Retail sales of plant-based meat have been shrinking, but they’re still higher than pre-pandemic levels. Opportunities lie in price cuts and bundling these analogues with fresh produce.

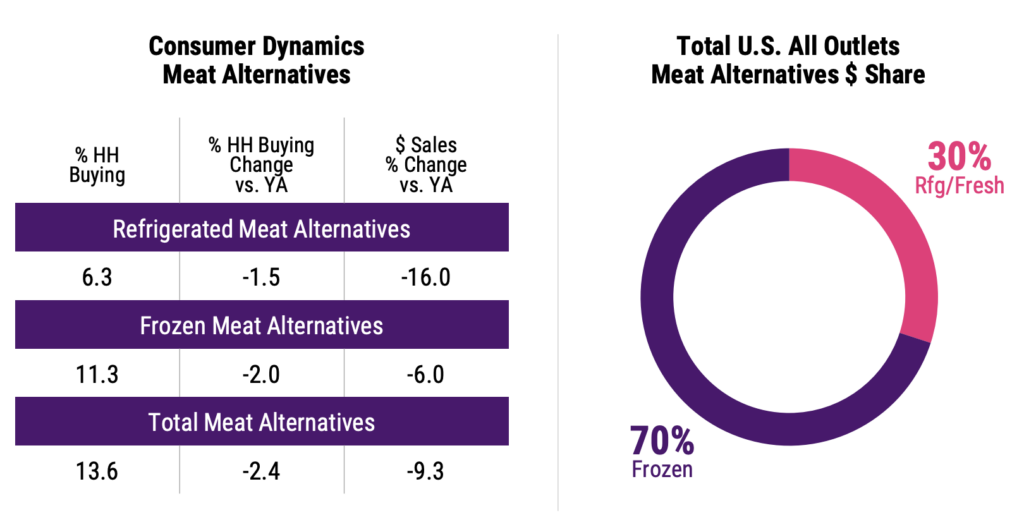

In 2023, sales of vegan meat and seafood fell by 12%, on the back of higher manufacturing costs, lower investment levels, and consumer concerns around ultra-processing. This year, it has been more of the same, with Americans spending 19% less on chilled meat analogues and 7% less on frozen products.

Despite these declines, though, people are still purchasing more plant-based meat products than they were before Covid-19 – last year’s dollar sales ended up at $1.1B, versus $856M in 2019, according to new analysis by market insights firm Circana.

The Current State of Meat Alternatives report shows that meat analogues have experienced a 2% loss annually over the last four years, compared to a 5% growth for plant-based dairy and a 7% hike for vegan seafood. Since 2019, the market share of meat-free products in the overall meat market has reduced consistently, but still remained largely the same, going from 1.39% in 2020 to 1.07% so far this year.

Frozen rules, and on-trend products make gains

Plant-based meats sell much better in the freezer, the report found. Sales dropped by 9% in the 52 weeks to July 14, 2024, compared to the same period a year ago. But the decrease was much larger in the refrigerated section, where dollar sales took a 17% dip to reach $309M, than in the frozen aisle (a 6% loss totalling $720M in sales).

Americans spent twice more on meat analogues in the freezer, and that can be seen via their market share too – these products were bought by 67% of Americans, compared to 37% who bought chilled plant-based meats. Only 29% of people purchased items from both sections.

Still, some brands are delivering growth. Beyond Meat has increased dollar sales by $10M, driven by its focus on “shifting the ultra-processed perception”, while Meati has seen a $2.7M hike year-to-date, thanks in large part to its all-natural ingredient list for whole-cut steak.

Circana’s report suggests that the way to consumers’ hearts and wallets are by “delivering quick and easy solutions along with elevated experiences”, with a focus on flavour, form and convenience. Beyond Meat’s ‘heart-healthy’ steak product has been the most successful in the last year, with sales $7.7M higher than the same period last year – this is one of the products that delivers on all three of these metrics.

Similarly, Impossible Foods’s flagship beef and Beef Lite were up by $3.6M and $3.2M, respectively, while Morningstar Farms’s vegan chicken strips and beef crumbles had sales increases of $3.3M and $3.2M.

