British cultivated meat startup Hoxton Farms has submitted a regulatory dossier to the Singapore Food Agency, with filings in the UK, North America and other Asian countries to follow soon.

Amid a wave of regulatory successes for cultivated meat, UK startup Hoxton Farms is getting in on the act with an application in Singapore, the first of several submissions planned globally.

The London-based food tech firm filed a dossier for its cultivated pork fat with the Singapore Food Agency (SFA), which has already doled out approvals to three startups in the space. It expects to receive the green light between late 2026 to early 2027.

Hoxton Farms’s submission was overseen by CSO Vitor Espírito Santo, who played a key role in helping Eat Just’s Good Meat division achieve the industry’s first regulatory approval back in 2020, also from the SFA.

“The SFA remains a world leader in regulation for cultivated products. While the team has evolved, their commitment to safety, transparency and collaboration hasn’t changed,” co-founder and CEO Max Jamilly tells Green Queen when asked about how the regulatory landscape has evolved in the five years since.

“We also benefit from clearer guidance and more precedent today, which makes the process more predictable and improves our chances of success,” he tells Green Queen.

Jamilly first teased the Singapore filing in an interview with this publication earlier this year, when Hoxton Farms set its stall out in Asia through manufacturing and commercialisation partnerships with Japan’s Sumitomo Corporation and Mitsui Chemicals.

Hoxton Farms to build commercial-scale cultivated meat facility

Founded in 2020 by Jamilly and COO Ed Steele, Hoxton Farms leverages cell biology and machine learning to grow fat from pig cells in modular bioreactors. The ingredient is a drop-in replacement for animal fats and plant-based oils, and can be mixed with plant proteins to create products like soups, sauces, and hybrid pork.

“We start with stem cells from a pig, specifically mesenchymal stem cells, grow them in proprietary cell culture media (made of proteins, vitamins and sugars, much like you would feed a conventional pig), and differentiate them into real pork fat, or adipocytes,” explains Jamilly.

“Not only are we making real fat tissue – not biomass – but our proprietary cell lines, optimised bioprocess and patented bioreactors are all designed for cost efficiency and scale. Using AI to fine-tune growth and differentiation, we can produce delicious, high-quality fat at low cost – real animal fat made for food manufacturing.”

That said, Jamilly notes that its current costs are high due to limited scale. “But our technology is designed to bring these costs down rapidly. At industrial volumes, our process and reactor design allow us to reach a cost in use competitive with conventional pork fat while maintaining excellent quality, so food manufacturers can make delicious products,” he highlights.

Hoxton Farms currently operates a 14,000 sq ft pilot facility in London, running 500-litre bioreactors. “Our next facility, in the 10kL range, will be built next year and commissioned in early 2027,” the CEO reveals. “This expansion will enable us to move from pilot to early commercial scale and meet the huge demand we have from major food manufacturers.”

Cultivated fat more efficient to grow than muscle

Hoxton Farms is one of several companies spotlighting fat as a more viable way to bring cultivated meat to market. This includes Mission Barns (which has begun selling its hybrid pork products in the US), Mosa Meat (which is seeking approval for beef fat in multiple markets), Steakholder Foods, and Genuine Taste.

So why the focus on fat? “First, fat is what makes food taste delicious. A small amount of fat can be transformative to any dish – it’s a low inclusion, high-impact ingredient,” says Jamilly. “Second, and we know this as humans, fat is easier and faster to grow than muscle.

“Most importantly, demand for meat (and the fat that makes it taste amazing) is growing, prices are increasing, and there’s more and more uncertainty with tariffs and climate change.”

Speaking of which, pig farming is a highly emissive industry that requires excessive amounts of water and land. And plant-based hard fats like coconut or palm oil – preferred by many manufacturers for their functionality – are the primary drivers of tropical deforestation.

“Cultivated fat delivers taste, nutrition and performance, while reducing dependence on volatile animal and commodity oil markets,” says Jamilly. “Even at low inclusion rates, Hoxton Fat transforms flavour, juiciness and cooking performance.”

He adds: “Our model is fully B2B. We supply cultivated fat as an ingredient to food manufacturers – primarily processed meat producers looking for healthier, scalable, more reliable and sustainable fats, and to plant-based brands seeking authentic taste and performance.”

