By failing to invest and innovate in plant-based foods, global food giants including Nestlé, Unilever and Walmart risk losing out on the protein race.

Political sensitivities, a lack of research, and low specialised expertise are driving the plant-based innovation gap and putting the global food system under increased pressure, according to a new report by a $90B-backed investor network.

The FAIRR Initiative’s protein diversification report pulls the curtain back on investor engagement with 20 of the world’s largest food retailers and manufacturers, outlining how a declining corporate investment into alternative proteins is creating supply chain, climate, and public health risks.

Almost all companies in the report – including Nestlé, Ahold Delhaize, Unilever, Walmart, Tesco, Kraft Heinz, and Amazon – overlook the supply chain implications of protein diversification. And only 40% have assessed the transition risks of failing to meet evolving consumer preferences for plant-based products and the climate impact of livestock-heavy portfolios.

For instance, 90% of companies continue to launch and promote new plant-based products, but 77% said concerns over taste, cost and nutrition are hindering consumer uptake.

Yet, just 60% of companies are working to improve access and affordability of these proteins. In fact, only 40% have dedicated resources to increase product innovation in 2025 (versus 45% last year).

Dana Wilson, research and engagement manager for protein diversification at FAIRR, argues that most companies struggle to understand their consumer base and preferences well enough to address plant-based product concerns.

“Companies may have identified that consumers are dissatisfied with the taste of plant-based meat alternatives, for example, but not identified which specific aspects could improve product performance, such as mouthfeel, tenderness or removing specific off-flavours,” she tells Green Queen. “There is also not one type of consumer, and more detailed segmentation could help identify innovation priorities for the plant-based category.”

Wilson notes that 55% of companies are reliant on desk research to find general consumer trends (like the boom in health and nutrition), and only 25% have conducted surveys to tailor their product and marketing approaches. “The remaining 15% of companies are yet to utilise consumer research related to either healthy diets or alternative protein sources to target marketing efforts,” she says.

Misguided UPF fear has pushed consumers to whole foods

FAIRR’s research found that two of the companies analysed have already discontinued new plant-based products launched in the last 12 months, citing low sales.

“The products that have been discontinued are in the processed meat alternative category and did not cater to current consumer preferences for less processed products with shorter lists of more familiar ingredients,” says Wilson.

Indeed, the fear around ultra-processed foods (UPFs) has hit meat alternatives harder than most other categories. With governments looking to impose restrictions on UPFs, this will only continue, despite experts warning against linking processing with nutrition.

“The definition of ultra-processed foods remains under contention without a universally recognised standard, so the ambiguous narrative has caused confusion and concern among consumers about their food choices,” Wilson highlights.

“Foods high in nutrients such as salt, sugar and saturated fat, or additives known to be harmful, can be less healthy. However, food processing levels do not necessarily correlate with nutritional value, as some processes, such as pasteurisation, canning, freezing or vitamin fortification, can have public health benefits. Overall, there is increasing academic consensus that some processing of foods is essential to ensure food safety.

“Although most animal-sourced foods are also processed, news and social media outlets have focused disproportionately on processing levels of plant-based meat and dairy alternatives, leading to consumer wariness around the healthiness of these products.”

The consumer focus has swiftly shifted to whole foods, just as 88% of global dietary guidelines advise people to eat more fruits, vegetables, legumes, nuts, and whole grains. Over half of the companies in FAIRR’s engagement cohort see an opportunity in whole-food plant-based products, and 60% have launched at least one such offering in the past year. This, however, falls to just 38% among brand manufacturers (which tend to favour more processed alternatives).

“Although health and nutrition trends are increasing consumer interest in whole foods, there are also other factors influencing actual consumer purchasing behaviour, such as convenience, price and taste,” says Wilson.

Companies need to put more resources into product innovation

“While 60% of companies in FAIRR’s engagement are dedicating resources to increasing the accessibility and affordability of their alternative protein portfolios, through initiatives such as multi-buy offers, discounts, loyalty cards, ceiling prices, and collaboration with government nutritional programmes, many of these efforts are short-term,” Wilson notes.

According to the companies in the report, traditional plant-based proteins more familiar to consumers, such as tofu and legumes, are the strongest-performing. “Plant-based dairy products are also a popular category, although the performance of individual products has varied between companies and regions,” she says.

