A previous article, “Challenging China,” described the mixed and managed economy that enables China (PRC) to overcome the economic pressures posed by an overly contentious America. More to it.

China’s mixed and managed economy is designed to match its stage of development and is well managed. The U.S. non-managed economy has no design and does not match its advanced stage of economic development. China uses exports to grow its economy and limit debt. The U.S. runs severe deficits in its trade balance and needs a growing debt to finance the trade deficit and to increase the GDP. The rapidly growing debt portends economic decline, and there is no certified way to escape the predicament. U.S. hegemony and world leadership appears doomed. The sooner the U.S. leaders recognize the dangers and readjust the economy, the less will be the slide. More on this later. Facts and statistics supply the proof that the PRC has successfully met the challenges.

Overly contentious USA

Using sanctions from legislative directives, rather than pursuing cooperative efforts to combat China’s rise to the world’s number one industrial power, the U.S motivates China to become self-sufficient in technological applications, temporarily interrupts China’s advances, and eventually causes havoc to American companies

Citing security concerns, the U.S. Congress, in 2019, passed the National Defense Authorization Act and essentially banned use of telecommunication equipment from 5G network pioneer Huawei and smartphone manufacturer ZTE. In June 2020, the Federal Communications Commission (FCC) designated ZTE a national security threat. The security concerns proceeded from a possibility that the Chinese government could demand the habits of American citizens, similar to the information that Google and a host of advertising firms gather from internet searchers.

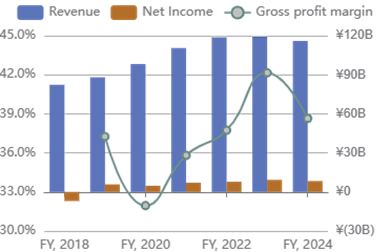

Huawei is of more major significance, but ZTE’s shrugging off the sanctions deserves mention. Its steady revenue growth until facing competition from other companies, relates its success.

This telecom company entered the smartphone market in 2010 and now has the 12th spot in the listing of the Largest Smartphone Manufacturers & Brands in the World. ZTE is also the 6th largest supplier in the Global 5G Infrastructure Market.

Huawei, global leader in development of 5G networks and China’s technology powerhouse, reeled from U.S. sanctions and stumbled as a boxer from an unaware punch. Predictions had Huawei barely surviving. Labelled as a company the U.S. could not do with, Huawei is now the company the world cannot do without. Refuting U.S. attempts to restrict its advances, Huawei expanded into new markets, into new industries, and developed unique alternatives to the denied technologies.

After years of “barely surviving,” Huawei is a leading network company on the globe, having constructed approximately 30% of worldwide 5G base stations, and is fourth in global smartphone manufacturing. After losing access to Google’s Android and Oracle’s software, Huawei developed its own operating system, Harmony OS, which has become the second most popular mobile operating system in China and, by 2025, was installed in over 900 million devices.

In 2022, the Commerce Department informed NVidia and AMD to restrict exports of AI-related chips to China, and informed chip equipment makers — Lam Research, Applied Materials and KLA — to restrict sending tools to the PRC for manufacturing advanced chips. China’s tech giant responded by challenging NVidia artificial intelligence dominance with its Ascend 910D AI processor chip, which “reflects China’s strategic push to develop indigenous semiconductor capabilities.” The U.S. did not respond to Huawei’s advance with its own technology advancements and again responded with threats. On May 15, 2025, the Trump administration warned that using Huawei’s AI chips might violate US export laws.

Ignoring U.S. threats, Huawei expanded use of its chips into the automotive industry and set a new standard for smart driving and self-driving technology.

Huawei’s ambitious undertaking includes the introduction of cutting-edge smart vehicles equipped with advanced autonomous driving technologies. The company is leveraging its prowess in artificial intelligence (AI) and big data to enhance vehicle performance and safety features. With a focus on seamless connectivity and user experience, Huawei is positioning itself as a significant player in the highly sought-after smart driving space, previously dominated by traditional automotive giants and tech firms like Tesla.

