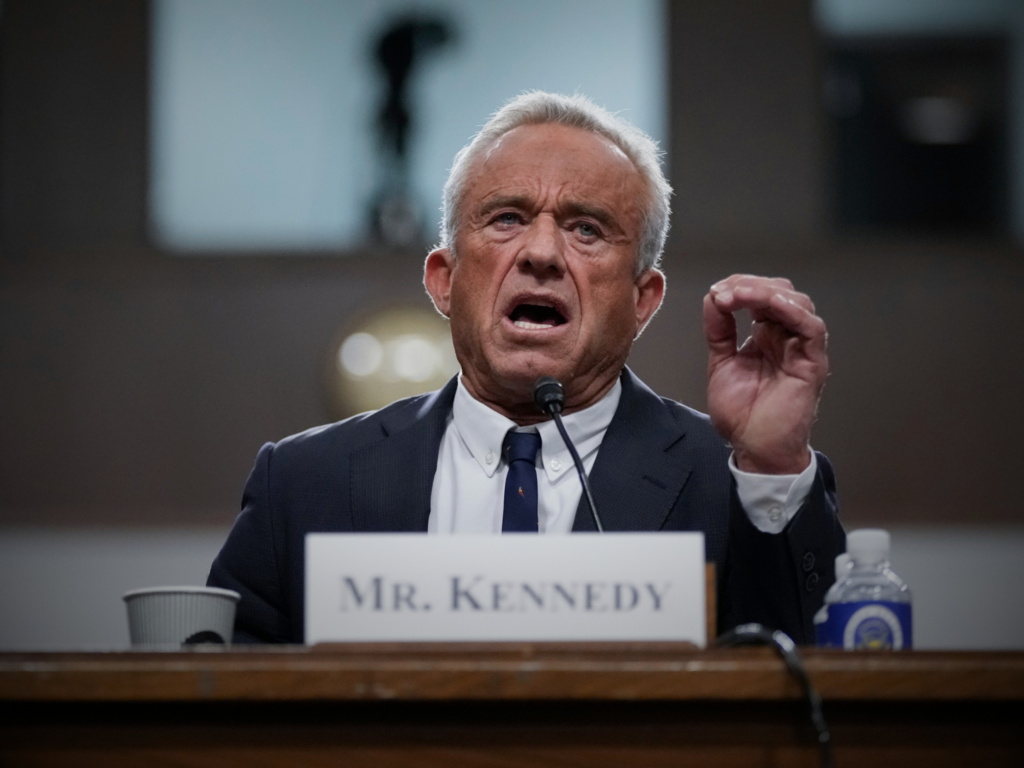

US health secretary Robert F Kennedy Jr has directed the country’s food regulator to close a ‘loophole’ that allows companies to self-affirm their ingredients as safe. What does it mean for future protein firms?

In the latest blow to the alternative protein ecosystem, a new directive from the US Department of Health and Human Services (HHS) could make it harder for companies to bring new ingredients to market.

HHS secretary Robert F Kennedy Jr has instructed the Food and Drug Administration (FDA) to explore “potential rulemaking” to revise and eventually eliminate the self-affirmed Generally Recognized as Safe (GRAS) provision.

The rule currently allows companies to self-determine their ingredients as safe to use based on scientific evaluation, thus paving the way for market entry. But Kennedy argued that this is a “loophole” that needs to be closed to provide greater transparency to Americans.

The move could have major repercussions for producers of novel food ingredients, particularly those using non-traditional fermentation or cell cultivation technologies, who have used this pathway to commercialise. It has made the US a more attractive proposition for many startups, but that may be about to change.

What is self-affirmed GRAS, and why do companies use it?

Self-affirmed GRAS status doesn’t legally require FDA review – instead, companies only need to conduct a safety assessment by a scientific panel, which can include both internal and external experts.

For example, Finnish firm Solar Foods conducted large-scale scientific research and published food-safety-related results in peer-reviewed journals to self-affirm its gas-derived Solein protein as GRAS. A qualified panel of experts additionally compiled a statement on Solein’s safety and intended use based on the determined food categories and ingredient concentrations.