“Companies that allocate more resources to product innovation to improve performance and conduct consumer research to effectively meet their needs and market a value proposition, such as a nutritional benefit, tend to perform better in the segment.”

French retailer Carrefour exceeded its target of reaching €500M in plant-based sales two years ahead of the 2026 timeline by focusing on plant-based whole foods (it has since extended the goal to €650M). And in the Netherlands, Ahold Delhaize pledged to achieve 50% plant-based protein sales across all its European supermarkets by 2030.

“Both companies incentivise their boards to deliver their Scope 3 emission reduction targets through linked executive compensation metrics,” notes Wilson. “They have also undertaken consumer research related to alternative protein sources and healthy diets to understand their customer base, and have taken actions to promote plant-based products, such as through dedicated marketing campaigns, events, product tastings, shelf markings, partnerships, recipe inspirations and social media content.”

In terms of innovation, Danone has dug deep into health and wellness with a focus on fibre, gut health and protein in its plant-based dairy expansion this year. “The company utilises reformulation and blended products to improve the nutritional profile of plant-based options,” says Wilson. “It has also invested in the Biotech Open Platform, in partnership with Michelin, Crédit Agricole and DMC Biotechnologies, to help scale manufacturing in the precision fermentation sector.”

Despite the evidence, food giants fail to grasp protein diversification’s potential

The report comes weeks after the Eat-Lancet Commission reinforced the Planetary Health Diet to safeguard the food system, suggesting that plant-rich eating patterns can prevent 15 million premature deaths and reduce emissions by 15% by 2050.

With plant protein’s potential more and more evident, why is the food industry failing to recognise it? “Companies are primarily approaching protein diversification as a business opportunity, but consumer demand is variable, and product launches do not always reflect their preferences,” says Wilson.

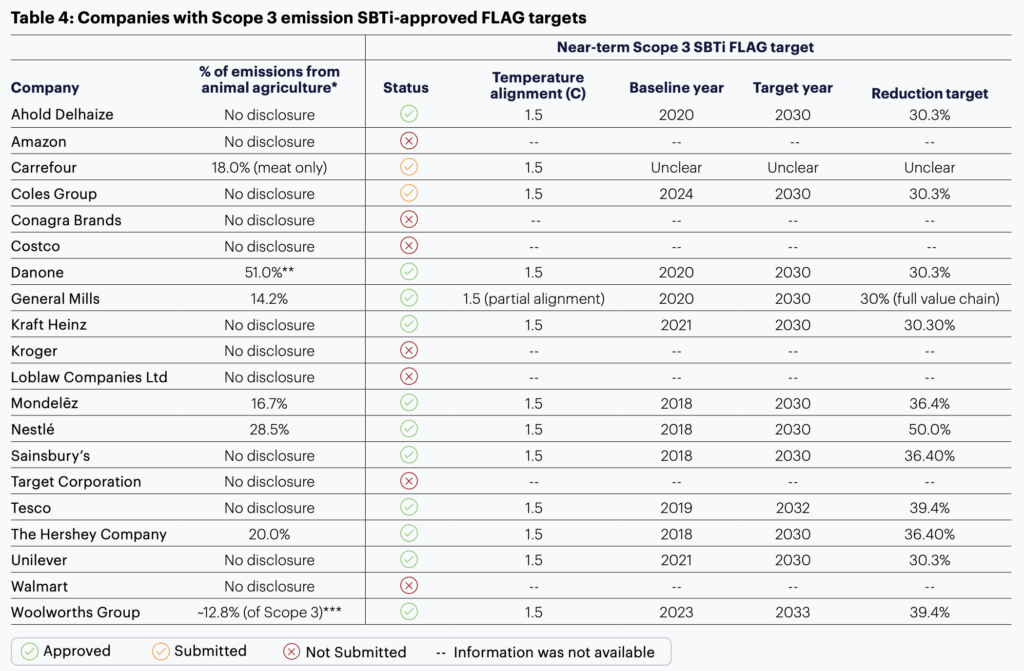

Most are unaware of how it can support their climate goals.”The number of companies setting 1.5°C-aligned Scope 3 emission reduction targets that include FLAG emissions has increased, from 35% in 2024 to 55% in 2025. However, it is unclear how most companies will meet these targets, as only 25% have developed clear roadmaps quantifying the emissions mitigation potential of their decarbonisation interventions,” she explains.

