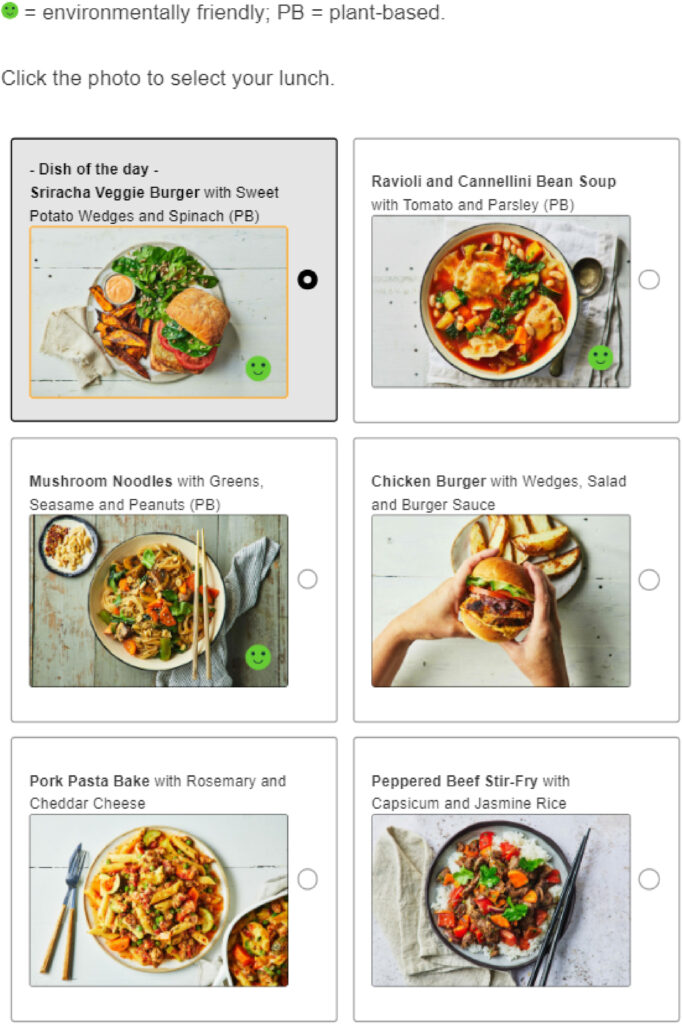

The EU has published its much-anticipated food and farming vision, raising alarm bells among climate experts and ignoring calls for a shift to plant-based proteins.

“A near-total failure.” “Very timid.” “Tunnel vision.” “The death of Farm to Fork.”

These are just some of the reactions to the EU’s new vision for agriculture and food, unveiled yesterday by ag commissioner Christophe Hansen.

The policy document is set to define how the future of food and farming is governed in the region and is centred on simplification, digitalisation, and research and innovation.

What it doesn’t focus on is the climate, a marked departure from Commission president Ursula von der Leyen’s first-term flagship European Green Deal, which included the Farm to Fork strategy.

Grateful to the Strategic Dialogue & Chair Prof. Strohschneider.

— Ursula von der Leyen (@vonderleyen) September 4, 2024

For their vision and concrete recommendations for an agriculture that works with and for nature.

And that promotes a competitive European food value chain.

Let's keep that positive spirit alive.

While von der Leyen promised that the agrifood vision would be based on the conclusions of the Strategic Dialogue on the Future of EU Agriculture, in which stakeholders including farmer lobby groups and climate activists advised the Commission to shift towards a more sustainable agrifood sector and create an EU-wide action plan for plant-based foods.

But the final vision ignores the outcome of the Strategic Dialogue, despite calls for the EU to stick to it by everyone from doctors, consumer groups, climate experts, and even some of the largest food companies.

It leaves the EU’s protein diversification in limbo, and keeps out future food innovation (like alternative proteins), at the same time its member states are actively encouraging citizens to eat less meat and more plants, and implementing carbon taxes on livestock farming.

What did the Strategic Dialogue recommend?

The 29 organisations behind the Strategic Dialogue had five broad recommendations to advance the EU’s food system: creating a more competitive future, advancing towards a sustainable agrifood sector, promoting climate resilience, building agricultural diversity, and broadening access to knowledge and innovation.

