Cultigen Group, which opened an online cultivated meat shop for consumers this year, has now launched a B2B marketplace for companies.

To make it easier for the cellular agriculture industry to access equipment and inputs for future-friendly food production, UK-based Cultigen Group has opened an online marketplace for “cultivated meat procurement”.

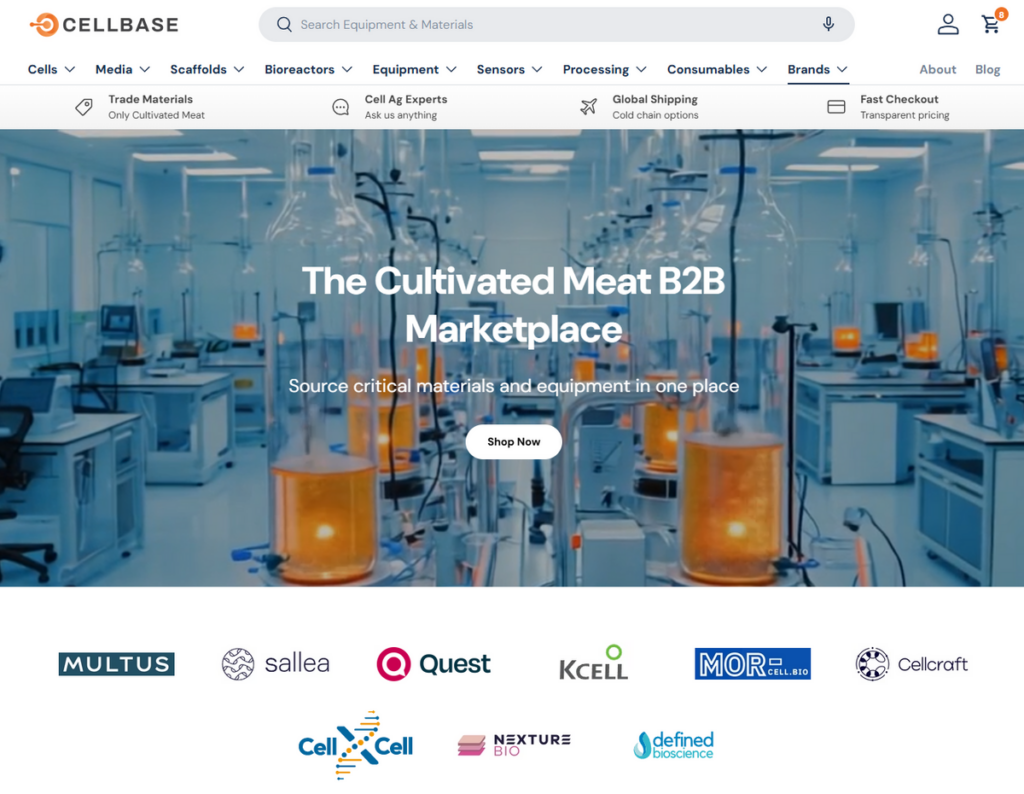

The platform, called Cellbase, connects suppliers of bioreactors, growth media, scaffolds, cell lines, sensors, and processing equipment with cultivated meat startups and researchers.

“The supply chain is fragmented. Companies spend weeks chasing quotes and manually gathering product information across multiple vendor websites,” explains David Bell, founder of Cultigen Group.

“Every emerging industry hits this wall. Someone has to build the rails. That’s what we’re doing. Cellbase removes procurement friction so companies can focus on R&D and scale rather than email chains and PDF spec sheets,” he adds.

Cellbase’s launch comes six months after Bell set up a consumer-facing online store for cultivated meat, for when it eventually gets regulatory approval and enters the European market.

These projects are part of the wider Cultigen Group, which emerged over the last 18 months as Bell mapped infrastructure gaps across the cultivated meat value chain.

“Rather than building one business, I realised the industry needed an ecosystem, so I built out all the parts where I can add value through my niche expertise,” he said.

Cellbase supports multiple currencies and languages

Bell notes that Cellbase is an international B2B marketplace, with localised currency support for “every major currency worldwide”. It has also translated the platform into 20 languages, including Dutch, simplified Chinese, Hindi, Korean, Spanish, Thai and Arabic, covering around 95% of the cultivated meat industry.

Now, the website is live with the first cohort of partners across three core categories: cells, media, and scaffolds. “Launch suppliers include Multus, Sallea, Quest Meat, KCell, Mor-Cell.bio, Cellcraft, CellxCell, Qkine, Nexture Bio, and Defined Bioscience,” reveals Bell.