“Ahold Delhaize, Carrefour, Danone, Nestlé, and Unilever are the only companies that have developed roadmaps quantifying the carbon mitigation potential of their chosen decarbonisation levers, and they also recognise protein diversification as a lever to achieve their Scope 3 targets.

“This suggests that undertaking such analysis can support companies in understanding how protein diversification can help them meet their climate goals, aligning with the latest scientific evidence published by organisations such as the IPCC and the Eat-Lancet Commission.”

Danone, meanwhile, is the only business reskilling its workers to support a transition to more sustainable and healthy diets. It is helping its factory staff in Villecomtal-sur-Arros produce oat milk after shifting away from producing dairy yoghurt.

The report further highlights the role of government policy and regulation in accelerating the protein transition, such as the UK’s 10-year health plan, which mandates supermarkets to disclose sales of healthy products.

“If implemented, such disclosure standards could be a step towards healthy sales targets and incentivise companies to allocate more resources to innovation in healthier, more sustainable categories, such as diversified protein sources,” Wilson says.

Why investors fell out of love with plant-based proteins

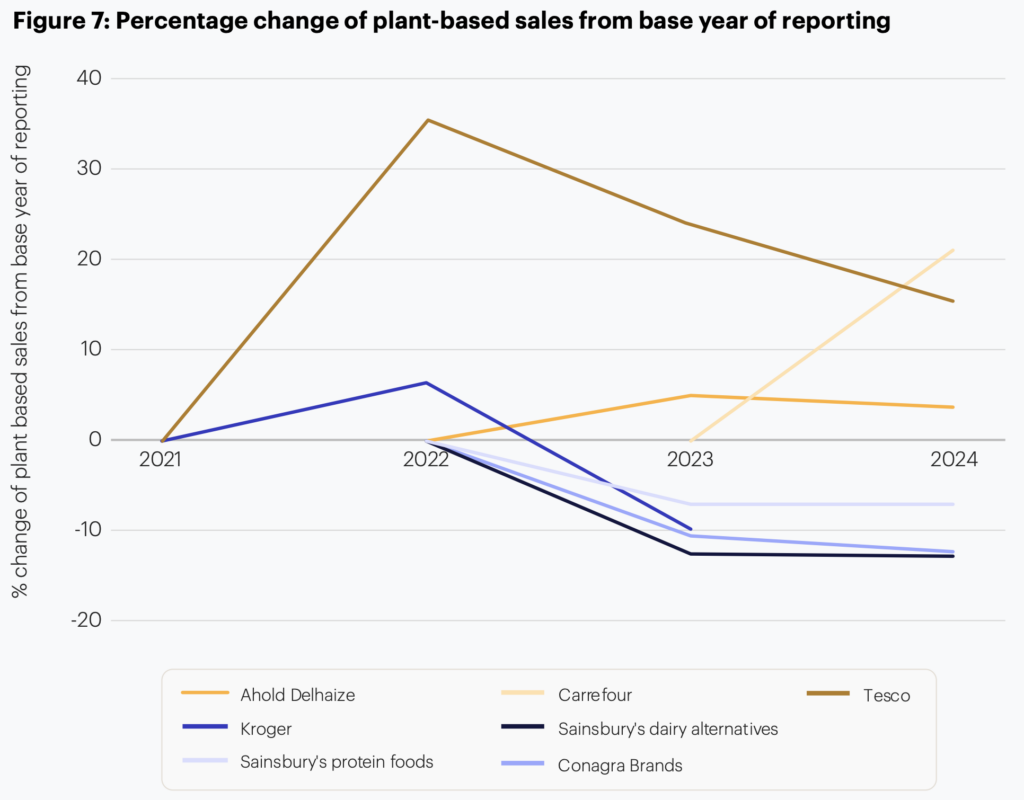

It has been tough going for plant-based companies. Consumer purchases have seen a constant dip in some of the largest markets too, including the US and the UK.

One reason behind the slowdown in sales is a lack of specific marketing commitment. Asked why they don’t employ direct marketing strategies, some companies in the FAIRR report cited potential backlash from “politically sensitive topics” like diets and sustainability, and 30% said they were moving away from messaging that could isolate consumers, like prominent vegan labelling.

