Sales of meat alternatives are on the rise in Thailand, as plant-based proteins get cheaper and consumers look to shift away from animal-sourced foods.

The plant-based meat market is struggling in Western markets like the US and the UK. But in Thailand, sales are booming, and the food industry senses a window of opportunity.

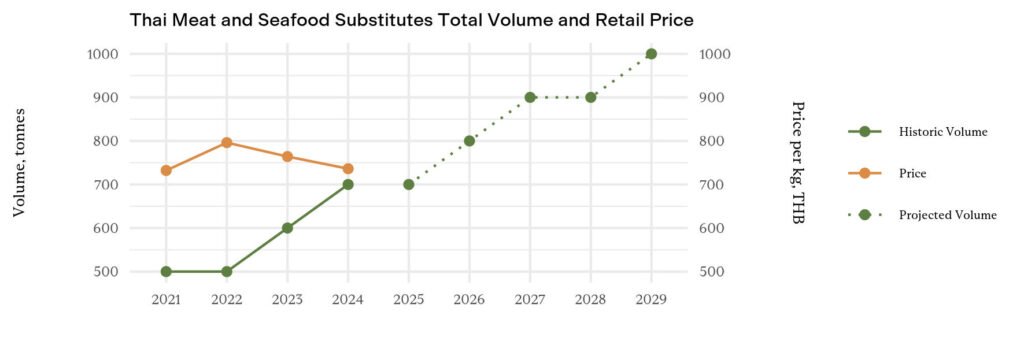

Between 2021 and 2024, volume sales of meat and seafood alternatives increased by nearly 30% in the Southeast Asian nation, according to Euromonitor data obtained by Madre Brava. This is only set to continue, with analysts predicting another 43% increase between now and 2029.

A driving force behind this rise is the fact that these products are becoming more affordable for locals. In 2022, the average price of vegan meat peaked, but it has fallen for two consecutive years since, contracting by 8%.

According to Madre Brava, this provides an opportunity for Thai meat and seafood producers to supply to this growing industry and ramp up exports to more mature markets like Europe, which spends more money on plant-based meat than any other region.

Can plant proteins deliver price parity in Thailand?

In a 2024 survey by Madre Brava, two-thirds of Thai consumers said they would reduce or stop eating meat in the next two years, with 44% wishing to replace it with traditional plant proteins, and 39% with novel alternatives.

