A new consumer survey highlights the three key barriers to plant-based food purchases in the US, and the opportunities for brands to overcome them.

Alternative protein finds itself at a bit of a crossroads in the US, where sales and investment have dwindled, as has the number of vegans. But while plant-based meat did lose a bit of steam in terms of purchases, dairy analogues remained on their growth trajectory, and traditional proteins like tofu and tempeh gained slightly.

Over the last year, the health focus has really taken over how people interact with food. Cleaner labels, whole foods, and high-fibre are all-important now. Taste still remains crucial, however, and plant-based meat brands are doubling down on the flavour and nutrition focus to regain customers who may have had a loss of faith.

So while there’s been a dip, there’s also a lot of opportunity. A new survey by Dig Insights – in consultation with the Good Food Institute and the Plant Based Foods Association – dives into the thoughts of 1,500 Americans to find out what’s missing in the alternative protein industry, and how to address it.

The poll revealed that 64% of US consumers are looking to increase their protein intake, especially younger demographics. But there’s a gap to fill with older respondents – 60% of Gen Xers, for example, haven’t tried tofu, tempeh or seitan, while 52% have never tried meat analogues either. Meanwhile, for 47% of Americans, finding plant-based meat in the grocery store isn’t easy.

All these challenges open up new opportunities for plant-based food companies. Here are the three major barriers to widespread consumer adoption, and how to address them.

Barrier #1: Not everyone sees plant-based as healthier

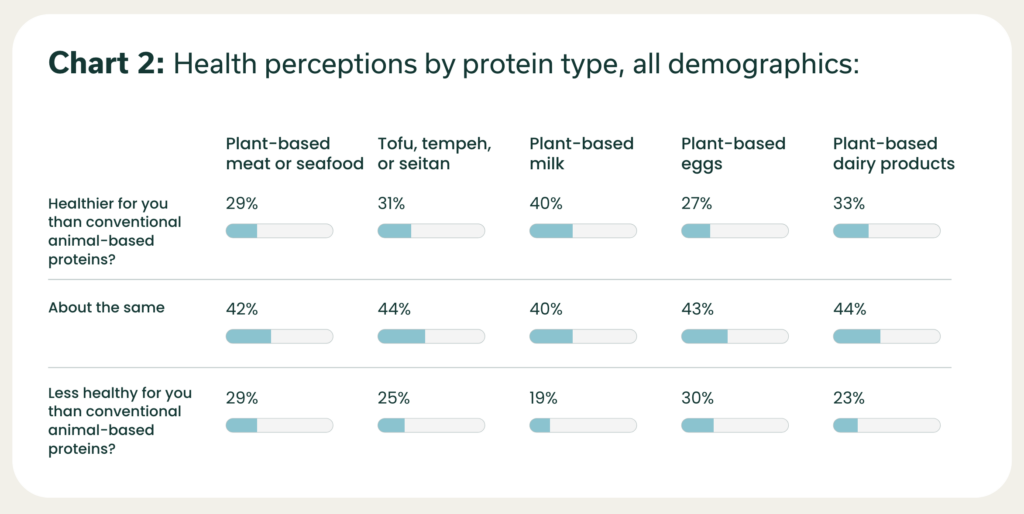

The research found that the number of Americans who think plant-based meat or seafood products are healthier than their conventional counterparts (29%) is the same as those who believe the opposite to be true. Across the board, over 40% of people find vegan foods to be nutritionally on par with animal proteins.

In fact, there are more respondents who find tofu, tempeh, seitan and plant-based dairy healthier than those who don’t, with the largest gap appearing for milk – 40% say plant-based milk is healthier, but only 19% think it’s less healthy than cow’s milk. The perception of vegan eggs, however, is on the flip side, with more Americans finding them unhealthier.

But even with a majority of consumers trying to up their protein consumption, 47% aren’t too familiar with plant-based meat. And therein lies the opportunity, says the report, which found a correlation between those who want more protein and their willingness to buy plant-based protein in supermarkets and restaurants.

Among these consumers, 28% have ordered dishes with plant-based proteins in restaurants (4% more than those who aren’t looking to increase protein consumption) – 45% of these respondents state it’s very important for restaurants to have options with plant proteins. Similarly, nearly a third (32%) of protein-seekers expressed a willingness to buy these products in the grocery store, versus 28% of those not looking to eat more protein.

“The consumers becoming more accustomed to plant-based proteins are also those who will be dining out regularly,” the report suggests. “Creating plant-based protein-filled meal options, with an emphasis on protein content, caters to a wide audience of consumers, including those who may not typically consume plant-based protein.”

