Over nine in 10 Singaporeans say they’d replace a portion of their meat with blended proteins, with one product outperforming 100% chicken mince on taste.

Combining meat with plants in a best-of-both-worlds approach is gaining favour in the west, and a new study signals a growing appetite for these proteins in Asia too.

For 88% of omnivores in Singapore, eating meat is a critical part of their normal routine. Yet 91% say they would replace at least some portion of their consumption with blended proteins – and taste is the most important lever.

The state’s Agency of Science, Technology and Research’s (A*STAR) Singapore Institute of Food and Biotechnology Innovation institute conducted the blind taste test, which was commissioned by the Good Food Institute (GFI) APAC and sensory research firm Nectar.

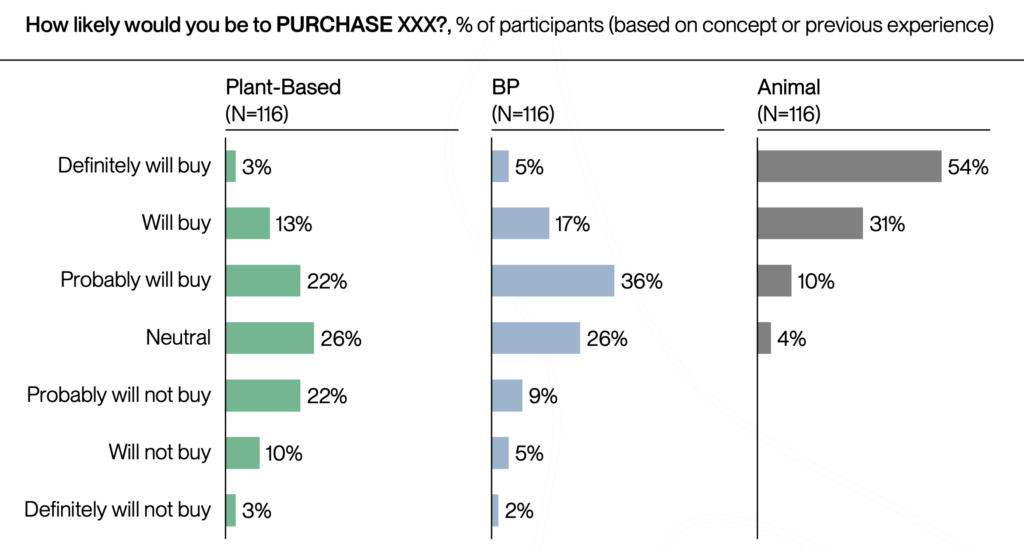

Though only 58% of participants said they would likely buy “balanced proteins” (versus 95% who echoed the sentiment for meat), this is significantly higher than the interest in plant-based meat (38%).

“Balanced proteins appeal far beyond the current plant-based audience,” Nectar director Caroline Cotto tells Green Queen. “93% of Southeast Asian consumers are interested in trying balanced products, including three-quarters who had no intention to buy fully plant-based meat again.

“The category unlocks a markedly wider segment: 50% of likely balanced protein buyers had low intent to purchase plant-based meat. The APAC data illustrates that by leveraging familiarity – upgrading traditional meat formats rather than swapping them out – companies can attract mainstream consumers, including flexitarians and “meat eaters” who wouldn’t typically consider pure plant-based alternatives.

“This incremental approach fits Asia’s rising protein demand and culinary culture, where dishes often blend plant and animal proteins naturally.”

Q Protein’s blended meat outperforms 100% chicken mince

The research included 20 blended meat products and 10 animal and plant proteins each. It found that 81% of consumers liked the 100% meat option, and this rose to 85% for the leading balanced protein SKU.

This is the chicken-soy mince product created by Q Protein, a collaboration between Quality Meat, Cremer Sustainable Foods, and Temasek subsidiary Nurasa. In taste tests, 41% of Singaporeans preferred it over 100% chicken mince, compared to 29% who liked the latter more.

“The success reveals the potential for achieving not just parity, but sensory advantage through blending. This is a compelling argument for incremental ‘step changes’ rather than radical innovation.

The optimal blend ratio (30–50% plant proteins) preserves the sensory familiarity of meat, while embedding nutritional upgrades,” says Cotto.

“Co-development between conventional and alternative protein experts, plus strong local manufacturing, ensures better regional flavour and ingredient alignment. Q Protein’s case highlights that with modest R&D investment, balanced proteins can win on taste, drive health benefits, and unlock sustainable growth in meat-centric markets.”