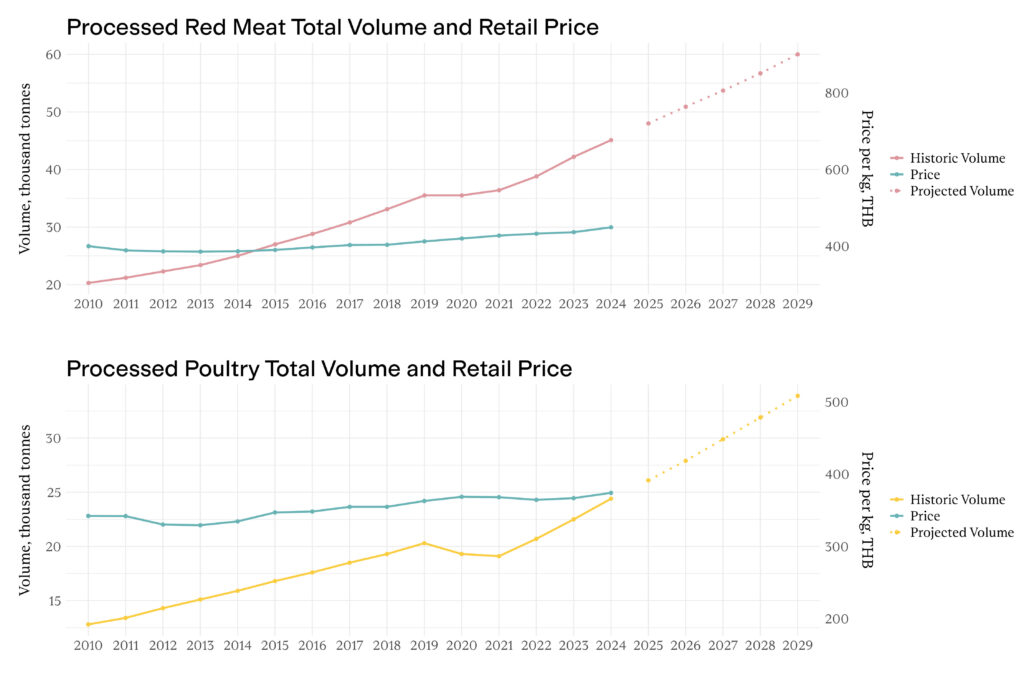

Still, sales of processed red meat and poultry are set to increase by 25% and 30%, respectively, in the next five years. While that rate is slower than plant-based alternatives in Thailand, it’s nevertheless “alarming”, given the environmental and health consequences.

Despite being excoriated for their ultra-processed nature, plant-based alternatives have largely been found to have better nutrition profiles – higher fibre, lower saturated fat and calories, and equivalent protein levels – than processed meats, which have been deemed carcinogenic by the World Health Organization.

But for plant-based meat to truly take off, price parity is paramount. Currently, these products are more expensive than fresh meat as well as traditional plant proteins like tofu, legumes and nuts.

Madre Brava’s research found that the price of meat analogues is eight times higher than chicken, four times higher than pork, and twice as high as beef. However, the gap with processed meat is narrower, with vegan alternatives costing 40% more.

The organisation suggests that the price difference between animal and plant proteins will shrink further thanks to the economies of scale and the increasing input costs to produce conventional meat (the country’s livestock production relies heavily upon imported feed crops like maize and soy, which are getting more and more expensive).

You only need to look at developed alternative protein markets like the US, the UK and Germany, where many plant-based meat products are already at par with the price of their conventional counterparts (and some are even cheaper).

Thai meat producers could capitalise on climate targets and Europe demand

Speaking of which, the price reductions have been led by retailers’ private-label ranges, especially in Europe, where many supermarkets have announced ‘protein split’ goals to expand the share of sales coming from plant-based foods.

And this is where Thailand’s food industry can thrive. The country is one of the main exporters of poultry to Europe, and major Thai meat and seafood companies could use that network to enter the plant-based sector in the region.

“Given the increasing price of raw materials to produce meat, leading protein producers in Thailand should seize this opportunity to diversify their protein portfolio, and strive for price parity between meat (both fresh and processed meat) and plant-based meat alternatives,” said Madre Brava.

This would also help lower domestic greenhouse gas emissions. Agriculture is the second-largest source of emissions in Thailand, and its livestock sector alone generates 39 million tonnes of CO2e annually. As things stand, this will grow by another five million tonnes by 2050.

But the country’s second nationally determined contribution (NDC) to the Paris Agreement covers agriculture as a key focus sector, setting an unconditional emissions reduction target of 30% by 2030. Alternative proteins are a critical lever here.

Previous research from Madre Brava found that replacing half of its meat and seafood production with plant proteins is the only way for Thailand to stay below the climate-safety threshold (zero deforestation by 2025 and a 72% cut in emissions by 2050) set by international experts.

The transition is estimated to cause the loss of 900,000 animal husbandry jobs, but create over two million new jobs in the production of food-grade soybeans and plant proteins. And investment from the government and the private sector could help yield ฿1.3T ($39.6B) in economic value by reducing the reliance on imports.

“Leading protein-producing companies can also harness Thailand’s reputation as the ‘kitchen of the world’ to produce Thai-inspired ready-to-eat products made with meat substitutes to maximise opportunities for export markets in Europe,” Madre Brava stated.

The post In Thailand, Plant-Based Meat is Getting Cheaper & Selling Faster appeared first on Green Queen.

This post was originally published on Green Queen.