THIS, the UK startup famous for its plant-based meat analogues, has introduced a new product format that champions whole foods and has more protein than tofu.

After years of building its brand around products named THIS Isn’t Chicken and THIS Isn’t Beef, London-based startup THIS has announced a new range of plant-based products that it says are not meant to replicate animal meat, while still offering shoppers a centre-of-plate protein option.

The food tech innovator has launched THIS Is Super Superfood, which it describes as a “next-generation” plant protein that can compete with traditionally vegan protein-rich ingredients like tofu and tempeh. It’s geared towards a UK population currently looking for minimally processed whole-food options, just as meat alternatives struggle to capture wallet share.

The new product range comes in a 250g block format, as well as a 180g pack of lemon-and-herb-marinated pieces, with both retailing at £3.95. They will roll out at Tesco and Waitrose and on Ocado by the end of this month, and in Sainsbury’s and Asda (only the Super Block) in May.

They contain fava bean protein, a range of seeds, and vegetables to offer consumers a protein rich in fibre, omega-3, and iron, and contribute to your five-a-day. The block and pieces can be used for stir-fries, curries, pasta and ramen dishes, among others, and importantly, the protein holds its texture when fried in a pan.

With the Super Superfood, THIS is aiming to fill a gap in the category by delivering on health, convenience and flavour.

“Two years ago, I thought of the idea in the shower, whilst my cat was watching me,” THIS co-founder Andy Shovel said last week. “Since then, the team have done an amazing job of developing them, building a supply chain for them, perfecting their branding, and selling them in… I think these have a shot at really disrupting the plant-based food category.”

Is this the next generation of plant-based protein?

