The owner of the world’s largest meat company has warned that the US is not producing enough beef to satisfy the GLP-1-fuelled protein demand. But two of its subsidiaries have a readymade solution.

As beef prices go out of control, leading consumers to opt for other proteins, the world’s biggest meat producer is putting part of the blame on Ozempic.

Americans are chomping down on protein like never before. This year, 70% are trying to consume the macroingredient, and one in three have increased their intake, with meat being the top source. However, the food industry isn’t able to keep up with this soaring demand, thanks to climate-change-induced supply shortages.

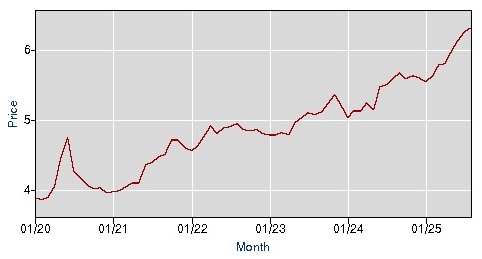

Beef is the primary example of this mess. It has never been more expensive in the US, breaking the all-time record every month since March. In August, average ground beef prices reached $6.32 per lb, up by 14% from last 12 months ago. In contrast, the rate of overall inflation was 3%.

It is the most polluting and land-intensive food out there, and the planet simply does not have the resources to produce the amount of beef people want.

But the co-owner of JBS, a $15B stain on the climate fight, says rising beef prices are a result of high tariffs and the GLP-1 boom. One in eight Americans has used a weight-loss drug like Ozempic and Mounjaro, which have turned the food industry on its head.

“No one knows exactly what is the impact of these new drugs, Ozempic or Mounjaro… but something is happening because protein overall became [a trend],” Wesley Batista, who sits on JBS’s board, told the Financial Times. “In the past […] the doctor said you should not eat too [many] eggs, you should not eat too much protein. Now it’s the other way around.”

Why beef is getting more expensive

Batista’s claim that Ozempic is driving protein demand isn’t unfounded. GLP-1 users are recommended to eat plenty of protein, since these drugs can cause a 25-40% decrease in muscle mass over eight to 16 months, several times greater than non-medicated weight-loss approaches and age-related muscle loss.

Meanwhile, GLP-1 users are already spending 11% less on most categories of food, and over half (56%) are aiming to make healthier food choices. Foods high in sugar, fat and calories stand to lose, while protein and fibre are all the rage.

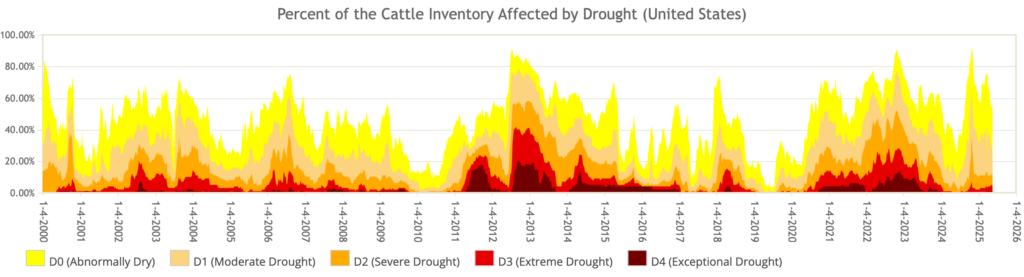

The conundrum for the US meat industry, though, is keeping up with the demand while retaining prices. Right now, it is unable to do either. American beef cattle herd inventories have fallen to levels not seen in 70 years, as an ongoing drought decimates grazing pastures.

Cattle cycles tend to run for eight to 12 years, characterised by cattle production and producers’ response to changes in the market. The current cycle began in 2014 and hit a contraction phase in 2020 that has continued since, thanks in large part to drought.

In fact, cattle inventories have contracted at an increasing rate each year since the start of the pandemic. In October 2024, 62% of cattle were in areas suffering from drought, the most since December 2022. The US Department of the Interior warns that drought poses a “serious environmental threat”, and climate change makes droughts “more frequent, longer, and more severe”.

Beef herds will also continue to get smaller unless producers expand their operations, an expensive premise given the high interest rates that mean they’re paying more for operating loans.

US beef imports set to rise, at a climate cost

“The US is facing the highest beef price in history, and so the US needs to import more and more because production is not there to support the demand,” Batista told the Financial Times.

While it’s the largest beef-producing country, the US has imported 30% more beef in the first half of 2025. And Brazil has benefitted particularly, exporting 91% more beef to the US in this period, despite a 10% tariff imposed by President Donald Trump.

Brazilian beef imports only began to fall in August after Trump increased the tariffs to 50%, thanks in part to a political spat with the South American country. Batista said JBS, which debuted on the New York Stock Exchange in June despite widespread calls to block its IPO, wasn’t hit hard by the tariffs.

