Consumers are cutting back on meat due to health concerns, but plant-based alternatives fail to meet their taste expectations – a new study says blended proteins could offer a balance.

Flavour, nutrition and affordability have long been thought to be the most influential factors driving food purchases. A new report from Food System Innovations (FSI) suggests that entrenched beliefs, familiarity concerns, and functional expectations are becoming increasingly important and are having an effect on people’s food choices.

The future food non-profit says that while their data shows consumers’ appetite for meat is decreasing due to health concerns, plant-based alternatives are not meeting the moment either – and their acceptance hinges on taste improvements.

FSI’s proposed solution? Blended meat – or, as they say, ‘Balanced Proteins’. The clue’s in the name. These products combine meat with plant-based ingredients, providing a better-for-you and better-for-the-planet solution without “changing the essence of what makes meat so beloved”.

According to a 2,000-person nationally representative survey of US omnivores and flexitarians, FSI conducted with YouGov, a 50:50 blend is the “sweet spot”. Since 37% of Americans prefer products with 1-49% of plant-based ingredients, and a third favour a 51-99% ratio, brands offering 50:50 blends – like the Both Burger, Fable Foods, and the Duo Burger – stand to win.

“This is an intuitive heuristic that people gravitate towards and helps them understand the category,” suggests Tim Dale, category innovation director at FSI.

Balancing health, taste and price concerns

Gen Zers have been labelled as the group spearheading the protein transition. Studies suggest that they are likely to reduce meat consumption based on factors like the environment, and the same goes for millennials.

According to FSI’s data, these two demographics also find the blended meat category more appealing than other age groups – 38% of Gen Z and 34% of millennial Americans were interested in the concept, compared to just 8-21% of the rest.

That being said, the widespread adoption of balanced proteins – as well as plant-based meat – is faced with a major barrier: taste. Nearly two-thirds of consumers who tried vegan alternatives rated their flavour as ‘okay’, ‘not so good’, or ‘terrible’, no doubt contributing to the 71% of respondents who said they’re unlikely to buy meat-free products in the next six months.

