US plant-based giant has proposed an exchange offer for convertible bonds to eliminate over $800M of debt, sending its stock to a record low.

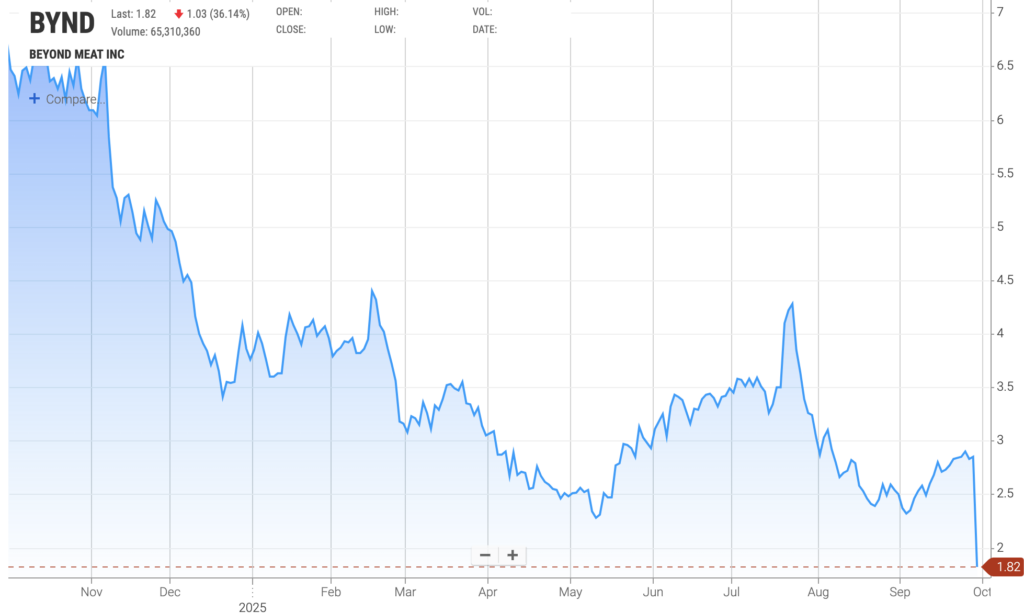

Beyond Meat’s shares plunged to $1.23, a 36% drop, on Monday, the lowest in its six-year history as a public company.

The vegan meat giant’s stock was down by nearly 82% from 12 months ago, following the announcement of an exchange offer that would wipe out more than $800M of the company’s debt.

It comes after a turbulent couple of years for the Californian firm, which saw revenues drop by 15% in the first half of the year, and was forced to deny a wave of bankruptcy rumours last month.

Nearly half of Beyond Meat’s creditors agree to debt restructuring

Beyond Meat is currently $1.15B in debt, thanks to 0% convertible notes that will mature in 2027. But under the new exchange offer, this would be swapped for higher-interest 7% notes that are due in 2030, plus stock shares.

The new debt arrangement will only take effect if 85% of the company’s holders agree to swap. So far, 47% have done so, amounting to $203M of new bonds and 325 million shares of Beyond Meat stock. Other creditors have until October 28 to accept the proposal (those who do before October 10 will receive a premium).

The deal, called payment in kind, will allow Beyond Meat to pay interest with additional debt (at a rate of 9.5% per year) instead of in cash.

“As we continue our business transformation, we have simultaneously worked to strengthen our balance sheet and are today pleased to announce that we are launching an exchange offer for our existing convertible notes,” said Beyond Meat founder and CEO Ethan Brown.

“The exchange offer is intended to significantly reduce leverage and extend maturity, two outcomes that meaningfully support our long-term vision of being the global plant protein company,” he added.

Layoffs, low sales and brand identity plague Beyond Meat

The move is Beyond Meat’s latest attempt to turn its fortunes around. The company recorded its lowest quarterly revenue in Q1 2025, reaching $69M. It also secured $100M in debt financing from Unprocessed Foods, a subsidiary of Ahimsa Foundation, a non-profit advancing plant-based diets.

The firm has blamed its poor sales performance on softening demand and reduced distribution in US retail, and low sales of its burger products to restaurants internationally. Overall sales of plant-based meat plunged by 7% in the US last year, as concerns around pricing and ultra-processing have driven consumers away.

In February, Beyond Meat announced that it would lay off 9% of its global workforce, or 64 employees, which included all its staff in China, where it has suspended operations. And last month, it said it would let go of 44 employees in North America, though it isn’t clear if this is part of the same job cuts as above, or an additional round of layoffs.

It has also hired John Boken, managing director of corporate restructuring consultancy AlixPartners, as its interim chief transformation officer. The aim is to drive its operational footprint into the current revenue environment and improve margin to become EBITDA-positive within the second half of 2026.

Moreover, the company is dropping the word ‘Meat’ from its name to focus on traditional plant proteins. Its next product, Beyond Ground, features just four ingredients – fava bean protein, potato protein, water and psyllium husk – and isn’t intended to mimic meat.

It remains to be seen whether Beyond Meat can convince 85% of its holders to take up the debt resructuring offer. Regardless, the move has raised some alarm bells and sent its stock crashing down. Can it dig itself out of the hole?

The post Beyond Meat Stock Sinks to All-Time After Proposal Wipe Off $800M of Debt appeared first on Green Queen.

This post was originally published on Green Queen.