Discount retailer Aldi Nord has become the latest company to hop on the blended meat bandwagon with a burger made from 60% beef and 40% plant proteins in the Netherlands.

As part of its move towards shifting protein sales in favour of plants, Aldi Nord has quietly released a blended meat burger in its Dutch locations.

The discount supermarket’s newest burger contains 60% beef and 40% plant-based ingredients, and it is clearly labelled as a product blending animal and plant proteins.

The product is priced at €2.50 per 300g pack, or €8.33 per kg. This makes it a more affordable option than several conventional meat options at Aldi Nord, including half-and-half mince (€10.83 per kg), ground beef (€14.15), and lean ground beef (€9.99).

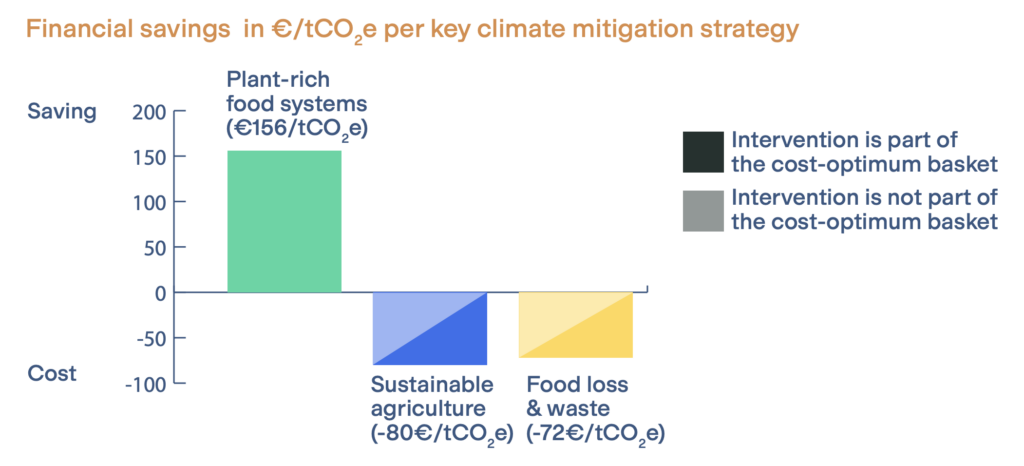

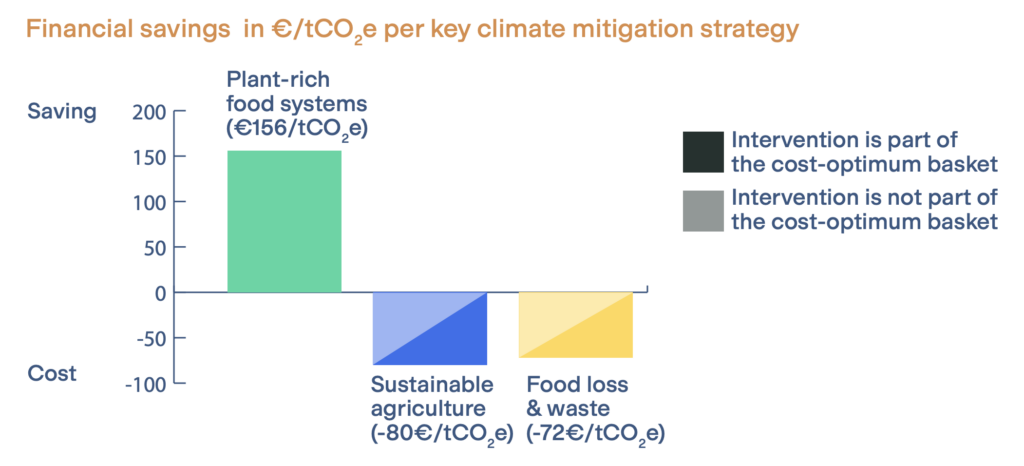

The move is part of its climate strategy. Lowering the amount of animal protein in a product and replacing it with low-carbon alternatives is an effective strategy to slash the emissions of a product.