Since producers choosing this pathway don’t need to notify the FDA or disclose the information publicly, it allows them to maintain confidentiality around proprietary information and trade secrets. It’s also a cheaper, easier, and faster way to get to market – the FDA only evaluates around 75 GRAS notices a year, and each can take between six to 12 months to be approved.

But this does mean companies make their own safety assessments independently of the FDA (while complying with its requirements). So, many also prefer to go through the GRAS notification process, which is much more rigorous and requires the submission of a host of comments, including both positive and negative reviews and studies of a company’s ingredients.

If approved, the FDA sends a ‘no questions’ letter, deeming the ingredient safe for sale – this is seen as a more transparent process with publicly available data and breeds both market and consumer confidence.

Why does RFK Jr want to scrap the self-affirmed GRAS rule?

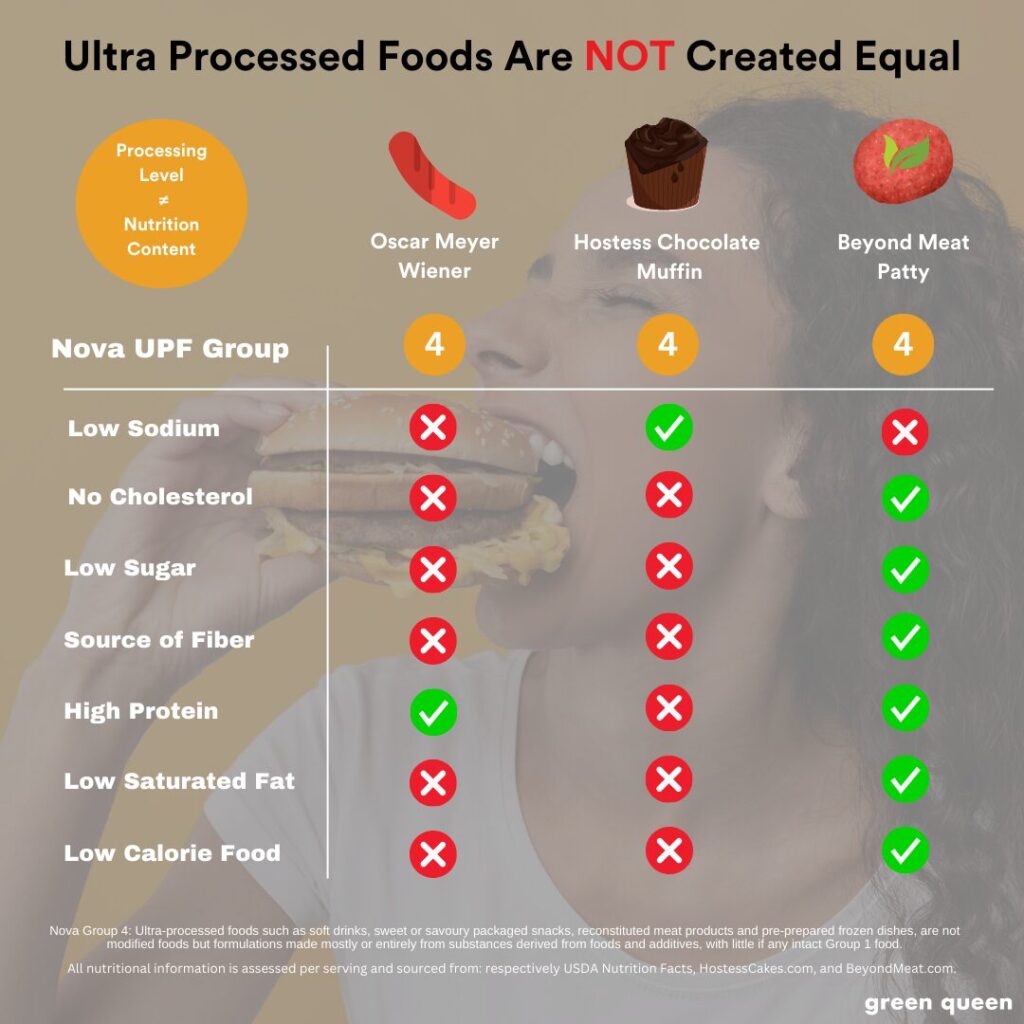

It’s part of his Make America Healthy Again (MAHA) drive, which has seen him attack ultra-processed foods, GMO ingredients, cultivated meat, and plant-based foods.

