US startup Fork & Good has acquired fellow cultivated meat producer Orbillion Bio to combine their global operations and fast-track the launch of their proteins.

Waiting a decade to find supply chain solutions to meat shortages and price hikes isn’t an option. We need immediate fixes that can make our protein systems resilient to climate shocks and trade disputes.

That’s the thesis that convinced New Jersey-based startup Fork & Good to snap up California’s Orbillion Bio, marrying their B2B platforms to produce cultivated red meat and taking their merged operations to four crucial regions across the world.

“We’re already working with customers in North America and East Asia, and are excited to bring Orbillion’s relationships in Europe and the Middle East online,” says Niya Gupta, co-founder and CEO of Fork & Good. The latter two regions have been working to advance their novel food regulation, so this is timely.

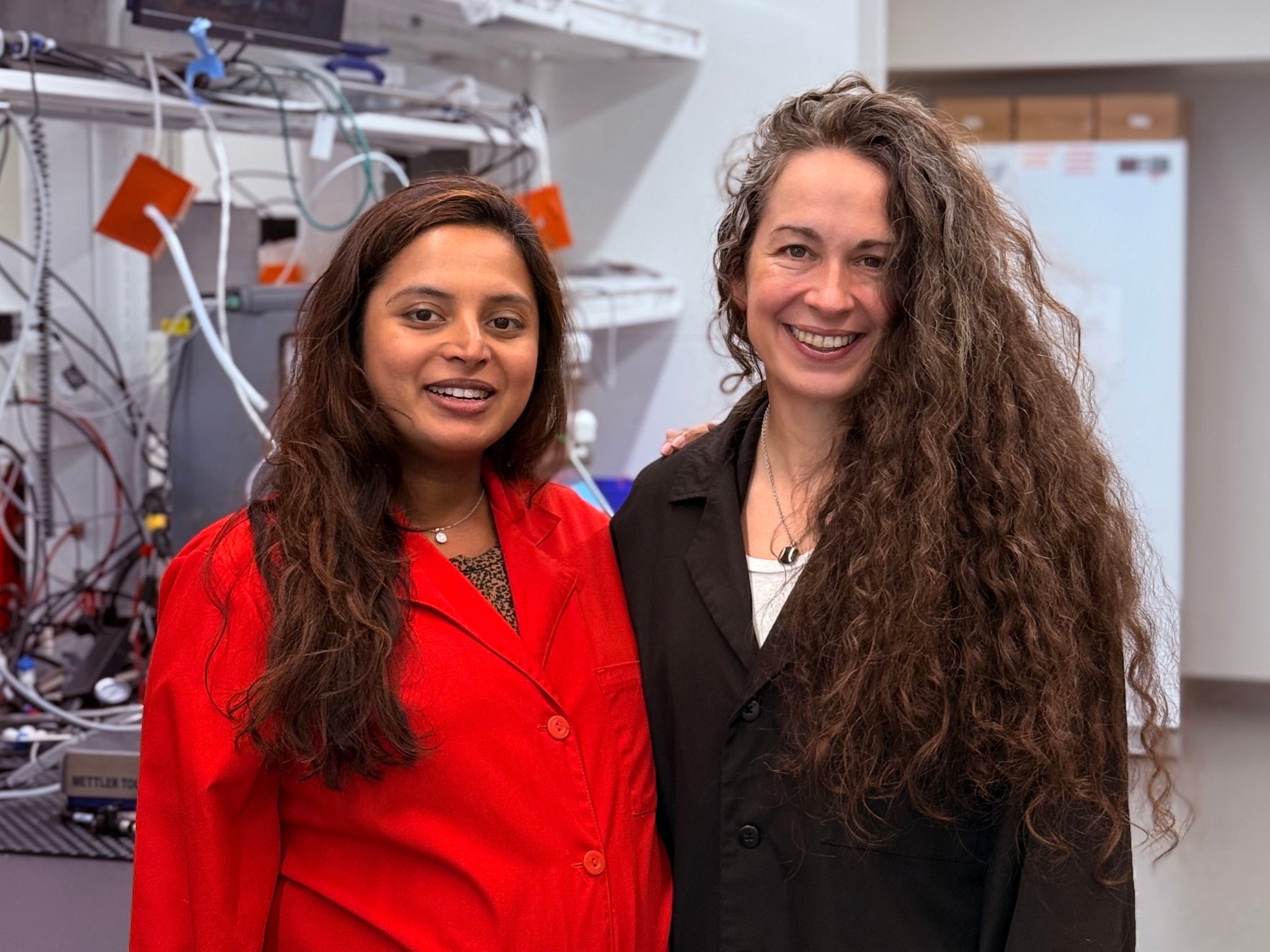

“This consolidation brings together technical and commercial expertise from both companies in one location to accelerate production,” Orbillion founder and CEO Patricia Bubner, who is now Fork & Good’s co-founder and COO, tells Green Queen.

“The teams have been integrated at Fork & Good’s headquarters in Jersey City, which houses a pilot plant capable of producing several tonnes of cultivated meat per year,” she explains. “The combined company also maintains a subsidiary in Abu Dhabi, supporting growth in the Middle East and beyond.”

Asked why the two firms decided to join forces, she says: “Both companies share a B2B focus, proven customer traction, and complementary technology platforms, product focus and markets. This combination immediately expands both companies’ product range and global reach while uniting industry-seasoned talent to deliver on existing contracts.”

Fork & Good boasts ‘most comprehensive’ IP in cultivated meat

Gupta founded Fork & Good with Gabor and Andras Forgacs, co-founders of cellular agriculture firm Modern Meadow, in 2018. The startup produces cultivated pork using a patented integrated cell manufacturing platform, which lets it grow a large number of cells in a cost-effective manner.

Its pilot facility can produce about seven tonnes of product in less than 800 sq ft of space. As it scales up, Fork & Good is targeting a cost of $5 per lb of biomass at commercial levels, eventually bringing it to parity with commodity pork at $2 per lb. And last year, it became the first startup to host a public tasting for cultivated meat in Europe, serving dumplings with 30% cultured pork in Davos.

