The EU’s first Biotech Act has proposed to expand the support given to companies looking for novel food approval, but has kept these products out of the scope of regulatory sandboxes.

Despite promising a regulatory overhaul for novel foods like cultivated meat, the provisions in the European Union’s newly released Biotech Act are half-baked.

The much-anticipated strategy seeks to boost the region’s competitiveness in biotechnology by modernising its regulatory environment. And while the primary focus of this first strategy is the health sector, it also includes measures to commercialise the findings of researchers working on food technologies like precision fermentation.

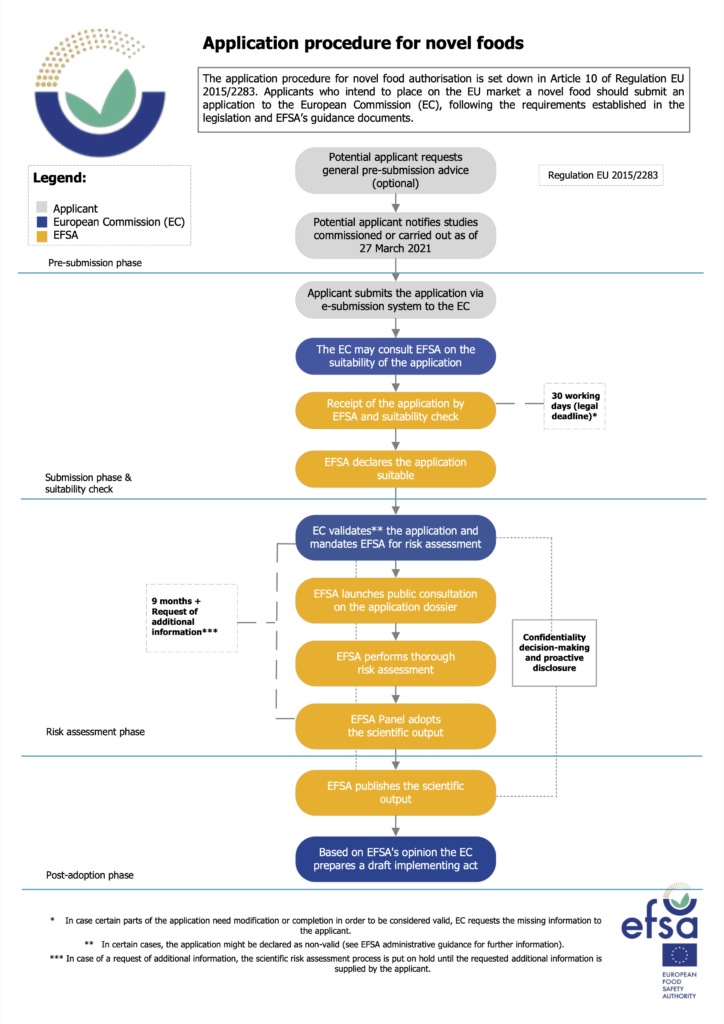

Part of the life sciences strategy announced in July, the Biotech Act was designed to speed up the regulatory pathway for such novel foods, which has become a sticking point for the alternative protein space.

The legislation only achieves this partially. It will enhance pre-submission interactions between regulators and applicants by expanding the advice available to the latter, paving the way for improved dossiers and faster approvals.

However, novel foods are the only category left out of new food and feed regulatory sandboxes, which are controlled environments that let businesses and researchers design standards and guidance for new products with regulators.

“Experience has shown that certain types of novel foods trigger ethical or cultural concerns among various consumer segments regarding their acceptability,” the Biotech Act reads, adding that it is therefore “appropriate to exclude novel foods from the scope of regulatory sandboxes”.

The food industry, which welcomed the move to expand guidance, railed against the explicit exclusion of novel foods from the sandbox regime.

“The Commission’s decision to block novel foods from the sandbox rollout is a disappointing move that marks a missed opportunity to drive forward evidence-based regulation while providing a forum for open dialogue that can give consumers more confidence in new products,” said Seth Roberts, senior policy manager at the Good Food Institute Europe.

Food Fermentation Europe (FFE), a coalition of companies working in the novel fermentation sector, said it was “deeply concerned” about the move. “Properly designed sandboxes would not weaken safety standards; they would allow limited, tightly controlled testing and tastings in a more supervised, transparent and evidence-based way, keeping innovation, investment and jobs in Europe,” it remarked.

