US food tech startup Clever Carnivore has achieved industry-leading cost reductions for its cultivated pork, which it hopes to begin selling in the country next year.

As companies scramble to lower the production costs of cultivated meat, one Chicago startup has announced several breakthroughs to compete with the price of conventional pork.

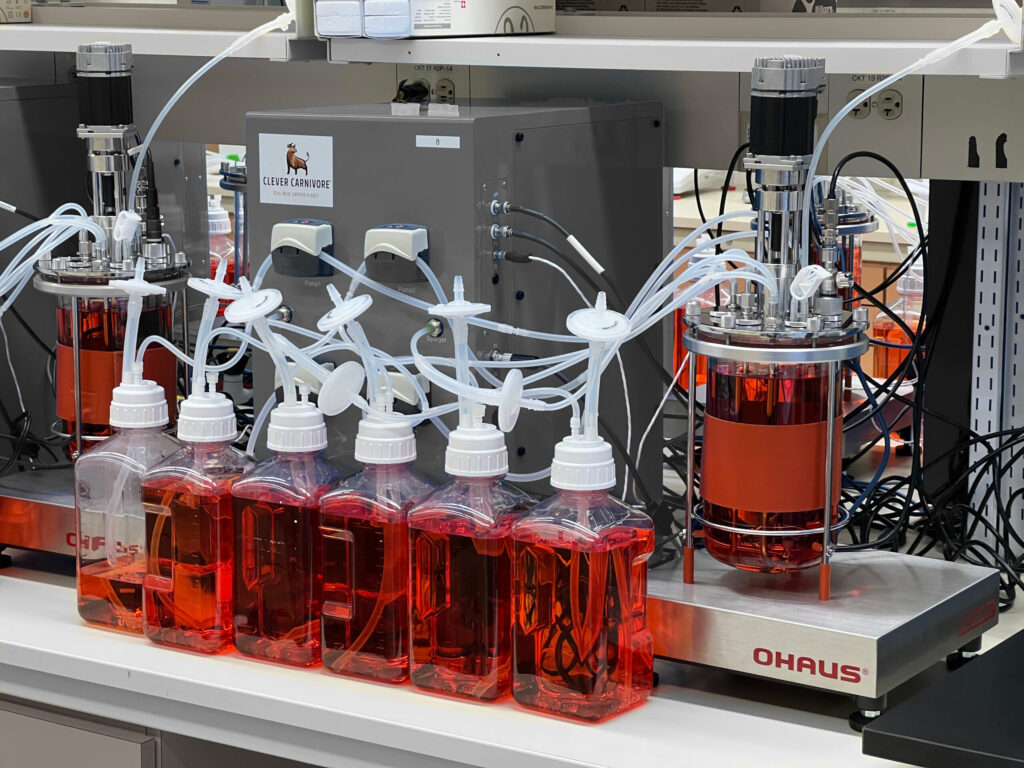

Chicago-based Clever Carnivore has brought the cost of its culture media down to $0.07 per litre at pilot scale, sped up the doubling times of its porcine cells, and designed inexpensive bioreactors that could enable its demo facility to reach profitability in its first full year of production.

Typically, cell culture media costs hundreds of dollars per litre, thanks to expensive inputs like bovine serum albumin (BSA) and fetal bovine serum (FBS), as well as growth factors and basal media (like amino acids, vitamins, and glucose).

“Our expertise in media optimisation allows us to replace expensive components like BSA and FBS with carefully chosen alternatives, [and] ensure that we’re using only the absolutely essential components, maximising growth and minimising cost and waste,” CEO Virginia Rangos, who co-founded the startup with CSO Paul Burridge in 2022, tells Green Queen.

Clever Carnivore is now raising a $7M extension to its seed round from 2023 (which also closed at $7M) to focus on new products and regulatory approval. “We have a term sheet in hand and commitments from current investors. We’re beginning concerted outreach to fill out the round,” she says.

In addition, the firm is aiming to secure the regulatory green light from the US Food and Drug Administration (FDA), and credits “pioneers in the space” that have already received approval and made it easier for companies to do so.

“In reviewing their published dossiers, we paid close attention to which data the FDA ultimately asked them to provide, and we’re providing as much information as possible in our initial submission,” Rangos explains. “We project [our] cultivated meat could be available on the market as early as summer 2026.”

How Clever Carnivore achieved industry-best media costs

The bulk of the cost of cultivated meat comes from culture media. Over the last year, several startups have announced milestones to slash media costs, including Gourmey (€0.2/$0.23 per litre) and Meatly (£0.22/$0.30).

Clever Carnivore’s culture media cost – which has been at the $0.07 level for two years now – undercuts its competitors. “That’s what we’re paying today – including our in-house growth factor production, water purification and mixing. We anticipate further reductions as we scale to a production plant with a capacity of thousands of litres,” says Burridge, who has over 20 years of research experience in cell line development and growth media optimisation.

