Cattle populations are declining in the Netherlands, leaving companies with an opportunity to foray into hybrid milk products. And consumers are here for it.

Hybrid dairy has already been in Dutch headlines once this year, after retail giant Albert Heijn introduced two products blending cow’s milk with plant-based alternatives in the summer.

Now, decreasing livestock numbers are putting hybrid milk into the spotlight once again. A new report by Dutch bank ABN-AMRO estimates that meat supplies will shrink by 15-18% by the end of the decade, while the number of dairy cows will drop by 8%.

In fact, the bank expects three to four dairy processors to shut down by this time, and with upcoming government regulations, livestock numbers could decline even further. But this also offers up opportunities for companies to enhance their sustainability through “fewer animals, higher added value, and the possibility of combining animal and plant proteins in products”, it said.

And as part of the report, polling shows that Dutch citizens are willing to embrace hybrid dairy.

Why hybrid dairy is a solution for shrinking livestock numbers

The report ascribed the decline in population numbers to termination and depletion regulations. Last year, the EU approved a €700M sustainability scheme by the Dutch government, which compensates livestock farmers who voluntarily close their sites to help mitigate climate change. Since then, an extra €100M in aid has been made available for the initiative.

As expected, this has disrupted the meat and dairy sectors. While the farmers who continue to work in this sector could see incomes rise, companies that work directly with them face higher costs, only some of which can be passed on to consumers.

Another consequence is the decline in volumes, which threatens overcapacities at companies that slaughter animals or process milk. These processors are now under pressure to adapt their business models to keep being profitable, ABN-AMRO said.

“The extent to which companies are affected depends on their flexibility, which varies significantly depending on their position in the supply chain,” it explained. It leaves them with two mitigation strategies: focus on added value instead of volume (by targeting luxury markets or creating higher-value dairy products), and look for substitutes.

This is where hybrid dairy comes in. A recent global survey, meanwhile, suggested that among the 38% of people who don’t buy non-dairy products, 58% showcase the potential to switch if certain needs are met. The biggest problem was unsatisfactory taste or texture, which left 57% of consumers resistant to these products, followed by limited availability (55%) and high prices (37%).

Hybrid milk is positioned as a middle-ground product. It’s targeting consumers who want an all-round nutritional profile with less saturated fat, and are concerned about the climate impact of dairy production, but at the same time, don’t universally love the taste of plant-based milk.

A third of Dutch consumers open to blended proteins

To offer a snapshot of consumers’ perceptions about hybrid dairy, ABN AMRO commissioned PanelWizard to conduct a poll on the topic recently.

