Unilever’s struggle to sell The Vegetarian Butcher and Nestlé and Monde Nissin’s slowing meat alternative sales are bad news for the plant-based market.

In the span of seven months, the CEOs of Nestlé, Monde Nissin, and Unilever have all left their roles amid weak sales, as the company’s boards look to accelerate strategy executions with fresh leadership.

Each of these Big Food companies owns some of the largest plant-based meat brands in the world, which have been a talking point in their financial discourse. The bottom line is, it feels like they’re not getting what they want out of meat alternatives.

Quorn, the mycoprotein pioneer that Monde Nissin acquired a decade ago, has been struggling for several years now, posting double-digit losses in the last quarter after sales hit a six-year-low the year before.

Nestlé, which pulled its Garden Gourmet brand from the UK in two separate instances, has been forced to slim its meat-free offerings under the Sweet Earth brand.

And Unilever, whose CEO Hein Schumacher is stepping down this weekend, is in a bind with The Vegetarian Butcher. The CPG giant has been looking to offload the vegan meat brand as part of its strategy to “prune” its vast portfolio, and is facing an uphill battle to find buyers at attractive prices.

It paints a dim picture of the plant-based meat industry. Big Food hopped on the bandwagon in the late 2010s on the back of the explosive success of Beyond Meat and Impossible Foods, but now, it’s stuck in limbo with meat alternatives.

Quorn sales shrink further as Nestlé withdraws alt-meat offerings

In September, company accounts showed that the pre-tax losses of Marlow Foods – the parent division of Quorn and Cauldron Foods – quadrupled in 2023, surpassing £60M. And while the business slashed its selling and distribution costs by nearly half, the soaring cost of goods caused its gross profit to plunge from £65M in 2022 to just £1.4M in 2023.

Shortly after, Quorn CEO Marco Bertacca stepped down and was replaced by former Heineken UK managing director David Flochel, who called 2025 a “reset year” for the firm.

However, according to Monde Nissin’s latest earnings report published on the Philippines Stock Exchange, Quorn’s losses kept widening in the latter half of 2024, from single-digit declines in Q3 to a decrease in the mid-teens in Q4, compared to the corresponding periods in 2023. The company said it “continues to operate in a challenging environment”, but in spite of the topline weakness, it expected to achieve positive EBITDA – revenue excluding all non-operational expenses – in Q4.

Still, Monde Nissin noted that it may book £80-100M in impairment charges for Quorn – these are reductions in the recoverable value of an asset. “Although substantial, this figure is notably lower than last year’s impairment,” the company said. (It wrote down £145M in 2023 and £290M in 2022, and has pledged to make up the impairment value for Quorn every year until 2032).

Quorn remains one of the best-selling meat-free brands in the world, though its financial turmoil in recent years is a marker of the troubles that befall plant-based companies today.

It’s a problem illustrated by the world’s largest food company too. Nestlé CEO Laurent Freixe – who was appointed in August – has said that the business excessively focused on meat alternatives, subsequently finding that the market wasn’t as big as initially thought, according to Reuters.

A Nestlé representative told the news agency that its Sweet Earth label now only sells bowls like General Tso’s tofu and bulgogi, having discontinued items like plant-based chicken strips and bacon.

Can Unilever find the right price for The Vegetarian Butcher?

Faltering sales have also decreased the value of industry-leading brands. You’d think the plant-based meat supplier to Burger King and Subway in multiple markets would be hot property for potential buyers, but Unilever is finding it hard to offload The Vegetarian Butcher at the price it wants.

Sky News reported in November that Unilever had hired Piper Sandler to run an auction for the sale of the Dutch vegan business, with “a number of potential buyers” in talks for the deal. Unilever declined to comment on “market rumour or speculation” when approached by Green Queen.

The move followed the consumer goods company’s decision to scale back a number of its key climate goals and focus on its “power brands”, which collectively represent over three-quarters of its turnover. It had already begun demerging its ice cream units in India and Indonesia, and is mulling a sale of its global ice cream division, which includes Ben & Jerry’s and Magnum.

