Beans and peas are the best-performing alternatives to meat and milk when it comes to health, environmental and cost benefits, a new analysis has found.

2024 has been a seminal year in global history. More people voted in elections than ever before, temperatures are reaching their highest recorded levels, the US put a convicted felon back in the White House, electric vehicles outnumbered gas-powered cars in Norway, and the world put the humble bean back on the map.

Beans have become the flagbearer of academic and research support for plant proteins, just as they have begun reappearing on restaurant menus, retail shelves, and on our Instagram feeds in new formats. Some even suggest it’s now a cult going by the moniker ‘Leguminati’.

Now, a new multicriteria analysis by Oxford University is piling on the bean love, suggesting that legumes are the best alternatives to conventional meat and dairy products.

“Unprocessed legumes such as peas and beans were the clear winner in our assessment. They performed well from all perspectives, including nutritional, health, environmental, and cost,” said Marco Springmann from the university’s Environmental Change Institute, who led the research.

Out of a possible tally of 100, soybeans, peas, and beans racked up scores of 93 to 97 for replacing meat, with soybeans performing best on nutrition and costs, and peas best on mortality and GHG emissions. Soybeans were superior when it came to replacing dairy too, scoring 95 overall and having the greatest impact on mortality and land use.

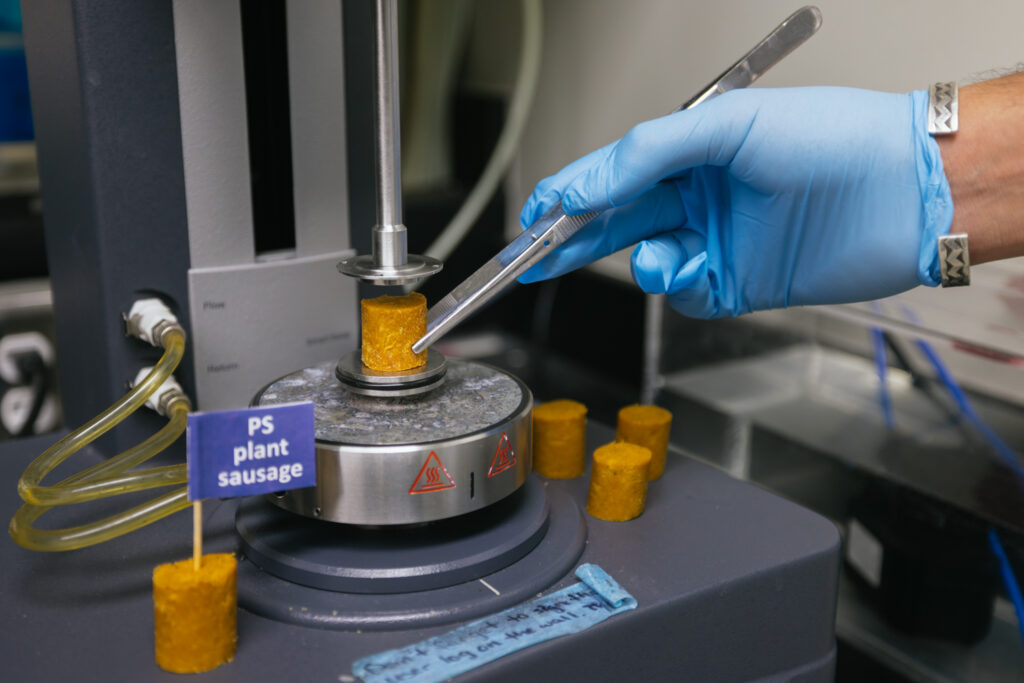

“A surprising runner-up was tempeh, a traditional Indonesian food made from fermented soybeans, which retains much of the nutritional properties of soybeans without much processing or additives,” said Springmann. “This and the relatively low cost gave it an edge over more processed alternatives such as veggie burgers.”