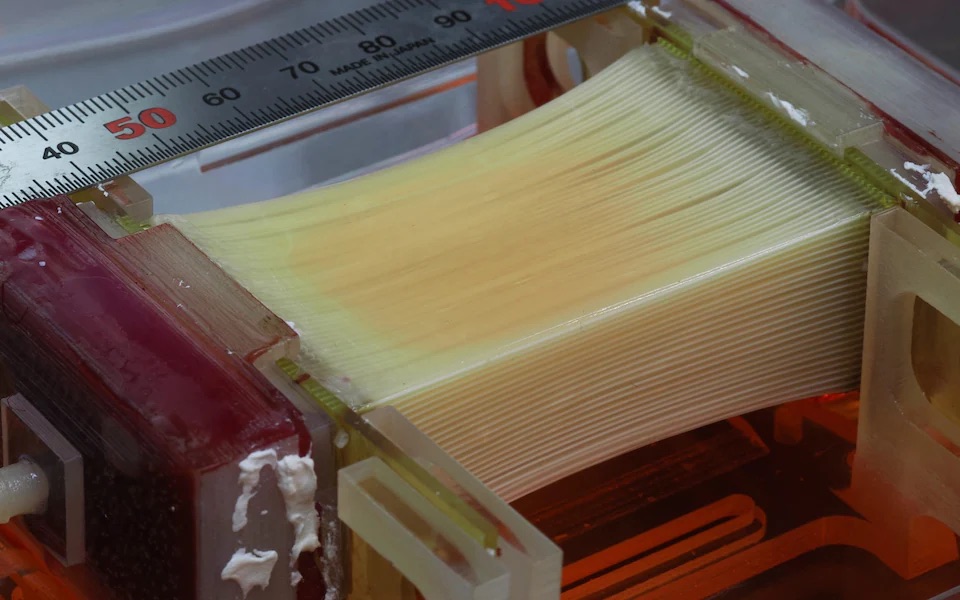

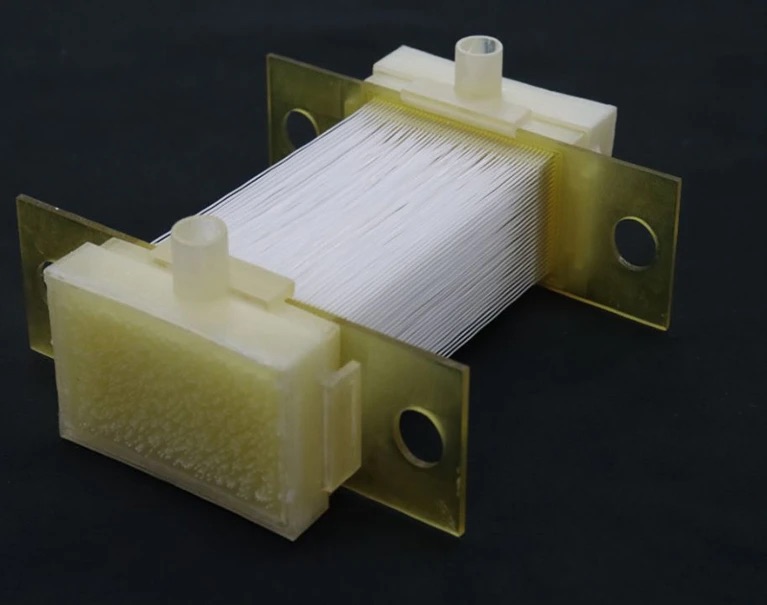

Luke Bryne, innovation director at THIS, explained that the Super Superfood range is a testament to how simple ingredients can be transformed into something “truly innovative”. “Our innovative superfood technology harnesses the natural synergy of beans, seeds, and mushrooms to create an entirely new plant-based texture,” he explained.

“At its core, we use fava bean protein as the primary source of protein, blending it with shiitake mushrooms, celebrated for their rich umami depth and unique texture. To further enhance the sensory experience, we incorporate selected seeds that add layers of complexity and mouthfeel.”

The products contain pumpkin seeds, flax seeds, hemp hearts, and chia seeds, while the shiitake mushrooms are complemented by spinach. They contain 18g of protein per 100g, on par with tempeh and 9% higher than the UK’s bestselling tofu from The Tofoo Co.

The protein concentration is lower than conventional animal proteins like chicken or beef, as well as THIS’s own meat alternatives – though given that the UK overconsumes protein by 44-55% than what’s recommended, the company is betting on the fact that they will still hold appeal for the average British consumer.

In fact, THIS plans to lean into the demand for nutritious plant proteins with a texture that matches consumers’ expectations. “This cutting-edge approach allows us to craft a next-generation plant-based protein – one that is not only nutritious, but also elevates texture and taste to unprecedented levels,” says Bryne.

THIS CEO Mark Cuddigan added: “We have created a whole new plant-based protein and texture using nothing but natural ingredients – it’s like discovering a new superpower. We think that’s pretty super… so much so, we named it twice. The plant-based category is evolving, and THIS Is Super Superfood offers consumers something new.”

New range meets consumer demand, but THIS’s meat alternatives here to stay

The launch of the Super Superfood was teased by Cuddigan last year, when he said the company was developing a ‘tofu-life’ superfood with more nutritional value than anything currently on the market. The company’s £20M Series C round was also earmarked to roll out new products catering to “evolving consumer health preferences”.