Several other blended meats were close to taste parity with their conventional counterparts, including chicken chunks and beef mince, both of which were within 0.2 points of liking with the 100% animal version on a seven-point scale.

How should plant-based meat producers respond?

Even the average blended protein product performed better overall than plant-based alternatives, liked by 59% versus 44%, respectively. When compared directly, 71% of taste-testers said balanced proteins taste better than vegan meat analogues. 51% find the former better for health and 40% believe they’re more economical.

This is perhaps why a third of consumers said they would buy products to reduce their meat consumption once blended proteins were added to the fray, higher than the 19% who’d do so when plant-based meat was the only alternative.

So should vegan producers reformulate their offerings to fill the sensory gap, or begin supplying their ingredients to meat companies for blended protein innovations?

“Both paths hold value, but the collaboration model may unlock faster market growth and scale in Asia. Partnering as ingredient or innovation suppliers gives alternative protein companies access to established processing lines, distribution networks, and trusted retail channels,” says Cotto.

“Reformulation for local flavour or texture alignment remains important, but pure direct-to-consumer strategies have lower traction.”

R&D needed to fill gap between average and leading balanced proteins

The research highlighted a likeability gap between the average and leading blended meat products, which were embraced by 37% and 44% of participants, respectively – in comparison, conventional meat was liked by 60%.

“Improvements in balanced protein flavour and appearance are the highest priorities: in categories like chicken mince and beef, the leading balanced proteins matched or outperformed conventional benchmarks in overall liking, pointing towards attainable parity with continued R&D,” Cotto explains.

Another top driver is health, with 69% of consumers rating blended proteins as better for their wellbeing than conventional meat. “This perception led to a 0.5-point increase in purchase intent, equal to the benefit of being perceived as tastier or better priced. Lower cholesterol, more fibre, and reduced fat are the main benefits cited,” she says.

“While sustainability strengthens that choice, it’s a multiplier rather than the initial hook. The awareness of up to 50% lower greenhouse gas emissions bolsters the narrative for climate-conscious buyers. However, environmental benefits boost purchase intent only marginally unless paired with health and taste.”

According to GFI APAC, some of the tested products were pre-commercial prototypes that are being fine-tuned, so the results “represent the floor for enhanced meat performance, not the ceiling”.

So how can companies make these products better? It seems blending meat with savoury vegetables or mushrooms is far more popular (cited by 49-52%) than with plant-based analogues (16%) or ingredients like pea protein (7%). Chicken is the most appealing balanced protein format, and the most preferred ratio (chosen by 57% of consumers) comprised 75% meat and 25% plant-based ingredients.

How blended meat attitudes differ in Singapore and US

The research comes as retailers bring out private-label blended meat products in Europe and offer branded innovations in the US. In fact, Nectar’s research shows that four blended meat SKUs match or outperform 100% animal products on taste among Americans.

Cotto outlines that taste is the strongest purchase driver of blended meat in both the US and Singapore. However, motivations differ. “In the US, interest in blended proteins skews more toward health motivations, with cholesterol and nutrition leading drivers, and with slightly lower overall intent to repeatedly substitute conventional meat,” she says.

“In Singapore, curiosity around innovation and alignment with cultural eating habits played a stronger role,” she notes. This is helped by the prevailing regional familiarity with mixed-protein dishes such as mapo tofu or sambal tempeh.

“Importantly, Singapore consumers showed higher openness overall: nine in 10 said they’d replace a portion of their meals with meat enhanced with plant proteins, compared to about seven in 10 in recent US tests,” adds Cotto.

“While both US and Singaporean consumers cited flavour as the biggest opportunity for improvement in BP products, appearance was a bigger issue for Singaporean consumers than texture, a marked difference from the US study of balanced proteins. Almost all top R&D opportunities for balanced proteins in APAC were related to flavour (six out of seven), with only one for appearance and none for texture.”

“Integrating plant proteins with conventional meat has the potential to enhance product nutrition, boost protein content, lower prices, and increase food-industry profit margins,” says Jennifer Morton, head of corporate engagement at GFI APAC.

“Such products could also create a virtuous cycle in which plant-protein producers can rapidly scale up their manufacturing capacity, leverage economies of scale, drive down costs, and expand the accessibility of sustainable proteins, including fully plant-based products,” she adds.

The post For Singapore’s Meat-Eaters, Blended Proteins Are Way More Inviting Than Plant-Based Alternatives appeared first on Green Queen.

This post was originally published on Green Queen.