Self-heating vegan Hanwoo beef, plant-based octopus legs and Beyond Lamb were among the winners of the 2025 ProVeg Food Innovation Challenge.

Student-led teams across Asia-Pacific have won big at the fifth edition of the ProVeg Food Innovation Challenge, working in conjunction with some of the world’s leading future food companies.

This year’s winners have explored uncharted territory, creating innovations like plant-based lamb for Beyond Meat and Hanwoo beef for CJ Foods using local and innovative ingredients such as mung beans, konjac, rice bran, microalgae, duckweed, and wolffia.

The contest involved Unilever, Mars, Beyond Meat, CJ Foods, Charoen Pokphand Foods (CPF), DaChan, Monde Nissin, and Thai Union, which presented the innovation topics students needed to address with their products. The first prize winner received $3,000, with those coming in second earning $1,500 and third getting $1,000.

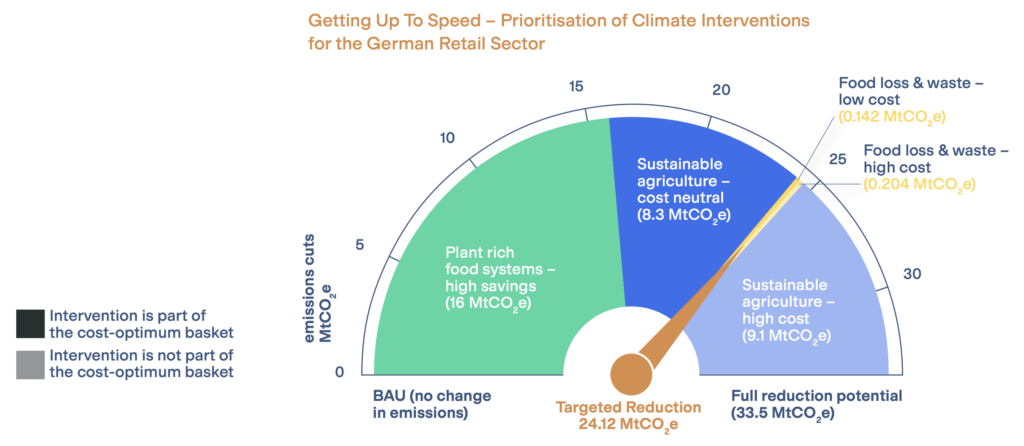

Already the world’s largest market, Asia is set to be home to half the world’s population by 2050. The region is a culinary trendsetter, but as part of the Global South, it is much more adversely impacted by the climate crisis.

