Animal fats are terrible for the planet, but most plant-based alternatives fall short. For Israeli startup Accellta, the key lies with cell-cultured dairy.

With plans for an $8M and a regulatory application in the US, Israeli firm Accellta is aiming to bring cultivated dairy fats to the forefront of the future food conversation.

When it comes to food, cell cultivation technology is best associated with meat, with only a handful of companies focusing on dairy proteins. By focusing on milk fats, this startup is targeting something even more niche.

This is because fat delivers the taste, texture and mouthfeel people love in dairy products. “While proteins are already produced at scale via fermentation and plant-based systems, fat is the real bottleneck,” Accellta co-founder and CEO Michal Amit tells Green Queen when asked why it’s choosing to focus on fats over proteins.

“The dairy industry faces a structural shortage of milk fat,” she says, adding that discussions with global dairy leaders confirmed the urgent need for scalable and authentic milk fat solutions.

There’s also a consistency issue. “Dairy companies struggle with operational challenges: milk fat concentration is not constant, varying between herds and across seasons. In summer months, fat levels are particularly low, forcing companies to purchase additional fat from external sources just to keep production lines running,” explains Amit.

Cultured dairy fat, though, offers a “reliable, geographically closer, and consistent supply”, which streamlines operations and lowers dependency on volatile external markets.

Accellta isn’t a new name in the biotech industry. It has been around since 2012, starting as a stem cell tech startup and building what Amit says was one of the world’s strongest large-scale suspension culture platforms.

It has been profitable since 2018, thanks to tech and media licensing, process development, and media optimisation services. It was in 2023 when the firm turned its focus to the food sector, specifically cultivated fats for dairy products to solve the “fat balance” in the industry while simultaneously decarbonising it.

How Accellta makes its cultivated dairy fat

Unlike cultivated meat, which often requires structured tissues, scaffolds, and multiple cell types, Accellta’s dairy production process focuses solely on fat cells grown efficiently in suspension. “This is simpler, more scalable, and directly aligned with the needs of dairy products, where fat is the key ingredient,” says Amit.

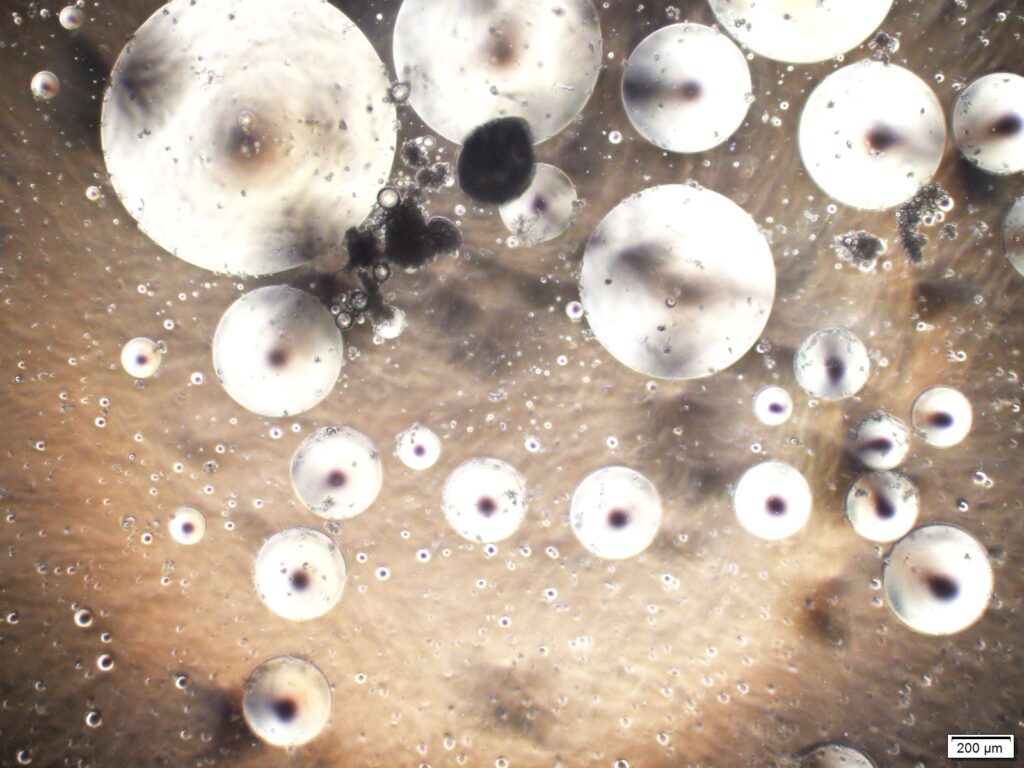

Its proprietary 3D suspension culture grows stem cells in chemically defined media, eliminating the need for scaffolds or microcarriers and enabling very high cell densities with minimal contamination risk. It starts with pluripotent stem cells (PSCs) in suspension. Unlike immortalised cell lines that need to be altered to multiply indefinitely, these have the natural ability to continue multiplying, and in a rapid manner.

The PSCs are then differentiated into adipocytes. “The resulting fat droplets are harvested and processed into functional dairy fat ingredients,” explains Amit. “A unique feature of our platform is the media formulation: it makes PSCs ‘think’ they are attached to a solid surface, while actually growing in suspension; achieved without any genetic modification of the cells.”

