Food prices are skyrocketing in the US, and President Donald Trump’s tariffs on its neighbours and China could make it harder to access alternative proteins when they’re needed more than ever.

The continued discourse against ultra-processed foods, legislative efforts to ban cultivated meat, and rollback of key climate policies have all been signs that alternative proteins may not have it easy under Donald Trump’s second stay in the White House.

Now, with his tariffs on imports from Canada, Mexico and China officially coming into effect, things might just get even bleaker.

All products imported to the US from China now carry a 20% tax (versus 10% previously), rising to 25% for all Mexican products and most Canadian ones. In response, outgoing Canadian Prime Minister Justin Trudeau has announced a retaliatory tariff of 25% to be placed on over $100M worth of products over the next three weeks.

China, too, is imposing an additional 10-15% tax on a range of foods. And Mexico President Claudia Sheinbaum confirmed her country will also impose tariffs on the US, with the affected products set to be announced this weekend.

Trump isn’t stopping his trade war here, though. He has teased another 25% levy on imports from the EU, and announced additional tariffs on “external” agriculture products starting next month.

Inflation continues to bite consumers. Take eggs, for example, which have never been more expensive in the US, a crisis that has highlighted the supply potential of plant-based alternatives. However, these tariffs could further complicate matters for the alternative protein industry, impeding its efforts to provide a solution to food shortages and sky-high prices.

From oat milk to plant-based meat, get ready for even higher prices

Food already cost 2.5% more this January than 12 months prior, and the US Department of Agriculture predicts that overall food prices will rise by a further 3.4% in 2025.

The tariffs will most likely worsen things – analysis from Congressional Democrats on the Joint Economic Committee has found that food costs might increase by 2% as a direct result of Trump’s decision, costing American families up to an extra $2,000 per year.

Mexico, China and Canada are the US’s three largest trading partners, accounting for 42% of the latter’s imports. The tariffs may not directly impact the price tag of a packaged food product – but they will raise the cost of imported raw materials and equipment for domestic manufacturers, which in turn would lead to higher on-shelf markups.

A recent report from Pitchbook explains that the tariffs would impact alternative protein companies too. This is because China supplies raw materials, processing equipment, and packaging materials, while the EU provides specialised ingredients and machinery. Moreover, restaurant and grocery e-commerce in Mexico and Canada supply fresh produce and packaged goods.

“Tariffs are expected to increase operational costs for food tech companies due to higher prices for imported goods and materials. Such an increase could lead to reduced profit margins and potential price increases for consumers,” outlines Pitchbook.

For example, most of the oat supply in the US is imported from Canada – in fact, Oatly too uses Canadian oats for its US market. Since grains are one of the categories impacted by the tariffs, consumers could end up paying more for oat milk.

Likewise, meat alternative makers that use avocado or canola oils (such as Beyond Meat and Tofurky, respectively) could also face higher costs thanks to the levies on Mexican and Canadian imports.

With egg prices breaking records, plant-based alternative manufacturers like Eat Just have seen sales and demand grow quickly over the last few weeks, proving to be a crucial solution to empty egg shelves and prohibitive costs. Again though, for its Just Egg, the company sources mung beans from various parts of the world, including Asia and Africa – could Trump’s upcoming tariffs on international agricultural products threaten its momentum?

A supply chain overhaul incoming?

Farmers will arguably be even worse off with the tariffs. Greater levies on potash and fertilisers – imported in large quantities from Canada – will make it more expensive for American farmers to grow crops.

Minnesota Senator Amy Klobuchar, the highest-ranking Democrat on the Senate Agriculture Committee, believes the tariffs “will make it harder for Americans to put food on the table and will squeeze farmers who will lose valuable export markets and see higher input costs”.

And while retaliatory tariffs from China could weaken demand (and thus prices) for crops like soybeans, corn and wheat, the impact wouldn’t necessarily be reflected in grocery costs. It is farmers who will be affected, compounding their ongoing struggles to sustain income levels.

Many manufacturers, meanwhile, may need to shore up their domestic supply chains to stay ahead of the tariffs’ repercussions, either by switching or acquiring suppliers. This may also impact employment – analysis from the Federal Reserve found that manufacturing jobs were among the biggest casualties of Trump’s 2018 tariffs, thanks to higher input costs and retaliatory tariffs.

All this raises an important question: who do the Trump tariffs benefit here? Companies that have their ducks in a row with their sourcing and supply chain – with local raw materials and a domestic manufacturing setup – could stand to win.

With the US having poured tens of millions of dollars to ramp up biomanufacturing, there is an opportunity here – although as a business, having deep pockets will become even more important.

Arturo Elizondo, co-founder and CEO of animal-free egg maker The Every Company, told Green Queen last month: “The biggest risk is any retaliatory tariffs which might affect our supply chain, but we’ve planned ahead by building redundancy.”

