The continued price hikes for meat in the UK have created a retail environment where vegan alternatives are at parity or cheaper, according to a new report.

Amid the investment and sales boom for plant-based meat at the turn of the decade, some industry experts had predicted that these products would begin reaching price parity with conventional meat by 2025.

They weren’t wrong. New analysis by think tank Green Alliance shows that several vegan alternatives are now priced the same as meat, and some are even cheaper, at the UK’s largest supermarket.

It comes amid a major hike in meat prices this year. Compared to 2020, the retail cost of beef is 52% higher in 2025. Farmgate prices, meanwhile, have reached record levels, and research shows that meat is one of the primary drivers of food inflation in the UK.

According to Green Alliance, a kg of meat at Tesco’s online store is £1.18 more expensive than last year, but the average price of plant-based alternatives fell by 14p. And the trend is set to continue.

“The price of meat in the UK is largely driven by global commodity markets,” it said. “Factors increasing meat prices are unlikely to relent.”

Why is meat so expensive? And how does it help plant-based products?

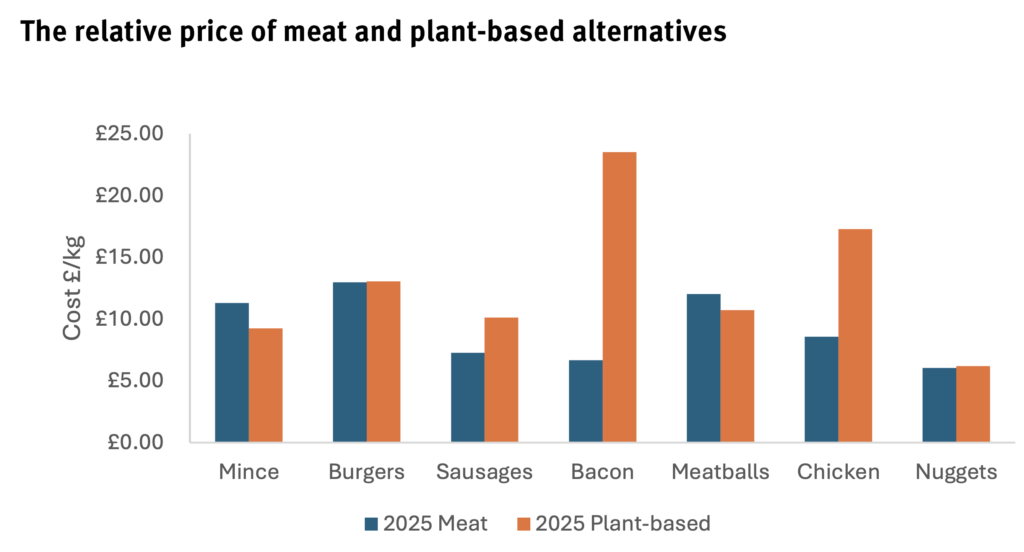

Green Alliance’s report suggested that meat products were cheaper per gram than plant-based versions in every category in 2024, but “this has now changed significantly due to rising meat prices”.

In fact, bacon is the only product where plant-based prices have increased faster than the animal-derived version. Conventional beef has witnessed the biggest hikes, with the cost up by 33% this year.

This is why plant-based mince and meatballs are now cheaper per gram than their animal-based counterparts – in fact, it takes £2.15 less to make a family-sized lasagna with vegan mince now.

Plant-based burgers and chicken nuggets are at price parity. And while vegan pork and chicken products (apart from nuggets) are still more expensive, their animal equivalents are experiencing higher rates of inflation (except bacon), so price parity is closer than it was a year ago.

There are a host of factors driving up meat prices, including climate-change-induced droughts in North America, reduced stock intensity and outputs, and sustained consumer demand amid outbreaks of avian flu and African swine fever.

Green Alliance’s findings showcase the potential of plant-based proteins at a time when one in two Brits is worried about being able to afford food in the next 12 months.

Separate research shows that a third of UK consumers want to cut back on meat and dairy, primarily due to their high prices (cited by 25% of respondents). Meanwhile, 38% want to increase their plant-based consumption.