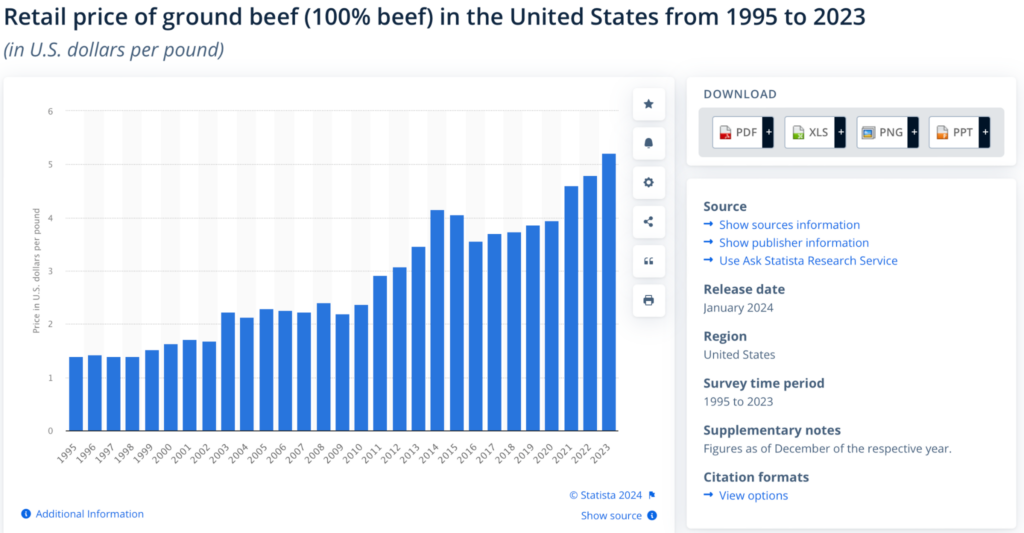

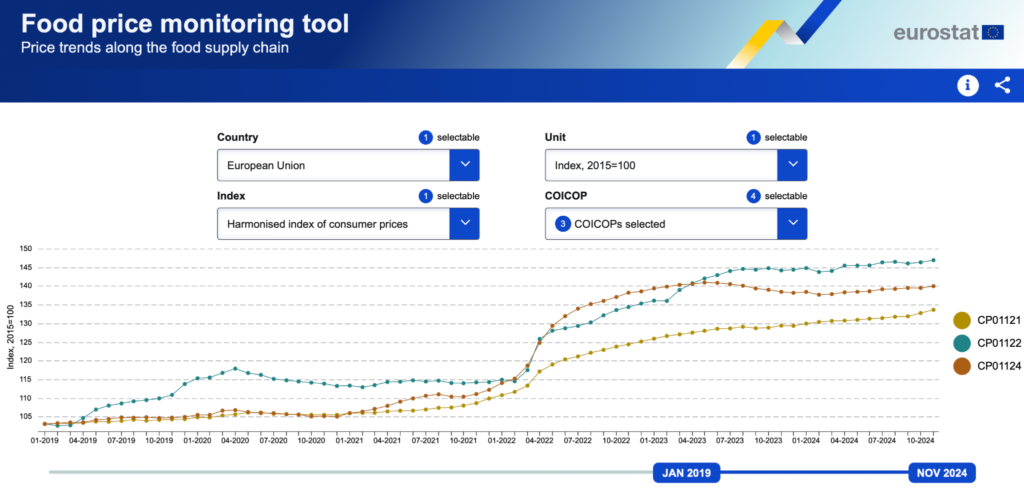

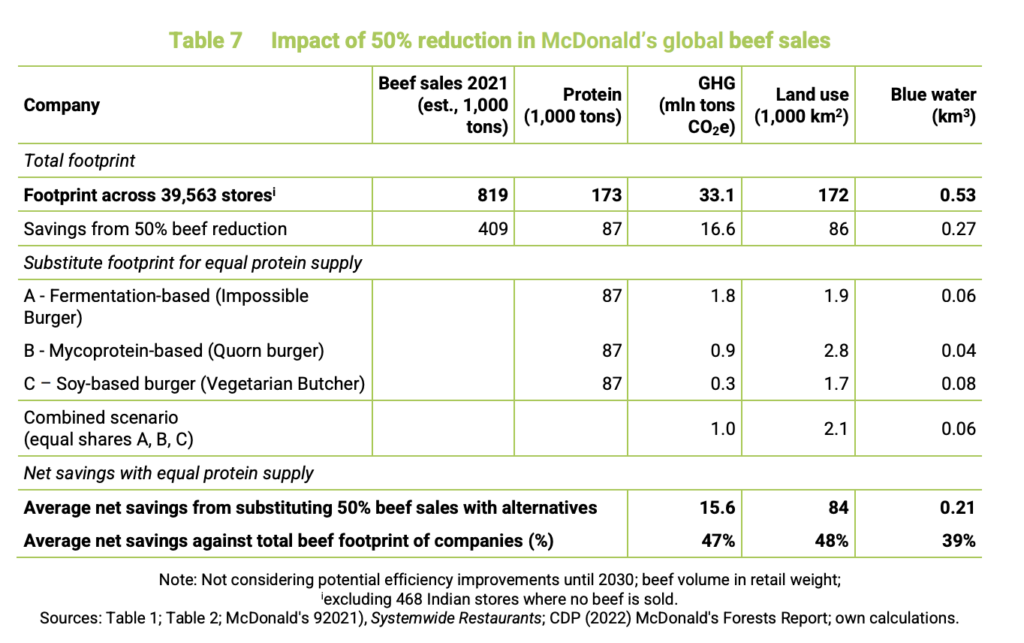

The continent will likely account for half of the global increase in beef and poultry consumption by the end of the decade, and 70% of global fish intake. To keep up with this demand, farms will need to increase their output by 60-70% versus a decade ago, a task growing harder by the day, thanks to the expansive land use and high emission of animal protein production.

Experts have identified alternative proteins as crucial to decarbonising Asia’s agrifood sector, free up land, and drastically reduce water and resource consumption. They will also be key in addressing hunger and food insecurity in Asia-Pacific, which already impacts 800 million (or 10% of the global population) of its inhabitants.