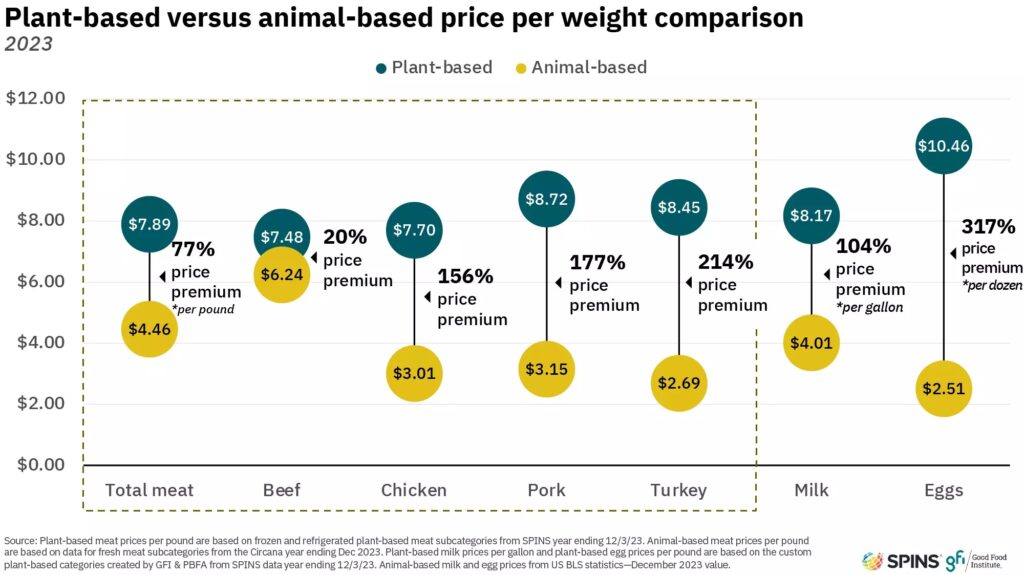

The document acknowledged that meat consumption is too high in the EU, and called for a transition from animal proteins to plant-based options. “The sustainable choice needs to become the choice by default,” the report said, asking the Commission to develop a plant-based strategy to strengthen the agrifood chain “from farmers all the way to consumers”.

It also namechecked other alternative protein technologies like precision fermentation and products such as cultivated meat, as part of a range of “concrete technological innovations” that stakeholders debate over – whether to call for faster approval or raise questions about their potential safety risks.

The spotlight on sustainable diets didn’t set any targets for cutting back meat production, though the report advised policymakers to update food labelling regulations to let consumers make informed food choices around sustainability and animal welfare – the EU currently doesn’t allow food producers to use terms like ‘milk’ and ‘cheese’ on alt-dairy labels.

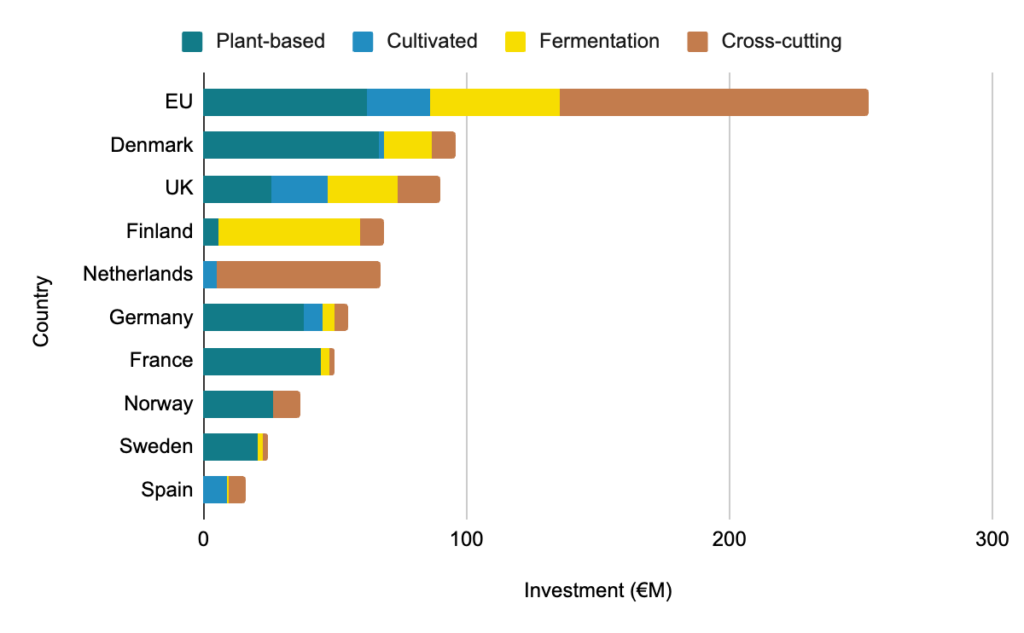

These recommendations came in light of the fact that agriculture is responsible for 11% of the EU’s greenhouse gas emissions, and 84% of these come from livestock. That’s despite animal-based foods providing 35% of calories and 65% of proteins in the region.

The meat and dairy sector is also heavily subsidised, receiving four times as much public money as plant-based farming, and around 82% of the subsidies under the Common Agriculture Policy (CAP).