Alternative protein executives have maintained an air of cautious optimism around his appointment, praising his intention to make the food system cleaner and more nutritious, but criticising him and President Donald Trump’s administration for ignoring climate science.

“For far too long, ingredient manufacturers and sponsors have exploited a loophole that has allowed new ingredients and chemicals, often with unknown safety data, to be introduced into the US food supply without notification to the FDA or the public,” he said of the self-affirmed GRAS rule.

“Eliminating this loophole will provide transparency to consumers, help get our nation’s food supply back on track by ensuring that ingredients being introduced into foods are safe, and ultimately Make America Healthy Again.”

The FDA itself is undergoing an overhaul, having reorganised its structure last year. It recently also proposed draft labelling guidance for plant-based meat, suggesting that companies highlight the source ingredients of products on-pack. And before a month before Trump returned to the White House, it updated the labelling criteria for companies to market their foods as ‘healthy’.

Sara Brenner, the acting FDA commissioner, said: “The FDA is committed to further safeguarding the food supply by ensuring the appropriate review of ingredients and substances that come into contact with food. The FDA will continue to follow our authorities and leverage our resources to protect the health of consumers to ensure that food is a vehicle for wellness.”

According to Politico, RFK Jr is set to meet the bosses of major US food companies next week, but one person familiar with the matter suggested that there’s a “major concern” that they’re “going to agree, as major industry players, to things that eliminate science from the FDA”.

Where does this leave alternative protein companies?

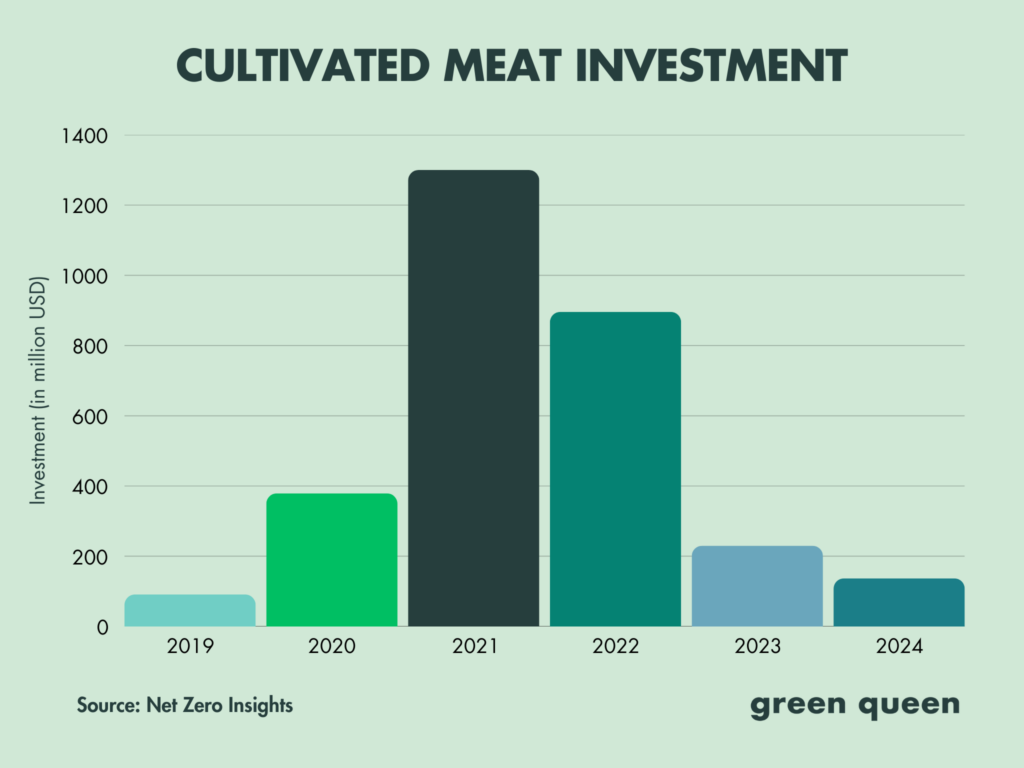

In the US, cultivated meat is jointly regulated by the FDA and the US Department of Agriculture – companies need approvals from both agencies before they can sell the product on the market. So the elimination of the self-affirmed GRAS rule likely wouldn’t affect these firms too much.