But Reuters reports that The Vegetarian Butcher – which Unilever bought in 2018 – only records around €50M in annual sales and is loss-making, according to analysts, who suggest that it may appeal to trade buyers like meat producers looking to diversify into plant-based alternatives.

Unilever this week ousted Schumacher who said the board was keen to “step up the pace of our strategy execution and realise swift value creation underscored by a change in leadership”, installing CFO Fernando Fernandez as the new chief executive.

Big Food losing faith as UPF discourse heats up

These are the latest signs of uncertainty for plant-based companies, whose sales and valuations have been hurt by the ultra-processed food (UPF) debate. Consumers have been moving towards fresher, more ‘natural’ foods, leaving processed meat analogue makers like Quorn and The Vegetarian Butcher scrambling.

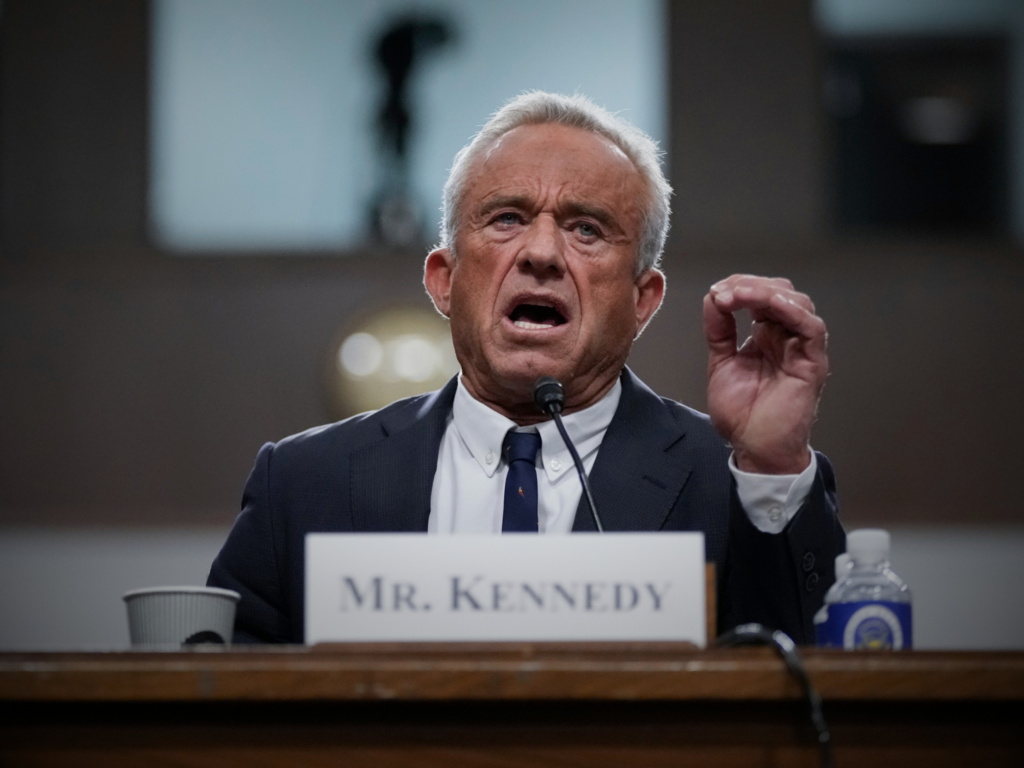

These sentiments have been heightened by new US health secretary Robert F Kennedy Jr’s anti-UPF rhetoric, and sustained misinformation campaigns led by meat lobby groups.

All this has led several commentators to mourn an apparent demise of the industry, which they ascribe to an “anti-vegan backlash”. But for all the criticism, while retail sales of meat alternatives have continued to decline in the US, they grew by 3% between 2022 and 2023 in Europe’s largest markets.

For the world’s biggest food companies, plant-based meat still remains an impediment to their aggressive growth strategies, and that’s a problem for the alternative protein sector.

Could a sales turnaround for Quorn and a successful exit for The Vegetarian Butcher convince investors and businesses otherwise?

The post Plant-Based Struggles: Unilever, Nestlé & Monde Nissin Reassess Meat-Free Ambitions appeared first on Green Queen.

This post was originally published on Green Queen.