Spanish mycelium meat firm Libre Foods has sold its brand, IP, and key assets to Swiss fermentation manufacturer Planetary.

Libre Foods, the startup known for its mushroom bacon, has been acquired by Swiss biomanufacturing platform Planetary. The terms of the transaction have not been disclosed.

The deal includes Libre Foods’ core brand, commercial agreements, and IP, and will help advance fungi-fermented protein production across Europe.

“We were happy with the work we’d done at both lab and pilot scale the past few years, and also quickly realised how important access to manufacturing was for commercial success,” Libre Foods founder and CEO Alan Ramos tells Green Queen.

“Considering the current complexities of raising private capital for capex, the nascent state of public and corporate financing for said endeavours, and, ultimately, how a ‘move’ to manufacturing would essentially be a pivot away from our specialisation and core business, we realised that the most effective way for our technology to realize its impact was through collaboration,” he explains.

“We had a few open discussions, yet Planetary was high on our list from the start. This was mainly due to the dynamic edge of their technological platform, the advanced commercial readiness of their manufacturing facilities, and their internal know-how to both seamlessly and successfully transfer our technology to their lines and infrastructure.”

As part of the deal, some staff members (Ramos included) will be part of the transfer, but won’t be joining Planetary’s team upon completion.

Planetary eyes Libre Foods’s fermentation and AI capabilities

Using biomass fermentation to make fungal proteins, Libre Foods first made a splash in late 2022, when it unveiled its mushroom-based bacon product in Spain, using oyster mushrooms and pea protein. Months later, it teased a whole-cut chicken breast made from mycelium, the root-like structure of filamentous fungi.

Its products leverage the entire fungi organism, utilising upcycled materials and high-performing fungal strains to achieve “industry-leading yields” through its R&D and novel fermentation tech. At one point, its bacon was available at over 30 points of sale, and it received a €335,000 R&D grant from Neotec to develop a low-cost mycelium protein ingredient.

Last year, the startup worked with Spain’s Microfy Systems and Germany’s Software Logistik Artland to develop the Fungi.AI platform, an R&D tool for the fungi-based food industry.

It uses artificial intelligence to power rapid experimentation and conduct high-throughput screening to find the best growing conditions for a range of fungal strains. The enhanced data quality and real-time monitoring are said to accelerate the shift from lab experiments to commercial production.

“After announcing our line of mycelium technology at the end of 2023, we spent 2024 scaling up our technology to pilot scale and into position for industrial trials,” recalls Ramos.

“In parallel, we optimised our discovery capabilities for both strain and bioprocess development, to not only increase efficiencies in our initial mycelium bioprocess, but also expand into additional fungi-based ingredient solutions, leveraging the opportunities offered by the immense strain diversity of the fungi kingdom.”

That work aligns with Planetary’s expertise. It operates the only active industrial mycoprotein facility in continental Europe, and is building a unique full-stack biomass and precision fermentation platform in line with the agro-industrial complex, titled BioBlocks. It’s designed to support the development and industrialisation of future-facing food and material solutions, using a wide array of feedstocks.

Now, through the acquisition of Libre Foods, Planetary will look to expand its product offering and bolster its capacity to connect AI-led ingredient discovery with productive biomanufacturing at a commercial scale.

Founders ‘bear some responsibility’ for alternative protein decline

“This is a strategic acquisition for Planetary as we seek to continuously build and strengthen our BioBlocks platform,” says Charles Pontvianne, group CFO of Planetary. “We are proud to partner with Alan and will seek to extract both operational and commercial synergies from Libre’s brand, products and IP in a short timeframe.”

He added: “Combined with our full-stack fermentation platform, the acquisition of Libre’s assets will reinforce our asset-light licensing offering and further accelerate our commercial ramp-up.”

As part of the deal, Libre Foods’s lead backer, Green Generation Fund, is joining Planetary’s investor base too. “With Planetary’s unmatched infrastructure, scientific expertise and deep vision for scaling bio-based technologies, we believe they are the ideal home to carry Libre’s product innovation from lab to scale and will build out further their position as the leading player for the next era of sustainable biomanufacturing in Europe and beyond,” says Peter Dorfner, the fund’s principal.