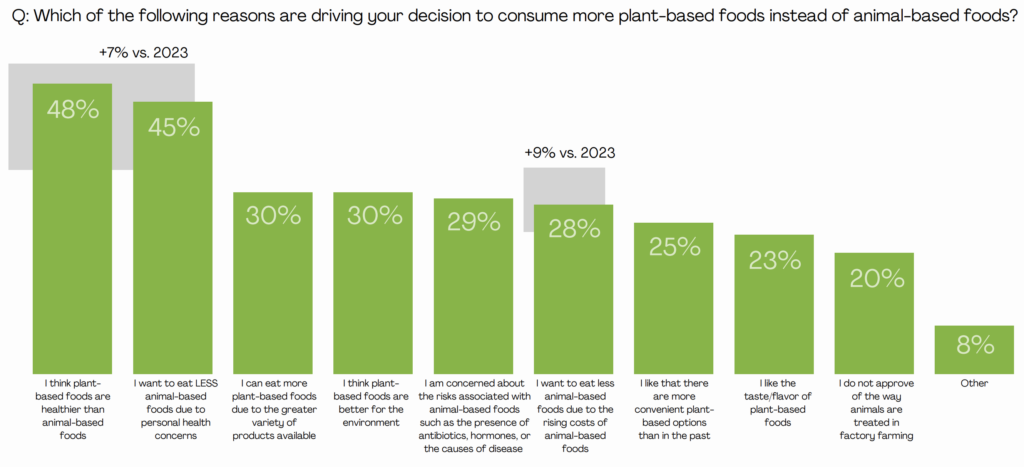

But processed products like veggie burgers and non-dairy milks also resulted in significant health and climate benefits. “Our study shows that a range of foods and food products exist that would have multiple benefits when replacing meat and dairy in current diets,” said Springmann.

Beans and peas provide outsized health and nutrition benefits

The study – published in the Proceedings of the National Academy of Sciences journal – analysed 24 meat and dairy alternatives with a focus on high-income countries, which typically overconsume animal protein. Experts have long identified the necessity of populations to cut back on these foods to lessen agriculture’s impact on the planet, which ends up disproportionately affecting lower-income developing nations.

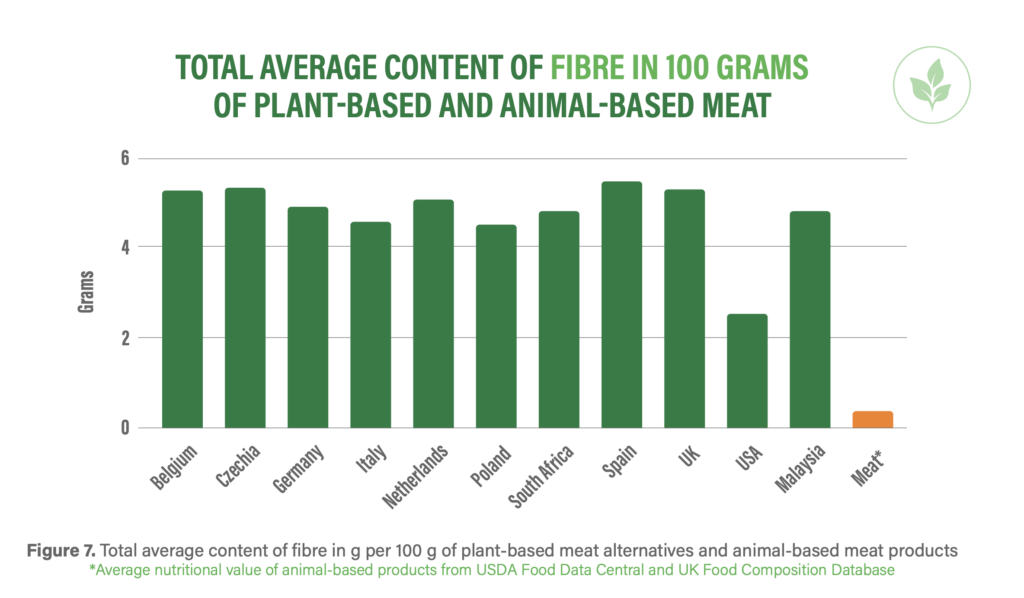

Replacing all calories from meat or milk with alternatives can decrease nutritional imbalances by four to five percentage points (pp), thanks in large part to reductions in saturated fat (by 44%) and increases in fibre (20%) and potassium (12%).

Among meat, the largest impact came from soybeans, peas and other beans (3.1-4pp), followed by processed plant-based burgers (2.5pp), tempeh (1.8pp), and tofu (1.1pp).