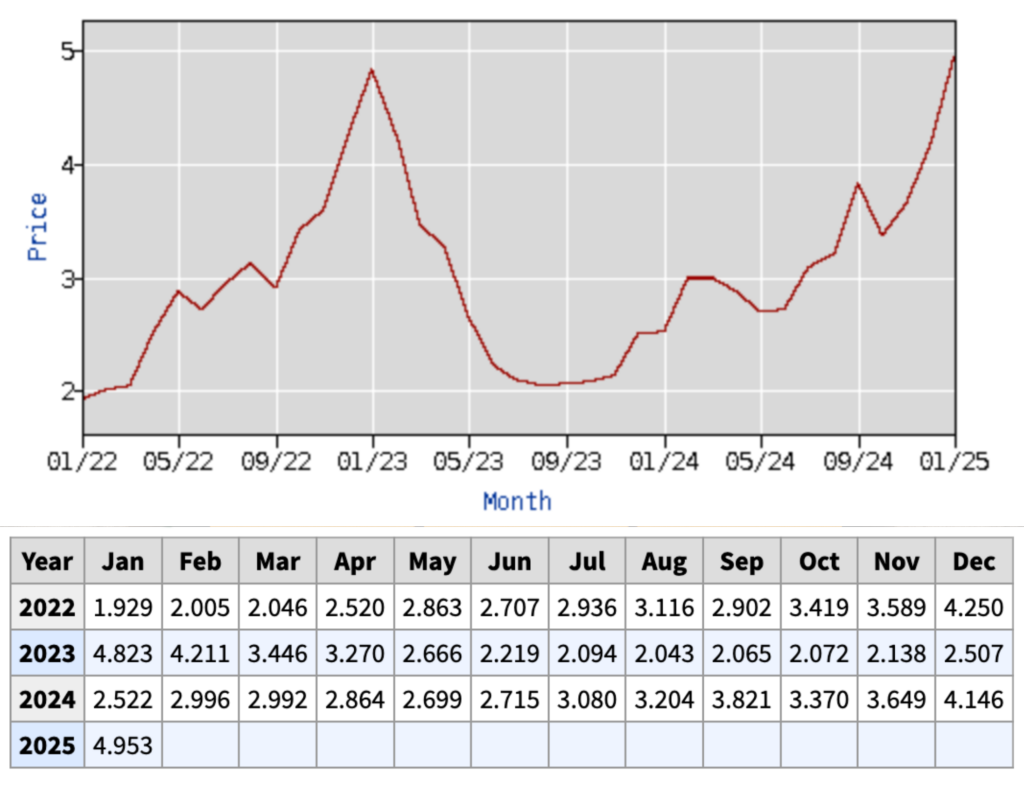

Those that will keenly feel the impact are startups using fermentation to bring novel ingredients to market. If this rule existed 10 years ago, it likely would have impeded the launch of the Impossible Burger, whose flagship ‘heme’ ingredient is made via precision fermentation.

There are several precision-fermented protein companies that either have self-affirmed GRAS status, or have received the FDA’s ‘no questions’ letter. This includes early adopters like Perfect Day, Remilk (both for whey protein), and The Every Company (egg proteins), as well as the wave of notices in the last couple of years, involving Imagindairy, TurtleTree, New Culture, Vivici, 21st.Bio, Bon Vivant, All G, Fermify (all making recombinant dairy proteins), Onego Bio (egg proteins), and more.

It’s not just precision fermentation startups that have benefitted though. Solar Foods’s Solein protein is produced via gas fermentation, while The Better Meat Co – which received a ‘no questions’ letter last year too – uses biomass fermentation to make mycoprotein. Aqua Cultured Foods also employs the latter tech to make its cell-cultured seafood analogues, and obtained self-affirmed GRAS status last summer.

HHS said that eliminating the self-affirmation process would require companies to introduce new ingredients only after publicly notifying the FDA of their intended use and underlying safety data. It added that it will work with Congress to “explore ways legislation can completely close the GRAS loophole”.

