US sales of plant-based food fell by 4% and 5% in retail and foodservice last year, respectively, but they held steady above the $8B mark for the third year in a row.

Despite widespread sales declines across the plant-based category, more Americans now like the taste of these foods, while health concerns continue to drive many away from animal proteins.

The slowdown of the vegan food sector has been well-documented over the last couple of years, though there are several caveats to it: some segments are more popular than others, household penetration remains strong (59%, with a 79% repeat rate), and the industry is better off now than it was in 2020 (at least in term of sales).

For instance, Americans spent 4% less on these foods in supermarkets last year, while foodservice sales were down by 5%. At $8.1B, retail purchases were still up by 14% compared to the beginning of the pandemic, with foodservice seeing a 19% increase ($289M).

“Given the enormous diversity of the plant ingredients that make up its products, the unique and compelling opportunities to foster customer loyalty and generate substantial incremental sales are essentially boundless,” notes the Plant-Based Foods Association (PBFA) in its 2024 State of the Marketplace report.

Here are the key takeaways from the research:

While health is a critical lever, taste is gaining ground

According to PBFA’s analysis of Kroger shopper data with the retailer’s insights firm, 84.51°, two in five Americans are reducing milk intake in favour of plant-based alternatives, and a quarter are doing the same for fresh meat.

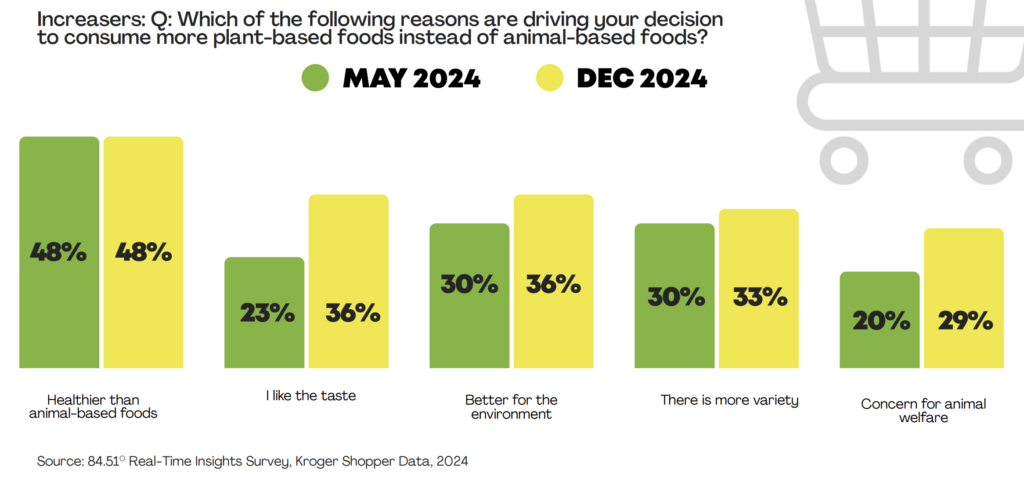

Asked why they’re making the switch, nearly half (48%) said they felt vegan foods are healthier, and 36% wanted to eat fewer animal proteins due to personal health concerns.

Interestingly, though, the share of consumers motivated by health remained the same at the end of 2024 as it did six months prior, but rose across a number of other factors. Only 23% said they were shifting from animal- to plant-based foods because they liked the latter’s taste in May, and this grew to 36% in December.

Similarly, 36% agreed they’re better for the climate (versus 30% earlier in the year), and 29% were doing so out of animal welfare concerns (compared to 23% in May 2024).

When assessing how companies can attract more consumers, there was a clear winning factor: price promotions. Discounts and coupon offers would make it easier for 63% of Americans to buy plant-based foods, followed by more recipe ideas (34%) and greater education about these products (31%).

