British plant-based milk firm Mighty Drinks has entered administration amid rising costs and fundraising challenges, with its future now hanging on a rescue deal.

Mighty Drinks, the brand that introduced pea milk to the British mainstream, has gone into administration after seven years of operation.

The company appointed Interpath as administrator earlier this week, which said Mighty suffered from rising costs and “fragile consumer confidence” that impeded its scalability and path to profitability. While it looked to explore investment, a lack of options led the company to file for insolvency.

“The plant-based category has shifted dramatically over the last few years. Despite our best efforts to adapt, streamline, and secure new investment, we couldn’t raise what was needed to take the next step,” said Tom Watkins, co-founder and co-CEO of Mighty, who established and ran the startup with his brother Nick.

The decision came on the back of mounting losses for the business, which has raised £8M over the years. Government filings show it lost £12M at the end of 2023, £3.4M more than the year before.

Mighty Drinks a victim of dire investment landscape

While it began as a pea milk company (it was formerly known as Mighty Pea), the firm has since diversified into other ingredient bases too. This included a line of oat milks, a pea protein and oat blend, oat milk powders, and fermentation-derived oat milks that sought to more closely resemble dairy.

Mighty banked on the UK’s growing appetite for non-dairy milk, which is as close to mainstream as any plant-based category has gotten. Last year, 32% of British households bought a non-dairy milk at least once, and 11% did so at least once a month.

However, the category hasn’t been immune to the wider headwinds faced by alternative protein sector. “The Mighty team has created a great product, with an exciting kids milk range set to launch with retailers given the allergen-free benefits of pea protein, and a path to profitability from improved margins and increased volumes,” noted Tom Swiers, food and drink lead at Interpath.

“Unfortunately, however, this has come at a point in the company’s cycle where it required further investment, which was not forthcoming from typical investors in this space, nor was it attractive to typical ‘special situations’ investors given the relatively early stage of the company’s development.”

Indeed, after the 2020-21 boom in alternative protein, investor interest has shrunk more and more every year. Plant-based companies raised only $309M in 2024, a sharp 64% fall from the year before.

“Alternative protein funding has slowed amid this increased investor focus on AI, while elevated interest rates, high production costs, and topline sales declines have also weighed on investment activity,” Daniel Gertner, lead economic and industry analyst at the Good Food Institute, told Green Queen recently.

Interpath’s Swiers added: “There has been an increasing focus on profitability within all aspects of the ‘alt’ category, following the investment boom of a few years ago. It is no longer simply a case of ‘growth as number one priority’.”

Plant-based milk on a rollercoaster ride in the UK

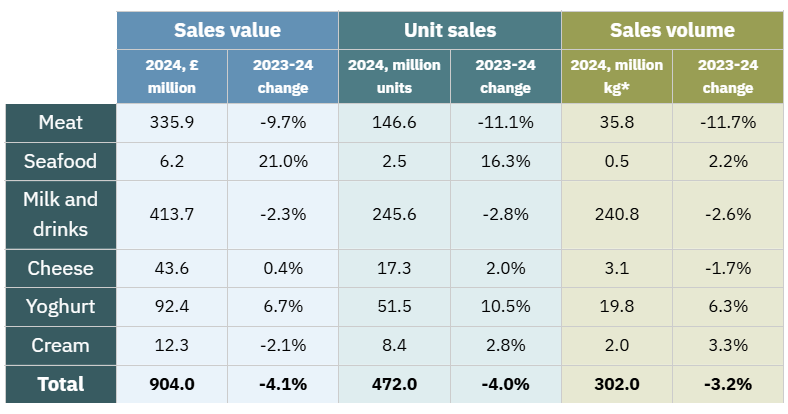

Mighty’s insolvency comes at a curious time for plant-based dairy in the UK. On paper, retail sales of milk alternatives fell by 2.3% last year, with volumes dropping by 2.6% too. And despite matching the price deductions of cow’s milk (reducing by 3%), plant-based milk is still 69% more expensive on average.

However, it remains a category with broad appeal, especially with product formats like barista milks, which saw a 10.4% growth in volume sales in the UK last year. Oat milk is especially popular, accounting for over half of milk alternative sales in 2024, and witnessing steady volumes compared to the previous year. The overall plant-based segment, meanwhile, made up 11% of all milk sales.

Still, a number of underperforming products have been pulled from British supermarkets. Nestlé \withdrew its Wunda brand of pea milks (a direct competitor to Mighty) two years after launch, while Innocent Drinks made the same decision with its milk alternative range.

Oat milk products weren’t spared either. Oatly took its entire range of ice creams and its Plain Oatgurt off shelves, while Arla discontinued its Jörd line of oat milks earlier this year. And Alpro, meanwhile, pulled its oat-based This Is Not M!lk – which aimed to mimic dairy, much like Mighty’s M.lkology range – from the UK in 2024.

“While ‘This Is Not M!lk’ was designed to create a more familiar dairy milk taste, our UK shopper research showed us that many of our consumers enjoy the taste of oat just as much, if not more so,” Tom Kerr, head of plant-based at Danone UK & Ireland, told Green Queen in March. Still, it is doubling down on its core oat milk lineup, making a multimillion-pound investment to expand the production of the range using British oats.

Meanwhile, other plant-based milk brands have secured investment and successful exits too. British clean-label producer Rude Health was acquired by Finland’s fellow plant-based milk firm Oddlygood, and Swedish pea milk maker Sproud, which counts the UK as a key market, gained investment from Love Island host Maya Jama and pea protein giant Lantmännen.

M&As continue to grab plant-based headlines

“We fought through Brexit, a pandemic, inflation, massive global instability – not to mention the perpetual challenge to go up against some of the biggest FMCG brands in the world who all wanted a slice of the alternative milk category,” noted Watkins.

Mighty is far from the only plant-based startup that has suffered this fate. Since 2024, several firms globally have been forced to cease operations or declare bankruptcy before being rescued, including Akua, Sunfed Meats, Willicroft, Allplants, Wild Earth, and Atlantic Natural Foods.

As whole milk regains popularity and the ultra-processed food tag continues to threaten alternative proteins, the trend of mergers and acquisitions in the sector is set to continue.

“Becoming a founder of a VC-backed food and drink business isn’t so much a rollercoaster – it’s strapping yourself to a rocket and hoping you won’t disintegrate on the way to orbit,” said Watkins. “I want to thank every member of staff, investor, customer, and retailer who believed in us and supported the mission over the years.”

Mighty will hope it ends up the same way as businesses like Allplants, Wild Earth, Meatless Farm, VBites and Plant & Bean, which were rescued from the brink.

“We will now work with the company’s stakeholders to explore the options available, including seeking offers for the business and its assets, including the Mighty brand and related intellectual property,” said James Clark, managing director at Interpath and joint administrator of Mighty.

The post Mighty Drinks: UK Plant-Based Milk Startup Seeks Rescue Deal After Entering Administration appeared first on Green Queen.

This post was originally published on Green Queen.