Food and climate tech investors remained cautious with their cash in 2024, as funding for alternative protein dipped, investments failed to align with emissions impact, and women founders were sidelined yet again.

The venture sector is experiencing a crunch overall, with 2024 being a disappointing 12 months for those looking for funding. GlobalData’s Deals Database suggests that early-stage rounds – which remain key for the growth of the wider climate tech ecosystem – were down 14.2% last year, while growth, expansion, and late-stage funding rounds decreased by 2.7%.

Moreover, fewer firms are deploying less, as US-headquartered funds dropped from 8,315 to 6,175 in 2024. The Financial Times reported that this trend concentrates “power among a small group of mega-firms”, leaving “smaller VCs in a fight for survival”. Further, it thins out “funding options for smaller companies”.

Businesses in the food tech world may have hoped for an investment reset last year, after a tough 2023 forced downsizing, M&As, and in some cases, closures. But venture capitalists continued to be cautious in 2024, with food tech funding shrinking, and investment in alternative protein players declining for a third consecutive year.

This is reflective of the broader 38% dip in climate tech venture funding, from $52B to $32B last year, according to BloombergNEF research, which in turn was the result of a shift in investor interest towards artificial intelligence (AI), where financing crossed $100B.

Layoffs, mergers and takeovers are part of a trend that’s likely to continue this year, according to Sharyn Murray, senior manager of investor engagement and financing at the Good Food Institute, an alternative protein think tank.

“While challenging for individual companies, such consolidation is a natural phase of industry maturation and can accelerate technological and operational progress for those that remain,” she says.

Speaking of trends, there are several to pick out from 2024 data on food tech funding – let’s just say it was a win for AI, fermentation, and men.

The emissions-funding mismatch

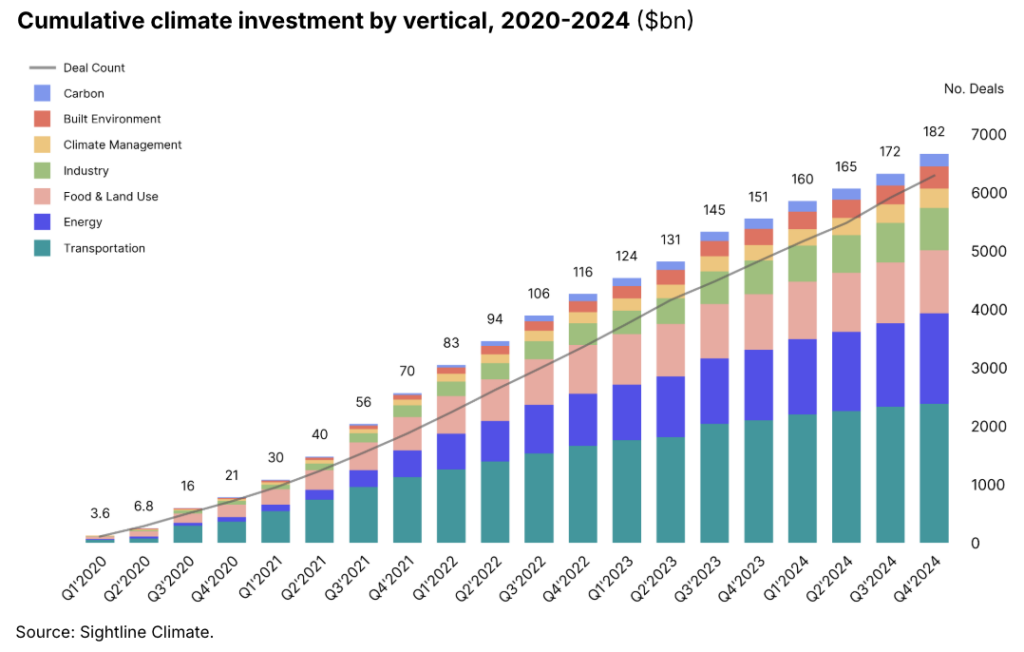

According to climate tech data platform Sightline Climate‘s 2024 investment report, the “still-high interest rates, delayed IRA funding rollouts, and political uncertainties created headwinds” for investors, blocking any restart the “2023 ‘wait-and-see’ crowd had hoped” for.

