CellRev, a Newcastle-based bioprocessor of cell culture technologies, has ceased trading and appointed administrators to sell its assets.

UK biotech firm CellulaREvolution (CellRev), an enzyme technology specialist for the cultivated meat, regenerative medicine and vaccine sectors, has gone into administration.

“We couldn’t deliver commercial milestones fast enough to secure Series A investment. The bar is higher than anyone (in 2021) could have foreseen,” said CEO Chris Green.

CellRev brought in Ed Connell and Mike Kienlen from advisory firm Armstrong Watson as administrators on August 12. “Following their appointment, the joint administrators have made all staff redundant and are working with their agents, Hilco Valuation Services, in relation to realising the assets of the company,” a spokesperson for Armstrong Watson said.

CellRev’s partnership with BSF Enterprise was abandoned last year

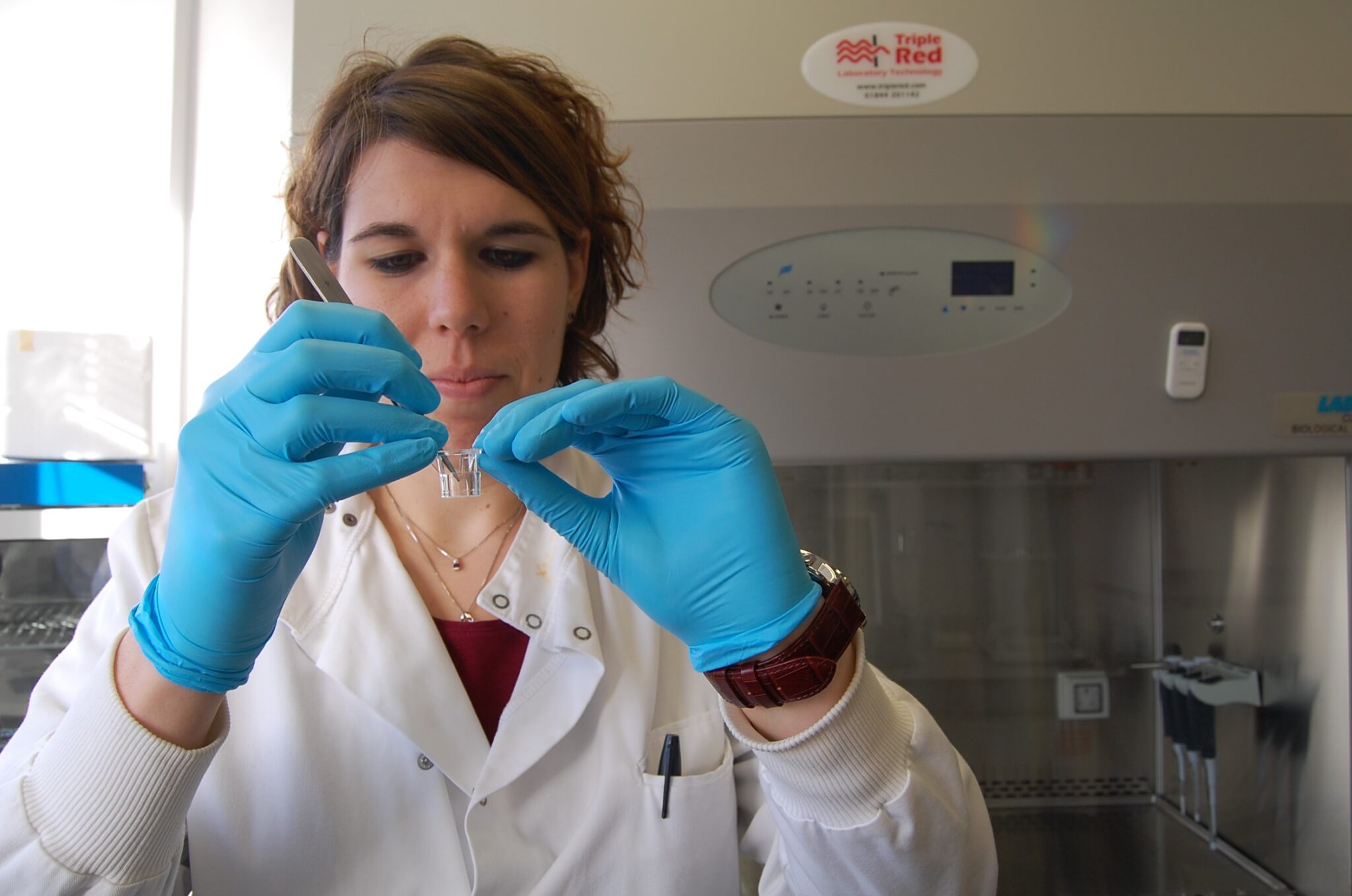

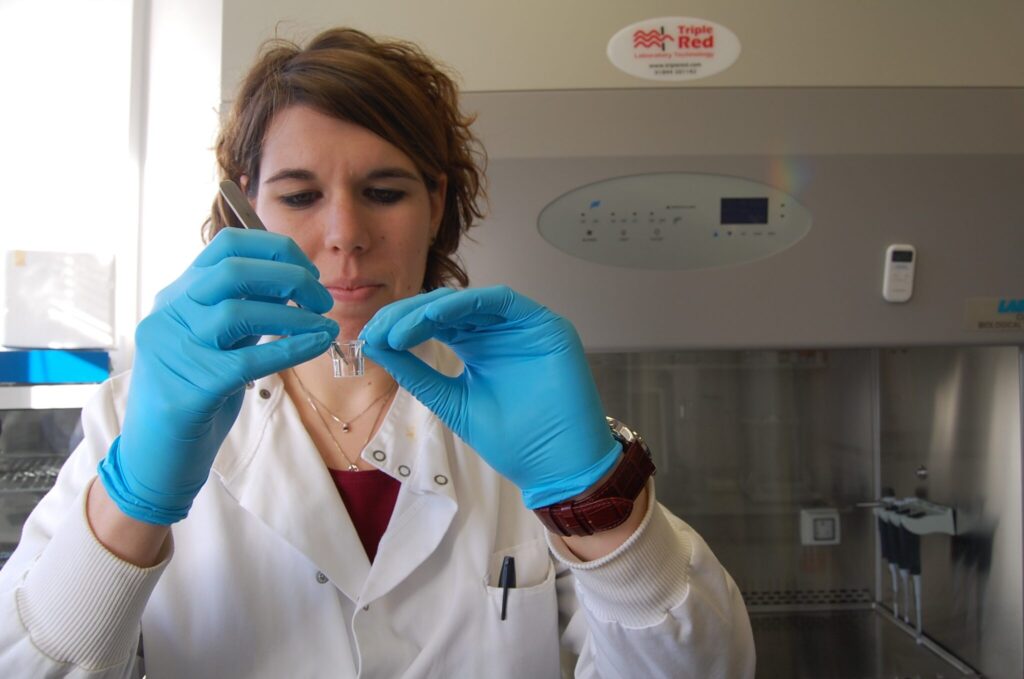

CellRev spun out from Newcastle University in 2018 with a breakthrough novel enzymatic process that overcame longstanding bottlenecks in bioprocessing. It aimed to optimise cell manufacturing with reagents, addressing the industry’s scalability, quality and cost barriers.

The company sought to tackle the manufacturing challenges in the cultivated meat industry to help change consumption habits, and produce tissues for clinical trials to speed up the development of life-saving treatments. It served a global customer base of biopharma, vaccine producers, regenerative medicine developers, and cultivated meat startups, supplying them with high-value media additives in trial and production volumes.

Its flagship product, AggreGuard, is a specialist enzyme blend that stops cells from clumping together during production, which helps increase yields, improve quality, and reduce waste, without slowing cell growth.

And Continuase is its continuous cell manufacturing enzyme solution, which enables extended production runs and reduces downtime to offer step-change improvements in efficiency and cost-effectiveness for large-scale manufacturing.

Over the years, CellRev has secured multiple rounds of investment. It closed a £1.2M seed round in 2021, followed by another £1.75M raise a year later. In 2023, the firm brought in £1.4M (supported by the European Regional Development Fund), and secured a £330,000 grant from national innovation agency Innovate UK.

In December 2023, CellRev partnered with BSF Enterprise (parent company of cellular agriculture startup 3D Bio-Tissues) to launch a joint venture, Cultivated Meat Technologies Limited, to mass-produce cultivated meat in a cost-effective manner.