Plugging the price gap

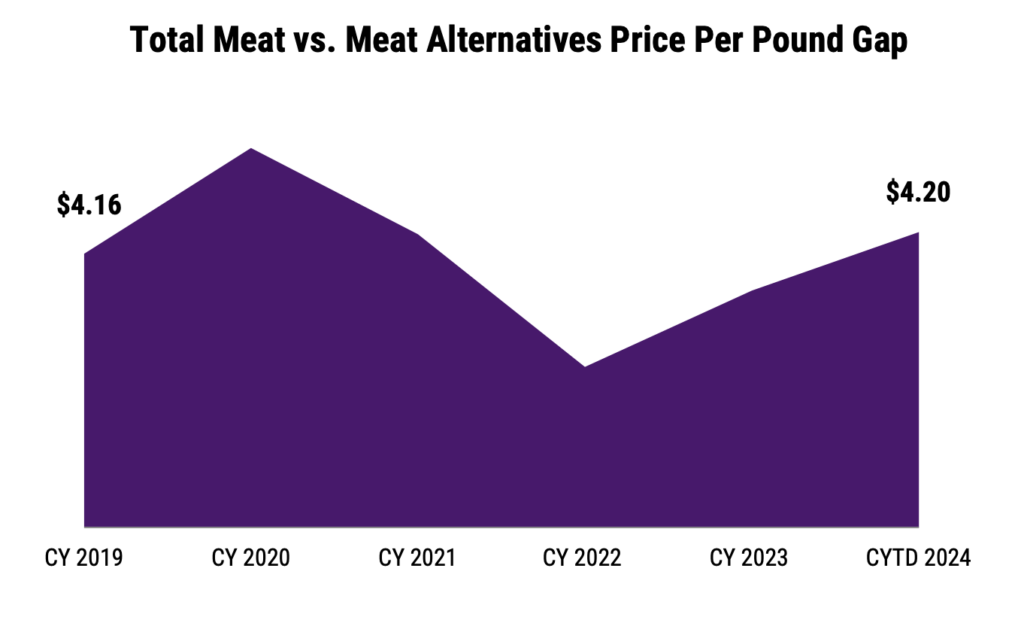

Plant-based meats continue to be more expensive. SPINS data for the Good Food Institute has shown that there was a 77% price premium on meat analogues last year. This continues to be the case today, with the price gap between conventional and vegan meat exceeding pre-pandemic levels.

In 2019, meat analogues were $4.16 costlier per lb, but this gap was narrowing in 2022. However, it has been increasing for the last two years, and is now at $4.20 per lb. Given that plant-based products currently make up only 1.07% of the meat market, progress is a tall order for manufacturers as things stand – especially since the per-pound price gap is 31 cents for alt-dairy and $1.27 for vegan seafood.

That said, chicken and turkey patties have seen prices decrease by 4.5% and 5.5%, respectively, with volume sales also up by 7% and 4% (compared to a flatlining of beer burgers). “This growth is providing value and a ‘better for you’ lean protein option,” the report states.

Meanwhile, the headwinds of the sector have also resulted in the closure of some companies and withdrawal of certain product lines. Since 2020, the number of alt-meat brands has shrunk by 28%, from 116 to 83.

One way companies can increase consumer interest is through merchandising. Nearly two in five (38%) people who buy meat analogues also purchase fresh fruit and salad vegetables. “Cross-merchandise with the produce aisle to inspire healthy meals,” Circana suggests.

Who is the alt-meat shopper?