Most companies buy off-the-shelf bottled media or a pre-made powder. To help lower this cost, Clever Carnivore produces its media in-house, mixing it from stocks of vitamins, salts, and amino acids. This eliminates the cost of logistics, as well as the “massive profit margins of commercial media suppliers”, according to Rangos.

“We also make our own growth factors – reducing what would otherwise be the most expensive component of our media to a negligible cost,” she says. These are specifically engineered for optimal performance with enhanced temperature stability and cost-effective production. “Most companies are reliant on external suppliers, and these suppliers charge a premium.”

She adds: “To achieve a profitable, scalable process, cheap media is necessary, but not sufficient. Your media must also provide every resource your cells need to grow quickly and at high density. Our highly optimised media ensures the cells have exactly what they need (and nothing else) at each time point in their development.”

One key aspect is the creation of cell lines that are never exposed to animal-based inputs; instead, they grow in this custom culture medium from the get-go. “It’s incredibly difficult to eliminate FBS or BSA from your media if your cells are ‘used to’ these expensive components. If you take them away from cells that have been exposed to them, their growth rate will plummet,” explains Rangos.

Unlike human nutrition, cells aren’t influenced by the cost or variety of their diet. Once they’re adapted to a medium, they prefer it over others. “Our medium has the bare minimum inputs that cells require, and they thrive in that low-cost medium better than they would in a high-cost medium.”

Innovative bioreactors further drive down costs

Aside from the culture media cost reductions and optimised cell lines, Clever Carnivore’s porcine cells are capable of doubling in less than 14 hours in adherent culture. “We use our media to signal our cells to enter a naturally highly proliferative state,” says Rangos. “We don’t have to use genetic modification to ‘immortalise’ cells, but our cells are still extremely proliferative.”

“With the right process and training, our method is actually much more robust than methods that rely on genetic modification. We can reliably produce new cell lines on demand, whereas methods like spontaneous immortalisation rely on chance mutations that cannot be reliably reproduced.”

The startup is banking on a proprietary bioprocess design to lower costs and increase efficiency. Having low-cost media and numerous bioreactors allows it to run bioprocess experiments at an “unmatched pace” and refine all the parameters contributing to cell growth. “Elements like ideal temperature, pH, dissolved oxygen, and bioreactor design make a huge difference in yield,” says Rangos.

A key factor was the use of secondhand bioreactors for benchtop experiments, which the company bought on eBay. The company has since moved to large-scale stainless-steel bioreactors, which form the basis of the process described in the dossier it will submit to the FDA.

“Our goal has always been to submit for approval a process as identical as possible to our production process at full commercial scale, to ensure a streamlined path through approval,” explains Rangos.

The cultivated pork is produced in two 500-litre bioreactors, with a third on the way. The firm has managed to cut costs on these larger-scale tanks considerably by developing a design without expensive components – while they might be standard in biopharma applications, they are unnecessary for cultivated meat production.

It’s additionally working directly with steel fabricators that cater to food manufacturers, instead of ordering off the shelf from standard suppliers that usually serve the biopharma sector.

Clever Carnivore’s other bioprocess innovations include the growth of cells without microcarriers, which are “expensive, yield-limiting components that must be included in the final food product”, and a seed chain design and disaggregation/re-aggregation method that substantially increase yield and shorten the production timeline.

Upside Foods and Eat Just’s journeys paved the way forward

The startup isn’t shy about the fact that it benefitted from being a late entrant to the space. Witnessing early pioneers hit R&D hurdles and various milestones allowed it to avoid common pitfalls.

Rangos notes how Upside Foods and Eat Just – the first two cultivated meat makers to receive regulatory approval in the US – “didn’t have the luxury of waiting to submit a dossier for regulatory review until they had developed a process viable at factory scale”.

“Investors wanted to see that cultivated meat could pass regulatory review, so that was a box they needed to check. We’ve had more flexibility to allow science to drive strategy because pioneers have already proven that cultivated meat can be sold and that consumers will buy it,” she explains.

“We didn’t have to pitch why cultivated meat was important – just that we had viable technology and strategy to get profitable products to market.

“We’re also unusual because – in part due to the personalities of the founders and in part through necessity – we’ve run a very lean operation. The executives take their turns cleaning the bathrooms, our team painted our new facility together, and if the bioprocess team have an idea, Paul is the first to drive over to the hardware store to find a part we can adapt to try it out right away.”

Rangos outlines how early regulatory submissions “took a lot longer to progress” because the government and businesses had to work together to figure out how to evaluate cultivated meat.

“Our path to approval should be relatively smooth because the groundwork for evaluation has already been laid, we’re presenting as much information as possible up front, [and] we’re submitting a process that is identical in all meaningful ways to what we intend to do at factory scale, ensuring we won’t need to complicate the FDA’s workflow by submitting substantive changes for review.”