Nevertheless, the authors note the sector did settle down, as venture funding in climate tech fell by 14% to $30B in 2024, much less than the 24% drop it experienced 12 months earlier. Average deal size similarly dipped by 14%, while the value of growth rounds was down by 48%.

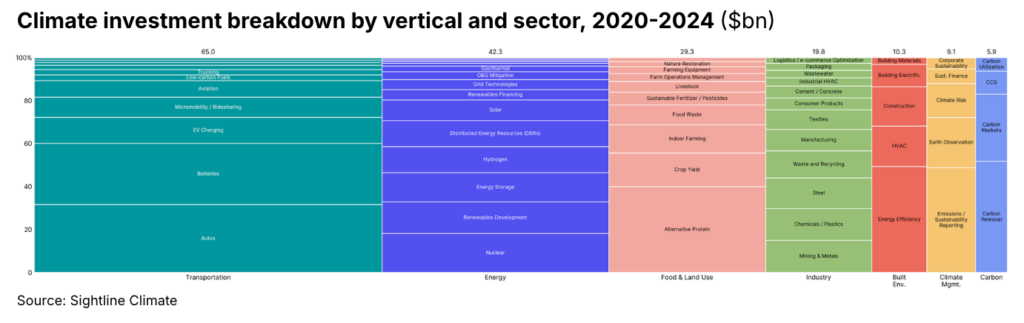

The average deal size in the food and land use vertical – which includes alternative proteins – was 6% lower in 2024 ($15M), though it is now the second most populated climate tech sector (behind energy) in terms of deal numbers, with more than 250 new companies raising money last year.

While food and land use had the second-highest number of funding deals (768), the total dollars poured into the vertical is disproportionate to the impact it has on the climate. The report suggests that this sector accounts for 22% of global emissions while receiving only 18.5% of climate tech capital ($29.3M) last year.

In its State of Climate Tech Funding 2024 report, PWC writes that “higher borrowing costs and uncertain economic conditions weighed on the broader deal-making market”, which resulted in a climate tech funding decline. The authors found that sector investments decreased “by 29%, from $79B, between Q4 2022 and Q3 2023, to $56B in the ensuing four quarters” and venture capital and private equity flows came down from $799B to $673B, contracting from 9.9% to 8.3%, with transaction volumes way down too as “investors and start-ups are finding it tougher than ever to make deals”.

Europe making gains, Asia not so much

The geographical makeup of the climate and food funding landscape has changed over the past few years with some regions gaining on others.

In the first half of 2024, while no region was spared from the investment declines of the previous years, Europe was “slightly less affected” by the challenges, according to analysis by Paris-based food tech consultancy DigitalFoodLab. This echoes previous data illustrating that Europe overtook the US in funding for the first time in 2023, making up 58% of global investments.

“Europe had been ignored for some time, maybe due to the old continent being slow to structure its innovation ecosystem (incubators, business angels, etc.),” Matthieu Vincent, co-founder and partner at DigitalFoodLab, told Green Queen in September. But the emergence of large delivery startups with an international focus “definitely helped put the continent on the global food tech map”.

Within the alternative protein world, too, 50% of all investments between Q1 and Q3 2024 came from Europe, garnering $528M. North America was second with a 38% share, and Asia a distant third at 10%.

Vincent ascribed the decline to the 80% fall in China, which in turn was a result of a shift away from delivery startups. Food science and alternative protein companies dominated investment (36% of the share), while in the second half of the year, analysts didn’t “observe a bounce back or even a plateau as investments keep declining”.

Numbers shared by data analytics firm MAGNiTT in its 2024 Emerging Markets Venture Capital Report show that total venture funding in Southeast Asia was down 45%, with both exits and the number of deals decreasing by more than 30% and 20% respectively. While Singapore – a hub for food tech in the Asia-Pacific region – continues to be the most active emerging market for VC, climate tech is not on the menu, with fintech dominating deal flow.

A January 2025 Deal Street Asia report depicts a similar picture. The data outlines that total deal volume in the region last year decreased by 10.3% (633 deals) compared to 2023, while deal value fell by 41.7% to $4.56B, less than half of the capital raised in 2020, during the Covid-19 pandemic. Meanwhile, revelations of fraud at one of the agrifood darlings of the Southeast Asian tech ecosystem have sent chills across the region’s investment community.

