Germany still taxes plant-based milk at a rate nearly three times higher than dairy, prompting retailers and manufacturers to launch a petition demanding parity.

Reduce the value-added tax on plant-based milk to the same rate as dairy to ensure “socially just taxation” consistent with Germany’s climate, health, and nutrition goals, a group of companies have urged in a petition to the Bundestag.

In Europe’s largest economy, conventional dairy products carry a 7% surcharge, but vegan alternatives made from oats, peas, soy, etc. are charged a 19% VAT.

But retail giant Rewe Group and plant-based dairy companies Oatly, Vly and Berief Food are calling on the government to lower the non-dairy levy to the same level as cow’s milk, creating “a level playing field” that will enable companies to pass on the cuts to customers.

The petition is live until August 20, and at the time of reporting, has received over 5,000 signatures in under 24 hours.

“The tax discrimination against plant-based drinks is no longer appropriate and contradicts social developments and scientific findings. Sustainable diets must not be discriminated against,” said Svenja Fritz, general manager of Oatly DACH and Poland. “We call on the Bundestag to finally end this social and ecological inequality and adjust the VAT rate. Now is the time to set the course for a fairer, future-proof, and sustainable diet in Germany,” she added.

“We strongly welcome this initiative by key players in the German market. The current VAT policy, which unfairly disadvantages plant-based milk, stands in direct contradiction to Germany’s own climate and sustainability goals – and it’s time to correct that,” Ivo Rzegotta, senior public affairs manager for Germany at the Good Food Institute (GFI) Europe, told Green Queen.

Lower VAT offers climate, health and economic benefits

In 2024, a litre of plant-based milk cost €1.52, while the same amount of cow’s milk set consumers back by €1.34, according to GFI Europe. If the former products had the 7% VAT applied, their average price would have dropped to €1.37, almost on par with dairy.

The petition lays out several reasons for lowering the VAT on plant-based milk. The companies argue that considering cow’s milk a ‘staple food’ (thus making it eligible for the reduced rate) and plant-based alternatives as ‘beverages’ that require the 19% levy is “implausible”.

This is because these products are integral to consumers who have intolerances, allergies, or certain dietary preferences – in Germany, 37% of households bought plant-based milk last year. The higher VAT, therefore, disadvantages these citizens and affects their freedom of choice. “Equal taxation would eliminate these products from tax discrimination, and consumers would have more affordable access,” the petition reads.

There’s the sustainability argument too. Plant-based milk requires a fraction of the land and water that dairy does, while also emitting dramatically fewer greenhouse gases. Oatly’s oat milk, for example, has a nearly three times smaller climate footprint than Bären Marke’s 1.5% cow’s milk.

The petition points out how fortified plant-based milks are a “nutrient-dense option” part of many countries’ dietary guidelines (though Germany’s recommendations were criticised for excluding non-dairy milk). These products are higher in fibre, lower in saturated fat, and have no cholesterol – but a lower VAT rate is needed to make them affordable and attractive for people.

A reduction to the 7% rate for plant-based milk also makes economic sense, the petitioners argue. A study by the Institute for Policy Evaluation found that while it would lead to a €40M annual decline in tax revenue, the lower emissions from these products would save around €62.4M per year in future climate change costs.

“Tax equality at 7% would not be a gift to the industry, but a strong signal for fairness and a modern and forward-looking food policy. It’s not about subsidies, but about equal opportunities – for consumers and companies alike,” said Nicolas Harmann, founder and CEO of VF Nutrition, the startup behind the Vly range of pea protein milks and yoghurts.

Germany not in step with European counterparts

The fight for tax parity for plant-based milk isn’t new. Germany has one of the widest VAT gaps between dairy and non-dairy products in Europe. In 2023, MPs Tim Klüssendorf (SPD) and Bruno Hönel (Green Party) proposed a change in the country’s tax laws to reduce the VAT on alt-milk in the annual tax law negotiations, though that effort was unsuccessful.

Several of Germany’s European counterparts have closed the gap and now charge an equal VAT rate for dairy derived from both cows and plants, including Czechia (10%), Greece (13%), France (5.5%), Denmark (25%), and Portugal (zero-rated). In the Netherlands, soy milk remains at the same level as dairy at 9%. And Belgium charges the same rate for soy, rice and cow’s milk.

“Hardly any other EU country disadvantages plant-based milk to this extent – many don’t tax plant-based alternatives more heavily at all. If we want to encourage more people to choose sustainable options, plant-based milk must be priced on equal footing with conventional milk,” noted Rzegotta.

“The current VAT rules unfairly inflate the price of plant-based products, discouraging climate-friendly choices. Yet public sentiment is clear: 62% of people in Germany want this corrected, including a strong majority of voters from the governing CDU, CSU, and SPD parties.”

The petitioning companies allude to Germany’s disparity with much of the rest of Europe. “Equal tax treatment of animal milk products and plant-based drinks is not only objectively necessary, but also a step toward a fairer, healthier, and more sustainable food policy,” they said.

“We are seeing increasing demand for plant-based protein sources in our stores. This also applies to plant-based drinks,” said Emilie Bourgoin, director of public affairs at Rewe Group, which opened a fully vegan store in Berlin last year.

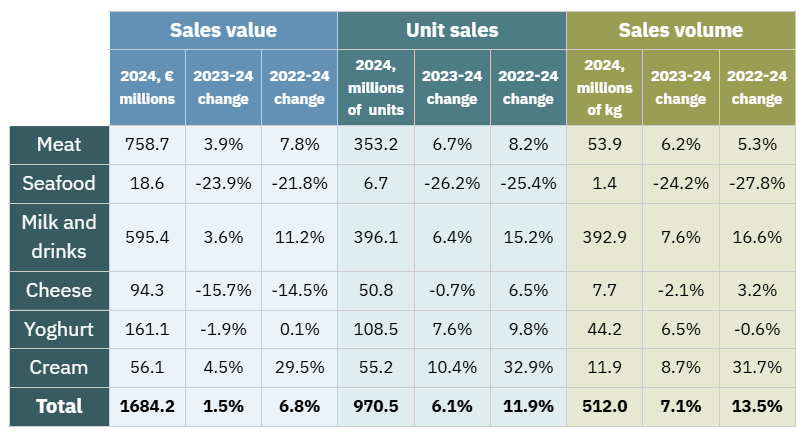

Indeed, sales of plant-based milk were up by 3.6% in the country last year, with volumes growing by 7.6%. This was the result of strategic pricing, with many dairy-free milks now on par with cow’s milk, and vegan cream 5% cheaper. This itself is driven by private-label offerings: Lidl spearheaded the shift by achieving price parity for its Vemondo line.

“The 19% tax on plant-based milk alternatives is a relic of past nutrition policy and an obstacle on the path to a more sustainable future,” said Harmann. “This unequal treatment creates a market environment in which startups like us find it more difficult to compete with traditional products – even though we focus on innovation, sustainability, and transparency.”

He added: “We demand equal tax rules for equivalent products. And we expect policies that don’t slow down transformation, but rather help shape it. Those who want sustainable nutrition must also make it possible through taxation.”

The post Rewe Group, Oatly & More Ask Germany to Reduce VAT on Plant-Based Milk appeared first on Green Queen.

This post was originally published on Green Queen.