But it’s unclear what it would mean for companies that have already self-affirmed their ingredients as GRAS, and have been actively selling their products after doing so. Green Queen has contacted HHS and the FDA for clarification.

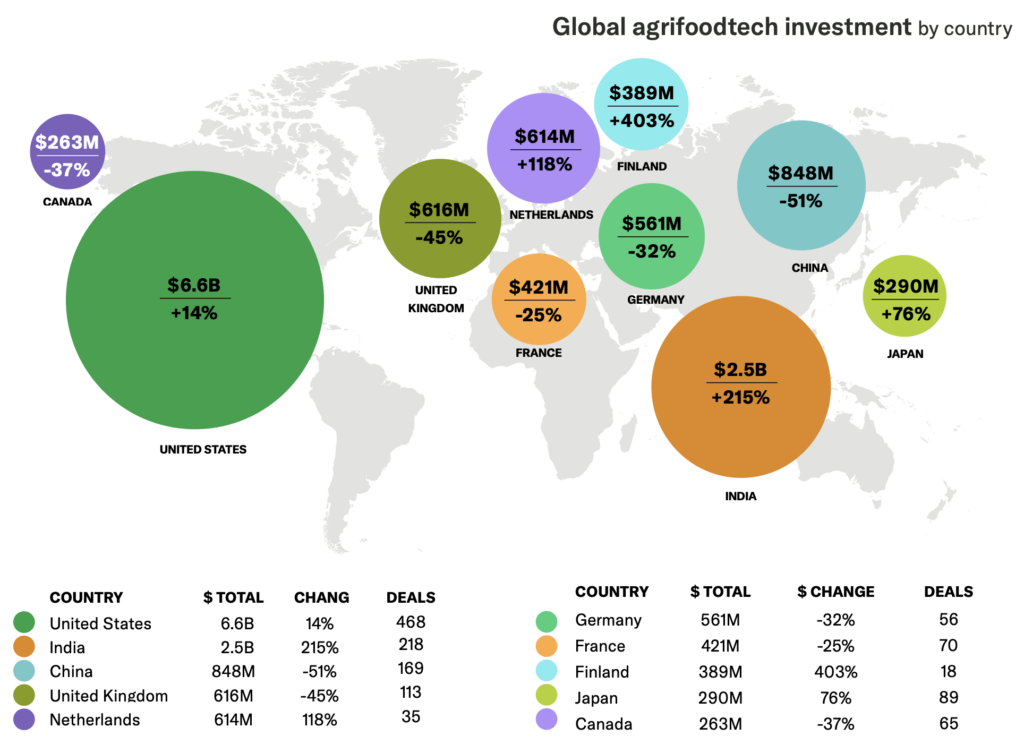

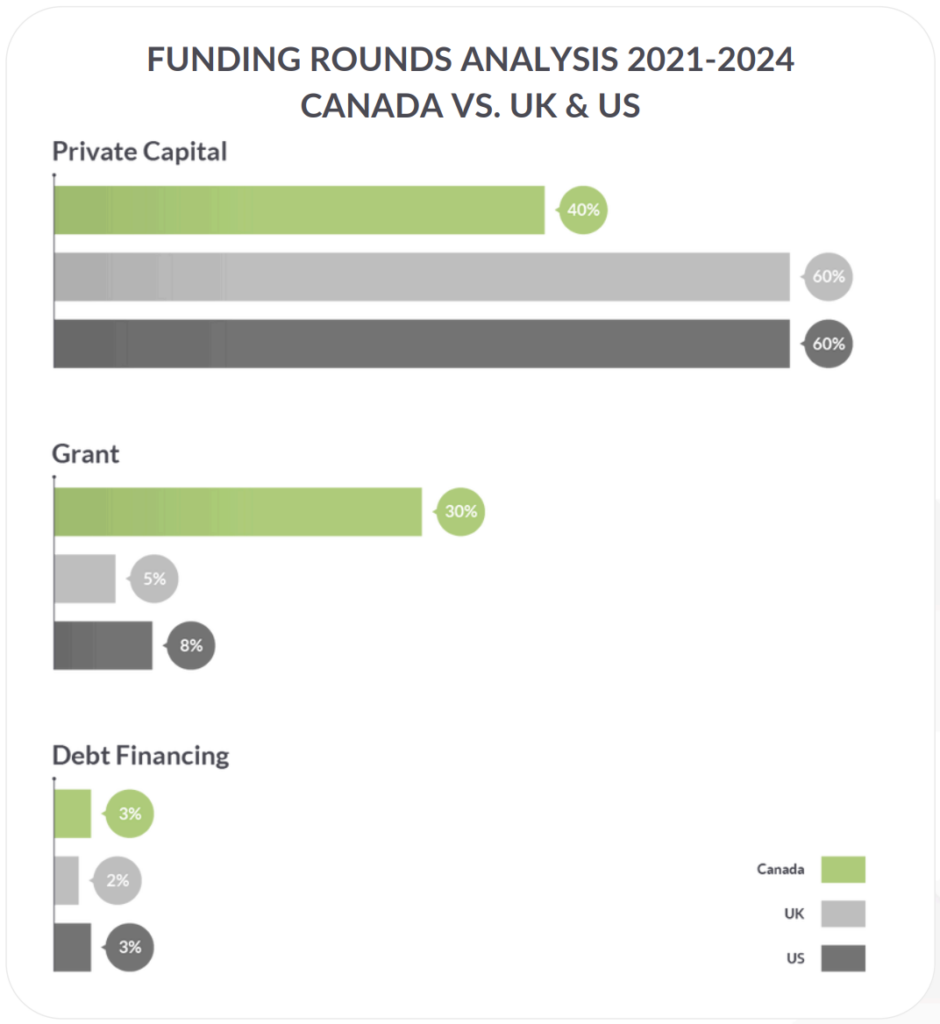

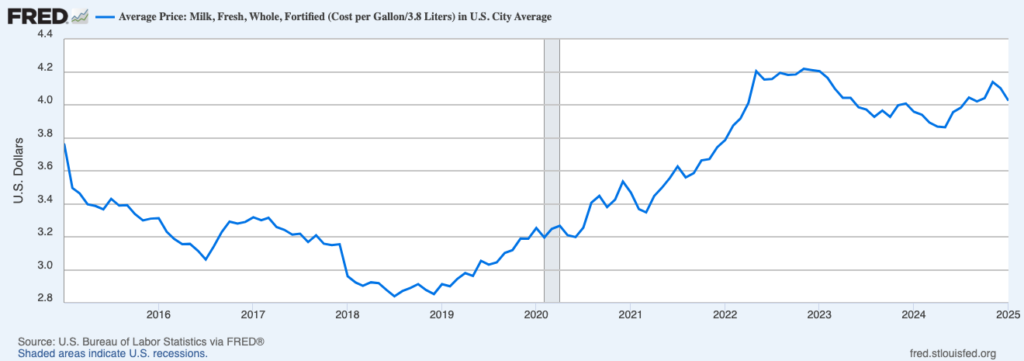

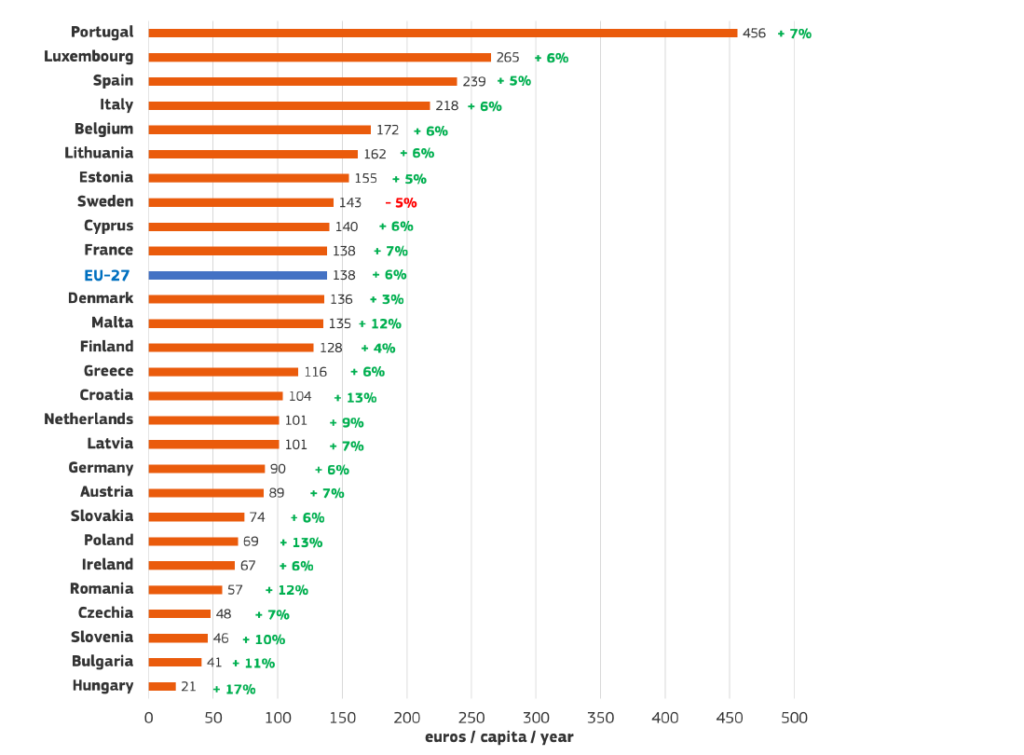

