with meat alternatives priced at least 30% higher due to high production costs, specialised ingredients, and smaller-scale processing.

Taste and texture also continue to be a barrier for Canadian consumers, which is why the report calls for further product innovation to alleviate these concerns. Moreover, varying labelling requirements and a complex regulatory landscape complicate market entry and consumer understanding.

If these issues are addressed, Canada’s plant-based sector “can strengthen its position both domestically and as an exporter, aligning with consumer demand and supporting sustainable growth in food tech”.

In addition to plant-based foods, biotech-enabled functional ingredients, upcycled foods, and food waste solutions are the strongest verticals in Canada’s food tech industry.

Trump tariffs a threat to Canada’s food tech ecosystem

The Canadian government has led the way in terms of support for plant-based food. Protein Industries Canada, a public-private partnership for alternative proteins and one of the country’s economic clusters, has invested more than $105M into projects that promote sustainable protein production and innovation, encouraging collaboration across the value chain.

Speaking of the government, the tussle with President Donald Trump’s administration over tariffs could have major implications for Canada’s food tech sector.

Trump announced a 25% tariff on imports from Canada, before the latter’s outgoing Prime Minister Justin Trudeau responded with his own 25% tariffs on products sourced from its neighbour. The dispute is currently on hold, with Trump delaying the move by at least 30 days.

But the US is Canada’s largest export market, taking up over 77% of the share, so any tariffs would hit both countries’ economies hard. In the agrifood tech context, it would make meat alternatives and plant-based dairy products from brands like Gardein, Daiya or Bettermoo(d) more expensive for Americans. This, in turn, could hurt the bottom line of Canadian firms – and the opposite is true too if Trudeau’s retaliatory tariffs come into effect.

With more than 60 companies specialising in plant-based foods in the country, any such tariffs from the two neighbours would be a blow to Canada’s largest food tech category.

The post Plant-Based Sector Central to Canada’s Food Tech Economy – But Funding Gap & Trump Tariffs Threaten Progress appeared first on Green Queen.

This post was originally published on Green Queen.