Plant-based meat company TiNDLE Foods is pivoting its business model to divest its US operations and focus on private-label products in Europe.

Months after rolling out its vegan chicken in hundreds of Kroger stores – marking a ninefold increase in its retail footprint stateside – TiNDLE Foods is bidding adieu to the US.

The plant-based meat company is shifting its business model away from branded offerings to exclusively focus on producing affordable private-label options for B2B customers in Europe.

“This strategic pivot follows a clear logic,” said Timo Recker, co-founder and CEO of TiNDLE Foods. “The plant-based category has become increasingly price-driven, and we’re seeing that private label products are capturing a growing share.”

The move comes amid a slowdown in momentum for plant-based meat in the US, with year-on-year sales down by 7% in 2024 and prices up by 4%. In Europe, though, double-digit growth in low-cost vegan food from supermarkets’ private-label brands led to a 1.7% rise in sales of six plant-based categories last year.

“We are well-positioned to lead this shift by producing best-in-class, innovative products, while also making the necessary adjustments to maintain value and accessibility for our customers,” said Recker.

US market challenges drive TiNDLE Foods away

Beginning its journey as Next Gen Foods, the startup rebranded to adopt the name of its flagship brand, TiNDLE Foods, in 2023, shortly before Recker took over the reins from his fellow founder Andre Menezes.

The company, which has raised over $130M to date, made its name on its plant-based chicken range, starting with the foodservice sector, before expanding into pork sausages and bratwursts, and teasing a move into plant-based milk too.

Its products have appeared in countries including the UK, Switzerland, Germany, and the US – in the latter, the brand is stocked in over 1,300 grocery stores. And in an interview with Green Queen this summer, Recker suggested that retail was TiNDLE Foods’s most profitable channel, having witnessed a steady rise in sales here.

But as Americans rail against ultra-processed foods (UPFs), meat alternatives have been caught in the crossfire, and many companies have been forced to pivot – one of the biggest players, Beyond Meat, has suffered a consistent decline in sales and diversified into plant proteins that don’t mimic meat. Several others, meanwhile, have filed for insolvency or ceased trading altogether.

This year alone in North America, Planetarians has ceased operations, Yves Veggie Cuisine has been discontinued, and Meati Foods has changed hands after a banking default and months of uncertainty.

Now, TiNDLE Foods is pulling out of the US too, while suggesting that it maintains a solid capital base and remains positioned for long-term growth “despite challenging market environments”.

TiNDLE Foods banks on Europe’s private-label potential

The shift to manufacturing for private-label brands is a direct nod to one of the key barriers and drivers of plant-based meat consumption: cost.

Bringing the cost of these products more in line with animal-derived meat has been shown to increase the former’s sales – in Germany, discount supermarket Lidl reported a 30% sales hike in the six months after introducing price parity for products in its own-label vegan range, Vemondo, in 2023.

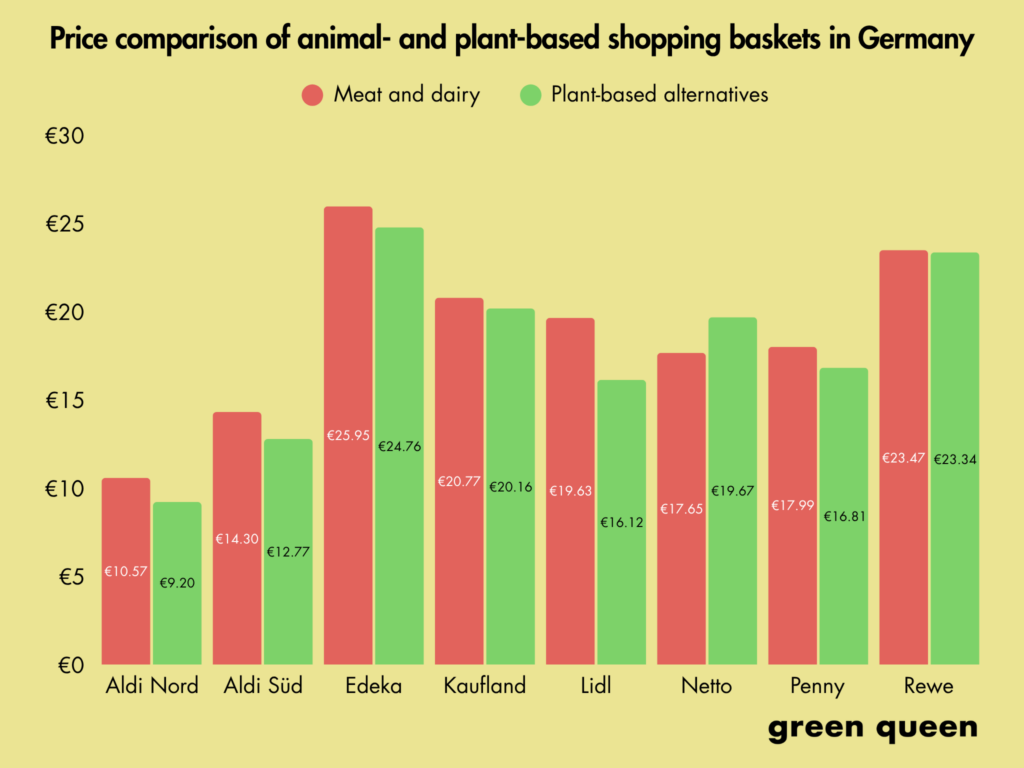

In fact, innovation in private-label brands has made a vegan shopping basket 5% more affordable than the animal equivalent in Germany. With its pivot, TiNDLE Foods is hoping to capitalise on this shift, labelling these products as a “primary strategic focus” for retailers.

Under its new model, it will sell unbranded plant-based proteins to major food manufacturers, retailers, and restaurant groups, giving them the freedom and flexibility to brand, formulate, and price the products according to the local market.

The move will help it significantly reduce marketing and distribution spend, and instead redirect capital into product development and operational efficiency. It’s in line with Recker’s comments in the summer, when he told Green Queen: “Our current priority is on capital preservation and with that, having a clear focus on the growth of our current product portfolio.”

Reflecting on the European focus, he said: “We are seeing greater growth potential in Europe, where consumer demand for plant-based innovations continues to rise – particularly among the younger generations, who have already fully adopted plant-based foods as part of their everyday lives and routines.

The post TiNDLE Foods to Sell US Business to Focus on Private-Label Products in Europe appeared first on Green Queen.

This post was originally published on Green Queen.