The advanced biotech sector can cut global emissions by 5% and create $1T in annual economic value, but only with major investments to derisk scale-up and ensure cost competitiveness.

Technologies that use microbes to feed the world, produce fossil-free materials, and create high-performing products with low emissions have enormous potential for the global economy, but they haven’t reached their “full scale of impact” yet, a new report shows.

Up to 60% of all physical inputs globally could be produced or replaced with bio-based methods, though achieving that would require significant investment to help scale up the technologies and reduce costs, according to Advanced Biotech for Sustainability (AB4S), a coalition of companies and organisations including L’Oréal, Lallemand, EIT Food, the Good Food Institute, and Arsenale Bioyards.

“Advanced biotechnology leverages breakthroughs in biological sciences such as genetic engineering techniques, as well as advances in computing and engineering, to achieve the full potential use of microbes at scale,” the report states.

“Until recently, however, advanced biotechnology solutions and products have not been able to compete with fossil-based products and solutions on scale or price,” it adds. “We firmly believe that future goals can be more ambitious, positioning the industry on a more transformative trajectory.”

Food represents the biggest biotech opportunity

The AB4S alliance teamed up with consulting giant McKinsey to quantify the environmental and economic benefits of the advanced biotech industry. They focused on four key technologies: precision fermentation, biomass fermentation, organism-as-a-product (think livestock breeding), and tissue-as-a-product (for example, cultivated meat).

They found that at its full potential, this industry could reduce three to four megatonnes of greenhouse gas emissions, or 5% of the global total in 2022. In addition, it can free up as much as four million sq km of land (equivalent to the size of India), lowering 3-6% of the total land used for agriculture.

This land could then be repurposed in different ways, including growing feedstocks for other sectors to improve overall farming output and restoring land to ensure more resilient ecosystems.

By providing an alternative to agriculture, advanced biotechnology could save between 250 to 500 billion cubic metres of water every year. For context, that’s between three to six times the water that flows through the Nile River every year.

The sector can further help boost food security by lowering pressure on food demand without affecting affordability, and making food production resilient to supply chain, pandemic and geopolitical shocks. Governments dependent on food imports can achieve strategic autonomy through these technologies, which enable the production of nutritionally and environmentally superior goods.

