Germany’s Veganz Group has established Mililk FoodTech to unlock hidden business value following a 34% drop in sales last year, and will sell its OrbiFarm subsidiary for €30M ($35M).

Following three years of revenue decline, German plant-based pioneer Veganz Group is eyeing a turnaround with strategic investment and a restructuring of its operations.

The holding company has set up Mililk FoodTech as a new subsidiary to “leverage hidden reserves” within the business, building on its Mililk brand of 2D-printed oat milk. In addition, it has agreed to sell 100% of OrbiFarm GmbH – a private limited company it formed in April, stemming from its indoor farming vertical – to a third party for €30M ($35M) plus an earnout.

These moves have been made in preparation for strategic investments in Q3, with the total volume expected to be between €10-20M ($12-24M), based on a pre-money valuation of €80M ($94M). Following the financing, Veganz will continue to hold a majority stake in Mililk.

Veganz goes global with Mililk expansion

Veganz’s 2D-printed milk technology was licensed from US startup Vitiprints in 2022. It prints the oat mass directly after fermentation via a screen printing process on an industrial printer. Drying out the oat base into compact discs requires 94% fewer materials for packaging (compared to the Tetra Paks used for standard oat milks), which is 85% lighter in weight and lowers emissions by 90%.

It has been selling the shelf-stable oat milk sheets since October 2023 under the Mililk brand, and given the technology’s potential to optimise a broad range of foods and beverages, Veganz has decided to diversify its business with the new venture.

Mililk FoodTech will deal with R&D, patents, production, distribution and tech licensing for food manufacturing. Its current focus is centred on plant-based milk, though projects for juices, smoothies and functional drinks are already underway.

Veganz partnered with Döhler Group last year to develop a new process that reduces the number of manufacturing steps and the energy requirements, making production more efficient and cost-effective.

And earlier this year, it signed a deal with Jindilli Beverages (the maker of Milkadamia) to bring its products to North America, Australia and New Zealand. This includes the production of Mililk’s oat and almond milks and its coffee creamer drops, as well as the export and distribution of one-litre Tetra Pak formats for retail and five-litre packs foodservice.

“In view of the enormous market potential for our Mililk technology platform, we are currently only scratching the surface,” said Anja Brachmüller, COO of Veganz and CEO of Mililk FoodTech.

The company predicts the demand for Mililk will reach 30 million litres over the next year, equating to €30M ($35M) in sales, suggesting that this volume is possible due to the significant cost savings its products present.

“In the US, we have already identified a production site that has all the necessary permits and offers enough space to produce more than 60 million litres of our plant-based milk alternatives per year,” noted Brachmüller. This plant is set to be opened in early 2026, with Mililk producing under a licensing model.

Can OrbiFarm sale and strategic investments help Veganz bounce back?

Veganz’s current facility in Ludwigsfelde only has an annual capacity of three million litres; it’s now being expanded to 11.5 million litres with €1M ($1.2M) of capital expenditure. “In Europe, we also want to establish six new production sites,” Brachmüller said. Once online, these would generate triple-digit revenue growth for the Mililk brand alone.

The expansion will be helped by the upcoming strategic investors and the sale of OrbiFarm, developed over several years with indoor farming tech licensed from the Fraunhofer Institute for Molecular Biology and Applied Ecology. The entity was officially launched just over two months ago, with Veganz initially planning to sell a 25% stake for €10M ($12M) – but now, it has agreed to part with the whole business.

Veganz said the transaction enables strategic partners who are prohibited from investing in subsidiaries of listed companies to become involved, with the proceeds from the sale boosting its liquidity and creating new scope for growth.

“The initial order forecast from North America makes it imperative for long-term investors to come on board so that we can build up production capacity as quickly as possible to meet the high demand,” said Brachmüller.

The firm has raised $24M to date, including an $11M equity round for Mililk’s expansion last year. And earlier this month, it issued a capital increase that would net the business a further $7.5M in gross proceeds.