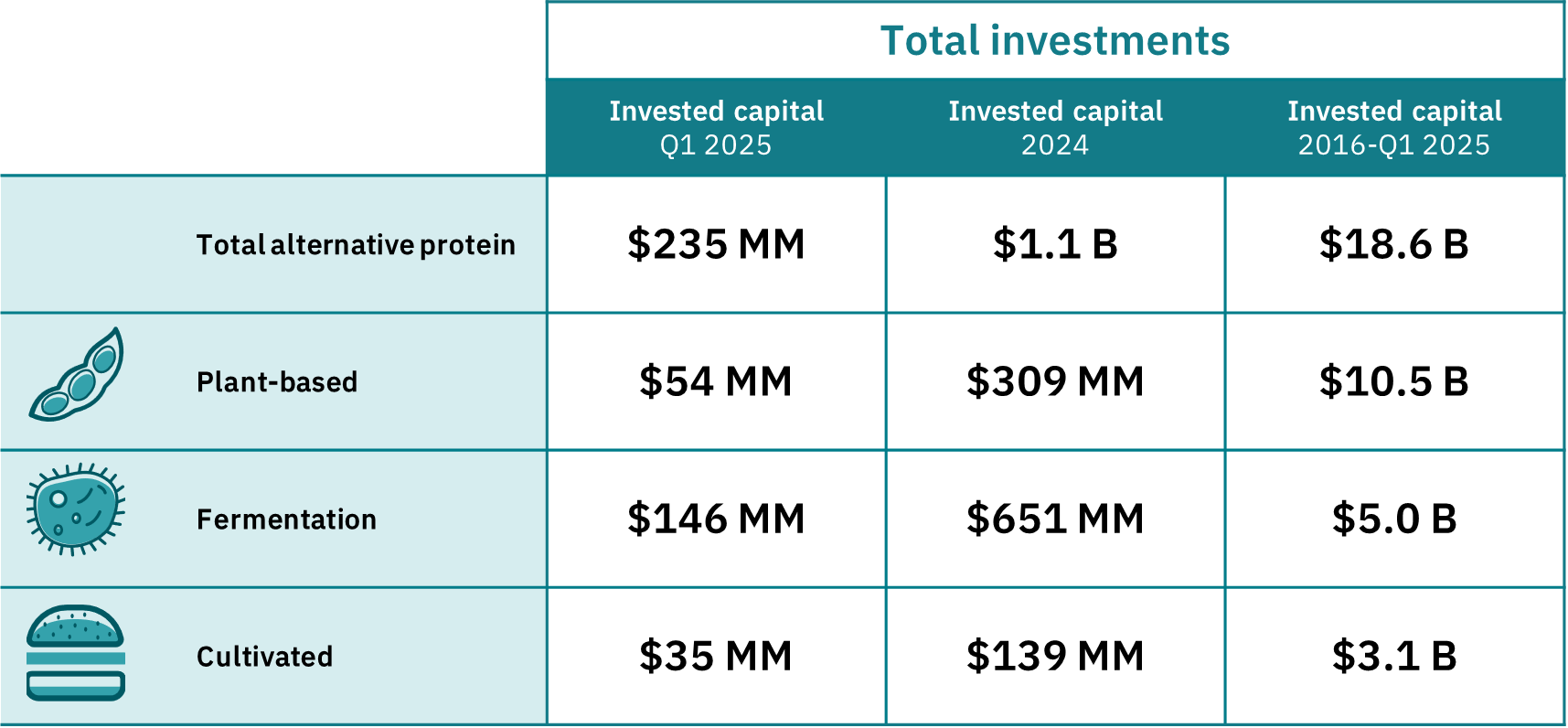

Libre Foods’s acquisition comes at a challenging time for alternative protein. While the sector saw a 27% decline in investment in 2024, fermentation startups bucked the trend with a 43% hike in funding. That run has continued this year, with these firms attracting more than half of the sector’s financing in Q1.

In fact, this tech vertical was responsible for the three largest rounds of the quarter: Formo’s $36M venture debt loan from the European Investment Bank, Vivici’s $33.8M Series A round, and Liberation Labs’s $31.5M investment.

“I think that as both the visionaries and pioneers that we consciously and unconsciously agreed to be when we kickstarted our industry, we do bear some responsibility for the current state of the industry,” says Ramos. “Yet, I also believe that it is highly unrealistic to place all the responsibility on the founders, teams and solutions that were brought forth as a result of it.”

“What the current state of global affairs is highlighting is precisely what we’ve been saying all along: just how fragile our food systems are, with everything from shortages to diseases to record-high prices, both across the value chain and ultimately, final products,” he continues.

“Because the world is changing so quickly, everyone is kind of forced to think more short term, and as a result, kicks both seemingly long-term problems and solutions to the back burner, which ultimately not only delays, but also accelerates, the negative impact on both society and our planet down the line.”

Libre Foods deal adds to industry consolidation drive

The overarching downward trend for alternative proteins, both in terms of sales and funding, has led to widespread consolidation in the industry. While mycelium meat leader Meati was forced to sell for pennies on the dollar due to a technical banking default, other fermentation startups have filed for insolvency (like Arkeon) or been rescued from the brink (like Mycorena).

In the broader industry, British vegan dog food brand The Pack was acquired by Prefera Petfood, dairy-free formula maker Kate Farms by Danone, frozen ready meal maker Daily Harvest by yoghurt leader Chobani, and Dutch meat-free startup Vega Insiders by poultry giant Plukon Food Group – all in the last two months.

“On the one hand, you have M&A’s, which I believe are more often a combining of strengths or specialisations. And on the other, insolvencies, which can be due to a solution not solving a real problem, not solving it adequately enough, or a host of other factors outside of a company’s control,” says Ramos.

“We’re seeing a bit of everything right now, especially after the future of food boom of 2020/21,” he adds, but outlines that sustainable food solutions are no less important now than they were then. “So most important now is to continue supporting the companies that continue carrying the torch, not only for our industry, but more so, for our food systems as a whole.”

What’s his advice to fellow alternative protein founders? “What makes our industry so unique is that it was birthed by many brave and bold founders who lived and breathed a personal mission to reinvent a food system – myself included – which I think is both noble and important,” he says.

“[But] it is more difficult to build a sound business around impact, than it is to build impact around a sound business. It’s a subtle distinction, yet I believe that the only feasible way to achieve both is by prioritising as such.”

The post Exclusive: Mycelium Bacon Startup Libre Foods Acquired by Biomanufacturer Firm Planetary appeared first on Green Queen.

This post was originally published on Green Queen.