Novel food applicants can now request advice on scientific data

The Biotech Act will let startups request advice from regulators on the technical and scientific information they need to include in their dossiers, and provides details about additional staff to ensure this function is properly resourced.

The EU Commission expects the Biotech Act’s provisions to “significantly increase” the European Food Safety Authority’s (EFSA) workload, since pre-submission advice will now also cover scientific guidance (such as the kind of studies, appropriate study design, and so on), which is expected to be taken up by a large number of businesses.

The EFSA anticipates around 200 submissions annually across multiple food domains, including novel foods, food additives, and genetically modified foods. The regulator will now be required to carry out a closer evaluation of requests and provide tailor-made advice covering both administrative and scientific aspects.

The scientific guidance will be “particularly demanding” as it will be specific to the needs of individual applications, with the EFSA needing to ramp up training programmes and coordinate with its working groups and expert panels, its legal department, and member state and other EU experts.

These measures will enhance clarity and consistency in the provision of pre-submission advice and maintain the uptake of this guidance to ensure the submission of high-quality dossiers, which would accelerate the risk assessment process.

The EU’s novel food regulation is fraught with delays and a lack of clarity, and costs up to €250,000. And despite a stipulated 18-month timeline, the average dossier takes around 30 months to be approved in the EU, and this can stretch to five years. The Biotech Act, however, can prevent lengthy authorisation delays, which are caused partly by the lack of clarity about the data needed, GFI Europe said.

“By expanding the regulatory guidance available to food innovators, the Biotech Act will play an important role in bringing new products to market in a way that meets the EU’s world-beating safety standards, helping to drive green growth, reduce our reliance on imports and boost competitiveness,” explained Roberts.

FFE labelled it a “concrete win” for the fermentation sector: “Early, structured dialogue on study design and testing strategies has been a long-standing ask from our sector and, if used proactively, can significantly reduce avoidable delays and improve dossier quality for advanced fermentation products under the EU’s rigorous safety framework.”

Sandbox snub ‘sends mixed signal’ from the EU

The EU Parliament had earmarked the introduction of sandboxes in the summer and has been developing a strategy that supports companies transitioning from the sandbox regime to full market access.

This was echoed by the Ministry of Future Affairs, a new think tank comprising regulatory experts across Europe, which recently published a framework for a novel food sandbox. “Member states that wish to support and benefit from the growing food biomanufacturing market should collaborate on setting up regulatory sandboxes,” the document read.

But the Biotech Act’s exclusion of novel foods comes as no surprise. As reported by Euractiv, an internal document seen ahead of the publication had already hinted at the move.

“This prevents advanced fermentation companies from generating controlled, real-world evidence under EU supervision, which would be a huge missed opportunity when it comes to improving commercialisation and economic growth,” the FFE said in its reaction.

“[It] sends a mixed signal at a time when the EU, the European Investment Bank, and major market players are investing heavily in advanced fermentation and other innovative food biotechnologies and biomanufacturing capacities.”

You only have to look at the UK to ascertain how effective these sandboxes can be. The former EU member state kicked off a cultivated meat sandbox in February with eight companies, which has resulted in the publication of the first set of safety guidance for novel food approval in the country.

The sandbox enables British regulators to “generate the information needed to answer outstanding questions and increase the efficiency of the regulatory process”, without compromising on existing food standards, according to its head, Joshua Ravenhill. “Sandboxes like ours facilitate innovation whilst ensuring citizens’ safety,” he said.

FFE said it would continue to work with the EU to improve the first Biotech Act during the legislative process, and ensure its bodies “fully recognise the strategic role of advanced fermentation” in the bloc’s bioeconomy agenda in part two of the act, which is focused on industrial biotech and will be released late next year.

GFI Europe, meanwhile, called on the Commission to build on plans to establish a pilot investment facility to scale up health biotech industries, by proposing ambitious new financing for food tech in the second Biotech Act. This, it said, would address commercialisation issues for fermentation startups caused by the lack of large-scale factories.

The post ‘Missed Opportunity’: EU Biotech Act Excludes Novel Foods from Regulatory Sandboxes appeared first on Green Queen.

This post was originally published on Green Queen.