Czech startup Mewery has secured €2.9M ($3.3M) in grants from the EU to expand the production of its cultivated pork and launch pilot projects with meat producers.

While private investment in cultivated meat is in freefall, public support for the category remains robust.

The EU has made its biomanufacturing ambitions clear, with €350M available in biotech funding and a new act aimed at simplifying the novel food regulatory process.

As part of its goal to establish the region as a future food leader, its key R&D funding programme, Horizon Europe, has invested €2.9M ($3.3M) in Brno-based cultivated pork maker Mewery.

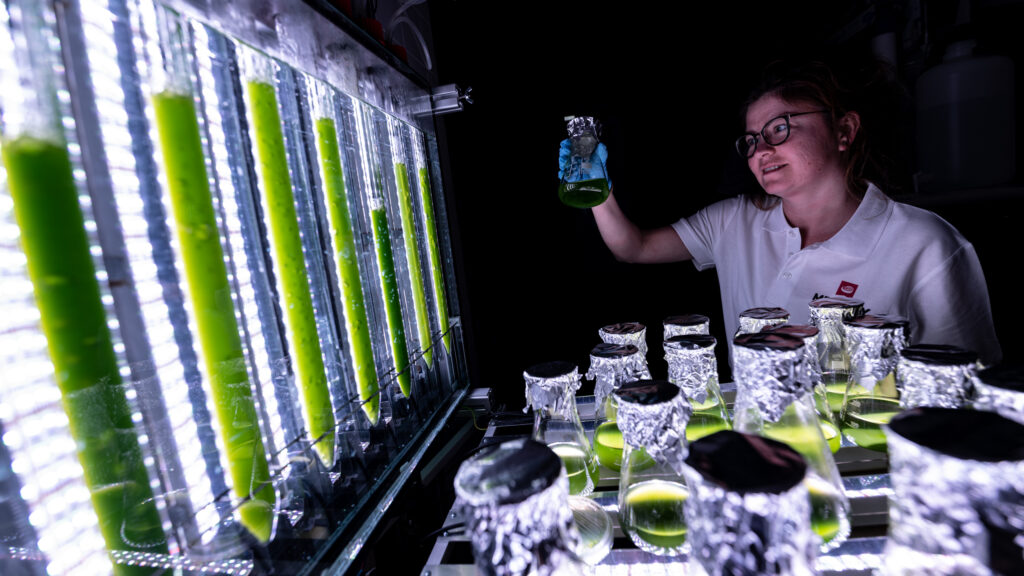

Most of the funding comes from a €2.5M ($2.86M) grant via Horizon Europe’s EIC Accelerator, backed by the Technology Agency of the Czech Republic. The rest comes from its participation in the international research consortium Alliance, a Horizon Europe initiative led by Wageningen University and supported by CzechInvest, which convenes 19 partners to expand the use of microalgae-based ingredients by developing multi-product biorefineries.

Mewery has already demonstrated its co-cultivation technology (combining pork and microalgae cells) on four prototypes. At the start of the year, it began gradual production in a medium-sized bioreactor with a production capacity in the lower kg range. Now, the firm will use the funds to scale up its tech to higher kg volumes of biomass, which it plans to achieve at the turn of the year.

“This will be a crucial step that will open the way for us to test our technology with meat producers,” says founder and CEO Roman Lauš. Initial talks are already underway, with pilot projects expected to be launched in the EU in the coming months.

“We are currently adjusting our bioprocess for the use in our medium-sized bioreactor with a goal to produce enough biomass for pilot testing projects with partners across Europe, i.e., kilos,” Rostislav Brzobohatý, Mewery’s chief commercial officer, told Green Queen.

“These projects will be in our focus in the coming months. Specific volumes will depend on the needs of individual manufacturing partners that we plan to involve in testing the unit across Europe,” he added.

How Mewery is reducing the costs of cultivated pork

Founded in 2020 by Lauš, Mewery’s co-cultivation tech allows it to enhance cell growth efficiency and reduce costs, resulting in a product with “highly valuable composition”. Last year, the company established a stable cell line and expanded its cell bank to include multiple types of non-GMO porcine cells.

It has since begun operating a pilot plant within its facilities at Brno’s Mendel University, which will help with the testing project. “Right now, we are focusing on internal validation of the bioprocess and its optimisation for the current bioreactor size,” says Brzobohatý.

“Mewery will produce the agreed volumes of biomass at its own facility and deliver them to manufacturing partners for testing. We expect them to test our biomass as part of their product applications,” he adds.

“We don’t consider the co-production of our biomass with external manufacturers as we expect to be able to produce required volumes with our current capacities. The co-production is not planned in later stages either, as our long-term business model is built on licensing and our effort will be to enable our manufacturing partners to develop their own production capabilities [by] leveraging our co-cultivation technology.”

Currently, its cost per kg of meat is in the tens of euros. “We are still in low experimental volumes compared to industrial production, and it is premature to draw conclusions about future prices from these figures,” notes Brzobohatý.

Its cost pipeline is pointing towards a price below €10 per kg, driven by the continuous optimisation of its inputs. “With up to 10 times higher yield than industry standard, we significantly reduce the amount of growth media required while simultaneously lowering waste management costs,” he says.

Replacing high-cost components like fetal bovine serum with its proprietary microalgae-based alternative and producing recombinant proteins internally allows it to reduce reliance on expensive external suppliers. “Combined, these factors are steadily narrowing the gap to conventional meat pricing and positioning Mewery not only as a technological pioneer, but as a commercially viable player in the future protein market,” Brzobohatý says.

“However, right now, we are primarily focusing our efforts on developing the right product together with our partners – a product that will excite consumers and deliver real added value, which is ultimately what will determine the perceived value for money and the whole production and pricing strategy,” he adds.