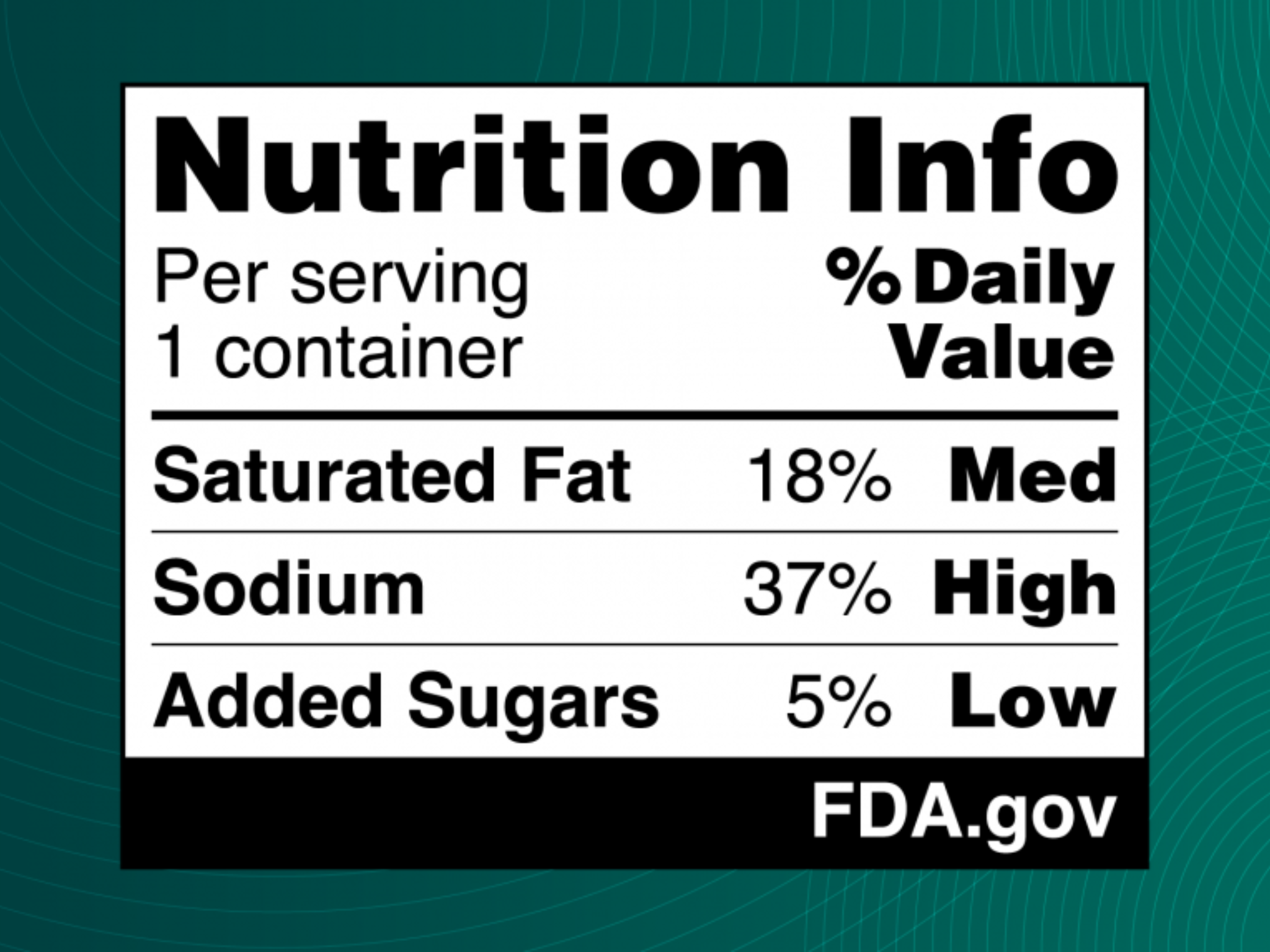

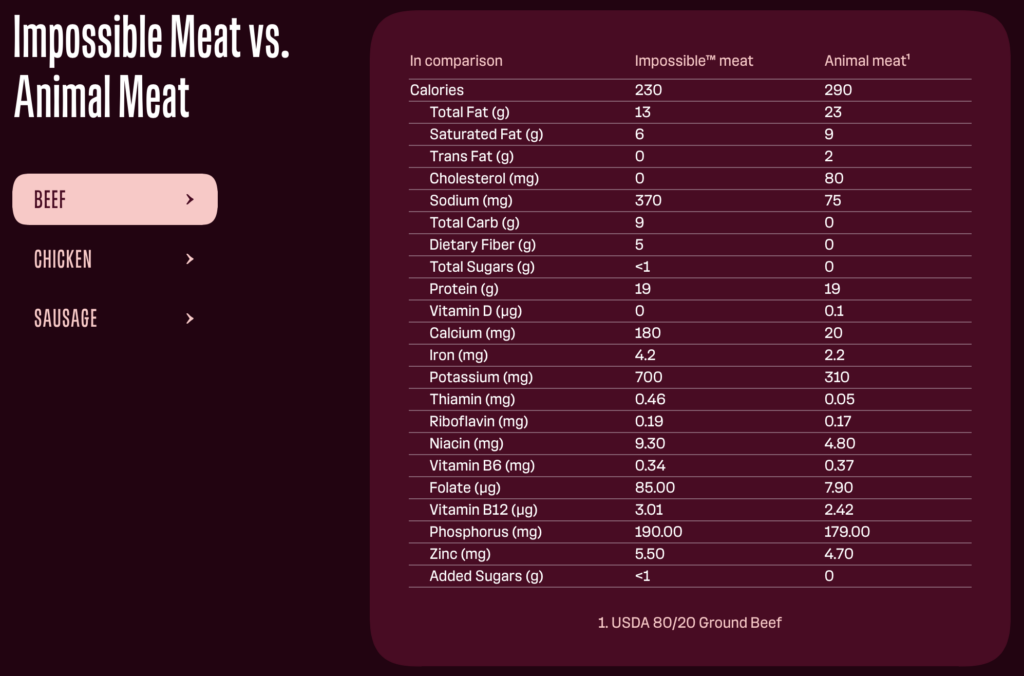

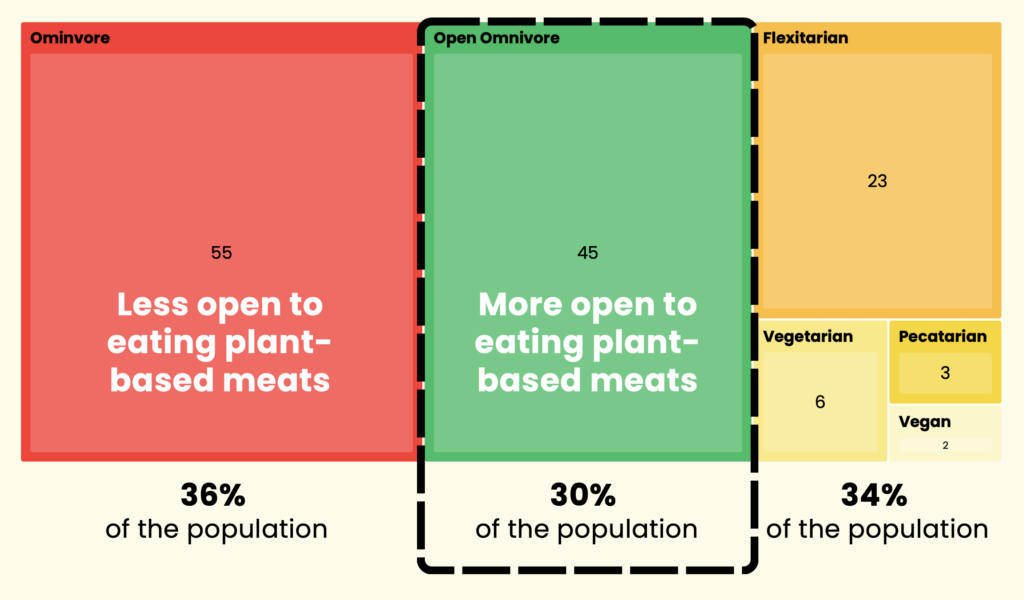

In Southeast Asia, research suggests a major knowledge gap around plant-based meat, with nearly half (44%) having never heard of it. But there are clear opportunities for the sector – particularly if these products were more affordable, nutritious and tasty than conventional meat. In China alone, 98% of poll respondents say they’re willing to add more vegan food to their diets once told their health benefits.