Orbillion, meanwhile, has developed an algorithm that can transform 2D culture into 3D culture in record time and at low costs. It has completed a 200-litre production run for its cultivated Wagyu beef, and teamed up with Dutch premium meat manufacturer Luiten Food, opening up access to its 1,200 distribution points.

“Orbillion has successfully scaled beef, and Fork & Good has developed highly efficient pork cell lines. The two platforms are compatible,” says Bubner. “Both centre on producing mammalian muscle cells – the core of what makes meat ‘meat’ – and the main source of its protein. This differentiates [us] from other companies in the space that use fat cells, fibroblasts or undifferentiated stem cells.”

According to Fork & Good, the entity now has the biggest IP portfolio in cultivated meat. “Fork & Good was founded on and expanded the foundational IP developed by Modern Meadow, the first cultivated meat company, adding multiple new patent families covering its own innovations,” notes Gabor Forgacs.

“With Orbillion’s complementary portfolio, the combined company now holds the most comprehensive and defensible IP in cultivated meat (i.e., the greatest number of issued patents), covering core production methods, cell lines, and bioprocess technologies essential for scalable manufacturing.”

Meat producers look to cultivated meat amid supply shocks

The meat industry is at an inflexion point. Its impact on the planet – already outsized – is only deepening as demand rises, but the climate crisis it’s helping fuel is wreaking havoc on livestock systems.

Meat prices reached an all-time high in July, becoming the primary driver of worldwide food inflation. It came as cattle numbers fell to their lowest in 70 years in the US, and high grain prices and rising interest rates raised beef production costs. The pork industry itself has taken several hits due to repeated cases of African swine fever – in 2018-19 alone, it wiped out a quarter of the global hog population.

Red meat relies on multi-year livestock lead times, so keeping up with rising demand is only getting harder. Cultivated meat can cut the production periods to weeks. USDA data shows that four countries are responsible for 70% of the world’s pork imports and 40% of beef imports – China, Japan, South Korea and Mexico – and it Fork & Good has operations in each of them.

