Novel fermentation methods to produce alternatives to meat, dairy and eggs could add £9.8B annually to the UK economy by 2050, new analysis shows.

Modern approaches to an age-old food production technique could bring in an economic windfall for the UK, boosting its net-zero plans for 2050.

Fermentation has been around for millennia, but many companies are employing new technologies that make use of this method to create sustainable alternatives to animal proteins.

And as the Food Standards Agency (FSA) launches a new initiative to boost its scientific understanding of novel fermentation methods, analysis by Systemiq and the Good Food Institute Europe has revealed that these technologies can generate £9.8B in annual economic value and £2.4B in exports for the UK.

“Fermentation is an ancient technology being reimagined to tackle the modern-day challenges facing our food system. These figures reveal the value to the UK economy of a thriving fermentation sector producing familiar, tasty and nutritious food,” said Linus Pardoe, senior UK policy manager at GFI Europe.

UK could be a world leader in fermentation

The research covers two types of fermentation tech. Biomass fermentation utilises fast-replicating natural microorganisms, like fungi or algae, to produce high-protein biomass. Here, the microbes themselves are the end product. The best-known use case of this method is the mycoprotein produced by Quorn.

Precision fermentation involves inserting specific DNA into microorganisms to teach them to produce the desired compounds when fermented. The process has been widely used for decades to produce insulin, rennet for cheesemaking, and vitamin supplements.

Food producers are now using these technologies to produce proteins and fats that resemble (or, in the case of precision fermentation, are bioidentical to) animal-based foods like meat, dairy, and eggs. Moreover, some companies are making alternatives to palm oil, chocolate, cotton and leather.

According to the report, a business-as-usual scenario would entail the UK maintaining steady progress with modest public R&D support and the inclusion of fermentation in engineering biology solutions. The FSA would provide a functional yet slow regulatory process, while a broader use of clear terminology would improve consumer and investor confidence.

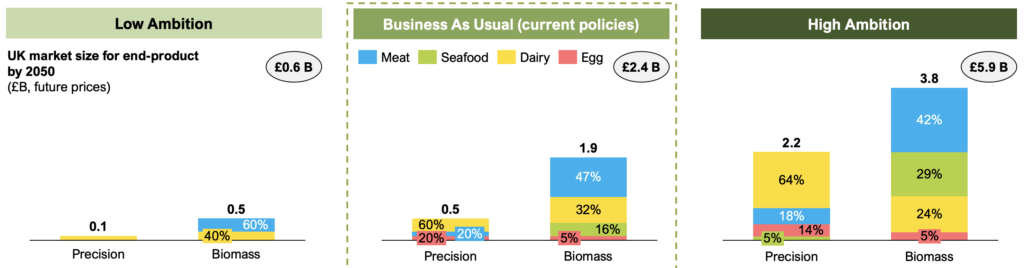

These policies would put the UK’s fermentation market on track to be valued at £2.4B by 2050, equal to just 1% of the current consumer spend on food and drink.

A low-ambition scenario, in which the UK falls behind global leaders due to regulatory delays, a lack of funding, and strict, uncoordinated naming rules, would see the sector contribute only £600M to the economy.

However, the real potential is in the high-ambition pathway, where the strong R&D and infrastructure funding and a coordinated national strategy make the UK a leading fermentation hub. The FSA would be well-resourced to enact fast regulatory approvals, while laws allow these products to use terms like ‘milk’ and ‘cheese’ on-pack.

This could boost the size of the fermentation market to £5.9B by 2050, with precision-fermented dairy and eggs driving a third of the growth.