That said, a report by AgFunder about APAC agrifood tech sector funding found that “while was still lower than 2020 levels in terms of dollar amounts, the number of deals in the first three quarters of 2024 (616) has already surpassed the full-year totals of each of the last three years, indicating that VCs remain interested in the category, but are more cautious in doling out larger amounts to single companies”.

AgFunder’s research also underscored some positive trends for alternative food, which falls under the report’s ‘Innovative Food’ category. The latter “attracted $204M by the end of October, an 85% increase from the same period in 2023, with deal count also growing from 49 to 59.”

Funding for fermentation proteins grows as investors quit plant-based and cultivated meat

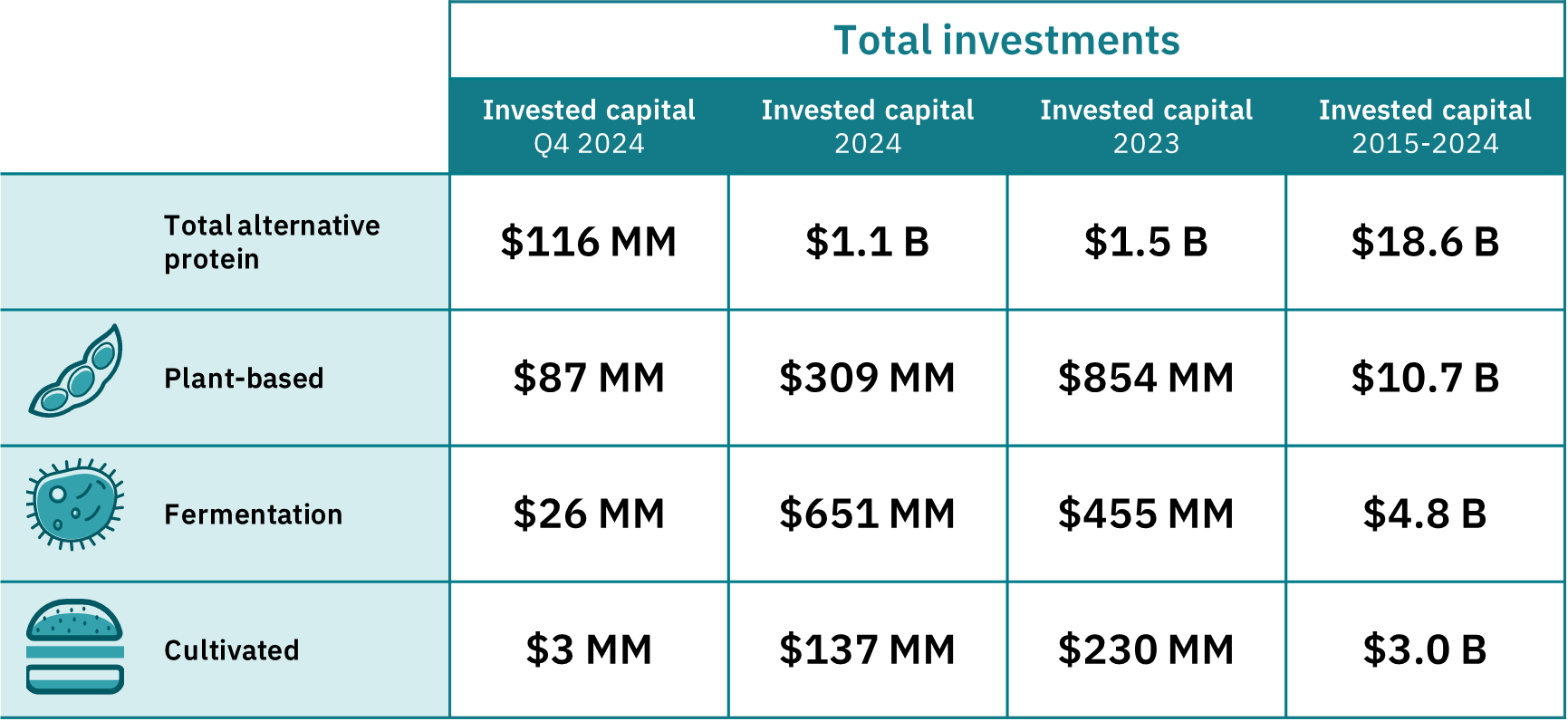

Funding for alternative proteins continued to decline in 2024, dropping by 27% from the previous year. This was driven by VCs abandoning the plant-based protein vertical (a 64% decrease) and the cultivated meat space (down 40%). Worryingly, the latter only saw $6M in financing in the second half of 2024.