2024 saw the resurgence of coconut milk

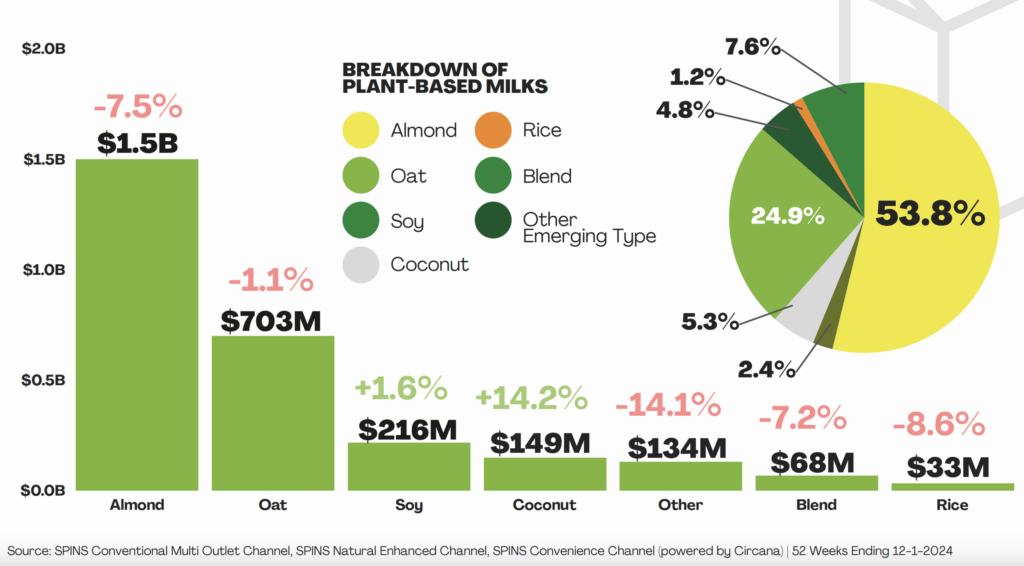

While sales of plant-based milk fell by 4% in 2024, at $2.8B, this is comfortably the largest segment in the sector, accounting for 35% of all sales.

Almond milk remains the dominant alternative (capturing 54% of the market), though Americans spent 7.5% less on it last year. Oat milk flatlined (-1%) and rice milk was down too (-9%). Soy milk, however, saw a minor increase (2%), and coconut milk enjoyed a growth of 14% (reaching $149M).

Despite the spate of new plant-based milks – from pistachios and pecans to sunflower seeds and bananas – these emerging products saw a 14% decrease in sales, as did products that blend multiple ingredients for their base (-7%).

However, plant-based milk did see a significant increase in dollar and unit sales in foodservice last year, outpacing the growth of conventional dairy.

Whole cuts represent a major opening for plant-based meat

Meat and seafood analogues suffered from a 10% annualised decline between 2022 and 2024, reflecting the challenges facing the category’s poster-child segment.

That has come amid a renewed appetite for meat, which saw record sales in the US last year, as the manosphere and political shift changes the way Americans eat now. Vegan meat has also been plagued by the ultra-processed food tag, exacerbated by health secretary Robert F Kennedy Jr. PBFA’s research shows that people who believe plant-based foods “contain excessive artificial ingredients” rose from 20% to 25% in the past year.

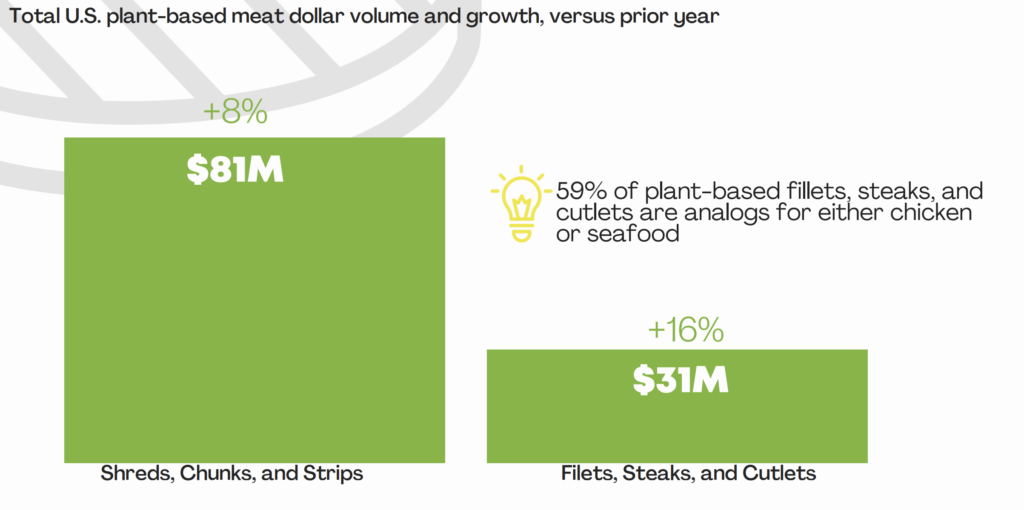

Vegan alternatives to meat and seafood only reached 13% of US households last year, though retained a strong repeat purchase rate of 63%. And not all products fell out of favour: shreds, chunks and strips saw sales grow by 8%.