“We work exclusively in B2B, partnering with food manufacturers and meat companies to address their key needs: value‑added ingredients, supply chain stability, and local production,” says Gupta.

“Our ingredients enhance clean‑label, nutritious, and functional properties in a variety of ground red meat products like burgers, sausages, and dumplings, replacing multiple ingredients with a single one. By producing locally, we provide a reliable supply and reduce dependency on traditional meat sources.

“Our approach also enables cost-competitive solutions, helping partners compete today and in the future by delivering scalable, high-quality ingredients that create tangible value in their products and supply chains.”

This is why the company has signed offtakes and paid development agreements with leading producers like Luiten Food, Sigma Alimentos, and several undisclosed “multibillion-dollar food companies”. Fork & Good itself earned its first revenue earlier this year, courtesy of a joint development agreement with an $8B global food manufacturer.

“Serving the customer of the future requires innovation,” says Lennert Luiten, CEO of Luiten Food. “Our vision is to integrate Fork and Good’s cultivated meat with familiar meat and plant-based options, paving the way for a new generation of products that satisfy our taste buds and support a sustainable future.”

A ‘margin-first’ focus as investor ‘patience wears thin’

Following the acquisition, Fork & Good said it is taking a “margin-first” approach, centred on proving techno-economic viability at mid-scale before pursuing larger expansion. This will help demonstrate sustainable unit economics, an area where the sector has struggled. A B2B business model that does not involve building massive factories, therefore, is a winning strategy.

“We focus on building a business that can deliver high-quality cultivated meat products at competitive cost while maintaining healthy profit margins,” says Gupta. “To reach a mass market, products must be both excellent and affordable. That requires constant attention to efficiency – optimising production, reducing input costs, and scaling smartly – without compromising quality or safety.

“In practice, this means we designed our system based on unit economics at a factory level, rather than building a tech platform and then reducing cost. Thus, we ensure that cultivated meat can compete directly with conventional meat.”

The acquisition comes amid a volatile time for cultivated meat – several companies have shuttered since 2024, and others have resorted to the M&A route (like Uncommon Bio and Parima). Funding, meanwhile, has plummeted from $1.3B in 2021 to just $139M in 2024 (and only $36M so far this year), as investors pivoted to AI and sectors with faster returns.

“Building real-world solutions, especially in cultivated meat, takes time for science, engineering, and scale, and patience has worn thin where fundamentals lag. Still, meat remains a growing $2T opportunity, and overcoming early hurdles, such as in Fork and Good’s case, creates a strong moat,” argues Bubner.

“Partners and strategic investors who understand this value and focus on long-term impact remain highly engaged, even as short-term ‘tourist’ investors move on.”

Fork & Good eyeing cultivated meat approval in several markets

Highlighting the regulatory success of cultivated meat this year, Bubner says the industry has reached a stage where companies can deliver to customers, and the funding environment clarifies who the strongest players are.

“Mergers and acquisitions reflect this maturation, consolidating talent and technology to accelerate commercialisation. We expect strategic consolidation to continue as the industry scales and focuses on delivering products reliably to market,” Gupta predicts.

The merged entity will accelerate commercialisation and regulatory approvals for Fork & Good, which has filed a dossier with the US Food and Drug Administration and previously earmarked Q2 2026 as the earliest launch date for its cultivated pork. Gupta told Green Queen in February that it is pursuing the green light in Singapore too.

Integrating Orbillion’s platform will create a “unified, scalable system applicable to both red meat types”, according to Bubner. The company is actively preparing submissions and engaging with authorities, but she declined to comment on product formats or timelines.

“We work with global customers and are ready to supply as soon as regulatory approval is granted; we’re pursuing regulatory approval where our customers are,” she notes. “Our focus remains on ensuring our products meet all safety and compliance standards to support broad commercial availability once approvals are in place.”

The post Exclusive: Fork & Good Acquires Orbillion to Take Cultivated Red Meat Platform Global appeared first on Green Queen.

This post was originally published on Green Queen.