More and more US universities are making it easier for students to go vegan, but many still lack concrete plant-based goals, according to a new protein sustainability scorecard.

University scorecards have long been a handy tool for prospective students to figure out which institutions are best suited to their needs. But aside from tuition costs and curricula, there are several other factors that can influence the decision, such as the sustainability initiatives and food on offer.

To help navigate this, the Humane Society of the United States (HSUS) has released its first College and University Protein Sustainability Scorecard, which ranks 39 institutions based on how planet-friendly their dining halls are.

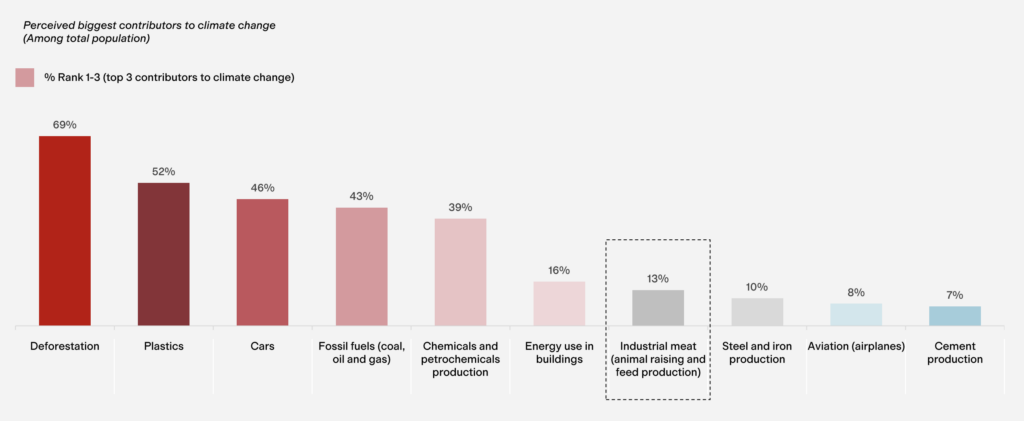

Inspired by its foodservice sustainability report, the scorecard is designed to showcase which higher education institutions are making progress in expanding plant-based dining options and lowering greenhouse gas emissions. Globally, the food system accounts for a third of all emissions, with meat and dairy production accounting for 57% of this footprint (twice as much as plant-based foods).

Since college dining operations serve millions of meals a year, adding meat-free options and reducing animal products can play a major role in mitigating the impacts of climate change.

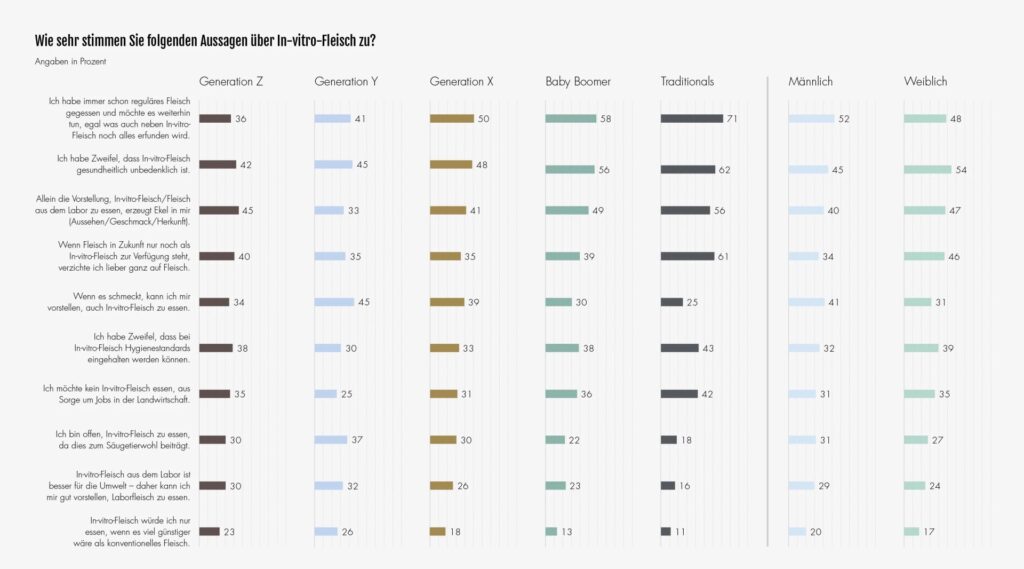

“More than a third of Gen Z members are limiting their meat consumption in some way, and over half prefer institutions that similarly prioritise lowering their food-related environmental impacts in operational standards,” noted Kitty Block, CEO of Humane Society International and HSUS.