From labelling to investment, how the UK can support fermentation

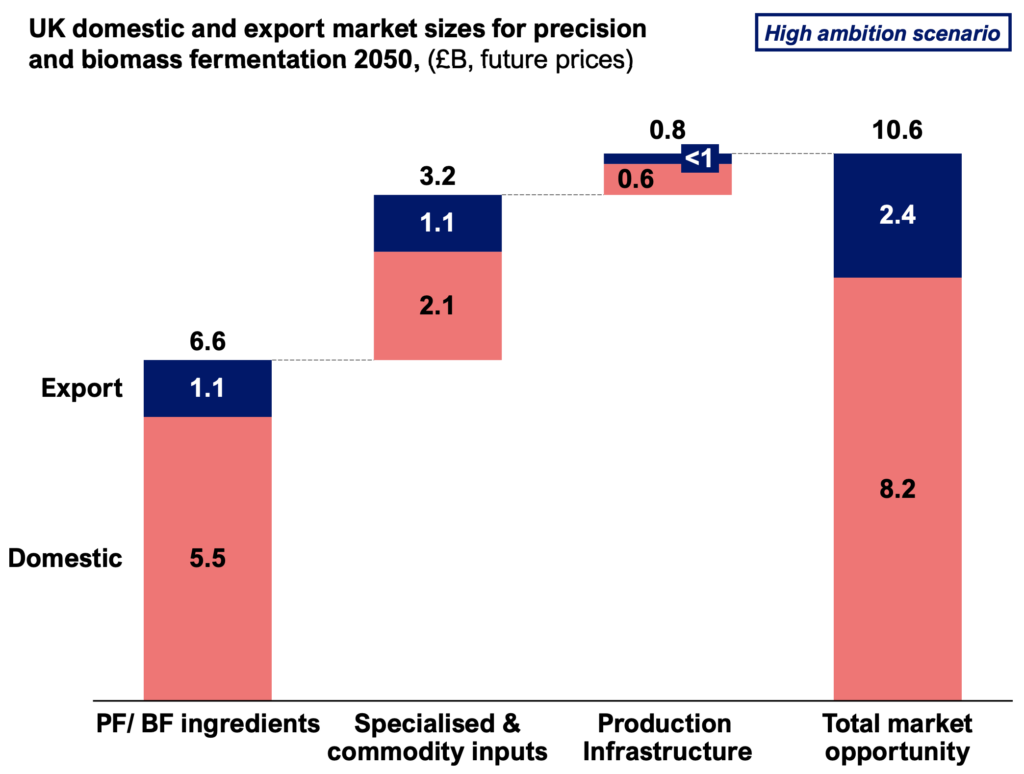

The analysis found that the total gross value added contribution of the fermentation sector could reach £9.8B, with biomass fermentation making up two-thirds of this share.

When factoring in sales of equipment and raw materials, the UK’s overall fermentation market could be valued at up to £8.2B, alongside £2.4B in exports (10% of the food, feed and drink export value in 2024).

The report suggests that the UK government’s stance towards fermentation is “broadly positive”, as momentum grows towards modernised regulation and greater investment. Since 2021, public funding into alternative proteins has crossed £75M, although that’s just 60% of the investment recommended by Henry Dimbleby’s National Food Strategy in 2021.

To unlock further growth, Systemic and GFI Europe called on public and private investors to pump £150M per year into R&D to reach taste and price parity and unlock revenue opportunities. Additionally, the sector needs £860M a year to develop fermenters and facilities at various scales.

The UK government must also recognise the role of fermentation in its new food strategy, reform the Precision Breeding Act to enable some fermentation-derived products to enter the market without novel or GM food authorisation, and revise dairy nomenclature rules to enable animal-free innovations to use terms like ‘milk’ and ‘yoghurt’.

So far, no precision-fermented meat or dairy has been approved for sale by the FSA, but the regulator has launched a year-long Innovation Research Programme to enhance its capabilities and expertise on these technologies.

The initiative is backed by £1.4M in funding from the Department for Science, Innovation and Technology’s new Regulatory Innovation Office, and aims to provide greater clarity to fermentation companies on how to apply for approval, and support food innovation through enhanced regulatory capacity.

“The FSA’s new programme is an important step, helping bring new fermentation-made products to market that meet the UK’s gold standard safety regulations, but the government and industry need to invest in order to unlock this full potential,” said Pardoe.

The post Animal-Free Meat & Dairy Could Bring £10B to the UK Economy Every Year appeared first on Green Queen.

This post was originally published on Green Queen.