Swedish oat milk pioneer Oatly delivered profitable growth for the first time in its four years as a public company in Q3 2025, thanks to its “Gen Z-driven flavour bonanza” strategy.

With a taste-forward strategy that’s already bearing fruit in Europe, Oatly has posted its first quarter of profitable growth since its Summer 2021 IPO.

The oat milk maker’s revenue for the July to September period reached $222.8M, a 7% increase from Q3 2024, and its highest quarterly total ever. After adjusting for foreign exchange impact, its constant currency revenue still expanded by 3.8%.

Its adjusted EBITDA – revenue excluding all non-operational and one-time expenses – was $3.1M, compared to a loss of $5M in the corresponding period a year ago. This was primarily driven by a near-7% rise in gross profit, and lower R&D, selling, general and administrative costs.

This success came largely on the back of consistent performance in Europe and a strong quarter in the Greater China segment, which was partially offset by weakening sales in the US.

That said, Oatly still reported a $65.3M net loss for Q3 2025, nearly doubling from the same period last year, largely due to fair value losses on convertible notes.

“To be clear, profitability is not our finish line. It’s a marker of progress, a crucial credibility milestone, and even more important, a ramp-up for future profitable growth,” said Oatly CEO Jean-Christophe Flatin, who has overseen a 20% hike in sales since joining the company three years ago.

“We see significant potential ahead of us, and we are confident that we are taking the right steps to drive durable, scalable, and profitable growth as we execute on our mission,” he said.

Why Oatly is thriving in Europe

The highlight of Oatly’s Q3 success was its Europe and International segment, where revenue increased by 12% to reach $123.3M, and volumes were up by 8.4%. Much like previous quarters, most of its sales in this region (79%) came from the retail channel.

Oatly attributed the European performance to its refresh playbook, which aims to drive relevance, attack barriers to conversion, and increase distribution. “To do so, we’re partnering with our customers to make their menus and shelves much more relevant for the taste and flavour-obsessed Gen Z,” COO Daniel Ordonez told analysts in an earnings call.

He noted that the company’s 60+ barista market developers look to renovate foodservice menus by being ahead of the trend curve with drinks that use Oatly as a “default experience canvas”, not just as an alternative to cow’s milk: “As these drinks generate vast awareness, consumer engagement and trial, our growth naturally shows up first in the foodservice channel, with retail following.”

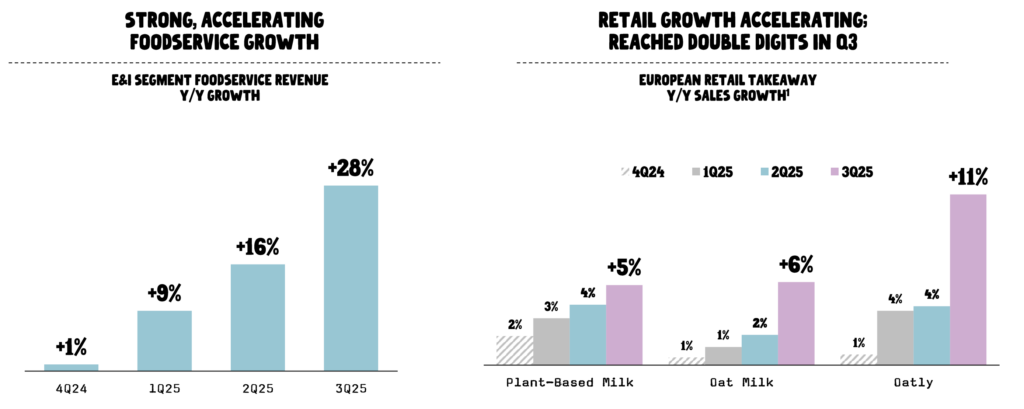

Oatly’s foodservice performance began accelerating late last year, and drove a 28% year-on-year increase in Q3. At the same time, the retail business shifted from a 4% growth in the last two quarters to 11% in the July to September period, surpassing the overall plant-based milk category.

“As consumers engage with our products in the foodservice channel, they naturally look for our products in retail,” Ordonez said. That dynamic can be seen in Germany, which was home to the launch of Oatly’s new Future of Taste trends report this month, and saw cafés introduce drinks inspired by its ‘lookbooks’ to capitalise on what he termed “the Gen Z-driven flavour bonanza”.

These actions have driven over 45% foodservice growth for five straight quarters, which, according to Ordonez, led to strong retail performance (with revenue up by 14% in the last 12 weeks). “Germany is our success story and an example of how this strategy can and will drive repeatable, consistent results,” he said.

Oatly is witnessing similar trends across its other large European markets, like the UK and Sweden, where year-on-year retail sales rose by about 4.5% in Q3. “In a nutshell, we see that our experience and taste-driven strategy hits the bull’s eye of what young and not-so-young generations are expecting,” the COO said. “Oatly is creating relevance and generating category demand again.”

Oatly doubles down on taste-led approach in ‘complex’ US market

Outside Europe, Oatly enjoyed a good quarter in Greater China too, following years of struggles in the region, which led the company to kickstart a strategic review earlier this year. Here, revenues were up by 29% to $37.4M, two-thirds of which came from the foodservice sector.

“The strategic review is ongoing, and we continue to evaluate a range of options, including a potential carve-out with the goal of accelerating growth and maximising the value of this business,” Flatin said in the earnings call.

However, the oat milk giant’s trials in the US continued, reflective of trends in the overall plant-based category. Last week, Flatin blamed the decline in non-dairy milk sales in the country on consumer indifference to sustainability claims and “too much greenwashing”.

Oatly’s North America revenue decreased by 10% in Q3 225, reaching $62.1M. And its volumes were down by 12.8%, which it ascribed to a “reduction in sales to the segment’s largest foodservice customer” and the discontinuation of certain frozen products.

As Ordonez pointed out, though, there has been some underlying progress. Excluding the impact of these headwinds, the company’s revenue grew by 5% in Q3 and by 4% year-to-date in this region. Its biggest foodservice client also only represents 10% of its business now, versus 30% three years ago.

“We are being thoughtful, deliberate, and disciplined in rolling out our playbook in North America. Given the success in Europe and International, we know what’s possible,” said Ordonez. “The underlying category, coffee, and consumer trends are extremely similar in both regions. However, our execution is a few steps behind.”

He added that the US market is also “more complex”, and the company doesn’t expect to grow as quickly here as it is in Europe. “Make no mistake, though: we are committed to driving the performance that we expect in these critical segments,” he said. “With sharp, locally relevant execution, our playbook can drive strong, profitable growth in North America, but step-by-step.”

Here, too, it’s betting on younger consumers like Gen Z and Alpha, who are “obsessed with flavour and taste”. “We do believe the taste-focused approach is the right approach for the US,” Ordonez said. “Of course, we’re adapting to the nuances of taste and […] formats. We are under no illusion that things are identical when it comes to the product offering in both markets.”

Reflecting on Oatly’s overall performance and profitable growth in Q3, he wrote on social media: “This milestone signals that our strategy is working while building a stronger, more focused business. A growth strategy that sees us operate in a much bigger playground, making menus in foodservice and shelves in retail more relevant and exciting. An ‘an alternative to milk’ no more, but a drinks-experience canvas that is relevant to all, not just for a few.”

The post Oatly Records First Profitable Quarter Since IPO, As European Growth Offsets US Slump appeared first on Green Queen.

This post was originally published on Green Queen.