What does the agrifood vision include?

Essentially, none of the above.

Despite the Dialogue’s strong focus on plant-based proteins and diversification, these terms don’t appear in the agrifood vision at all. ‘Livestock’, however, appears 19 times.

“Livestock is and will remain an essential part of EU agriculture, competitiveness and cohesion,” the Commission wrote, acknowledging that “sustainable livestock” is crucial to the bloc’s economy.

The only reference to protein production and consumption imbalances reads: “We need to consider both the way protein is produced and consumed in the EU.” The Commission promised to deliver a “comprehensive plan” to address these challenges.

The document noted that the European Food Safety Authority would need reinforcements to speed up safety assessments and clear regulatory bottlenecks – at the same time, there was a pointed dig at novel technologies like cultivated meat.

“Keeping Europe’s innovation edge in such new technologies is paramount for the sector to remain competitive and for the EU to remain a world leader in food innovation,” the report stated. “At the same time, certain food innovation is sometimes seen as a threat to the traditions and culture across Europe.”

It added: “This calls for an enhanced dialogue on this matter and better knowledge, to make sure that these innovations can be assessed in an inclusive way that also considers social, ethical, economic, environmental and cultural aspects of food innovation.”

The EU will also hold a Food Dialogue every year with stakeholders across the value chain, as part of which it will launch a study on the consumption of ultra-processed foods (UPFs) – this could have a knock-on effect on meat alternatives too, which have been misleadingly criticised by some as unhealthy because they’re UPFs.

As for the much-criticised CAP, the EU promised to better reward farmers who “actively engage” in climate-friendly food production, an approach that would prioritise agricultural products essential to the EU’s strategic autonomy and resilience.

“This could indicate increased support for plant protein production (whether just feed or also food is to be seen),” Rafael Pinto, senior policy manager at the European Vegetarian Union, tells Green Queen. “Overall, it mentions the need for a fairer distribution of subsidies, especially for small and medium farms – something that is needed but is mentioned in almost every CAP document since the beginning of the policy.”

Why does the agrifood vision ignore the Strategic Dialogue?

If you’ve been following EU food policy for a while, this may not have come as a surprise to you. At his confirmation hearing, farm commissioner Hansen hinted at this outcome, calling the Strategic Dialogue “rather a vague formulation” and suggesting more detailed discourse was needed.

He added that meat was “part of a balanced diet”. And though he noted that the EU was “massively underproducing” plant proteins, his focus was on producing more soybeans to feed animals, who would then be fed to humans.

The EU also has a history of giving in to lobby pressure and flip-flopping on its own proposals, including several aspects of the Green Deal. Most recently, the Commission was set to unveil a sustainable food systems framework to support the protein transition at the end of its previous mandate and ended up abandoning the plan after backlash from interest groups.

Something similar happened with the agrifood vision too. “Right after the end of the Strategic Dialogue, some of the biggest industry representatives decided to detach themselves from something they previously agreed on and cherry-pick only the policies that reflected their views – contrary to NGOs that would gladly accept the conclusions as a whole,” explained Pinto. “It seems like the Vision was highly and disproportionately influenced by some key economic interests.”

He added that the release of the vision “officially marked the death of the Farm2Fork Strategy”, the EU’s plan for sustainable agriculture: “With this new approach, it seems like decarbonising agriculture and promoting healthier diets are not priorities for the Commission. The over-reliance (and naivety) on tech fixes for the livestock sector risk under-delivering and undermining our broader sustainability goals.”

What happens now?

Pinto suggests that the EU Commission isn’t necessarily against promoting the protein transition in itself. “[I’d] rather, maybe hopefully, believe that the Commission showed a neutral stance towards protein diversification,” he said.

“Protein transition is required for sustainability, health, animal welfare and food security and this has been recognised several times by the Commission. However, the lack of policies to that effect shows that current political will is low and pressure from strong interest groups is high.”

Both the European Council and Parliament will be reacting to the vision in the weeks to come, so there’s still time to address the shortcomings in the agrifood vision.

“We hope the EU agriculture and food policies don’t limit themselves to this vision. There’s a lot of room for progress in other areas, and the vision leaves the door open to have a dialogue on innovation and alternatives. The vision is a framework that hopefully will expand over the mandate to better align with other policies and targets,” says Pinto.

He adds: “Protein diversification is a key solution for the polycrisis. It can support environmental and climate goals, reduce disease burden, improve EU food security [and] competitiveness, diversify farmers’ portfolios, and ensure long-term farm sustainability. This is clear for most stakeholders, but we need more political will to address the issue.”

The post Explainer: ‘Death of Farm to Fork’ – What Does EU Agrifood Vision Meant For Plant-Based Proteins? appeared first on Green Queen.

This post was originally published on Green Queen.