Whole-cut analogues such as steaks, filets and cutlets – 60% of which are either chicken or seafood analogues – experienced an even larger increase (16%), outlining the opportunity for companies in this space.

Tofu takes over the US market

The report mentions a “growing consumer preference for plant-forward foods that highlight plants and their application potential as distinct and limitless, rather than an industry confined to solely mimicking animal products”.

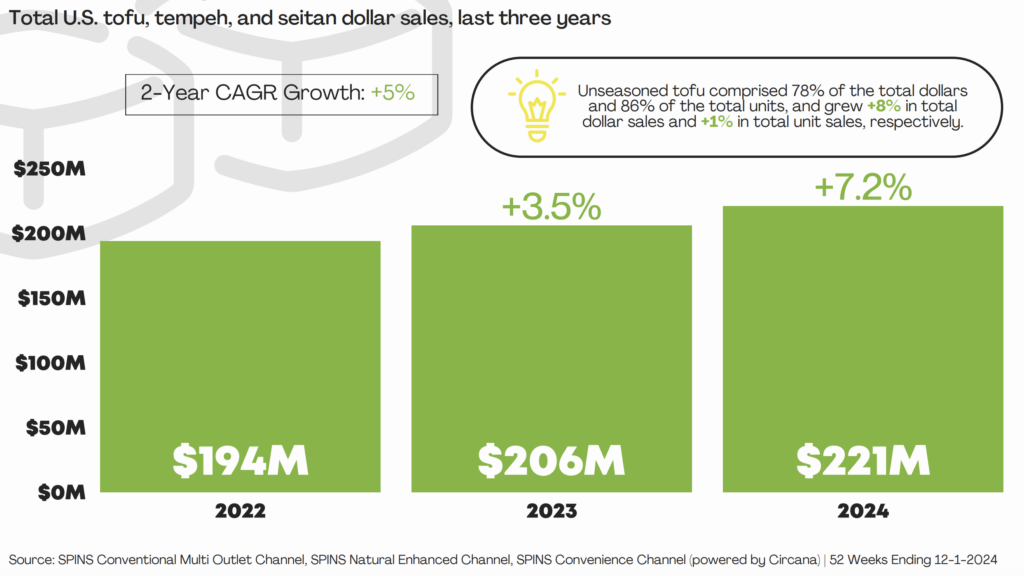

Indeed, as meat analogues falter, traditional plant proteins like tofu, tempeh and seitan are gaining ground. These products racked up $221M in dollar sales last year, a 7% increase from 2023 and unit sales were up 6.5%.

Unseasoned tofu performed “exceptionally well”, recording a 10% growth in dollar sales and capturing 78% of the tofu market. That said, these age-old products still only ended up in 7% of homes in 2024, although 59% returned to the store for more.

Other categories that experienced a significant retail boost in 2024 included protein powders and liquids (+11%), and baked goods (13%).