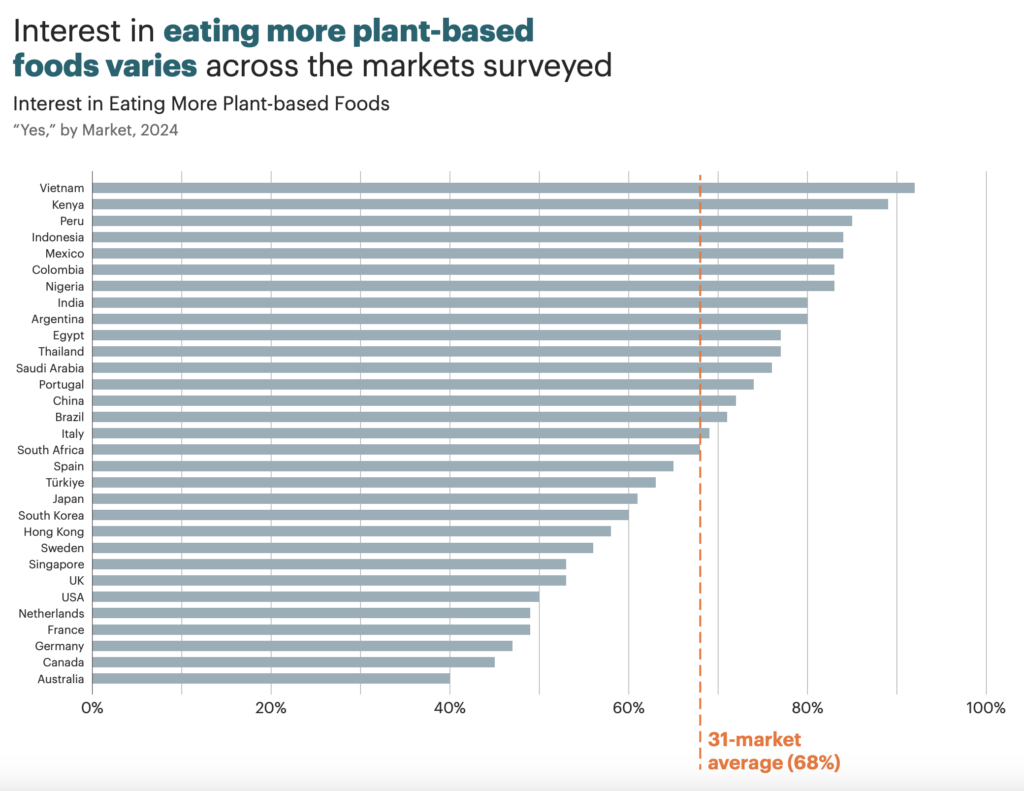

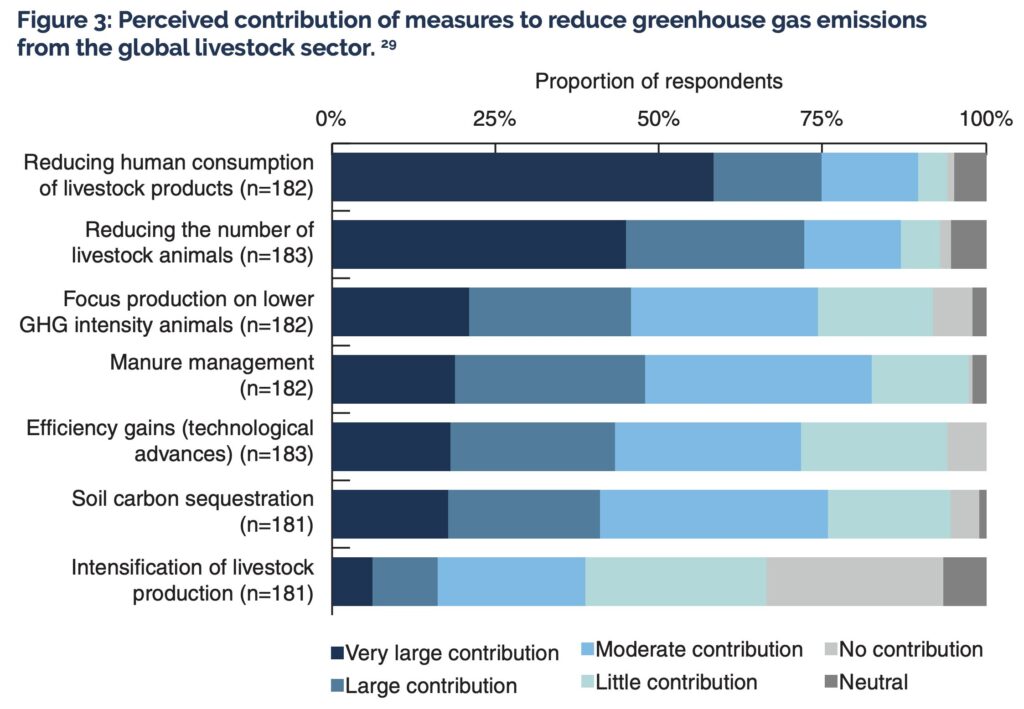

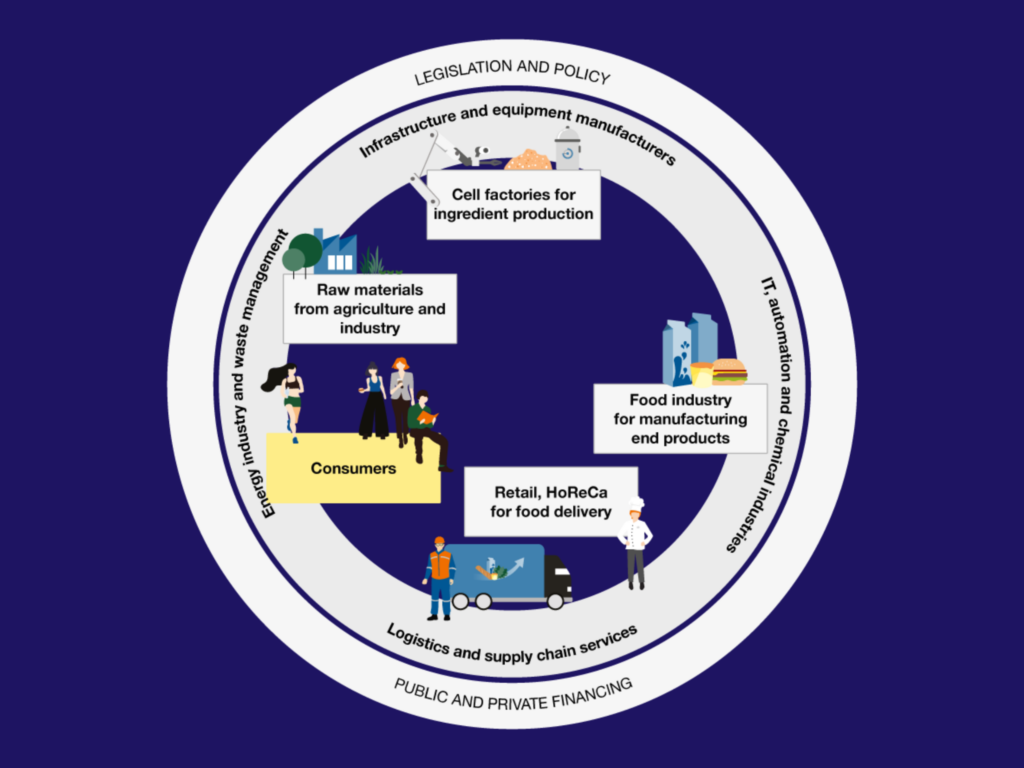

There’s a heightened demand for whole-food plant-based options in the UK. While sales of plant-based meat slid by 7% last year, tofu expanded its market share, reaching 9% of households. One of the best-performing meat-free brands, meanwhile, was tempeh maker Better Nature, whose sales grew by 476% (albeit from a small base). And searches for ‘high protein’ on online grocer Ocado doubled in 2024, with interest in plant-based sources like lentils up by 18%, chickpeas by 27%, and edamame by 44%.