She adds: “Importantly, we can also fine-tune the fatty acid composition inside the adipocytes, tailoring the nutritional and functional properties of the fat to specific dairy applications.”

Asked if Accellta is using fetal bovine serum, an ethically controversial and highly expensive component that most of the cultivated meat industry is moving away from, its CEO says she isn’t disclosing details about media formulations right now.

“We have over a decade of experience in developing and optimising suspension media for stem cells, and we are now applying this expertise to create a formulation that meets regulatory requirements while reaching a cost point that enables true commercial viability,” she offers. “Thanks to our strategic partners, we already have a clear target price for our cultured dairy fat that will allow us to compete effectively in the market.”

Cell-cultured dairy fat can be blended with milk or alternative proteins

Instead of selling consumer products, Accellta is focused on the B2B market, supplying its cultivated dairy fat as a premium ingredient to food manufacturers and dairy processors.

“These food manufacturers and dairy companies will then use our fat to create high-quality consumer products with authentic dairy taste and improved nutritional profiles,” says Amit. “Importantly, our technology also enables fine-tuning of the fatty acid composition, so we can adapt the ingredient to match the performance requirements of each customer application.”

In fact, it has already produced prototypes with a fatty acid profile that matches dairy fats. Unlike plant-based fats, the firm’s cell-based dairy version can provide the same taste, mouthfeel and functionality as milk fat, and has the same melting point and flavour release.

“Our cultured fat can be blended seamlessly with conventional dairy fat or with alternative protein bases,” she says. The inclusion rate depends on the specific product; ice cream typically contains 15% fat, butter around 80%, and cheese 20-35%.

“We have already incorporated our cultured dairy fat into prototypes such as yoghurt, butter, and ice cream to demonstrate functionality and taste,” says Amit. Its hybrid butter contains 20% cultured fat.

“We are planning to build our own production facilities to supply cultured fat as an immediate, high-quality ingredient for dairy applications. At the same time, we are pursuing joint ventures with strategic partners worldwide, enabling them to establish localised production facilities based on our technology,” she explains.

“Through these partnerships, we provide technology licensing, hands-on operational support, and benefit from long-term royalty streams,” she adds. “This dual approach – combining direct ingredient supply with scalable global partnerships – allows us to address near-term market needs while positioning Accellta as a key enabler of the dairy industry’s transition to sustainable, cultured ingredients.”

Accellta eyes $8M in funding, targets US as first market

Accellta is producing the fat in its in-house bioreactors, with monthly quantities enough for developing applications and prototypes to share with investors and strategic partners.

“The next stage, supported by our fundraising, will be to scale production through contract manufacturing partners who specialise in transforming lab-scale processes into industrial-scale manufacturing,” Amit reveals. “Moving to larger scales will enable us to produce hundreds of kilograms of cultured dairy fat per month, enough for our customers to purchase small batches for the development of dairy products based on our fat.”

Speaking of which, while it has been “self-sustaining and profitable for several years” – thanks to earlier investments, tech licensing revenues, and non-dilutive grants – Accellta is now raising $8M to speed up the development of the cultivated dairy fat, expand its production capacity, and deliver minimum viable product samples to partners.

“This funding will enable us to demonstrate feasibility at commercial scale and secure our first sales agreements within 24 months of closing the round,” says Amit.

Given that this is a novel food ingredient, the cell-based dairy fat would need regulatory approval in whichever markets it plans to enter. “Accellta is working with experienced international regulatory consultants to design and execute our approval strategy,” she says.

“Our first target market is the US, where we are preparing a submission to the FDA, building on the regulatory precedents already established for cultivated food products. In parallel, we plan to engage with regulatory authorities in Singapore, Israel and Europe.”

Alternative fats are heating up

Animal fats are revered for their flavour and functionality, but they’re terrible for the environment. Livestock farming may just be the leading cause of climate change, and uses up vast amounts of land and water.

Plant-based fats are essential too, with saturated fats providing form and functionality to legions of products. But palm oil alone is present in half of all supermarket items and responsible for most of the deforestation in tropical regions.

According to calculations by Savor, a US company making butter with captured carbon, green hydrogen and methane, the production of animal and plant-based fats collectively generates 7% of global greenhouse gas emissions. It underscores the need for new alternatives that don’t hurt the planet.

Like Savor, many food tech firms are using microbes and fermentation to develop planet-friendly replacements for animal fats and palm oil, including Nourish Ingredients, Smey, NoPalm Ingredients, Clean Food Group, Palm-Alt, Äio, C16 Biosciences, Melt&Marble, and Lypid.

Meanwhile, in the cell-based dairy category, Canada’s Opalia has secured the first commercial supply agreement for its milk from Dutch dairy giant Hoogwegt, ahead of an expected $4M fundraise.

Other startups working in the cell-based dairy category include Wilk (Israel), Senara (Europe), Brown Foods‘s UnReal Milk (US/India). France’s Nūmi and US-based 108Labs, meanwhile, are developing cultivated breast milk.

The post Accellta Bets on Cultivated Dairy to Solve the Alternative Fat Puzzle appeared first on Green Queen.

This post was originally published on Green Queen.