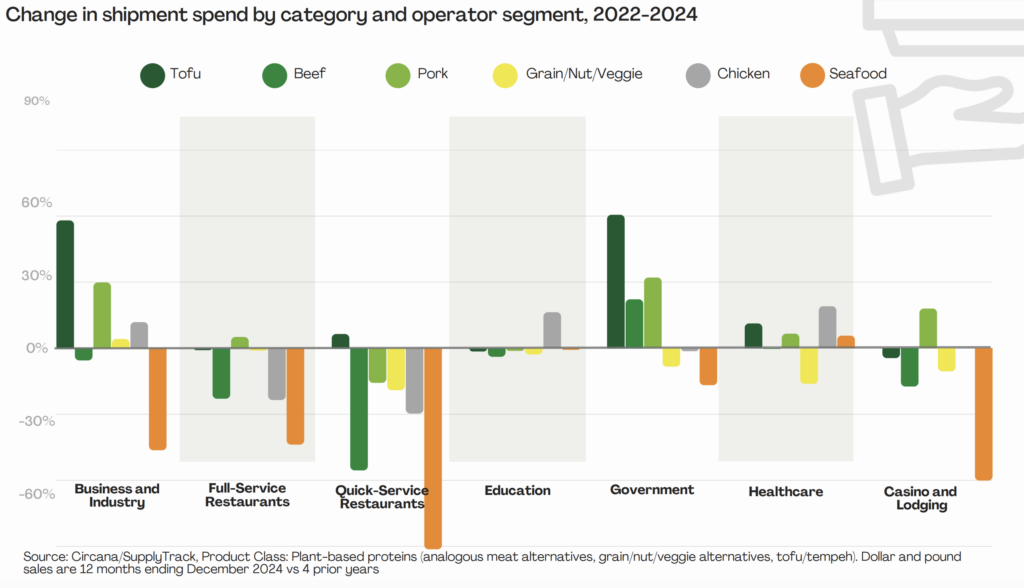

Further, tofu emerged as a star ingredient in foodservice, witnessing the largest (and in some cases, only) increases in this segment last year. Government catering services spent nearly 60% more on tofu in 2024, with business and industry operators coming close.

Animal protein prices are on the rise – plants are not

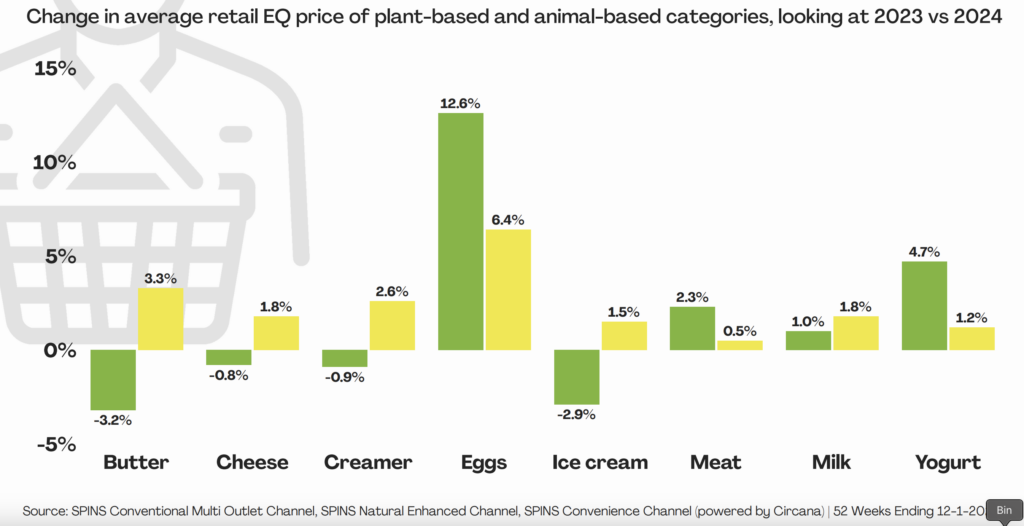

One of the most common complaints about plant-based food is its still-significant price gap with meat, dairy and eggs. However, PBFA’s report shows that the supply chain volatilities of 2024 hit animal proteins harder.

The average retail price grew across all animal-based food categories, with eggs unsurprisingly registering the largest hike (6%), followed by butter (3%), creamer (3%), and cheese (2%).

At the same time, prices for four plant-based categories actually declined. Vegan butter and ice cream were 3% cheaper in 2024 than the year before, while the cost of non-dairy creamers and cheese fell by 1%. And while milk alternatives were 1% more expensive, their price hike was lower than the 2% experienced by cow’s milk.

Vegan yoghurt and plant-based meat were among the only categories whose prices rose faster than their conventional counterparts. While eggs were also shown to have an increase, previous research shows that data on unit sales and price changes here is somewhat skewed as the market-leading product shifted to a larger pack size and thus a comparably higher price point.

“While interest in plant-based remains strong across categories, we’ve entered a new stage of the adoption curve: today’s consumers are motivated by different factors than before,” said Hunter White, plant-based category manager at KeHe Distributors. “Across our network, we see clear opportunities for clean-label products that align with broader food trends like high protein content, innovative global flavours, and gut health.”

He added: “The next wave of success will belong to those who evolve their products and sets with intention, tapping into these emerging consumer shifts.”

The post Tofu Emerges As Bright Spot in Embattled US Plant-Based Category appeared first on Green Queen.

This post was originally published on Green Queen.