It’s worth noting that many companies – especially those in Europe – look to the US as a point of market entry since the regulatory framework is more welcoming, compared to the likes of, say, the European Food Safety Authority. This has strengthened the US’s position as a future food leader, but without the self-affirmation rule, this could be challenged.

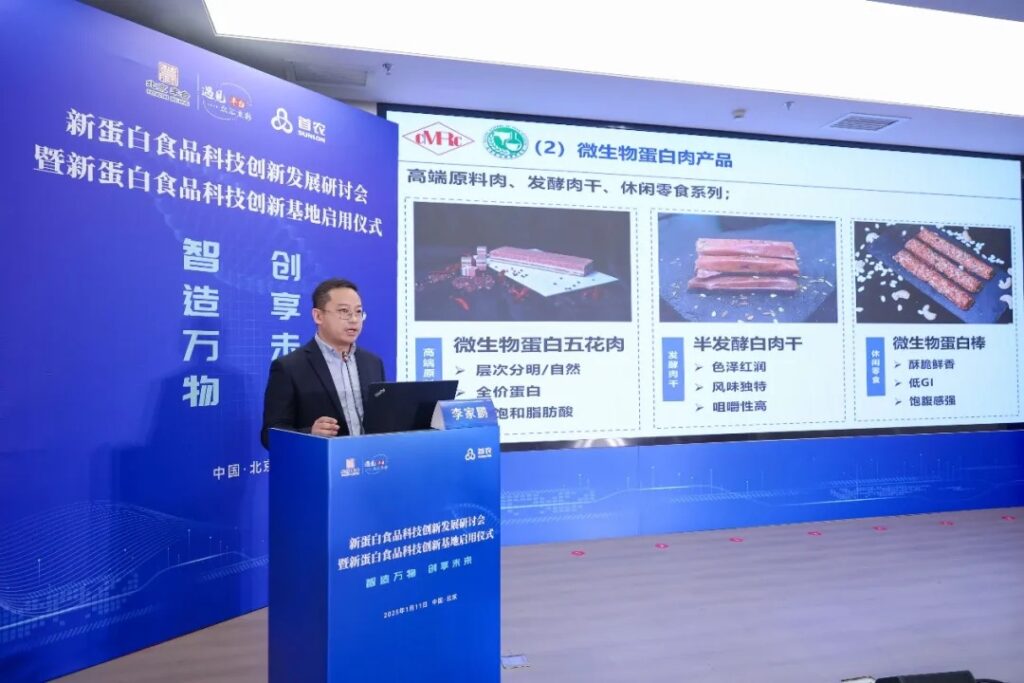

Rivals like the UK are already ramping up their regulatory support for novel foods, while Singapore has spearheaded this movement for years. Thailand, South Korea, Japan, and China are also making moves – Republicans have already expressed concerns about the latter overtaking the US as a biotech leader. Could RFK Jr’s latest move be a step towards realising those fears?

The post RFK Jr Moves to End ‘Self-Affirmed’ GRAS Rule, Threatening Food Tech Innovation appeared first on Green Queen.

This post was originally published on Green Queen.