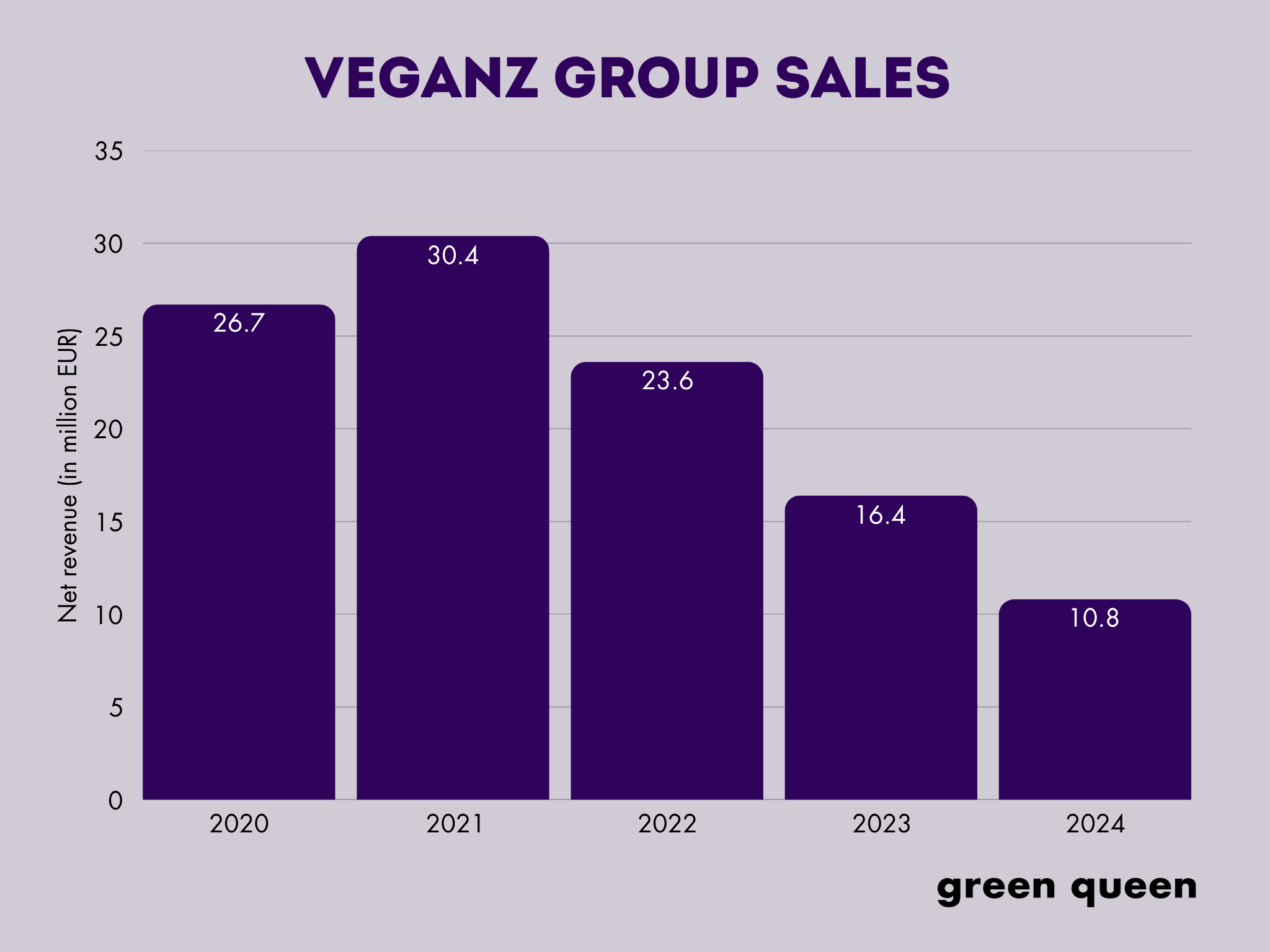

All this comes on the back of several years of decreasing sales, which peaked at €30.4M in 2021. Then, year-on-year sales fell by 22.4% in 2022, 30.5% in 2023, and 34.2% last year, when they totalled €10.8M. The company blamed difficult market conditions, portfolio adjustments, and production delays due to unfinalised financing.

That said, experts expect the company to bounce back this year with €13.2M in sales (representing a 22.5% growth). “In a challenging year 2024, we continued to successfully drive forward the reorganisation of Veganz Group AG and see a further increase in own production sales and an improvement in EBITDA,” Veganz co-founder and CEO Jan Bredack said earlier this year.

“With our five new business units [Veganz, Mililk, Happy Cheeze, Peas on Earth, and OrbiFarm], we are clearly positioned for the future and, assuming financing, will be able to meet the high market demand in 2025,” he added.

The post Veganz Eyes Turnaround with Launch of Mililk FoodTech & $35M Sale of OrbiFarm appeared first on Green Queen.

This post was originally published on Green Queen.