Food industry giant Cargill has teamed up with Kokomodo to advance cell-based chocolate solutions, with financial support from the EU.

In the face of the climate emergency, Big Chocolate continues to embrace alt-cocoa.

Cargill, the largest privately held company in the US, has partnered with Israeli cellular agriculture player Kokomodo to explore the use of cell-based chocolate in a range of applications.

The collaboration is partly funded by the Proof-of-Concept Co-Financing Instrument of EIT Food, the EU’s food innovation organisation. This initiative enables startups and corporations to jointly validate and scale transformative agrifood innovations.

The two companies will evaluate how cell-based cocoa ingredients perform in real-world applications, with a focus on elevated functionality, sensory experience and scalability. The goal is to accelerate research to fast-track these products’ market entry.

This partnership follows EIT Food’s €20,000 investment in Kokomodo in late 2024, as part of its accelerator awards. The startup was also one of 16 others selected for the 2025 cohort of the EU body’s RisingFoodStars programme, which helps agrifood tech startups scale up.

“At EIT Food, our goal is to bring together the best of both worlds – agile startups and global industry leaders – to deliver real impact,” explained Christoph Mandl, head of corporate venturing at EIT Food.

“By harnessing the collective power of our ecosystem – built on collaboration, transparency, and trust – at every stage, from research to investment and policy to production, we contribute in creating collaborations such as the one between Kokomodo and Cargill, and scale solutions faster to strengthen the resilience and innovation of the agrifood system.”

Kokomodo and Cargill to test cell-based cocoa in industrial settings

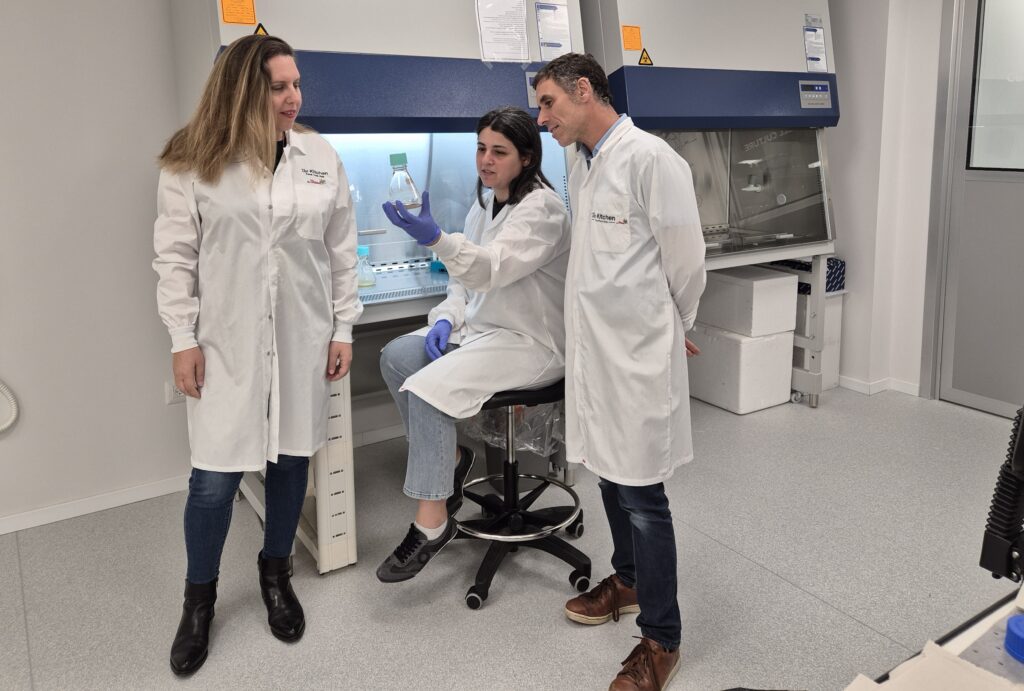

Kokomodo came out of stealth in 2024 with a $750,000 investment from The Kitchen FoodTech Hub and the Israeli Innovation Authority, working to produce cell-based cocoa for the food and beverage, supplements, and cosmetics industries.

