A new study suggests that plant-based meat analogues are more attractive to consumers when they’re cheaper than conventional options – taste may not matter as much.

Americans prefer beef, falafel and veggie burgers over plant-based analogues, but the latter become much more attractive if companies can offer them at a cheaper cost than meat.

These are the results of a two-part study conducted by researchers from the Martin Luther University Halle-Wittenberg, Humboldt University Berlin and Georg August University Göttingen. They analysed the preferences of over 2,100 Americans to find out what factors influence their protein choices.

The study, published in the Proceedings of the National Academy of Sciences journal, asked participants to choose between a conventional beef burger, a plant-based meat analogue, a veggie burger (which imitates the appearance but not the taste or texture of meat), and a falafel burger. The researchers then analysed how price changes influence consumer preferences.

They found that beef was by far the most popular option, chosen by 75% of respondents. But this was followed by falafels (34%) and veggie burgers (7%) – meat analogues ranked the lowest, selected by just 6% of participants.

If a conventional meat option was taken off the table, a majority of consumers (69%) would choose to remain in the market with one of the alternatives – but here, too, the uptake of plant-based meat would be the lowest (15%).

“This contradicts the widespread assumption that meat substitutes are only competitive if they are as close as possible to the original,” said lead author Steffen Jahn.

Price parity no longer enough

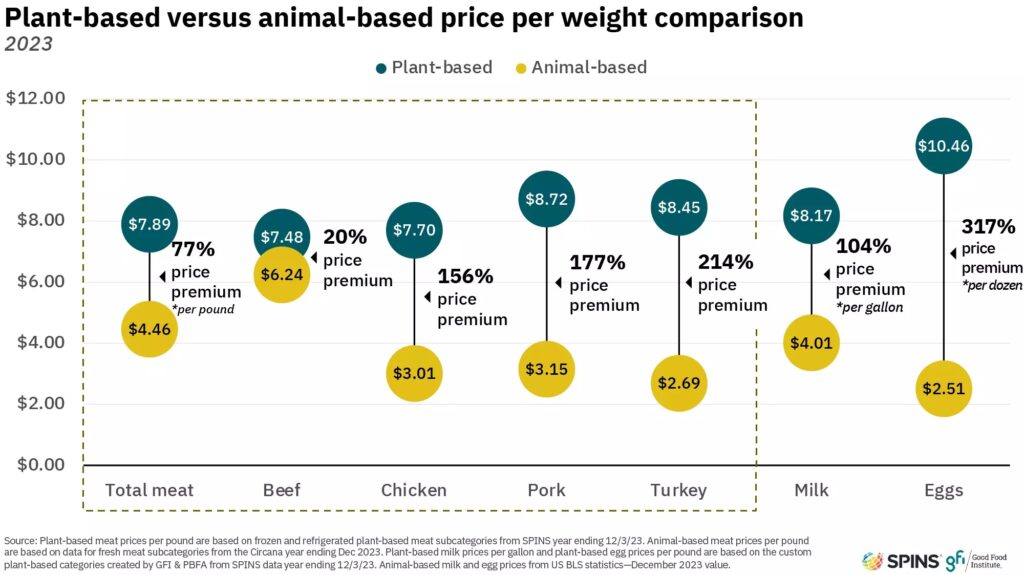

In the US, beef is 20% cheaper than plant-based meat on average, but this gap expands to 77% for the overall meat market. Experts have long held the view that price parity is crucial for meat analogues to compete in the market.

“However, we found that price parity has no real effect on people’s choices,” said Jahn.

The real impact, it seems, lies in undercutting the cost of meat. Making vegan analogues cheaper than animal proteins would significantly increase their popularity among Americans, according to the research.

On the other hand, if plant-based alternatives are more expensive than meat, their preference falls below 20%, and if they’re priced equally, this increases to 21%.

But if plant-based alternatives cost about half of the conventional meat burger, the number of people choosing the vegan options would double. And lowering the price of the meat analogue burger by 10% would result in a 14% increase in sales.

Meanwhile, men are more dedicated meat-eaters, but an attractive price point would make them more willing than women to change their consumption habits. If plant-based alternatives are priced at half the price of meat, their choice share increases to 50% among men. And even those who never tried a meat substitute before would opt for it.

“Restaurants and food manufacturers might actually be able to increase their sales of vegetarian or vegan alternatives if they offered meat substitutes at lower prices than the meat options,” said Jahn.

He suggested that “a truly faithful imitation is not the goal” for plant-based meat. “Maybe it’s because many people associate them with ultra-processed foods, which have a bad reputation,” he said, referencing a debate that has heated up in the last year.

Policy support can help businesses lower prices

Over the years, there have been numerous studies that point to health and taste as the most important factors behind plant-based meat consumption. But recently, affordability has crept up as a crucial point of influence, as inflation continues to squeeze consumers’ wallets.

“Our findings challenge the notion that plant-based meat alternatives will naturally replace meat, instead aligning with recent findings that meat and meat analogues may sometimes complement each other rather than serve as substitutes,” read the study.

“However, this dynamic could shift dramatically with more competitive plant-based meat alternative pricing, potentially turning these products into true meat substitutes. This is particularly true for analogues, which appear to benefit the most from increased affordability.”

The researchers believe there is a pathway for vegan meat producers to bring their prices lower than animal protein. “If these higher prices are related to processing costs, there is optimism that as economies of scale are realised, the reduced production cost will equalise the playing field between PBMAs and their meat counterparts,” they wrote.

Policy interventions could also help here. Meat taxes, while difficult to implement, can exert significant steering effects on consumers – Denmark was the first country to announce such a levy last year, which will come into effect in 2030. Other measures could involve redirecting tax revenues towards subsidising plant-based foods.

American companies can learn from their counterparts in Germany, the largest market for vegan food outside the US. Supermarkets have led the way here, with the likes of Lidl and sister retailer Kaufland, Aldi Süd, and Rewe Group-owned Penny and Billa all lowering the prices of their own-label plant-based alternatives to match or undercut the cost of meat and dairy. Outside retail, Burger King has followed suit, making all its vegan items cheaper than meat in Germany.

The post People Don’t Want Vegan Alternatives to Taste Like Meat – They Just Want Them to Be Cheaper appeared first on Green Queen.

This post was originally published on Green Queen.