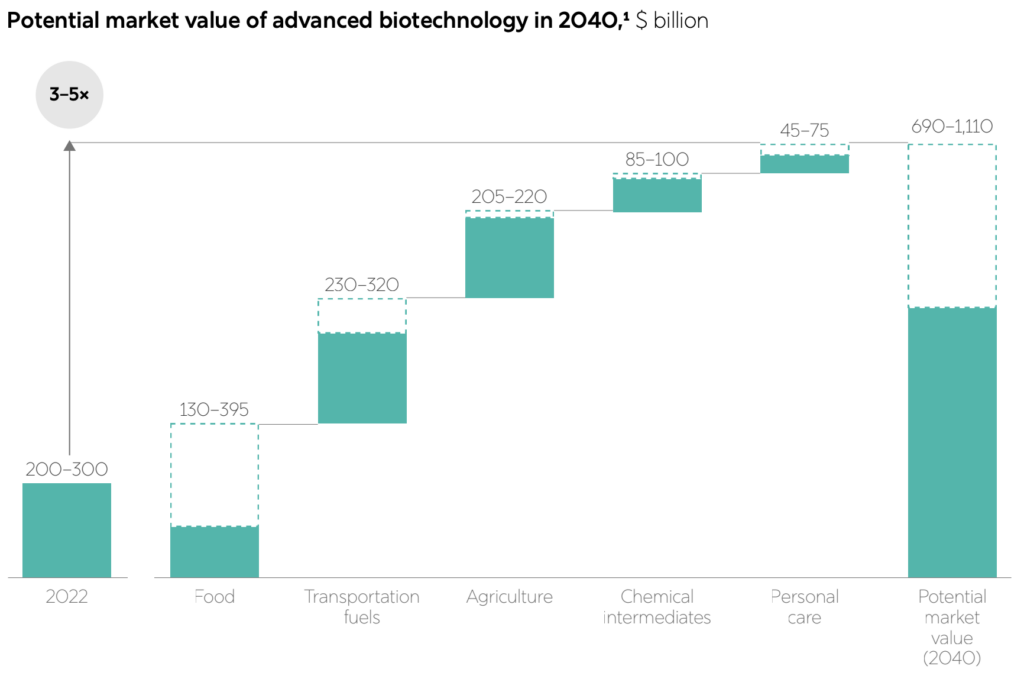

According to the report, the current market for advanced biotech stands between $200B and $300B annually; at its full scale, this could expand to $700B-$1.1T by 2040. This includes various sectors, like agriculture (which could account for up to $225B), food (up to $395B), chemicals ($100B), personal care ($75B), and transportation fuels ($320B).

Fermentation and cell cultivation in focus

The food sector represents the highest economic potential for advanced biotechnology by far, while also effecting significant reductions in emissions, land use, and water consumption. This sector can complement conventional technologies by producing proteins and high-value ingredients more efficiently.

AB4S outlines several use cases to highlight advanced biotech’s impact on the agrifood system, for example, meat and dairy production. Livestock accounts for up to a fifth of all emissions and uses 80% of the world’s farmland, despite only providing 17% of global calories and 38% of our protein supply.

Cattle are the biggest culprit here, alone emitting over 10% of GHG emissions, mostly methane. Advanced biotech, however, can cut beef and dairy’s climate impact through both conventional and alternative pathways. The former group includes techniques like selective breeding, feed additives, manure management, and advanced crop breeding, which could lower the climate footprint of dairy by 30%.

Alternative solutions, however, are threefold. Precision fermentation can replace dairy proteins like whey and casein. Since they’re already at low concentration in cow’s milk, purpose-made molecules derived from microbes can enable production at higher volumes.

Precision-fermented proteins can generate less than 5% of the greenhouse gases emitted by the animal proteins they’re built to replace, while reducing water and land use by more than 95%. Moreover, they are bioidentical to conventional dairy proteins, offering the same taste, texture, and nutritional profile for manufacturers.

Then there’s biomass fermentation, a commonly used technology that converts feedstock into protein-rich microbes to produce meat analogues. “Its broader potential lies in producing versatile proteins that can serve as ingredients in fortified foods, improve nutritional value, or substitute for conventional soy or whey protein,” the report states.

Finally, cell culture technology enables animal cells to grow with the same biological process found in livestock, but in a bioreactor instead. It allows companies to produce cultivated fat and muscle for use in meat alternatives.

According to AB4S’s analysis, fermentation could capture 20% of the market for food derived from cellular agriculture by 2040, while the higher price of cultivated proteins would enable it to take up 80% of the market.