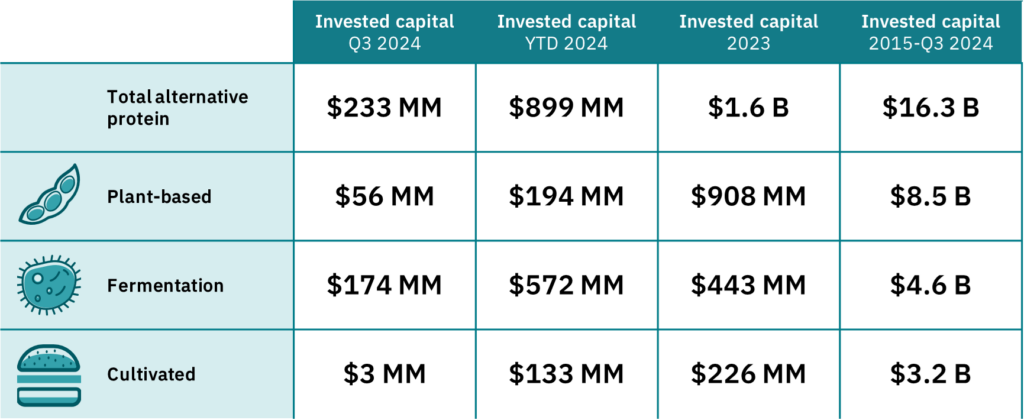

Asia-Pacific is also home to over 200 alternative protein startups, but with younger consumers leading the demand for low-carbon foods, Gen Z and Alpha are poised to disrupt the sector with novel offerings. Pairing them with proven industry successes – as the ProVeg competition had – is a marker of the collaboration needed to propel the future food economy.

Hanbap

Position: First Prize

Partner company: CJ Foods

Universities: Royal Melbourne Institute of Technology (Australia), Wageningen University & Research (Netherlands)

Hanbap answered CJ Foods’s call to create premium vegan meals inspired by Koran classics, which satisfied local tastes and the demand for healthier food.

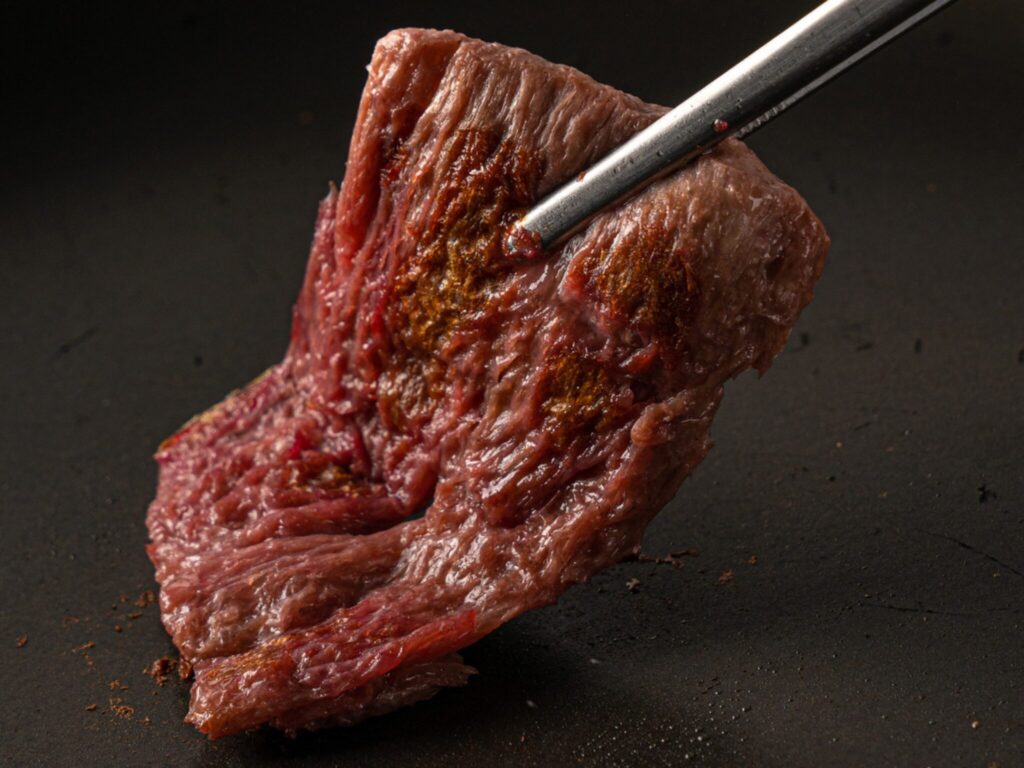

This team of students developed a self-heating lunch box featuring vegan Hanwoo beef – an animal-free version of one of the rarest and more expensive beef cuts (due to its high marbling) – rice, and local vegetables, with a wooden spoon.