Barrier #2: Taste and texture need a perception change

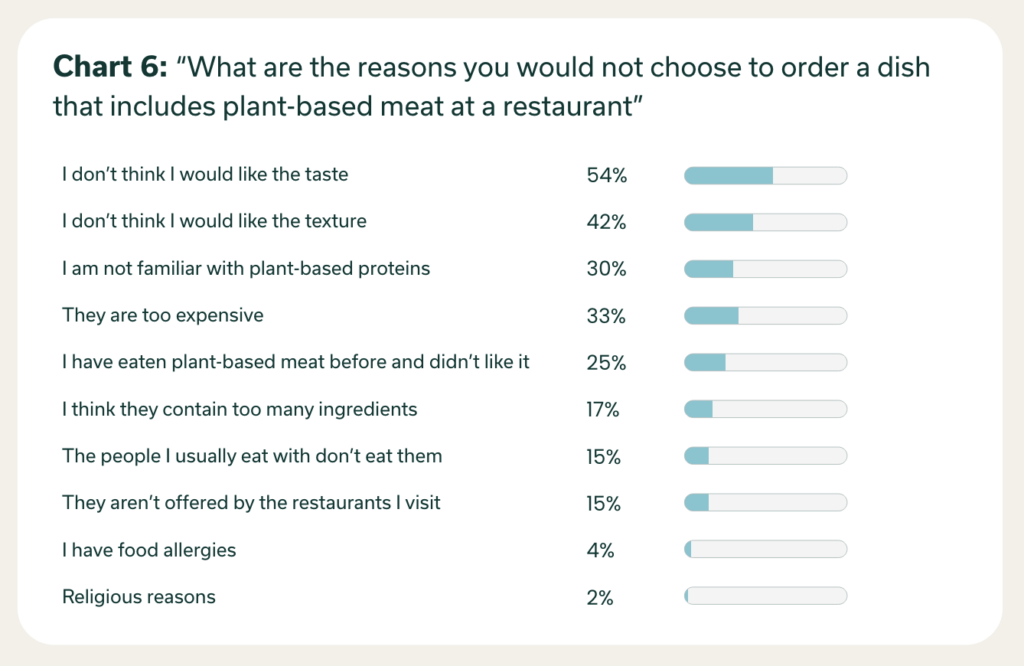

Despite 57% of survey respondents ordering food weekly, only 24% have opted for a plant-based dish off the menu. Meanwhile, 84% of people who will decidedly not buy plant-based meat in the supermarket never see themselves eating these analogues. Dig Insights ascribes this to “taste, texture, and familiarity”.

About 30% of consumers are just not familiar with plant-based meat, tofu, tempeh, et al. And, even among the Americans either likely to buy meat alternatives or leaning against it (but aren’t decided yet), only 16% would purchase them for their taste and texture attributes. Similarly, in a restaurant setting, taste (54%) is the biggest reason deterring consumers from choosing meat analogues, followed by texture (42%) and unfamiliarity (30%).

However, 91% of Americans who try plant-based protein like the taste and texture and are satisfied with it. This highlights a major perception gap for plant-based meat products, and the need for greater education. Focusing on product samples in retail locations and promotions in restaurants are two of the best ways of doing this.

This is because 31% of Americans would buy plant-based meat in grocery stores if they were offered free samples, and 30% would do so if it were on sale. And 15% don’t eat these products in restaurants due to a lack of offerings, and because the people they’re dining with don’t consume them either.