The entity set out to secure licensing agreements with meat producers who could help provide capital, production expertise and supply chain relationships. It was working on producing cultivated meat fillets as a proof of concept.

Late last year, BSF abandoned the joint venture, retaining full ownership and instead focusing on different ways to produce cultivated meat with major British and European food processors.

CellRev pivoted away from under-the-pump cultivated meat sector

While CellRev developed an industry-first cell production platform, filed three patent families, and secured initial strategic partnerships to launch products, its target market was “hit unbelievably hard by industry shifts” starting in late 2022, according to Green.

He explained that the startup pivoted in a major way, stripping back to a reagents-only model and focusing solely on the life sciences opportunity. CellRev settled on vaccines as its target, secured commercial partnerships and began conducting pilots. It also signed deals to develop a cell and gene therapy product range, secured its first pharma evaluation, and set up distributors.

“It wasn’t enough,” said Green. “We are still adamant that what CellRev set out to do is transformative and very much needed; however, we ran out of time.”

Now, the administrators are aiming to sell off the company’s assets, including the CellRev brand, the AggreGuard and Continuase products, its trademarks, patent applications, website and domain name, as well as tangible assets like centrifuges, bioreactors and microscopes.

The Newcastle University spinout is the latest example highlighting the hurdles facing the cultivated meat industry, with investors losing faith, governments attempting to restrict these products, and consumers continuing to be sceptical.

Cultivated meat witnessed a 40% decline in funding in 2024, securing only $139M, its lowest annual total since 2019. In fact, between 2022 and 2024, this sector cumulatively raised less money than it did in 2021 alone. This year has been even bleaker, with companies in this space receiving just $35M in the first six months.

It has resulted in startups either running out of cash or pivoting their strategies completely, much like CellRev had done. Last year, SciFi Foods wound down after facing fundraising difficulties, while in July, insect farming company FlyBlast declared bankruptcy and blamed its strategy of targeting the cultivated meat sector.

And this month, UK startup Uncommon Bio sold off its cultivated meat assets separately to Meatable and Vow, turning its attention to therapeutics with an initial focus on severe lung diseases like idiopathic pulmonary fibrosis.

The post UK Cultivated Meat Tech Firm CellRev Calls It Quits, Citing Funding Woes appeared first on Green Queen.

This post was originally published on Green Queen.