The beef was created with texturised pea proteins, oleogels and red microalgae, and made use of precision fermentation technology.

Burstatic

Position: Second Prize

Partner company: Thai Union

University: Institut Pertanian Bogor University (Indonesia)

Based in Bogor, Indonesia, the four-strong team of Burstatic created Bomb Bites!, an innovative ready-to-eat plant-based product.

This was in response to Thai Union’s call for convenience meals targeted to young urban Asian consumers, using its vegan seafood products – like tuna, shrimp or crab – as the base ingredients.

VegVenture

Position: Second Prize

Partner company: CPF

Universities: AgroParisTech (France), University of Newcastle Australia, University of the Sunshine Coast (Australia)

A modern twist on a Chinese classic, VegVenture’s team created a plant-based Peking Duck Wrap Kit with a durian filling, dubbing it Bao Bei Duck.

Working with CPF’s brief to develop a range of healthy and nutritious vegan ready meals to be sold in convenience stores, these students blended crispy plant-based duck with “bold flavours” in a format they said is convenient, sustainable, and ideal for busy, health-conscious consumers.

VeggieAlgaeSeafusion Sauce

Position: Second Prize

Partner company: Unilever

Universities: Ocean University of China, New York University (US)

One of the world’s largest consumer goods companies, Unilever is also the parent organisation of meat-free leader The Vegetarian Butcher (for now). It tasked students to create a new generation of products for the brand.

The final winner of the $1,500 prize, the team at VeggieAlgaeSeafusion Sauce used microalgae as a raw material. It added savoury peptides extracted from a Chinese seaweed called Porphyra, alongside a seafood flavour to develop a rice dressing.

They also used bursting purls to lock in the flavour substances and provide a unique sensory experience to diners.

Baa-yonders

Position: Third Prize

Partner company: Beyond Meat

University: National University of Singapore

Working with a brief from one of the world’s largest plant-based meat makers, students at the National University of Singapore created a new product for Beyond Meat.

This is based on the concept of ‘light eating’, and tailored to meet the taste preferences and use cases unique to Asian consumers.

Baa-yonders’s answer was a marbled plant-based lamb, created with duckweed and Asian-inspired ingredients. It is aimed at flexitarians and Gen Zers, bridging the gap in vegan lamb options while addressing its high carbon footprint.

Natugi

Position: Third Prize

Partner company: Thai Union

University: Ho Chi Minh University of Technology (Vietnam), University of Hohenheim (Germany)

Another team following Thai Union’s innovation topic was Natugi, developing a convenient, vegan sticky rice meal with the company’s fish-free tuna and shrimp products.

The team said that many urban Vietnamese students skip breakfast due to time and budget constraints, so its offering could help provide balanced nutrition and a sustainable food option for busy youngsters.

Teamo

Position: Third Prize

Partner company: Mars

University: Bogor Agricultural University (Indonesia)

Confectionery giant Mars had issued a call for a new vegan snack product lineup that leveraged abundant plant resources and crops well-known to Asian consumers, which would be launched under an existing brand or a new label that advances its chocolate, snack and ice cream portfolio.

The all-Indonesian group of Teamo came up with a winning solution, creating a chocolate made from the whole cacao fruit, filled with okara (the pulp from tofu production), tempeh, and chocolate paste.

With a proposed price of $2 per 50g bar, it’s aimed at health-conscious women, featuring 30% of the daily recommended value of iron and fibre in Indonesia, and 35% of protein.

World Peacemakers

Position: Third Prize

Partner company: CPF

University: Jiangnan University (China)

The final third-prize winner of this year’s challenge was a team called World Peacemakers, which worked on CPF’s call for healthy, convenient vegan ready-meals.

The Chinese team leveraged microalgae protein, plant polysaccharides and 3D-printing technology to create plant-based, high-protein octopus legs, providing what they called a “nutritious, tasty and sustainable alternative to seafood”.

The post Meet the Asian Students Taking on the Future of Food with Global Industry Giants appeared first on Green Queen.

This post was originally published on Green Queen.