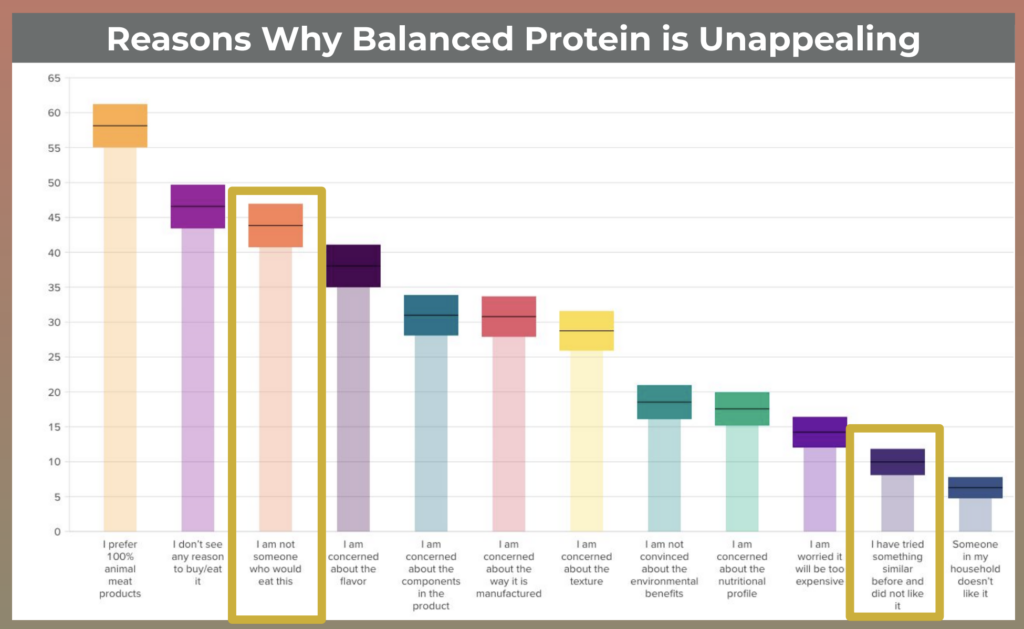

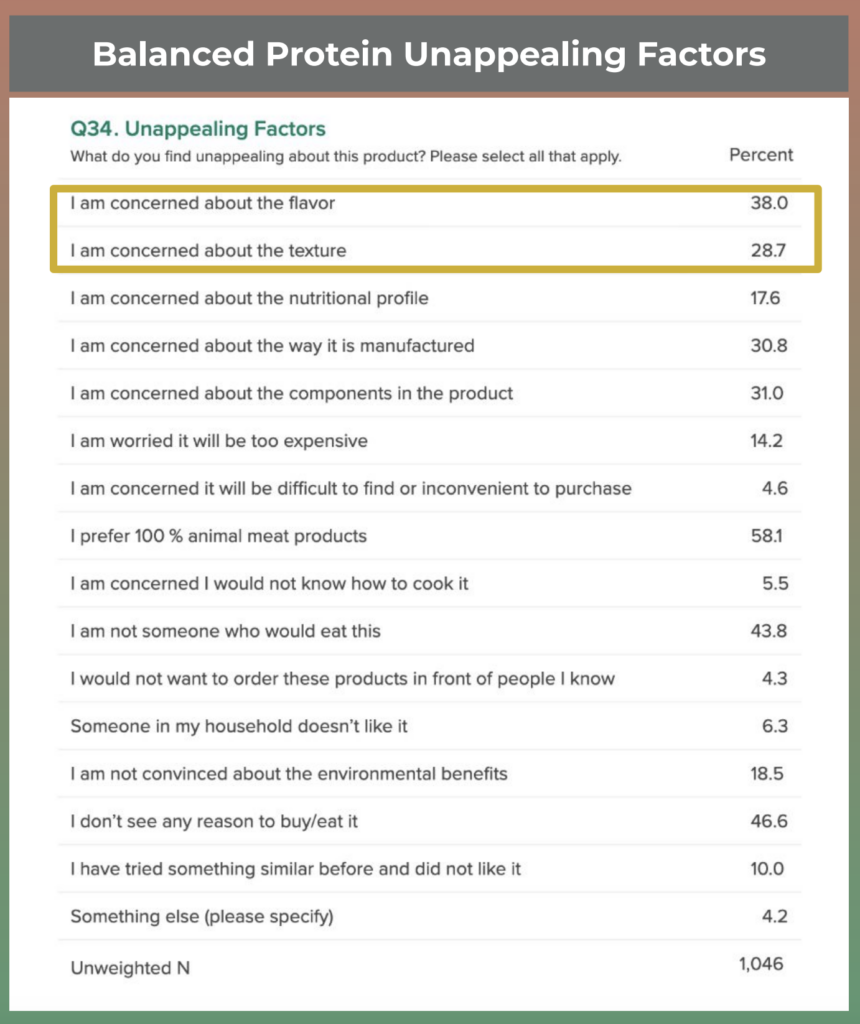

Even with blended meat, 63% said they wouldn’t purchase these products in the ensuing months. Asked why, 38% cited flavour and 29% texture.

At the same time, just over half of Americans who have reduced or intend to reduce their meat intake cite health and price as the biggest reasons. And for people who find blended meat appealing, having it be the same price or cheaper than conventional meat would influence at least 20% of those surveyed to buy these products.

So how do you balance the health and affordability concerns around meat with the taste dissatisfaction with alternatives? Dale proposes splitting the concept of taste into “perceived taste” and “actual taste”.

“Balanced proteins face a challenge with perceived taste, which is currently poor due to factors like familiarity, trust, and the role of meat and plant-based ingredients in consumers’ diets,” he says.

Indeed, 44% of those who find blended meat appealing say they’re “not someone who would eat this”, and cite it as a reason why they wouldn’t buy it for their loved ones.

“However, the actual taste of several brands has been shown to surpass leading conventional products in categories like burgers and chicken nuggets. This suggests that once consumers try these products, their initial taste scepticism may diminish,” notes Dale.