Testing project will inform regulatory filings

Mewery has previously teased products like meatballs and tenderloin made from 75% porcine cells and 25% microalgae cells. In 2023, it debuted a burger at a small tasting in its home country, where over 90% of attendees indicated their willingness to taste the cultivated product.

“Mendel University will collaborate on tests related to nutritional composition and safety and will assist in finetuning the joint product,” says Brzobohatý. “In the event of a successful application, we will continue to discuss with our partner regarding a possible joint application to the European Food Safety Authority.”

Only Gourmey and Mosa Meat have applied to sell cultivated meat in the EU so far, with its rigorous and – in its own words – “lengthy” approval process a major barrier for novel food companies. For Mewery, however, it would “make a lot of sense to start in Europe” with partners with whom it’s ready to move from joint development to commercialisation.

“However, we are still planning to apply in the US at the same time, despite the current developments in the field of cultivated meat there,” Brzobohatý says, nodding to the spate of state-level cultivated meat bans. “Based on the current schedule, we expect to apply in 2027-28.”

High costs, low scalability and ‘unfulfilled promises’ have led to funding gap

Mewery has secured €4M from public and private investors since its inception. Moreover, thanks to an EIC grant, it has won a Seal of Excellence, a European quality label awarded to projects that meet the highest standards set by the EU Commission.

“We see this award and funding from local sources as a strong sign of confidence, not only in our team, but also in the very idea of cultivated meat as a sustainable alternative,” said Lauš. “European validation at this level proves that our project is at the absolute forefront of technology and ready for scaling up to pilot production.”

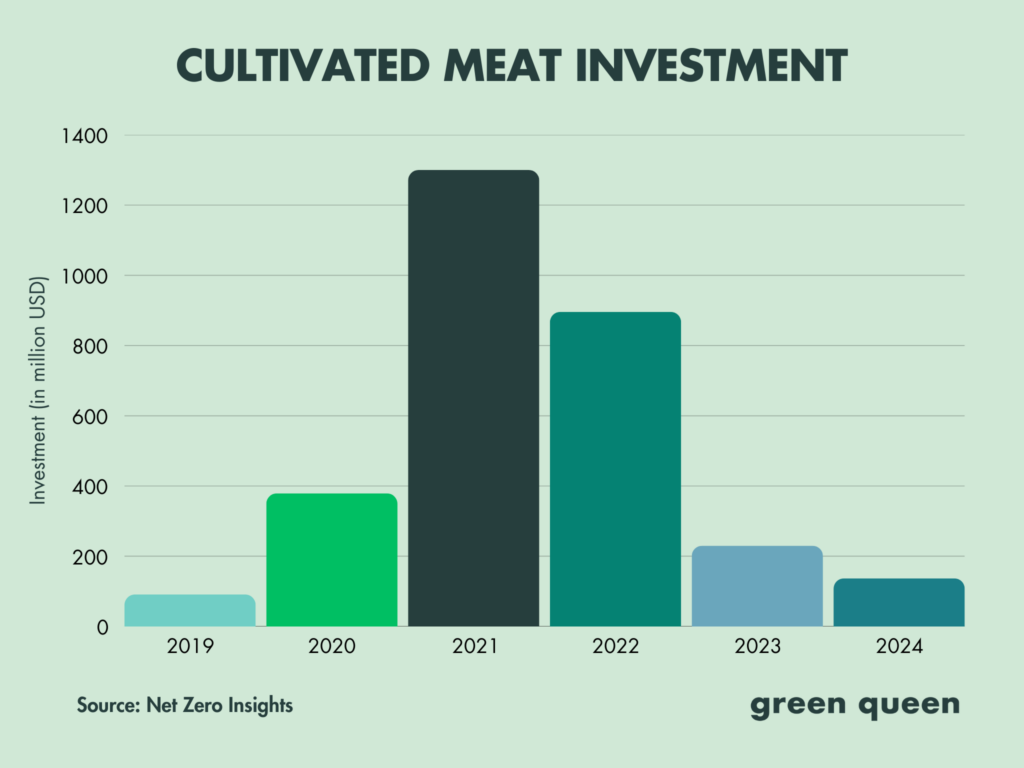

Funding for cultivated meat has slowed dramatically since the turn of the decade. The sector saw funding decline by 75% in 2023, and another 40% in 2024. In fact, in the last three years, these companies have cumulatively raised less money than they did in 2021 alone ($1.3B). And this year so far, the category has only attracted $35M.

Brzobohatý ascribes the slowdown to high production costs, limited scalability, and unfulfilled promises from earlier market players: “Many companies are struggling to transition from lab-based production to industrial-scale manufacturing or to develop cost-effective processes, leading investors to take a more cautious approach. At the same time, regulatory uncertainty is further dampening investor enthusiasm.”

What makes Mewery a prospect? Based on feedback from EIC biotech and VC experts, it points to two main factors. “Our proprietary unique co-cultivation method with technological advantages [is] already proven in previous proof-of-concept studies (high yield, lower production costs, longer shelf life, easier scalability, and more). These are arguments that give hope for a potential breakthrough in the industry that investors are waiting for,” he says.

Then there’s its commercial pipeline, which “takes into account the needs of our future manufacturing partners and involves them in joint development at an early stage”. This has the potential to “accelerate joint market entry after the regulatory phase”.

He adds: “We believe that there will be several major developments in the meat cultivation industry in the near future, which will attract renewed investor interest and confirm the enormous potential of our industry.

The post EU Pumps $3.3M in Mewery to Scale Up Cultivated Pork appeared first on Green Queen.

This post was originally published on Green Queen.