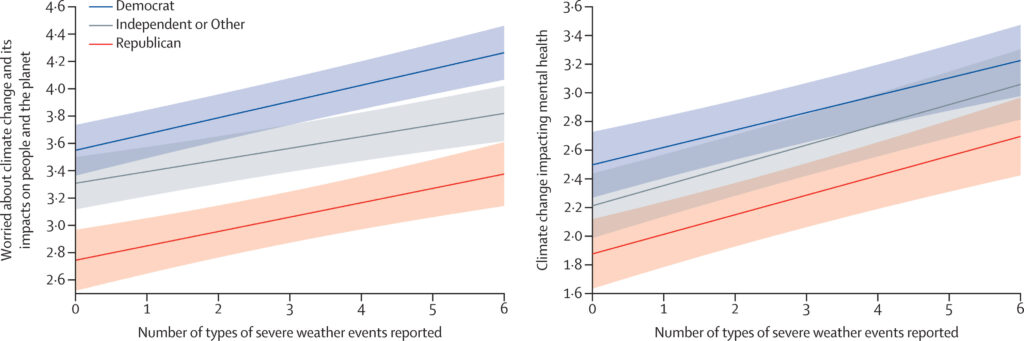

“People are less focused on vegan food vs non-vegan food. Instead, they’re looking for food that’s good for them, the planet and animals vs food that’s not,” Better Nature co-CEO Elin Roberts told Green Queen earlier this year.