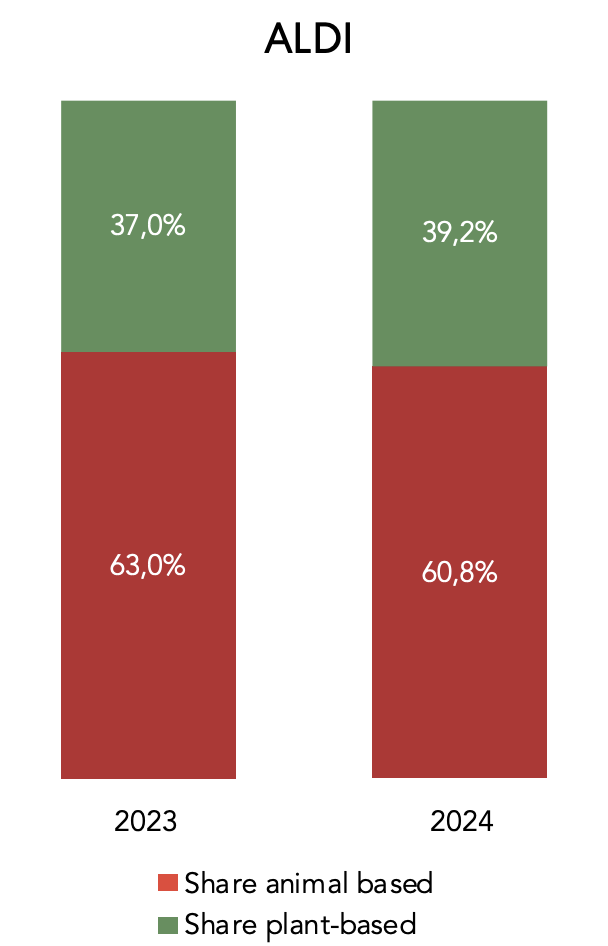

Aldi Netherlands has set a target of obtaining 50% of all protein sales from plant-based foods by this year, working towards a larger ‘protein split’ goal of 60% plant proteins by 2030. In 2023, these products made up 37% of its protein sales, but their share reached 40% last year.

Crucially, it aims to maintain the amount of protein sold, so it would need to achieve this by actively replacing meat with animal-free products. To fast-track the transition, it rolled out its My Vay private-label brand last year, starting with dairy alternatives before diversifying into plant-based meat in the autumn.

Can blended meat fill the plant-based gap?

Aldi’s blended meat offering follows a similar launch at Lidl Netherlands, which last year rolled out a minced meat mix with 60% beef and 40% pea protein that was cheaper and far more friendly to the environment than conventional beef.

Research shows that swapping just half of our meat consumption with plant-based proteins can lower agricultural emissions by 31% and land use by 12%, and halt deforestation.

Blended meat, or balanced proteins as they are called by US-based sustainable food advocacy non-profit Food Systems Innovations (FSI), is a key lever for doing this, especially as the uptake of plant-based meat products slows down. Dutch retail group Ahold Delhaize, the parent company of Albert Heijn, announced a plant protein strategy at the start of the year, but has since admitted that sales of these products have been disappointing.

The retailer aimed to raise the share of plant proteins sold to 47% in 2024, 50% in 2025, and 60% by the end of the decade. However, the ratio failed to increase in favour of plants last year, instead falling slightly from 44.5% in 2023 to 44.2% last year.

A major barrier is the discourse around plant-based meat and ultra-processing. A survey of nearly 20,000 Europeans this year found that 60% would like to avoid processed foods in the future, while only a quarter say the same for animal-based foods. In fact, 12% would like to increase their intake of meat and dairy.

With blended meat, consumers can have their beef and eat it too. It does away with concerns around the taste of plant-based burgers, and efforts like Aldi’s and Lidl’s ensure that there are no complaints about price either. The climate benefit is almost an added bonus for consumers, whereas for the retailer, it is a driving force of the decision.

Aldi is one of nine supermarkets that have committed to the 50-50 protein split goal for 2030, though as of last year, its share of meat alternatives (12%) was the lowest on the list. The new My Vay label and its blended meat offering will help it get closer to the goal.