Tariffs could scare off investors

And that takes us to another important implication of the tariffs: private investment. Venture capitalists’ interest in climate tech is waning fast, with funding down by 38% last year. Financing of food and land use solutions, meanwhile, only makes up 18.5% of climate tech capital, despite the industry causing a third of all emissions globally.

Alternative proteins had it even worse. After investment dropped by 44% in 2023, it fell by a further 27% last year, thanks to large declines in venture capital for plant-based food (-64%) and cultivated meat (-40%). Only fermentation startups saw a funding increase in this sector (43%).

With the tariffs creating further uncertainty for these companies, investors may become even more cautious with their cash this year, threatening businesses working to safeguard the future of food.

VCs have highlighted how the trade war between the US and these countries is likely to lower valuations, decrease exits, and give investors pause in terms of deployment – and this would cause a ripple effect on the food tech ecosystem too. Stock market volatility is also likely to continue as the fallout from the tariffs takes shape.

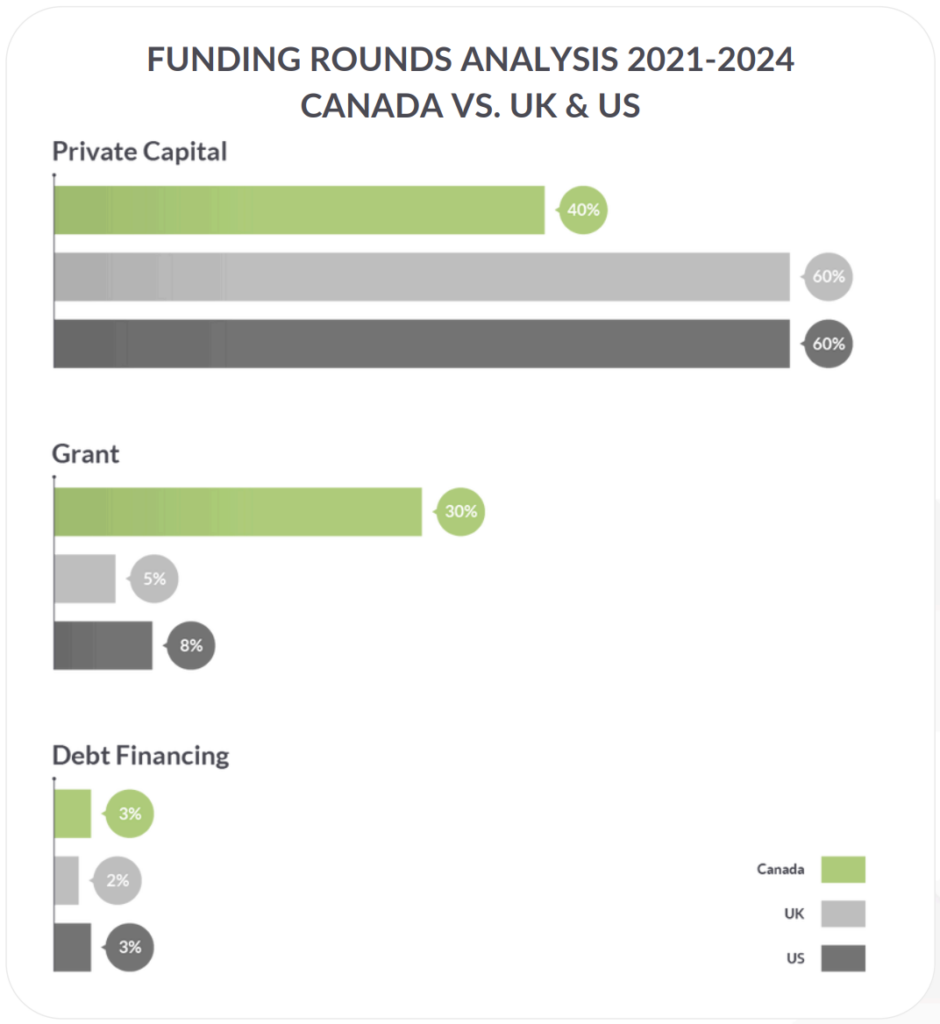

And it’s not just American companies that will feel the effects. The US is Canada’s largest export market, taking up over 77% of the share, so the tariffs are likely to hit both economies hard. Public financing represents a much larger chunk of food tech funding in Canada (30%) than in the US (8%), and plant-based food accounts for 12% of all investments in the category, making it “central to the country’s broader food tech ecosystem”, a recent report suggested.

Plant-based foods are also often costlier to produce, thanks to specialised ingredients and smaller-scale processing. So private investment needs to be significantly stepped up, since the gap with public funding carries “profound implications, including challenges in scaling operations, building supply chains, meeting regulatory requirements, and achieving strong exit opportunities”.

All said, the tariffs have promised an even more uncertain period for alternative proteins and food tech – with farmers, manufacturers and consumers all left worse off, for the most part. How they will make America cheap again, only time will tell.

The post Make America Cheap Again: How Trump’s Tariffs Will Impact Food Tech & Alternative Protein appeared first on Green Queen.

This post was originally published on Green Queen.