Retailers have found success with affordable ranges of plant-based products. Lidl has seen sales of private-label vegan food shoot up by nearly 700%, exceeding its own expectations. Many products in the Vemondo range are at parity or cheaper than meat and dairy.

UK government urged to create £30M plant-based innovation fund

Green Alliance is urging the UK government to reignite the growth of the plant-based meat sector (whose sales dipped by 10% last year) through targeted funding, supply chain development, retail accountability measures and regulatory flexibility.

“Continued investment is crucial to developing new, tasty, and healthy products that can better compete with meat. Integrating novel components made with precision fermentation and cell cultivation, such as those used for the Impossible Burger, could be critical for the industry.

The benefits go beyond food security – the greater adoption of plant-based meat products presents advantages to public health, economic development, and the farming sector too.

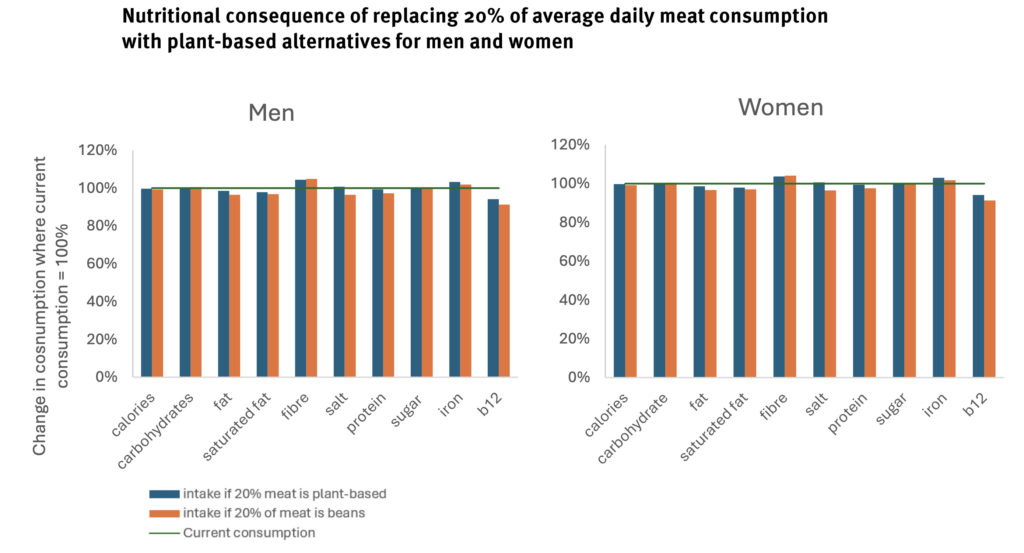

For example, replacing just 20% of weekly meat consumption with vegan alternatives would boost fibre intake by 4% and decrease saturated fat by 2%, without an increase in sugar or salt. And if all oat milk sold in the UK was made with British oats (as is now the case with Alpro), it could increase demand by 7% for oat farmers.

Green Alliance also found that every £1 invested by the government in plant-based products had stimulated £1.92 of private funding, a greater rate of return than the artificial intelligence sector.

The UK’s Climate Change Committee has recommended reducing meat intake by 20% by 2035, suggesting that the majority of this (80%) should be replaced by alternative proteins. If that happens, retail sales of plant-based meat would grow sevenfold to reach £2.7B that year.

Green Alliance is now calling on the UK government to establish a £30M plant-based innovation fund, in partnership with Defra and UK Research & Innovation, to boost the domestic supply chains and enhance the taste, affordability, and nutrition of meat alternatives.

Additionally, the government should also mandate supermarkets to publicly report on the percentage of plant-based and animal proteins sold, and secure a novel foods exception in the new Sanitary and Phytosanitary deal with the EU to retain the ability to approve precision-fermented and cultivated meat ingredients.

The post Rising Meat Prices Make Plant-Based Alternatives Cheaper in the UK appeared first on Green Queen.

This post was originally published on Green Queen.