In August 2023, President Biden issued an Executive Order “Addressing United States Investments in Certain National Security Technologies and Products in Countries of Concern.” The order prohibited U.S. investments in semiconductors and microelectronics, quantum information technologies, and artificial intelligence technologies in China. In November 2024, “The U.S. reportedly ordered TSMC to halt shipments of advanced chips to Chinese customers that are often used in artificial intelligence applications.”

As a result, Xiaomi, a leading smartphone manufacturer, which has expanded into electric SUV car production, developed its 3-nanometre XRing O1 system-on-a-chip (SoC). Following Apple, Qualcomm, and MediaTek, Xiaomi became the fourth tech company in the world to design a 3-nanometer mobile SoC for mass production. A Chinese company can now compete with American companies in selling the unique chips, and Qualcomm, which has been a long-standing supplier of mobile chips to Xiaomi, might have its sales disrupted.

Statistics tell the story

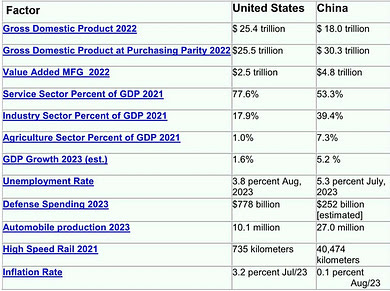

What have all these underhanded means to stifle the Chinese economy accomplished? Statistics in the following table tell the story. The Chinese economy surpassed the U.S. economy in 2022 and is leaving Uncle Sam far behind.

The table shows that China deserves consideration for the title of the world’s greatest economy. Start with the Gross Domestic Product (GDP), a favorite statistic for those who boast of America’s prominence.

The U.S. has a higher GDP than China. China has a higher GDP/PPP. Unlike nominal GDP, which uses current exchange rates, GDP/PPP adjusts for differences in price levels between countries and provides a more realistic measure of the value of goods and services produced. Another consideration is the value given to components of the GDP. Capital, hard goods, and agriculture supply the most needed wants to a community, and their purchases play a more significant role in the economy. The service economy, a paramount feature of the U.S. economy, exaggerates its GDP. One dollar of purchase in goods production requires time for feedback to the manufacturer before other goods are replenished and additional purchases augment the GDP. Purchases in the service economy quickly pass the same money from one service provider to another and elevate the GDP. Industrial output, whether for domestic or foreign use, more appropriately demonstrates the robustness of an economy. China leads the United States in industrial output and demonstrated robustness by becoming the leading manufacturer and exporter of automobiles.

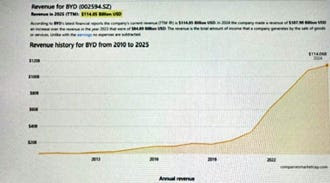

A comparison between two dynamos of each nation, U.S. Tesla and China BYD, automobile manufacturers and innovators that rose rapidly against established competitors, complete the story. BYD, which started at about the same time as Tesla, has surpassed Tesla in automobile sales.

BYD Revenue

Tesla Revenue

More than that, BYD has accomplished what was never considered possible; with a fully charged battery and a full tank of gas, unbiased testing of its new hybrid auto technology showed a driving range of 1,305 miles before charge or fill up. Its fully electric models use advanced sodium ion batteries and, in 5 minutes, can be charged to obtain a 250 mile range. A vertically integrated company, which manufactures its parts and is a leading provider of electric car batteries, BYD sells its autos at the lowest prices in China.

Revisions by BYD include paring the price of its Seagull hatchback to 55,800 yuan ($7,780), a 20% reduction to a model that was already the carmaker’s cheapest and one that had garnered global attention for its sub-$10,000 price tag. The Seal dual-motor hybrid sedan (direct competitor to the $37,000 Tesla Model 3) saw the biggest price cut at 34%, or by 53,000 yuan to 102,800 yuan ($14,333). (ED: These may be temporary price cuts.)