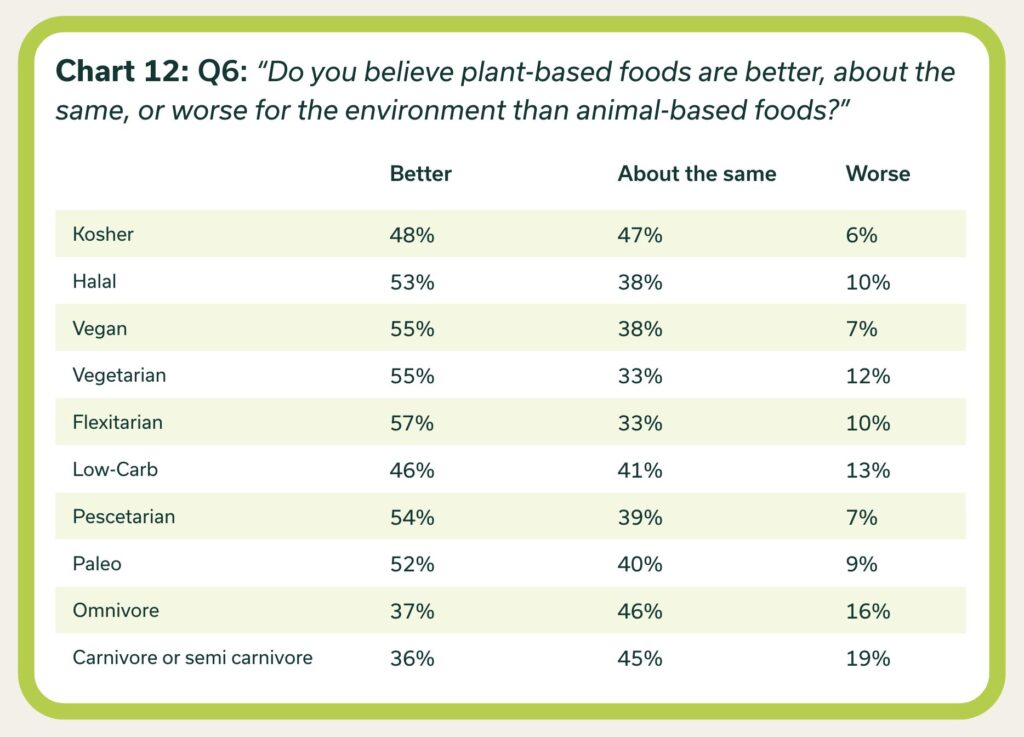

Another key aspect of consumer education is the environmental impact of plant-based foods compared to meat. The latter emits twice as many greenhouse gases as the former, and makes up 60% of the food system’s emissions. Despite this, 62% of Americans think the climate footprint of plant-based meat is the same or even bigger. This should come as no surprise, as previous research has shown that 74% of Americans don’t think eating meat is bad for the planet.

“There’s a large opportunity to educate omnivores and carnivores (who make up 45% and 21% of consumers, respectively) on the environmental benefits of eating plant-based meats,” the report says. “Educating consumers on the impacts will lead to them being more persuaded on purchasing and incorporating plant-based proteins in their diet regularly.”

Barrier #3: It’s hard to identify plant-based products

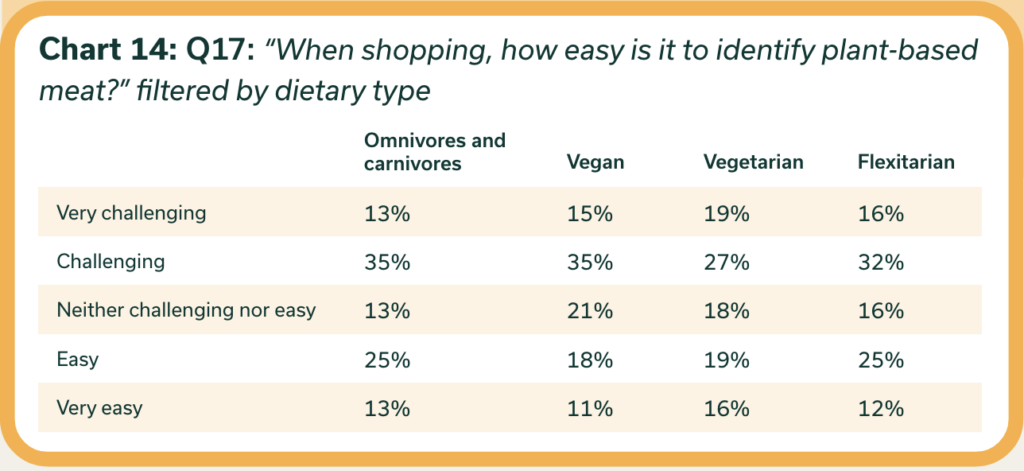

Plant-based meats are going through a bit of an identity crisis, both in the metaphorical and literal sense. Only 38% of Americans find it easy to identify meat analogues on supermarket shelves. And, surprisingly, Gen Zers and millennials have a harder time doing so than Gen X consumers. Similarly, spotting these products is most challenging for vegans (50%), while omnivores and carnivores are much more adept at this.

“Convenience, visibility, and brand awareness are crucial factors when it comes to consumer purchasing decisions in grocery stores,” says the report. While conventional practice is to separate plant-based from animal-derived meats, study upon study has shown the benefits of putting the former in the meat aisle.

The survey saw a majority of Americans agree that all plant-based foods should be placed in the same refrigerated section as animal foods, with 69% saying so for meat and 75% for milk. There are two ways of doing this: fully incorporating plant proteins alongside their animal counterparts, or putting them in the same aisle but in a separate subsection – more respondents preferred the latter, although preferences vary based on purchase frequency.

When it comes to restaurants, menu descriptions and placements are influential. Four in five (81%) want the words ‘plant-based’ in the dish’s name, and another 80% want the source of the protein mentioned. Customisation options (78%) and flavour indicators (86%) are vital too.

Finally, brand recognition and recommendations/reviews continue to be important purchase drivers for plant-based meat in retail, and clear labelling and differentiation in restaurants represent further education opportunities for consumers.

“Despite the surge in popularity, there remain significant untapped markets and consumer misconceptions to address. By focusing on education, product visibility, and catering to the increasing demand for protein-rich options, brands can effectively expand their reach and capitalise on the diverse preferences of consumers,” states Dig Insights.

“Through strategic initiatives such as sampling programmes, promotional offers, and enhanced product placement, the plant-based protein industry can overcome existing barriers and pave the way for sustained growth in the future.”

The post The Three Main Barriers Stopping Americans from Buying Plant-Based Food – and How to Fix Them appeared first on Green Queen.

This post was originally published on Green Queen.