The startup uses cells from premium cocoa beans grown in Central and South America and has successfully completed lab-scale production. In 2025, it was acquired by fellow cellular agriculture firm Pluri, which took a 71% stake in Kokomodo for $4.5M.

The partnership with Cargill marks an “exciting step forward” for the firm, according to co-founder and CEO Tal Govrin. “Our vision has always been to redefine cacao not only for its health benefits and functionality, but as a more sustainable, future-proof ingredient that can empower global food systems year-round,” she wrote in a LinkedIn post.

“Working alongside one of the most established ingredient players in the world allows us to validate our technology at an industrial scale,” she added.

The collaboration is already underway, with functional validation results set to be delivered over the coming months. The two companies will explore how cell-based cocoa can be incorporated into multiple categories, including beverages, dairy and confectionery.

They will do so by evaluating the functionality, sensory performance, and scalability of Kokomodo’s lab-grown cacao in industrial settings, which Govrin said was a key step towards establishing a new, resilient and innovative supply chain for the ingredient.

“This is a key part of Cargill’s ‘portfolio mindset’ in addressing the dynamic nature of the cocoa market,” Cargill’s Dimitris Lykomitros said in a LinkedIn post. “It’s about building choice: strengthening core chocolate capabilities, expanding capacity and collaboration, adding new formulation pathways where they make sense, and exploring what could come next for cacao ingredients.”

Like other chocolate giants, Cargill deepens alt-cocoa focus

But why does chocolate need a new supply chain? Climate change has pushed cocoa stocks to their lowest levels in a decade and driven prices to all-time highs.

Extreme weather and crop diseases are hitting plantations hardest in the Ivory Coast and Ghana, the two largest producers of cocoa, which have already lost over 85% of their forest cover since 1960. And scientists warn that a third of the world’s cocoa trees could die out by 2050.

The industry itself is a major food-related driver of climate change. Producing chocolate emits more greenhouse gases than any other food except beef, and is linked to widespread deforestation. Additionally, making a single bar requires 1,700 litres of water on average.

Cargill noted how quality controls, changing regulation and the need for more transparent supply chains are forcing chocolate manufacturers to change how they operate. “These dynamics mean chocolate manufacturers are no longer navigating just occasional price spikes. They are operating in a market where uncertainty is structural – and long-term planning now requires new assumptions,” it explained.

It’s why more and more chocolate giants are dipping their toes into alternatives, whether it’s cell-based cocoa or bean-free chocolate. For instance, Barry Callebaut, the world’s largest B2B chocolate supplier, has struck partnerships to explore both cell-based and cocoa-free chocolate.

Puratos and Mondelēz International have invested in alt-chocolate startups too, while Lindt, Dulciar, Walcom, Piasten and others have co-launched cocoa-free products with these disruptors.

Cargill is no stranger to this industry. It has been working with US cocoa-free chocolate producer Voyage Foods on an exclusive distribution deal, developing an alternative called NextCoa for global confectionery manufacturers. Last year, it also joined Bühler Group’s New Chocolate Challenge as an industry expert.

“A quickly changing market environment isn’t something customers can plan around once and move on from,” said Michiel van der Bom, product line director for cocoa and chocolate at Cargill. “What matters now is flexibility. Our role is to help customers with options that reflect today’s realities and the uncertainty ahead.”

California Cultured, Celleste Bio and Food Brewer are also working on cell-based cocoa, and startups including Planet A Foods, Compound Foods, Prefer, Win-Win, Foreverland, Nukoko, and Endless Food Co are all making cocoa-free alternatives.

The post Cargill Takes A Bite Out of Cell-Based Chocolate with EU-Backed Collaboration appeared first on Green Queen.

This post was originally published on Green Queen.