Fatal Decline of the Imperial Power

The U.S. cannot compete with or contain China. Using China as a scapegoat for its global economic decline has proved counterproductive. Better for the U.S. to cooperate with the PRC, realistically examine its economy, become aware of its limitations, and take decisive action to prevent a fatal decline.

The hindrances to economic progress is fourfold:

(1) Debt drives the economy and the debt has become unmanageable.

(2) Manufacturers have established offshore facilities to open new markets and to compete more effectively.

(3) Off shore production and having the dollar as an international currency has produced a high trade deficit.

(4) U.S. markets in the Middle East, Africa, and Latin America have eroded.

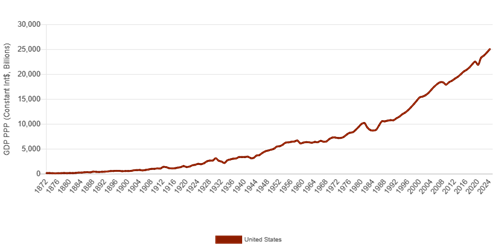

Debt drives the U.S. economy and, the two charts indicate that without increasing the exorbitant debt, the economy will stagnate.

GDP/PPP

All Sectors Debt

Given a money supply to purchase goods and services, how can production and eventual sales of goods and services advance without increases in the money supply? One way is to increase the velocity of money, which occurred with on-time inventory, credit card purchasing, and computer speedup of financial transactions. These phenomena occurred during past decades and exploded the GDP. Another means is by having a positive trade balance; selling goods externally. If these means are not occurring, and they no longer are, increases in the money supply are required to increase production and sell additional goods.

U.S. goods trade deficit increased in 2024 to a record $1.2 trillion, and, although many economists excuse the trade deficit, saying that,

a trade deficit can only arise if foreigners invest more in the US than Americans invest abroad. In other words, a country can only have a trade deficit if it also has an equally sized investment surplus. The US is able to sustain a large trade deficit because so many foreigners are eager to invest here,

is more a rationalization than a reality. The trade deficit arose because American industry found it more profitable to produce overseas and made the dollar the international currency. As an international currency, the dollar is in demand and its exchange rate is high compared to other currencies. The strong dollar raises the prices of U.S. goods, makes its exports expensive and its imports cheap. Yes, the balance of payments must be equalized, and the dollars return as either purchase of government securities ─ one principal reason for rise in government debt ─ or purchase of U.S. assets. The former has become unwieldly, leading to high interest rates and the latter gives foreign interests increased power in the American system. Having a positive balance of trade reduces government debt and foreign influence.

Government debt is not the total problem. A system that exists by debt is the real problem. For a free wheeling and profit first economy that generates huge trade deficits to grow, the money supply must grow. Because money is created by either bank loans (debt) or Federal Reserve borrowings from the Treasury (debt), all money is debt. For the economy to continually grow, debt must continually grow. Soon, financing the debt and its increasing interest rates will be a difficult problem. Credit will freeze, loans will default, and the money supply will shrink. Boom will become bust. The United States has no choice but to have its economy more managed and align government and industry in common goals that correct the trend to a fatal decline.

Tariffs as a government money raiser and incentive to produce locally will be another tax on the American consumer and will not stimulate private investment in internal production to replace foreign imports. So, why not maintain low priced imports and tax the consumer for another goal ─ government investment in competitive industries. Cooperation between government and industry, rather than free-wheeling economics will enable more rational decisions and predictable operations.

The United States pioneered the global economy but globalization is no longer a perfect fit for the economically mature nation. Markets once lost are usually lost for a long time. Preserving present markets and finding niche markets for specialized goods, which the omnipresent U.S. economy has many, will stabilize exports.

History shows that private industry has never been the source of solutions to economic lapses. Changes in life style and a return to the cohesion and social legislation that characterized the Franklin Delano Roosevelt era might solve the economic, social, and political declines predicted for America’s future. The democratic socialization of America is begging to begin.

The post Fatal Decline of the Imperial Power first appeared on Dissident Voice.This post was originally published on Dissident Voice.