Aldi looks to redeem its blended meat legacy

This isn’t the first time Aldi has dabbled with blended meat. In 2019, it brought out a BBQ Flexitarian Burger made from a mix of beef and beans in the UK, but it was widely panned. Other supermarkets have had missteps too – Tesco introduced a Lean & Greens range that combined chicken with vegetables in 2021, and discontinued it soon after.

In the past, blended meat products haven’t been commercially successful, especially from private-label brands. In 2025, it’s a growing category. Companies like Nestlé, Purdue Farms, Quorn and even Disneyland have entered this space now.

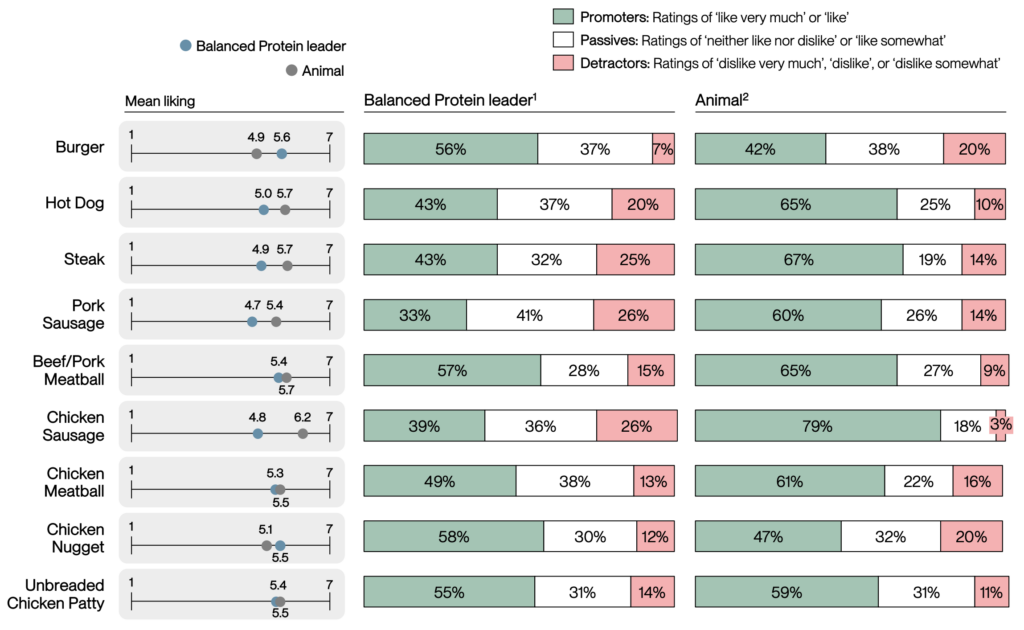

Sensory testing shows that these products are more likely to appeal to meat-eaters and flexitarians than plant-based alternatives. In some cases, they even outperform 100% meat products. Nectar, a non-profit initiative focused on accelerating the protein transition through taste, found four blended meat products that matched or surpassed conventional meat on taste.

These products can deliver financial wins for shrewd brands. Fable Food, whose Shiitake Infusion product is blended with meat and is one of the four aforementioned products, achieved a 50% year-on-year growth last year and expects to further improve this year.

“Taste is the gatekeeper for sustainable dietary change. These products represent a real breakthrough – where the more sustainable choice is also the more delicious one,” Tim Dale, category innovation director at FSI, Nectar’s parent organisation, told Green Queen. “Consumers don’t want to be convinced to love ‘better meat’. They want the meat they love to simply be made better.”

It’s not just the Netherlands where Aldi has launched a blended meat product – it has also introduced a BBQ burger with 70% beef and 30% plants in Germany. It comes on the back of research suggesting that the best way for German retailers to meet their climate targets without breaking the bank is to replace 30% of their meat and dairy offerings with plant-based alternatives.

The largest market for plant-based food in Europe, retailers in Germany are leading the protein transition race. Lidl has announced a protein split target, while Rewe Group has unveiled a plant protein strategy. Now, Aldi has brought blended meat to the market, and the time is ripe for it to redeem its original attempt in the UK all those years ago.

The post While Plant-Based Meat Sales Are Faltering, Blended Proteins Are Back in Vogue appeared first on Green Queen.

This post was originally published on Green Queen.