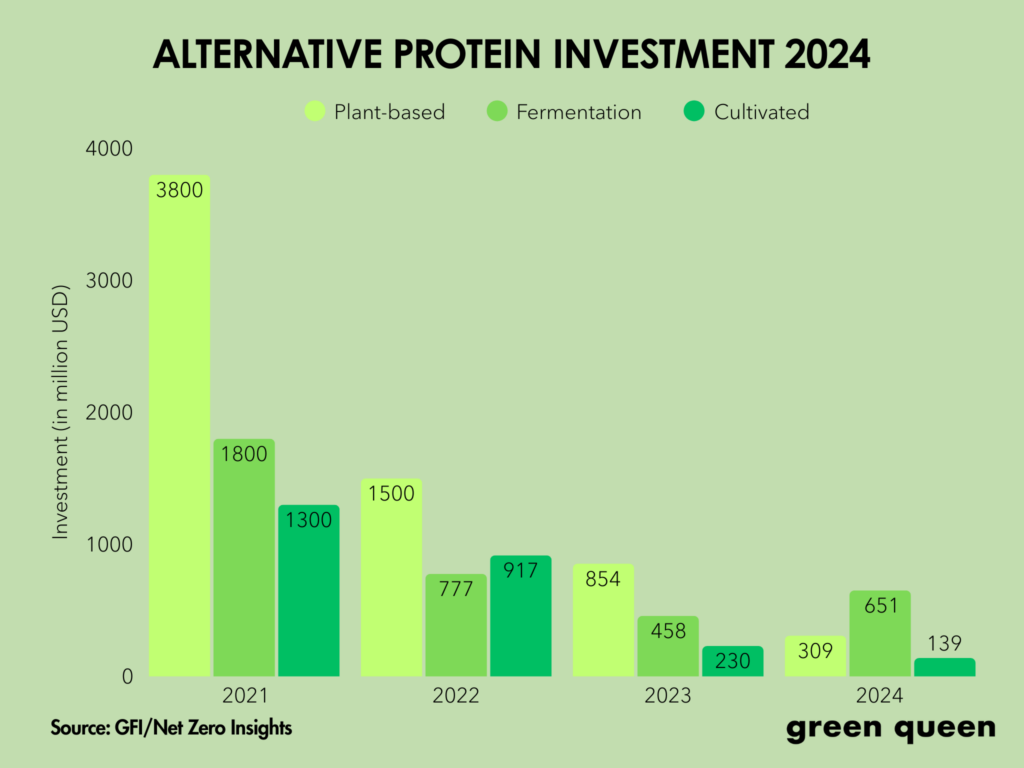

But the decline hasn’t just been at a consumer or business level. After investments in plant-based startups peaked at $3.8B in 2021, they have fallen by 61%, 43% and 64% in each year since. Wilson says capital has been less readily available in these years, thanks to a host of factors, including “general market issues that have reduced liquidity and increased the cost of investing, such as rising interest and high inflation rates”.

“However, there are also issues specific to the sector, including initial overvaluation of consumer-facing plant-based and novel protein companies as technology firms rather than food companies. The performance of early plant-based meat alternatives also varied, leading to disappointment among willing consumers, and slower-than-expected market uptake rates and returns on investment,” she points out.

“This was broadly reported in the media with a negative sentiment towards the category as a whole, further deterring consumers. Ultimately, without a track record of reliable cash flows, companies are considered high-risk investments.”

Regulatory risks are also a factor, with novel food approval pathways moving more slowly than expected in regions like Europe and Singapore. Unclear guidelines and negative press around bans on cultivated proteins and plant-based product labelling in Europe and US states haven’t helped either.

“As a result of these factors and losses on previous investments, in their due diligence, investors are now prioritising especially unique innovations that have intellectual property potential, or can also be applied across sectors beyond food for risk mitigation,” says Wilson.

In the first nine months of 2025, plant-based companies have already surpassed their investment totals from last year. Can it sustain this momentum? “Investors are primarily focused on returns and, therefore, a clear pathway to achieving profitability,” she says. “As with any company an investor backs, this comes down to a combination of technology, product performance, a clear target consumer, strong governance and a scale-up plan to reduce unit economics.”

The post The World’s Largest Food Companies Are Missing the Future Protein Opportunity appeared first on Green Queen.

This post was originally published on Green Queen.