“It’s no surprise, then, that when it comes to which college or university to attend, these students are assessing prospective schools based on their demonstrated commitment to creating healthier, animal-friendly and sustainable menus,” she added.

For the scorecard, HSUS focused on universities that have self-operated dining programmes and are not contracted with a foodservice management company. The institutions were evaluated not just for their climate goals, but also for how they’re prioritising food sustainability through concrete, evidence-based strategies.

Which universities have the most sustainable food options?

With an overall score of 360 (the maximum possible), the University of Colorado Boulder came out on top of the Protein Sustainability Scorecard. At least half of all meals here are plant-based, and it has a goal to increase this share to 75% by the end of 2025. The institute also offers vegan options at every station, with chefs working with registered dietitians.

Only three others received an A+ score. The University of North Texas, home to the country’s first fully vegan campus dining hall, received a score of 340. Between 41-45% of its fare is plant-based, with a target of reaching 50% by the end of the year.

“By prioritising a variety of plant-based foods, we aim to accommodate dietary preferences, enhance inclusivity, and ensure all students have access to nutritious, eco-friendly meals,” said Matthew Ward, an executive chef at the University of North Texas.

In the same state, the University of Texas at Austin scored 325, with 46-50% of food already plant-based. It’s also piloting blended burgers and replacing dairy and eggs with vegan alternatives. HSUS recommends that both thee institutions should use data collection to measure sales of vegan food and explore making plant proteins the default option.

The University of Michigan-Ann Arbor, meanwhile, came fourth with 315 points, with at least half of its meals already vegan, a share that’s set to rise to 55% this year. It tracks the emissions from food purchased and tracked, provides vegan options at every meal, and is actively increasing the availability of non-dairy milk across its operations.

Seven institutions received an A grade, including the University of Arizona (which has a mostly vegan dining hall), Washington State University (which offers culinary training for staff and student education sessions with dietitians), and Rutgers University (which has added carbon footprint labels to its menus).

Which institutions fell short on climate-friendly food targets?

On the other end of the scorecard were Kennesaw State University, Texas Tech University, and Utah Valley University, all of which received an F grade. These were among a number of institutions that didn’t respond to HSUS’s survey, prompting the organisation to rank them based on publicly available information.

The non-profit recommended each of these universities update their websites for full transparency. “If the institution does not have any targets around increasing plant-based menu offerings or reducing animal protein purchases, we recommend starting with a public, measurable plant-based goal and timeline and increased transparency on food-related sustainability efforts,” HSUS said.

Iowa State University of Science and Technology and Purdue University both received a D grade (with 20 points), while five others achieved a D+.

The Pennsylvania State University, with a score of 80 and a C grade, had previously set a target to increase the proportion of plant-based meals to 35% by this year. But that pledge was rescinded soon after, with the institution setting internal, campus-wide sustainability goals instead. It’s why it opted out of participating in this year’s survey.

Of the higher education institutes that did participate in the HSUS survey, the University of Oklahoma had the lowest score (85, a C grade). All dining locations feature at least one plant-based option, with the share of vegan meals at a low 5-9%.

“For those schools that fell short, we encourage them to join our efforts in creating a healthier, more sustainable food system by prioritising plant-based menu items and thereby investing in the future of their students – in this and every generation to come,” said Block.

Kate Watts, HSUS director of foodservice innovation, added: “Now more than ever, students are demanding meal options that are healthier for themselves and the environment. Colleges and universities have a responsibility to meet these demands, be transparent about their sustainability targets for prospective and current students, and work to reduce their environmental impact.”

The post What If We Ranked Universities Based on How Sustainable Their Food Is? appeared first on Green Queen.

This post was originally published on Green Queen.