Complying with the FDA and the US Department of Agriculture’s standards for production facilities is critical. Clever Carnivore is designing its demo plant with a “well-validated process, high-level quality controls, and equipment that is proven and can be amortised under known schedules”, explained Burridge. It features low-cost inputs and equipment, helping the firm keep buildout costs under $4.5M.

VC landscape forces Clever Carnivore to revise fundraising plans

To date, Clever Carnivore has secured $9.1M from investors, most of which came from the seed round that it’s looking to extend now.

“We initially planned to raise a Series A round to build our demonstration facility. Our commercial-scale factory design is composed of modular units of bioreactors and related processing equipment. The demonstration facility is designed to get a complete module up and running, producing profitable cultivated meat and providing final proof of concept for larger-scale facilities.”

That plan would require an $18M raise. The problem is, capital is “tremendously expensive” now, as investors flock away from food tech. After attracting $1.3B in 2021, investment in cultivated meat has dipped dramatically. In 2023, funding fell by 75%, followed by another 40% drop in 2024, reaching just $139M. In fact, in the last three years, this sector has cumulatively raised less money than it did in 2021 alone.

The headwinds have continued in 2025, with Aleph Farms’s $29M round the only sizeable raise for cultivated meat this year. “We’ve revised our initial plan for a Series A raise because cultivated meat valuations are at an all-time low, and many investors are sceptical about the space, due in part to the political climate, and in part to challenges faced by first-gen cultivated meat companies,” says Rangos.

“Many food and ag tech investors made early bets in the space and aren’t looking to make additional cultivated meat investments, and many sustainability or generalist investors are taking a ‘wait and see’ approach to the space right now.

“We decided to pivot to a plan that allows us to raise less and focus on regulatory approval, commercial partnerships, and beginning beef R&D. That said, we’ve received positive feedback and interest from both seasoned alt-protein investors and more generalist funds. We look forward to building our demonstration facility when capital markets are more favourable.”

Taste tests attract consumers and chefs alike

Investors aren’t the only source of positive feedback for Clever Carnivore – consumers and chefs have taken to its cultivated bratwursts, breakfast sausages, hot dogs and meatballs too. This month, it held two tasting events, where it served over 50 bratwursts to rave reviews, according to the startup.

“We’ve spoken to conventional meat advocates who candidly told us they ‘wanted to hate’ our product,” recalls Ramos. “But when presented with a product that cooks and tastes just like the sausage they’ve always loved, they quickly became intrigued.”

Aside from taste, consumers have expressed appreciation for its value proposition – think meat free from steroids, antibiotics or GMOs, a secure food supply chain with domestic production, and expanded options that will keep products on shelves amid shortages and price inflation for conventional meat.

“We’re very interested in partnering with existing conventional meat and restaurant chain brands. We know we’re asking consumers to try something new, and we think presenting Clever Carnivore’s cultivated meat for the first time under a label consumers recognise and trust will go a long way toward getting consumers to try the product.”

The nutritional profile will only help expand the appeal, with the cultivated pork exhibiting similar amino acid profiles and nutritional values to conventional versions. “Our prototype products incorporate a plant-based fat. Our cultivated pork delivers the ‘meaty’ flavour, allowing us to use plant-based fats and reap the nutritional benefits of plant-based vs animal fats.”

Why Clever Carnivore is targeting processed cultivated meat

Clever Carnivore is among a number of companies working on cultivated pork, offering alternatives to products that the WHO has deemed carcinogenic, like sausages and hot dogs. These include Mission Barns (already approved by the FDA), Meatable, Mewery, and Magic Valley.

The decision to focus on processed pork instead of whole cuts was driven by “a combination of scientific considerations, budgetary constraints, and strategic market positioning”.

“Producing whole cuts requires more time in the bioreactors – you need to swap the media and allow cells time to form tissues. Transition to a specialty bioreactor for added tissue development might also be necessary,” says Rangos.

“We’ve progressed to this point with only $9M in investment so far. To use resources as efficiently as possible and to avoid overstretching our team, we decided to focus our R&D on pork before other meat and on formed products before whole cuts,” she adds. “We like the idea of debuting accessible products – cultivated meat not as a luxury, but as a high-quality, reasonably priced staple.”

That being said, its process does make it feasible to develop whole cuts someday. “Getting there will require additional time and money, and we believe it’s important to bring competitively priced and compelling products to market as soon as possible,” she says.

Aside from pork, Clever Carnivore’s expertise in mammalian cell biology and bioprocess enables it to fast-track other mammalian species through its R&D pipeline. “Our next priority is beef, but we’re also interested in working on lamb to expand our appeal to international markets where pork and beef are less popular.”

The post Exclusive: Clever Carnivore Plans 2026 Cultivated Pork Launch with Industry-First $0.07/L Media Cost appeared first on Green Queen.

This post was originally published on Green Queen.