Hoxton Farms lays out global regulatory and funding plans

Hoxton Farms chose to begin its regulatory journey in Singapore thanks to its reputation as a food tech powerhouse. The startup suggests the city-state has set a global benchmark for science-based food regulation, citing its “forward-thinking, collaborative regulatory environment” and “transparent and supportive framework”

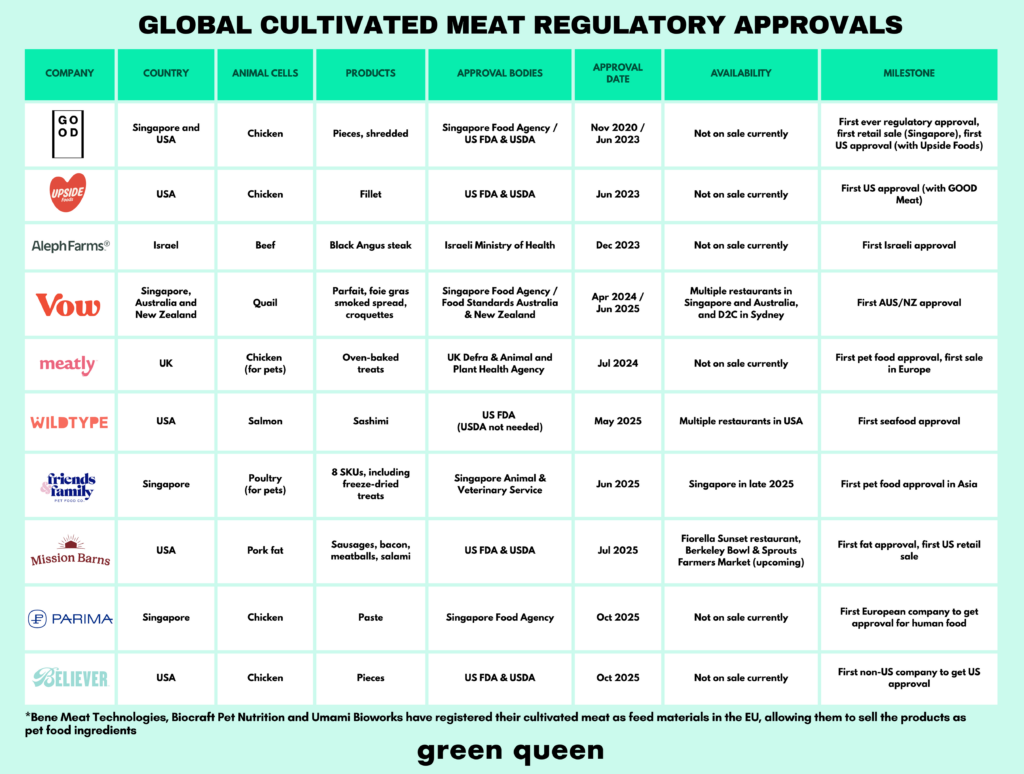

When it comes to cell-cultured proteins, the SFA has so far greenlit Good Meat’s chicken, Vow’s quail, and Parima’s chicken for use in human food. Moreover, the Singapore Animal & Veterinary Service has approved Friends & Family Pet Food Co‘s Kampung bird products for pet food applications.

Hoxton Farms’s Singapore application is a precursor to regulatory filings in a whole host of regions over the coming months, with Asia-Pacific a central focus. “Japan is firmly on the radar, along with a small number of other Asian markets, such as Thailand, South Korea, and Hong Kong, where regulators are taking proactive, science-driven approaches,” says Jamilly.

“Our partnerships with Sumitomo Corporation and with Mitsui Chemicals give us an ideal foundation to explore these opportunities as we scale production and commercial readiness across the region,” he adds.

In addition, the company is part of the cultivated meat regulatory sandbox launched by the UK’s Food Standards Agency (FSA) this year, which aims to help companies get approval and enter the market faster.

“The sandbox has been enormously helpful. It’s a genuinely constructive initiative from the UK government that’s helping shape regulation suited to cell-cultivated products,” Jamilly says. “The recent tasting guidelines and pre-submission advice reflect real feedback from companies like ours, showing that the UK is becoming one of the next great leaders in food tech and biomanufacturing.”

Hoxton Farms will submit its dossier to the FSA later this year. “Our launch will be B2B, supplying cultivated fat as an ingredient to manufacturers, though we may partner with chefs and restaurants for initial showcase events,” he outlines.

To date, his firm has raised $35M, and it’s planning a new funding round in early 2026. Investors’ appetite for cultivated meat has receded rapidly, with capital flows down from $1.3B in 2021 to just $139M in 2024 (and a mere $36M so far this year).

Still, Jamilly remains confident. “We’ve built proprietary technology, a de-risked regulatory path and a clear route to profitability at scale,” he says. “With low-cost reactors, efficient processes and a strong AI-driven manufacturing platform, we’re confident in both our position and our ability to attract new investment.”

The post Exclusive: Hoxton Farms Files for Singapore Approval of Cultivated Pork Fat appeared first on Green Queen.

This post was originally published on Green Queen.