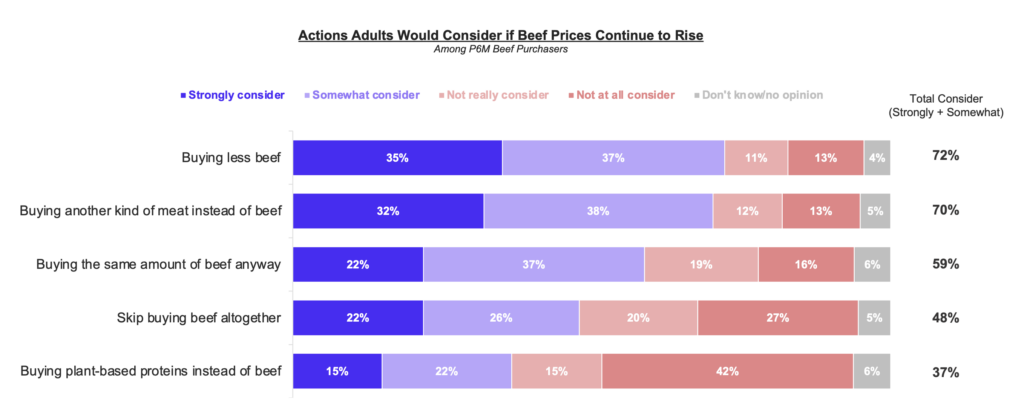

Consumers, though, have borne the brunt. In the last six months, 72% of Americans have noticed that beef has become more expensive, leading half (48%) to reduce the amount of beef they’re buying, and 12% to give it up altogether, a recent poll by Morning Consult and the Physicians Committee for Responsible Medicine (PCRM) found.

The US Department of Agriculture forecasts beef imports to increase in the second half of 2025 too, bringing the total volume up by 16% for the entire year. That, combined with inflation and tariffs, will mean continued high prices for beef.

There’s also a climate drawback here. The UN Food and Agriculture Organization notes that American beef has just a quarter of the carbon footprint of Brazilian beef. That said, the industry still has an outsized impact on the planet, generating more emissions and using up more land than any other food.

JBS already has a solution in Vivera and The Vegetarian Butcher

For Batista and JBS, the solution to beef’s multifaceted issues lies in-house. The company has invested hundreds of millions in alternative proteins over the years, most prominently buying meat-free leader Vivera for $400M in 2021, and then The Vegetarian Butcher from Unilever this year (the two have now been merged in a new collective).

Plant-based meat offers comparable amounts of protein to beef, albeit with a fraction of the climate footprint. For example, ground beef sold by JBS’s Certified Angus Beef brand in the US contains 19g of protein and 22g of fat. The Vegetarian Butcher’s soy-based Nomince, meanwhile, offers 22g of protein for the same amount, and with 98% less fat (and no cholesterol), playing into GLP-1 trends.

Similarly, a beef tenderloin steak from Swift Meats (another JBS subsidiary) contains 20g of protein, the same amount present in Vivera’s plant-based steak.

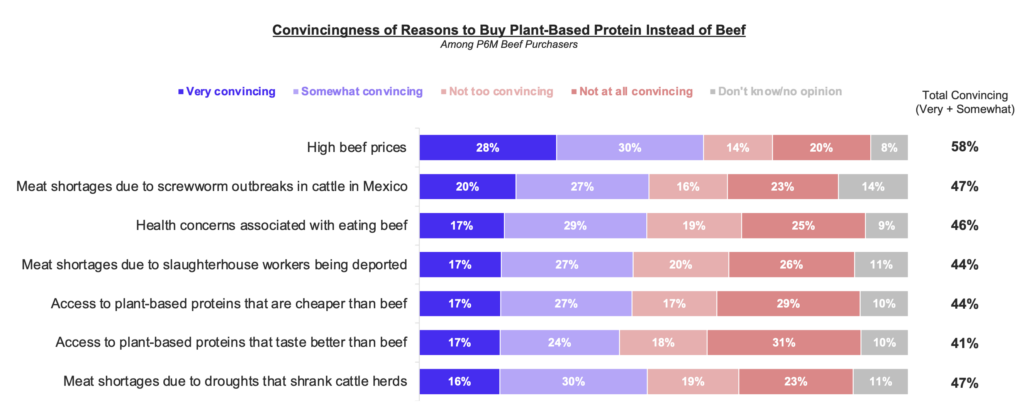

Americans aren’t afraid to shift away from beef. While only 7% of Americans have resorted to buying plant-based alternatives in response to high beef prices, 35% will consider doing so on their next trip to the grocery store, according to the PCRM poll. If the cost of beef continues to climb, this would rise to 37% in the long run.

In fact, high beef prices are by far the top reason that would drive consumers to buy plant proteins instead of beef, cited by 58%. Another 46% are concerned about the health implications of eating beef. Crucially, 44% of Americans would buy these proteins instead of beef if they’re cheaper (as of 2024, the average price gap stood at 14%), and 41% would do so if they tasted better – some already do.

There are other factors at play too. “In Nebraska, a slaughterhouse recently experienced an immigration raid, and given that there are other incidents, the current administration’s immigration policies could lead to a shortage of slaughterhouse workers,” Anna Herby, a nutrition education specialist at PCRM, told Green Queen.

“Producing plant protein requires fewer workers. Overall, it’s much more efficient to raise food for people to eat directly rather than hire workers to raise crops to feed to cattle and then employ another set of (mostly immigrant workers) to slaughter the cattle,” she added.

Batista said that while beef products keep getting pricier in some markets, the “demand is still very strong, especially in the US”. However, with extreme weather and tariffs butchering the industry’s ability to meet the appetite for protein, plant-based brands with established supply chains can fill the gap, and that too with better nutrition and climate credentials.

The post GLP-1 Drugs Driving Protein Demand & US Beef Shortage, Says JBS Boss appeared first on Green Queen.

This post was originally published on Green Queen.