Californian gas fermentation firm NovoNutrients, which makes proteins from gases, is selling its assets a year after raising $18M in funding.

The “shifting investment climate” around food tech has pushed another alternative protein startup to liquidation.

US firm NovoNutrients, a fermentation specialist turning carbon dioxide and hydrogen into protein, has entered the assignment for the benefit of creditors process. It allows financially distressed companies to sell their assets to third parties, serving as an alternative to formal bankruptcy.

“NovoNutrients enters its next chapter through an asset sale, after 7+ years transforming industrial CO₂ into protein,” David Tze, who transitioned from the role of CEO to senior advisor earlier this year, wrote on LinkedIn.

“This ‘assignment for benefit of creditors’ process opens a rare window: acquire proven gas fermentation technology with broad, multi-sector applications, issued patents, proprietary strains, and commercial-ready IP.”

NovoNutrients’s IP and equipment up for sale

Founded in 2017 by Brian Sefton and Russell Howard, NovoNutrients uses tailored microbial strains and feeds them on waste streams with different gas mixes.

It relies on thin looped cylinders instead of the big tanks found in most fermentation companies’ premises, allowing it to lower the amount of energy needed to blend the gases. The firm operates a B2B model, selling microbes and acquiring licences to build, operate and maintain production facilities.

While it was initially targeting livestock and fish feed, NovoNutrients later added human nutrition and pet food to its portfolio too.

“What we built could accelerate realising your carbon capture and industrial biotech ambitions. CO2 is the key bio-manufacturing input for the future, to make materials, chemicals, and yes, protein,” Tze explained. “The technology works. We were proving that in our pilot phase. The challenge was capital intensity in a shifting investment climate.”

NovoNutrient’s intellectual property is among the assets on sale, including US patents covering gas fermentation and carbon utilisation, proprietary non-GMO strains “with verified performance”, trade secrets related to bioreactors, scale-up models and downstream processing, as well as the Novotein and Novoceuticals brands.

The company is also selling its lab and pilot equipment suite “with validated fermentation protocols and years of lab operational data” and technology that achieves 73% protein content from waste carbon and high-value carotenoids.

Outlining NovoNutrients’s strategic value, Tze wrote: “For industrial biotech, carbon capture, or alternative protein companies, this represents compressed R&D timelines. What took us a decade to develop and validate can accelerate your market entry by five years.”

Investment struggles hit alternative protein sector hard

NovoNutrients is among a small but growing crop of startups leveraging microbial fermentation to turn gases into food. It’s a sector populated by the likes of Solar Foods, Air Protein, LanzaTech, Jooules, Aerbio, Unibio, and more.

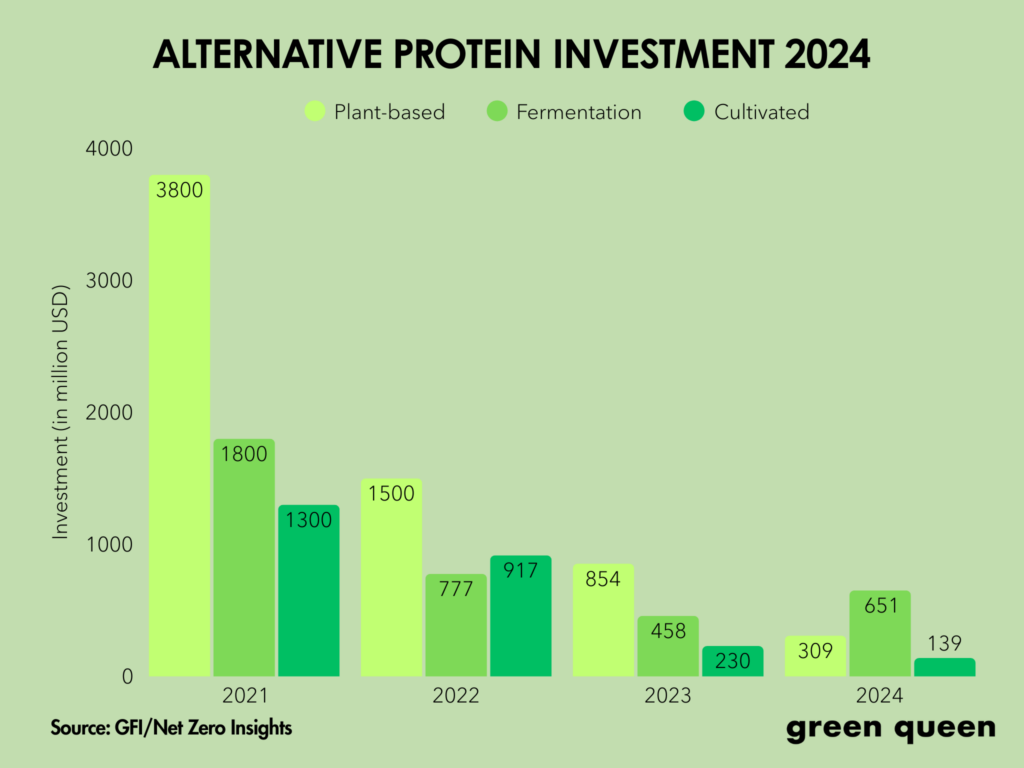

The company has raised $27M in funding to date, including $18M in a Series A round last year. But as Tze noted, it hasn’t been immune to the decline in VC interest in alternative proteins. The sector suffered from a 44% dip in funding in 2023, followed by a further 27% fall last year, and the trend has continued this year. Investment in the overall climate tech sector also fell by 38% in 2024, with VCs flocking to artificial intelligence instead.

It has led to a change in several companies’ fortunes. Fellow gas protein firm Arkon filed for insolvency in May, shortly after Tuno and Loma Linda maker Atlantic Natural Foods filed for bankruptcy (it is now in talks for a potential sale). In June, British plant-based milk brand Mighty Drinks entered administration amid rising costs and fundraising challenges.

Mark Cuban-backed vegan pet food startup Wild Earth has also filed for bankruptcy, before being taken over by InvenTel CEO Yasir Abdul. As reported by AgFunderNews, he is also set to acquire mycelium meat leader Meati in a $4M deal, following a bank-induced crisis that swept most of its cash reserves due to a technical default.

Meanwhile, the co-founder of French plant-based meat maker Swap stepped down as CEO after the company reportedly posted a turnover of just €1M in 2024. It now needs to raise €9M by year-end, and nearly €30M by the end of 2026.

This year has also seen a string of acquisitions in the sector, from bee-free honey maker MeliBio to vegan pet food startup The Pack and mycelium meat player Libre Foods.

“This isn’t the outcome we envisioned when we set out to capture megatons of CO2 and feed the world,” Tze said of NovoNutrients’s fate. “But the technology’s potential remains unchanged. In the right hands, with sufficient capital, it can still transform how we think about carbon and protein.”

He added: “The path forward may look different, but the needs for CO2-based biomanufacturing and protein only grow more urgent.”

The post Gas Protein Startup NovoNutrients to Sell Assets, Citing Investment Challenges appeared first on Green Queen.

This post was originally published on Green Queen.