“Overcoming the perceived taste barrier will take time and will depend on more people trying products that provide new value to the consumer diets and consistently deliver on taste,” he adds.

Choose ‘functionality’ over ‘nutrition’ as processing fears persist

Curiosity drives the demand for blended meat more than factors like health or sustainability, and for Gen Zers, ease of preparation ranks just as high as nutrition on their list of priorities.

Speaking of which, most Americans who are turned off by blended meat aren’t worried about the nutrition aspect (only 18% expressed this concern) – instead, a third are worried about the way these products are manufactured. It’s a nod to the debate around ultra-processed foods, and how plant-based meat has been targeted across the media and criticised as being overly processed, unfairly so according to some.

“Consumers are particularly concerned about processing in novel meat categories, even though ingredient and processing concerns are less prominent in their overall diet,” says Dale. The fact that this doesn’t impact their nutritional perception of blended meat shows that “while they may dislike the means, they accept the ends”.

He points to the “tension” of trying something new as a reason for the pushback against processing: “Consumers must overcome habitual purchases and anxieties when trying a new product. For balanced proteins to succeed, they need to clearly communicate a compelling benefit that outweighs the perceived risk of change.”

This lack of familiarity and trust gives people “an easy reason to dismiss” novel products, since they look for information that reinforces their preexisting concerns. “To overcome these barriers, balanced proteins should lean into distinct advantages – ideally tied to plant-based ingredient inclusion – that address different consumer pain points,” Dale explains.

“While consumer education and cleaner ingredient strategies can help, the most effective way to move past UPF concerns is by delivering benefits that consumers actively desire. I think Perdue Plus [which uses plant-based ingredients from The Better Meat Co] is a great example – getting children to enjoy eating vegetables.”

He notes that many blended meat formats are competing on the same value proposition as conventional meat, which has high consumer ratings for taste and value: “To win in these categories, balanced proteins must far exceed conventional options, not just match them.”

Dale also prefers using “functionality” over terms like “health” or “nutrition”, which may not be effective drivers. “While nutritional benefits matter, brands need to recognise how consumers perceive their conventional meat competition – if they don’t see a problem, nutrition alone won’t drive adoption,” he says.

How can brands tap into the blended meat opportunity?

Overall, only a quarter of respondents to the YouGov poll found blended meat appealing, in stark contrast to the 67% of omnivores who expressed interest in buying these products in a 2024 survey by FSI’s Nectar initiative.

Dale argues that the Nectar study likely setup the increased products’ appeal. People completed the survey immediately after tasting the product and were unaware whether they had eaten a blended or conventional version.

The methodology used in the YouGov poll, however, likely reduced appeal. “The category was described in the abstract rather than with images or real products, which may have limited familiarity,” explains Dale. The wording used to describe blended meat suggested that conventional proteins aren’t widely perceived as needing nutritional improvement and sustainability remains a niche driver.

Regardless, Dale advises brands to find their white space based on consumer needs and desires. “It is easier to solve an existing consumer problem rather than a created one,” he says.

Moreover, these products must be seen as approachable, and finding a balance between familiarity with meat and a differentiated value proposition from plant-based ingredients is crucial too.

“Don’t let the pursuit of perfect clean labels or niche positioning overshadow the fundamentals – taste, value, familiarity, and functionality,” he says. “Engage consumers early and often to develop a clear, realistic understanding of their taste perceptions and preferences.”

He adds that brands should lean into innovative formats, experimenting with products that break down barriers to improve accessibility and appeal – think smaller pack sizes or family-friendly options for shared meals. Moreover, lowering the barriers to trial is important. “Address key friction points – such as taste scepticism and price sensitivity – to make trying and switching easier for consumers,” says Dale.

He recommends businesses measure the results of marketing campaigns in the long run: “A new category with new benefits requires sustained communication. Prioritise long-term brand building and consumer education to drive lasting adoption.”

The post The 50/50 Solution: Could Blended Proteins Win Over Meat Lovers? appeared first on Green Queen.

This post was originally published on Green Queen.