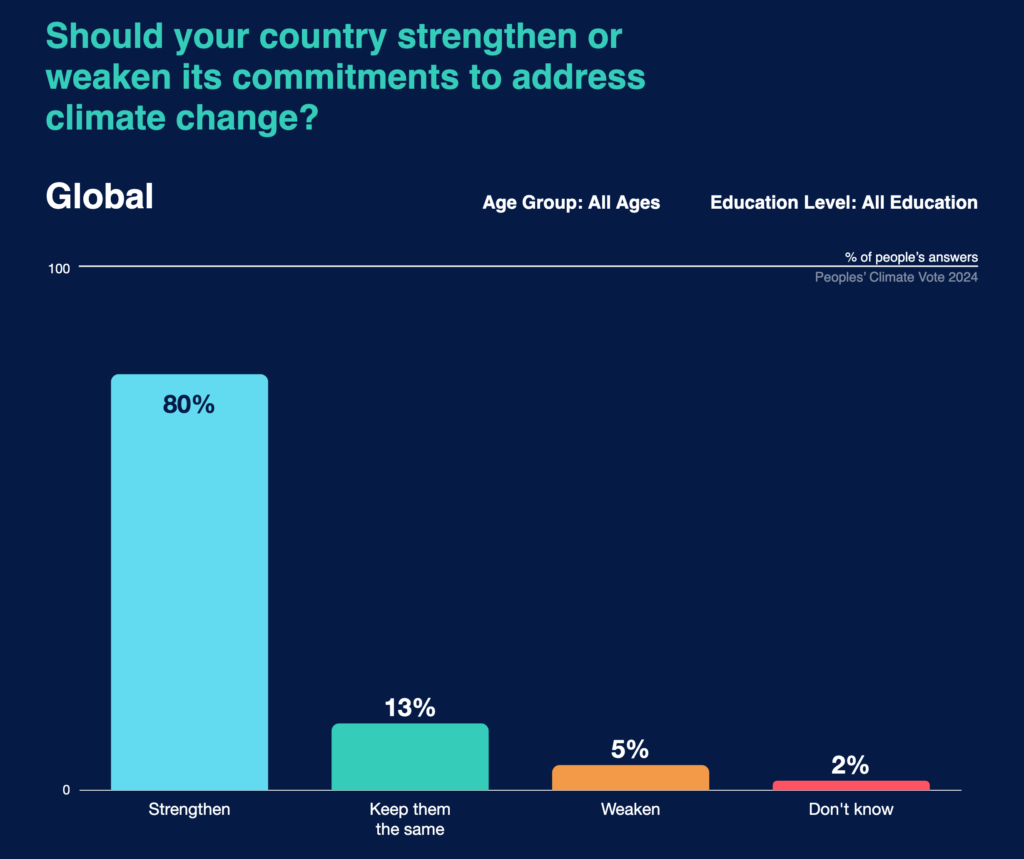

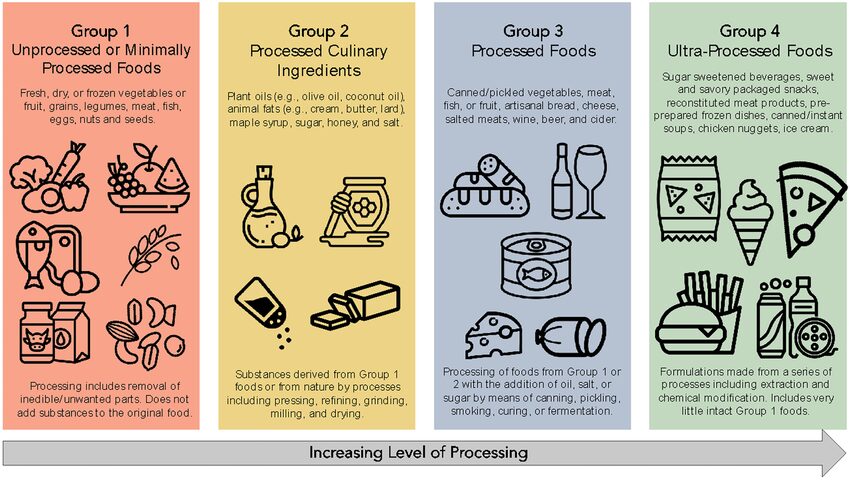

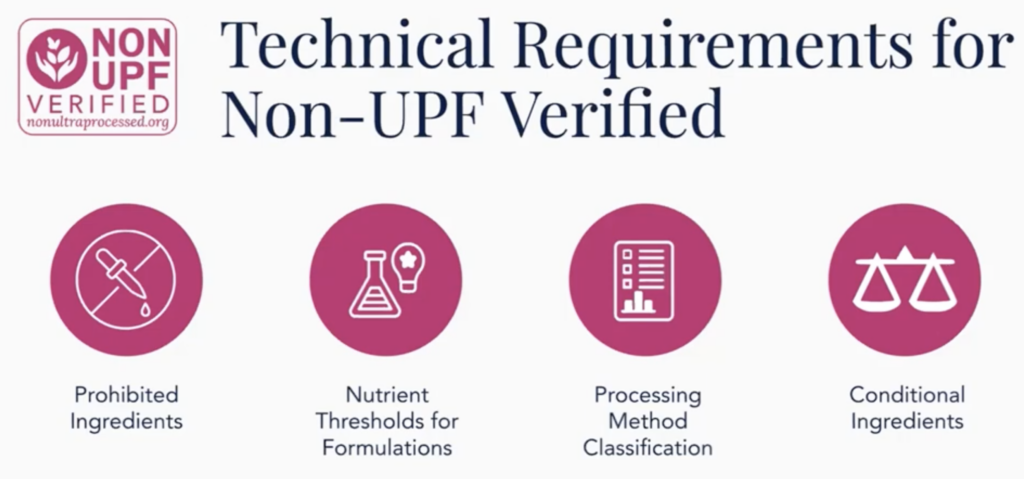

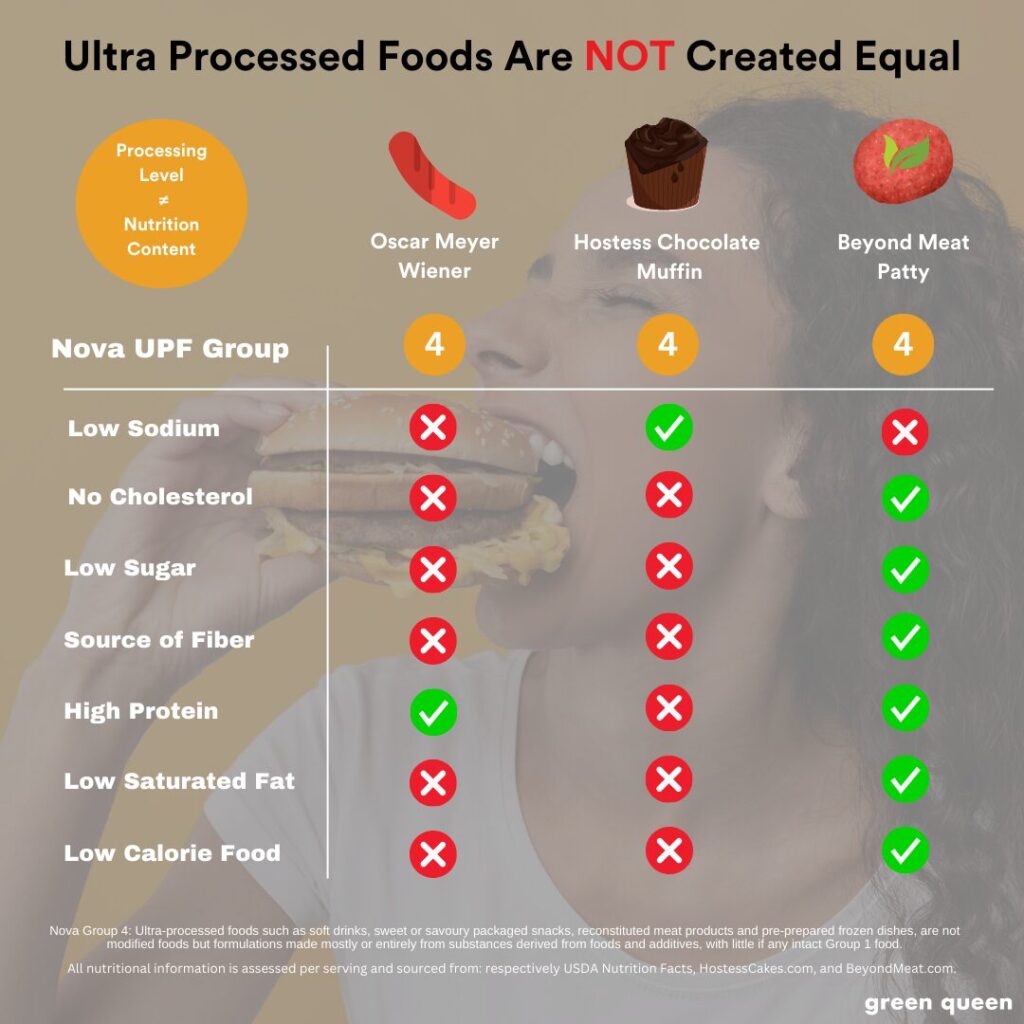

Consumers are increasingly apprehensive about ultra-processed foods (UPFs), which make up 57% of the average Brit’s diet, and up to 80% when it comes to children or people with lower incomes. Plant-based meat has suffered from a loss of confidence due to its classification as a UPF, driven by some misleading coverage by national media outlets.

“There’s so much misinformation out there now – people don’t know what to believe. Is vegan food good or bad?” noted Roberts. “Nutrition can be complex. That’s why messaging that is focused on eating more plant-based whole foods is resonating better – you can’t go too far wrong there.”

It’s this philosophy that drives THIS’s new superfood range. And it’s not the only brand taking this approach – Oh So Wholesome uses a similar concept, packing whole plants like quinoa, red lentils, split peas, seeds, and vegetables into blocks that can be used in a variety of dishes. Its product line, called Veg’chop (formerly Vegbloc), will launch at Tesco on April 28, the same day as THIS’s Super Superfood.

That said, THIS’s meat alternative line – which helped the brand grow by 33% to reach £22M in sales last year – isn’t going anywhere, Cuddigan noted. “We’re just growing. We still make the best plant-based meat alternatives, but now we’re giving consumers more options,” he said.

“The future for the plant-based category is about creating something for everyone, whether you’re a meat-lover, flexitarian, or fully plant-based. So whether you want meat-like texture or whole-food protein, we’ve got you covered.”

Still, THIS and other plant-based meat makers will need to navigate a fine line: catering to a new set of whole foods-focused customers without alienating the core fans of their original line of plant-based meat replacement products.

The post British Startup THIS Targets Anti-UPF Demand with Whole-Food Plant Protein Range appeared first on Green Queen.

This post was originally published on Green Queen.