We’re now actively onboarding across all other categories too: bioreactors, sensors, scaffolding, equipment, consumables, analytical tools, and services,” he adds. “We’re building comprehensive category coverage and looking for suppliers who want to be part of the industry’s default procurement platform. The target is 30 suppliers by year-end, and we’re moving fast.”

The idea is similar to Ocatté Base, the B2B marketplace operated by Japanese cellular agriculture pioneer, IntegriCulture. “I respect what they’re attempting. That said, Cellbase operates at a different scale of sophistication,” says Bell.

This includes multiple product categories with deep taxonomies; advanced filtering, search, and comparison via structured metadata parsing, full e-commerce functionality (online ordering, cart and checkout); comprehensive marketplace infrastructure (order management, automated payouts, account dashboards, etc.), and multiple suppliers across categories.

“We’re a fully-fledged marketplace built to remove procurement friction, not a directory or consortium model. Think specialised infrastructure for cellular agriculture,” says Bell.

Cellbase generates revenue the same way “most successful marketplaces” do: by taking a commission on completed sales. This covers platform infrastructure and hosting, payment processing, buyer acquisition and marketing, customer service, and product cataloguing, search, and comparison tools.

There are no listing fees, monthly charges, or hidden costs. “Suppliers only pay when they make sales,” he explains. “Our incentives align: we win when they win.”

Filling the technical execution and transparent pricing gaps

What roadblocks did Bella encounter when setting up Cellbase? “Honestly, the market response validated something we already suspected: this infrastructure gap was real. Suppliers approached us to list, buyers asked when they could order, and researchers engaged before launch. That told us we’re solving an actual pain point, not building a solution looking for a problem,” he outlines.

“The challenge has been technical execution – creating uniform metadata structures across multiple products and categories. Suppliers provide specs in PDFs, manuals, and inconsistent formats. We’ve parsed and standardised that data into structured fields so buyers can actually compare products apples-to-apples.

“The other friction point: pricing transparency. Many suppliers still operate on ‘request for quote’ systems: PDFs, email chains, weeks of back-and-forth. We’ve brought unit pricing, shipping costs, and purchasing into a single interface. One-click ordering, card or bank transfer, PO support.

“Everything we build focuses on removing friction. This industry runs on dated procurement workflows, and that slows everyone down. Cellbase solves that. The faster scientists can source what they need, the faster products reach the market.”

Bell bootstrapped the business, which has no external funding so far (and “currently none needed”). “We’re a small team that’s built everything from the ground up – every brand, site, system – without external funding. We move at operator speed: tight feedback loops, rapid iteration, sophisticated execution,” he says. “As we hit scale milestones, we’ll expand strategically where it creates leverage.”

An all-encompassing vision for cultivated meat

Culivated Meat Shop and Cellbase are far from the breadth of Cultigen Group’s vision. The company says unlocking these proteins’ potential requires more than scientific innovation: commercial execution, public trust, and practical systems that make it visible, accessible, and desirable are equally important.

As such, it is building a host of ventures tackling different tenets of the protein transition. Via public advocacy body the Cultivarian Society, it aims to establish “cultivarian” as a dietary identity for people who eat cultivated meat, while it’s planning an editorial platform called The Growth Medium and a real-time intelligence directory engine titled Cultideck.

Further, Cultigen Group is developing Cell.farm, an infrastructure platform that promises a reimagination of production accessibility and scalability.

As it builds this ecosystem, it’s recording quick progress on the ventures it has already introduced. Cultivated Meat Shop, for example, now operates localised domains and languages in over 20 markets in Europe, including Spain, the Netherlands, Poland, Sweden, and France.

“This positions us as the default consumer entry point for cultivated meat across the continent when products reach the market,” says Bell. “Products aren’t yet approved for retail in the UK or EU, so we’re in pre-launch positioning mode, building SEO authority, email subscribers, and brand equity ahead of regulatory clearance.”

He adds: “We’re not onboarding companies yet in the traditional retail sense. We’re owning the digital real estate and building an audience ahead of market opening. First-mover advantage isn’t launching first; it’s being ready when regulation clears.”

And Cultigen Group is certainly positioning itself to be ready. Can it grab that advantage?

The post Exclusive: This Cultivated Meat Marketplace Sells Inputs & Equipment for Manufacturers appeared first on Green Queen.

This post was originally published on Green Queen.