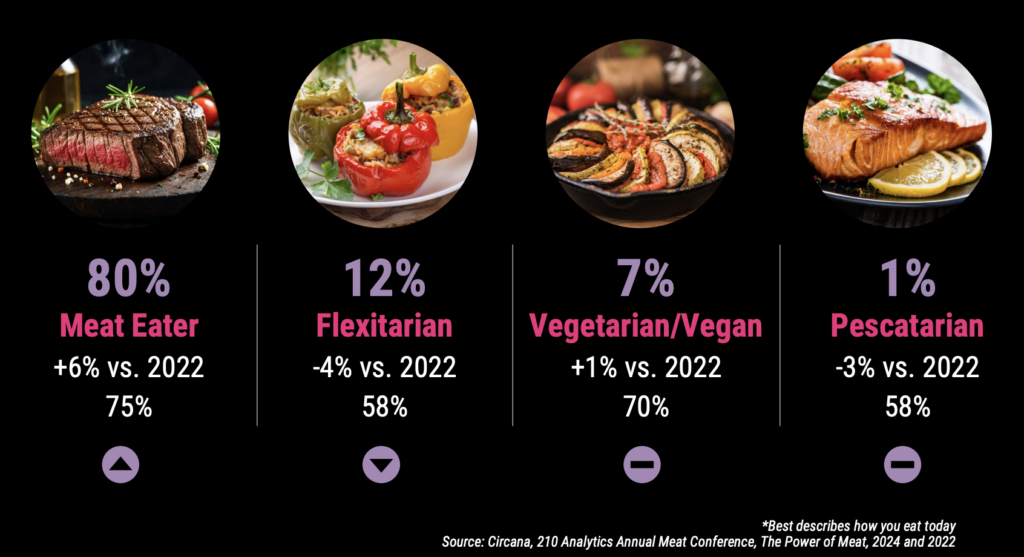

The report shows that the share of vegetarians and vegans in the US has been consistent at around 5-7% for the last 18 years, but the rise of keto and carnivore diets online has led to a 6% increase in meat-eaters since 2022 (making up 80% of the total). The number of flexitarians, meanwhile, is down by 4%.

When it comes to plant-based meat, the average households tend to be high-income African-American and Asian millennials and urban male Gen Xers. Nationally, plant-based meats are appearing in fewer households, a decrease of 21% between 2022 and 2023, while the number of individual buyers has also narrowed by nearly five million.

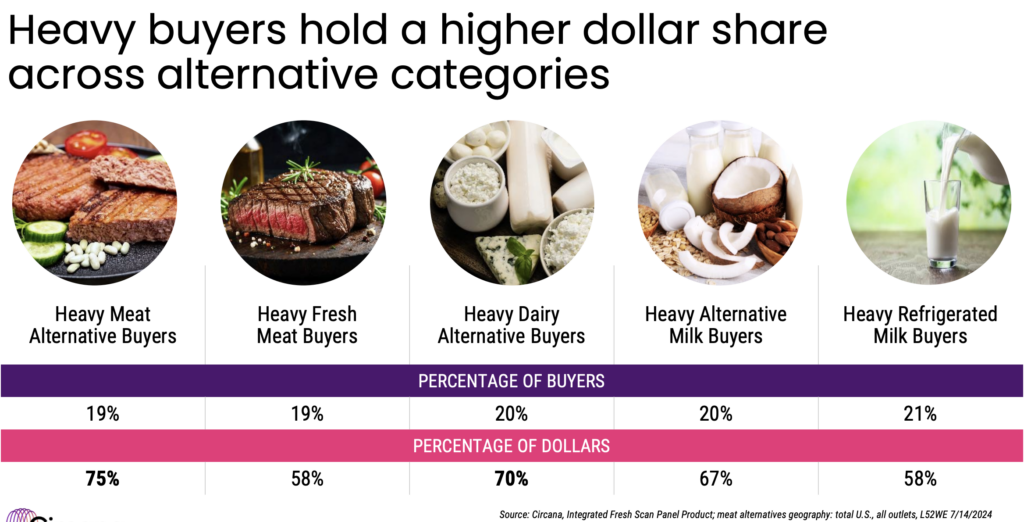

Along the same lines, meat analogues are losing shoppers faster than they’re gaining them, partly due to a 20% decline in “heavy meat alternative buyers”, who make four times more trips to the store and spend twice as much as the average American. This group is responsible for 75% of total spending on these products.

And worryingly, the share of frequent-purchaser households is declining faster (8%) than one-time buyers (5%). “Retention of frequent buyers is critical to category success,” the report says. “Understand frequent-buyer profiles and identify ways to keep them engaged in the category, such as highlighting trending flavours, pack sizes, and recipes.”

Companies are also encouraged to “invest in innovation”, with future offerings set to “deliver value through clean, quality products rooted in key consumer trends”. Finally, given the expanding price gap, brands need to define ‘value’ for consumers, including “taste experience, convenience, form, and nutritional profile”.

The post Despite Declines, Plant-Based Meat is Selling Better Than It Did Pre-Pandemic appeared first on Green Queen.

This post was originally published on Green Queen.