Following a dismal first half of 2025, funding for alternative protein startups bounced back in Q3 as investors rallied around differentiated tech and financial credibility.

Plant-based and fermentation-derived proteins enjoyed a resurgence in VC flows in Q3 2025, a departure from the sector’s recent struggles to attract investors.

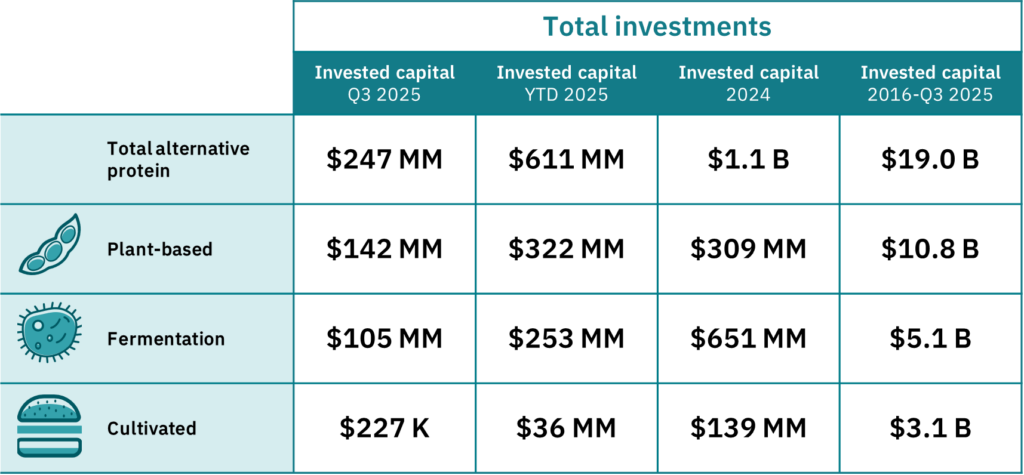

Alternative protein startups collectively raised $247M between July and September, nearly double the $130M total from the previous quarter, according to the Good Food Institute’s (GFI) analysis of data from Net Zero Insights.

There are caveats, though: investments were highly concentrated in Europe, and cultivated meat companies still struggled to attract funding, despite having their most successful year in terms of regulatory approvals yet.

Those working with plant-based proteins and ingredients derived from biomass fermentation, however, emerged as the biggest winners in this period. Still, barring a miracle fourth quarter, the overall sector is on course for a fourth consecutive year of investment decline.

Plant-based startups ride on unique tech and commercial traction

According to GFI’s analysis, plant-based companies attracted $142M in Q3 2025, surpassing the entire alternative protein sector’s Q2 total. This was led by a $58M round for France’s Nxtfood, which owns the Accro brand of meat alternatives and tripled its revenue last year.

It means this segment has attracted more capital in the first nine months of 2025 ($322M) than it did in all 2024, when annual capital flows declined by 64% to reach just $309M. This aligns with investment trends in the larger climate tech sector, which has surpassed its 2024 totals in this period too.

“Capital continues to flow to select, well-positioned companies with differentiated tech, credible paths toward progress on taste and price, and commercial traction,” said Daniel Gertner, GFI’s lead economic and industry analyst.

“In Q3, nearly three-quarters of plant-based deal value was secured by companies based in Europe, where retailers are driving protein diversification initiatives and private-label expansion, and where pockets of retail sales growth persist,” he added.

This speaks to a larger trend. Over two-thirds of alternative protein capital flows went to companies headquartered in Western Europe. US businesses captured less than one-fifth of the total.

Meanwhile, fermentation startups bagged $105M in Q3, most of which ($93M) went towards biomass fermentation technologies, specifically The Protein Brewery ($35M), The Better Meat Co ($31M) and Revyve ($28M). But while that takes the segment’s total to $253M so far this year, this is less than half of the $651M it raised in 2024.

Investors seeking ‘near-term proof points’ for cultivated meat

Cultivated meat has had a milestone year – seven companies have received some form of regulatory clearance in different jurisdictions to sell their proteins for human or pet food. But investor enthusiasm has not matched the regulatory success.

Startups in this sector received only $227,000 in Q3. And no deals were publicly disclosed in Q2 either, putting cultivated meat’s total investment at just $36M for the first nine months of this year. In contrast, this technology attracted $139M in 2024, itself a 40% decline from the previous year.

“Cultivated meat is capital-intensive and milestone-driven, so funding is likely to cluster around key technical and commercial advancements,” Gertner pointed out.

“Right now, investors seem to be watching for additional near-term proof points such as favourable unit economics, further regulatory approvals, and consumer traction. We’ve seen meaningful progress on these fronts in 2025, but bridging the scale-up phase will still require additional capital from public, private, and philanthropic sources.”

Can the alternative protein industry build on this?

The uneven access to funding across regions and technologies has pushed companies to tap into large corporations, foundations and the public sector, in the form of partnerships, acquisitions, grants, and research consortia. These mechanisms will be increasingly important in extending runway as VC dollars flow to fewer companies and in smaller checks until the sector delivers high-multiple exits, GFI said.

Compared to Q3 2024, investments in plant-based companies doubled in the corresponding period this year, but declined by 43% for fermentation startups and 92% for cultivated protein firms.

But Gertner warned against looking too much into quarter-to-quarter variations in a sector where just a small number of deals can significantly influence overall totals. Multi-year progress on “scale-up, product innovation, and corporate involvement” is more informative.

Can the industry sustain this bit of momentum? Is it past the trough of illusionment? It’s worth noting that investors pumped $1.1B into alternative proteins last year – as of Q3 2025, that cumulative total sits at just $611M thus far.

“A sustained upswing in private investments in alternative protein companies will rely on companies demonstrating credible paths to profitability and achieving tangible exits such as IPOs and strategic acquisitions,” argued Gartner. “In the near term, capital will likely continue to concentrate around firms that hit technical and scale milestones and demonstrate strong market performance.”

The post Funding for Alternative Proteins Rebounds in Q3, with Europe Leading the Charge appeared first on Green Queen.

This post was originally published on Green Queen.