French dairy giant Danone has partnered with the Big Ten Conference to expand access to its protein and plant-based products under the Oikos and Silk brands.

Danone is betting big on plants and protein with a sports-focused partnership with one of the US’s oldest collegiate athletic leagues.

The dairy behemoth has signed a multi-year deal with the Big Ten Conference, an association of universities focused on academics for students competing in college athletics, to advance nutrition with its high-protein yoghurts and plant-based milks, sold under the Oikos and Silk brands, respectively.

Danone is the 129-year-old league’s first yoghurt and non-dairy milk partner, and will explore the nutrition needs of students to identify ways to expand product access to Big Ten communities and fans nationwide.

“Led by our world-class research and innovation team and nutrition scientists, by bringing Oikos and Silk to Big Ten campuses, we’re providing nutrient-dense products that help students and athletes thrive — on campus and beyond,” said Dan Magliocco, president of Danone North America.

Danone to work with health leaders to advance nutrition science

Danone will begin programmes to raise awareness about quality nutrition from Q1 2026, as part of its mission to “bring health through food” and increase access to nourishing foods.

“This partnership with the Big Ten extends Danone’s global legacy of leveraging cutting-edge nutrition science and innovation to bring health through food to as many people as possible,” Magliocco outlined.

The partnership has the potential to reach all Big Ten campuses, athletic venues, local food pantries and digital platforms, covering over 14,000 student athletes, 580,000 students, and the largest collegiate fanbase in the US.

It will highlight the product ranges of Oikos and Silk, which lead the US market for high-protein yoghurts and non-dairy milks, respectively, through brand activations, athletic events and retail promotions. Danone will build on existing nutrition programmes to reach more students with accessible, healthy food options that support wellbeing.

It will also work directly with health leaders across the 18 Big Ten campuses to share nutrition science expertise and design initiatives that reflect real needs and lifestyles. Plus, it will create educational programmes and learning tools to help students build lifelong healthy habits.

“Our students and communities deserve the best when it comes to their health. This partnership with Danone is not only about access; it’s about fuelling potential,” said James Borchers, chief medical officer of the Big Ten Conference.

“By tackling challenges like food insecurity and expanding nutrition education, we’re helping students build habits today that will support them for years to come,” he added.

Danone targets protein-shaped gap in plant-based drinks segment

Danone said it shared “deep geographic roots” across the US with the Big Ten, with its 50+ farming partners and manufacturing sites in states housing the conference’s campus communities. That includes its largest yoghurt facility in Minster, Ohio, as well as suppliers in California’s Central Valley, which provide 100% of Danone’s almonds.

The dairy producer also recruits talent directly from Big Ten institutions, including The Ohio State University, Pennsylvania State University, and Michigan State University.

The company claims this boosts its ties with local communities, linking agriculture and career opportunities to student life and community health, and highlighting how it creates nutrient-dense products that fuel students, athletes and alumni through local sourcing.

“The Big Ten Network is proud to team up with Danone, a partner who shares our passion for elevating the fan experience while promoting healthier choices,” said conference president François McGillicuddy.

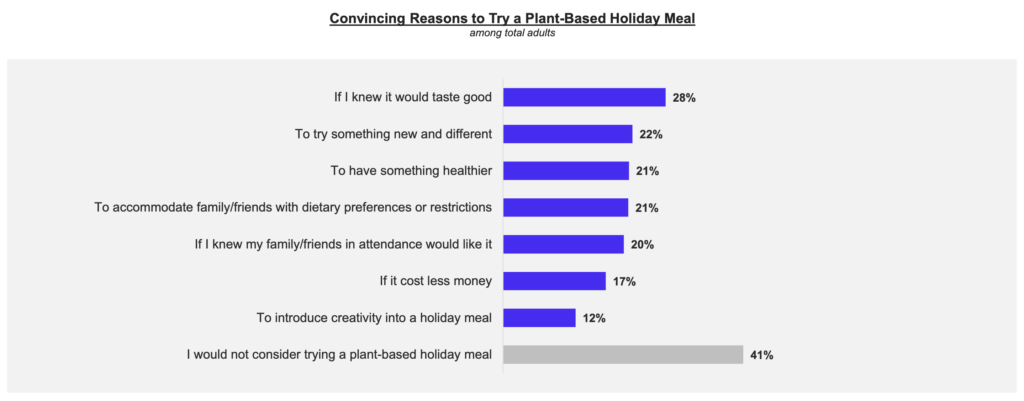

Polling suggests that 70% of Americans are looking to consume protein this year, with 41% turning to dairy products like yoghurts and 18% to plant-based milk. In another survey, 85% of Americans said they want to increase their intake of the nutrient.

Danone has recognised this shift, making protein the focus of several new launches. In its latest earnings report, the company said momentum for high-protein products “remained strong” in North America, but identified the region’s plant-based segment as a “work in progress”, after category sales dipped by 3% in the 52 weeks to July 19, against a 5% growth for cow’s milk, according to SPINS.

To arrest this decline, Danone launched a high-protein range of dairy-free milks under the Silk brand, offering 13g of complete plant protein per serving. It’s the company’s response to Mintel data showing that plant-based drinks represent less than 1% of protein-centric product launches.

“There’s a clear gap for a high-protein plant-based option that consumers are actively demanding,” said Wendy Nunnelley, president of Danone North America’s plant-based division. “We really see a gap in the marketplace for a good plant-based, higher protein offering that just hasn’t been there, and that consumers are demanding.”

The post Danone Eyes Plant Protein Boost with America’s Largest Collese Sports League appeared first on Green Queen.

This post was originally published on Green Queen.