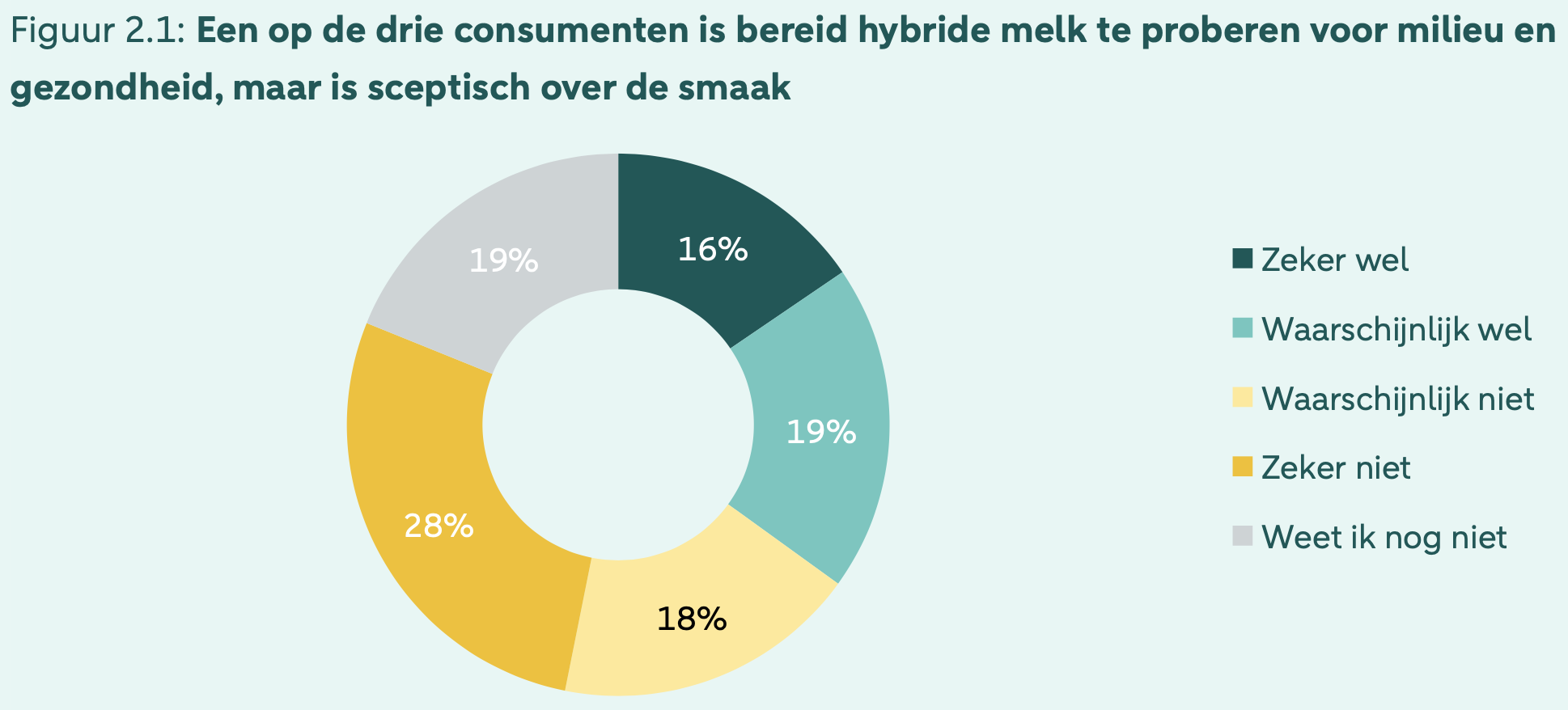

The survey revealed that over a third (35%) of consumers are willing to try a hybrid milk product that contains 30% plant-based ingredients, so long as its price is equivalent to conventional dairy. Their main motivators are related to the environment and health, with Dutch citizens still sceptical about the taste.

But an even larger share (46%) of respondents don’t want to try hybrid milk, indicating that they’re either satisfied with cow’s milk, don’t believe the taste will be comparable, or find the concept strange.

Still, a fifth of consumers are undecided, and the younger and more educated a respondent was, the more likely they were to be open to trying hybrid milk. At the same time, many respondents also already drink plant-based milk, or never drink cow’s milk at all.

There’s a similar openness to blended meat, which has become increasingly popular across the globe. Roughly three in 10 Dutch consumers are willing to consume the protein as an alternative to conventional meat for dinner.

This attitude isn’t surprising, considering that the Netherlands is among the leaders of the blended protein movement. In 2024, Lidl introduced a blended beef mince under its own-label brand, a move replicated by Aldi earlier this year.

Meanwhile, Albert Heijn launched a 15-strong range of blended protein products. This includes hamburgers, minced meat, sausages, and soup balls (with 66-76% beef), as well as deli sausages. Plus, it rolled out semi-skimmed and whole milk mixed with sunflower oil, faba bean protein, sugar and salt.

. “The idea of combination products is new and may take some getting used to. But taste tests show that these products are just as tasty as the regular versions,” said Nienke Tjerkstra, VP of health and sustainability at Albert Heijn. “We’re making it easier to eat plant-based more often, without customers having to compromise on taste or habits. Small changes can make a big difference – for yourself and for the planet.”

With the livestock industry facing a supply and cost crisis, and consumers willing to give blended proteins a go, can the Netherlands’s animal protein industry innovate with hybrids?

The post In the Netherlands, Shrinking Livestock Numbers Could Give Hybrid Dairy A Boost appeared first on Green Queen.

This post was originally published on Green Queen.