Plant-based meat was hit by the ultra-processed food debate, with misinformation from lobby groups causing consumers to question how healthy these products are. Meanwhile, in the US, lawmakers in more than a dozen states brought legal actions against cell-cultured beef. Two states (Florida and Alabama) went ahead with a ban, and several other states look likely this year.

The bright spot was fermentation. Companies working in this vertical attracted 43% more investment last year than in 2023 and made up four of the five largest alternative protein funding rounds. Even governments – from the US to the Netherlands – are getting involved with grant-based financial support.

Helene Grosshans, infrastructure investment manager at GFI Europe, wrote in August about why investors are increasingly attracted to fermentation-based proteins. “Many of the fermentation companies that received large investments are focused on leveraging agricultural and food industry sidestreams as a sustainable feed source, helping produce food more efficiently and affordably – both of which are attractive propositions for investors.”

James Petrie, CEO of fermentation startup Nourish Ingredients concurs. “The food tech sector, particularly in plant-based and precision fermentation, is experiencing a significant correction. We’re seeing companies that once commanded huge valuations facing massive down rounds or recapitalisation,” he wrote in an op-ed for Green Queen last month.

Women founders were let down – again

Analysis based on Pitchbook data shared by Trellis showed that women-founded businesses received just 0.4% ($135.8M ) of the $33.5B invested in US climate tech startups in the first nine months of 2024, compared to $2.45B secured by mixed-gender-led startups.

Part of this is a problem of underrepresentation within the VC world itself – Pitchbook data from 2022 exposed that only 16% of VC decision-makers in the US are women, while 96% of VC firms have a majority male population of decision-makers.

This is despite the fact that startups founded by women offer investors a much better return – 78 cents for every dollar, compared to 31 cents for male-founded businesses – and provide a 34% better return on equity than companies with minimal or no women in leadership. Female-founded startups also exit faster (7.2 years versus 8.1 years for the overall average).

Continued uncertainty amidst global tariffs, though investors face attractive entry points

“2024 wasn’t the launchpad [climate tech] investors had hoped for. The slow rollout of Inflation Reduction Act funds and guidance meant a lot of projects stayed stalled. Political uncertainty in Europe and the US stunted investment as investors continued to wait and see,” Sightline Climate co-founders Kim Zou and Mark Taylor write in their report.

While Zou and Taylor contend that “the uncertainty is mostly over” saying that “while the US may back away from climate commitments, markets anticipating higher EU carbon prices will be transformative for hard-to-abate sectors,” others are not so sure.

Fortune spoke to a handful of generalist venture capitalists about President Donald Trump’s tariffs and looming trade war(s), who pointed out uncertainty will almost certainly lower valuations, decrease exits and give investors pause in terms of deployment. While the investors were speaking broadly, it stands to reason that climate tech and food tech are worried too.

Still, some founders remain hopeful. Nourish Ingredients’ Petrie drew on historical parallels to point to a brighter future: “Every transformative industry has gone through periods of correction and consolidation. Current valuations, while challenging, create attractive entry points for new investors.”

“The days of raising significant capital on potential alone are behind us. That is not necessarily a bad thing for a sector that badly needs to mature. Investors have shifted their focus from promises of transformational products toward clear, tangible paths to revenue and offtake deals,” he added.

“This creates a particular challenge for companies that have blown their wad on CapEx before firming up customer demand, but this simultaneously creates opportunities for those willing to be patient and strategic.”

The post Food & Climate Tech Funding: Trends, Challenges & Opportunities appeared first on Green Queen.

This post was originally published on Green Queen.