The three solutions to propel advanced biotech

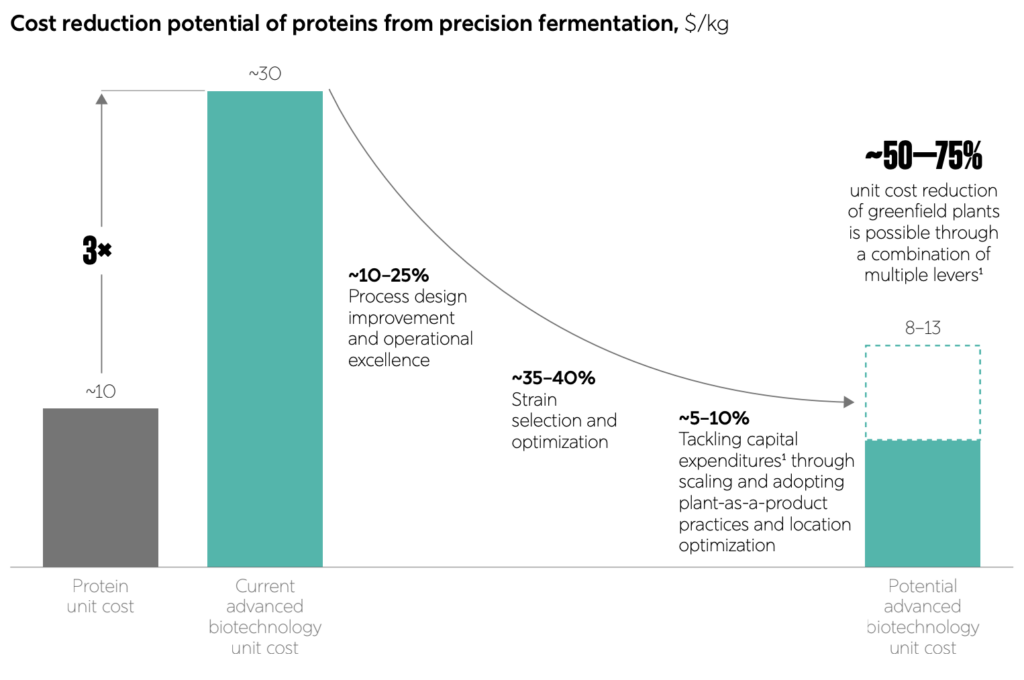

While these technologies are brimming with potential, they face some tall hurdles. Scaling them to meet consumer demand and reduce overall costs remains the biggest of them all. “Achieving cost comparability with traditional dairy products would require continued innovation, both in advanced biotechnology and in efficient industrial production processes,” the coalition says.

Moreover, consumer acceptance is still in its early stages, with many sceptical about the food safety aspects of cultivated meat and precision-fermented foods. Vast differences in regulatory approaches make things more complicated – while several such products are approved in the US, the EU is yet to join the race.

The report suggests that the industrialisation of advanced biotech at a greater pace will rely on three enabling concepts: minimising the variety of approaches to focus resources efficiently creating uniformity across processes, tools, roles, and technology to streamline operations, development, and scaling; and shifting from high-tech development to cost-effective, repeatable deployment of mature technology.

These concepts form the basis of AB4S’s three priority solutions. The first involves setting priorities based on market demand, focusing on products with the highest scalability and commercialisation potential. This entails overhauling policy and regulatory frameworks to steer demand and companies towards agreed goals.

The second solution centres around derisking the scale-up process to increase success rates and reduce financing costs. VC funding for food tech has fallen dramatically over the last few years, although fermentation startups have been an outlier. Since 2015, precision and biomass fermentation firms have received $5B in venture capital.

The fermentation sector requires an exponentially larger amount to overcome the industry’s current challenges, $500B by 2040, to be precise. This accounts for both capital spending on the buildout and startup financing, with capacity expansion alone needing 85% of these investments. This amount would also be needed to overcome regulatory obstacles, bridge talent gaps, and improve consumer awareness and acceptance.

The third solution mentioned in the report is to ensure cost-effectiveness at scale. “This can be achieved by strategies such as optimising plant operations to minimise running costs; applying best practice capital investment methods to develop and commission additional capacity; and using flexible, modular design and shared capacity,” AB4S says.

Its analysis found that these measures could bring the unit costs of precision-fermented dairy molecules down to $8-13 per kg, making them 50-75% cheaper than current costs and reaching price parity with conventional proteins.

“Many [hurdles are fully in the hands of the industry – in particular, prioritising products with the highest market demand, derisking the scale-up process, and reducing costs at scale,” the report says. “The challenges are significant, yet the rewards for successfully addressing them are paramount.”

The post Fermentation Sector Needs $500B Investment to Unlock Biotech’s True Potential: Report appeared first on Green Queen.

This post was originally published on Green Queen.