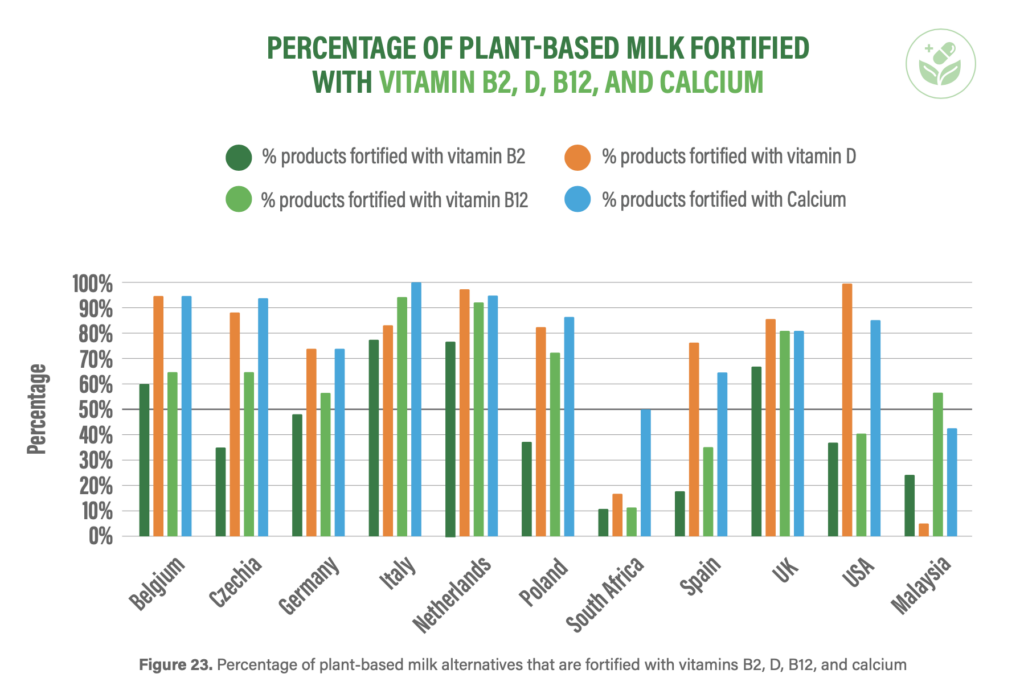

Meanwhile, soybeans lowered nutritional imbalances by replacing milk more than any other food analysed (5.4pp). Almond milk (4.7pp) was a close second, while oat and soy milk reduced these imbalances by 3.4-3.6pp.

All plant-based products were also linked to lower risks of chronic diseases, led by tempeh and soybeans (5-6%), and closely followed by peas, beans and veggie burgers (4-5%) on the meat front. For dairy, soybeans, almonds and oats led to a decline of 4-5%.

Likewise, replacing meat and dairy with vegan products can lower the risk of early death by up to 6%, with the changes attributed mainly to an increase in fibre (44%) and a decline in cholesterol and heme iron (20% each). “Among the meat alternatives, the largest reductions were for peas (6.1%), followed by tempeh, beans, and soybeans (5.1 to 5.7%), veggie burgers and tofu (4.0 to 4.3%), and veggie sausages and veggie bacon (3.5 to 3.6%),” the study noted.

And for dairy alternatives, soybeans offered the highest mortality risk reductions (5.2%). Almond milk (4.4%), soy milk and oat milk (4.3% each) weren’t too far behind.

Plant proteins highly climate-friendly, but cost and policy overhauls needed

A key reason why we hear scientists implore people to move away from meat and dairy is their impact on the environment. Animal agriculture produces up to a fifth of the world’s emissions, and 57% of agricultural emissions, while using up 30% of freshwater resources and 80% of farmland – but it only supplies 17% of our calories and 38% of our proteins.

If a person in a high-income country switches from meat to plant proteins, their diet’s impact on the environment shrinks by as much as 40%, when accounting for greenhouse gas emissions, water use, and land use. Soybeans, peas, vegan bacon, veggie sausages, beans, meat-free burgers and tempeh all reduce meat’s impact by a similar amount. With dairy, too, the climate footprint of alternatives is up to 16% smaller, a reduction offered by soybeans, oats, and almonds.

The researchers further conducted cost assessments based on UK supermarket prices, finding that meat analogues were more expensive than their conventional counterparts – in some cases, by as much as double – but unprocessed proteins like beans and peas were much cheaper.

By replacing meat, beans and peas decreased costs by 36%, followed by tempeh (20%), while tofu and vegan burgers had similar prices. Swapping milk for vegan alternatives lowered costs by 6% if using soybeans, oats and rice, and by 4% for almonds. In contrast, turning to vegan bacon or almond milk over their animal-based versions led to cost increases of 37% and 26%, respectively.

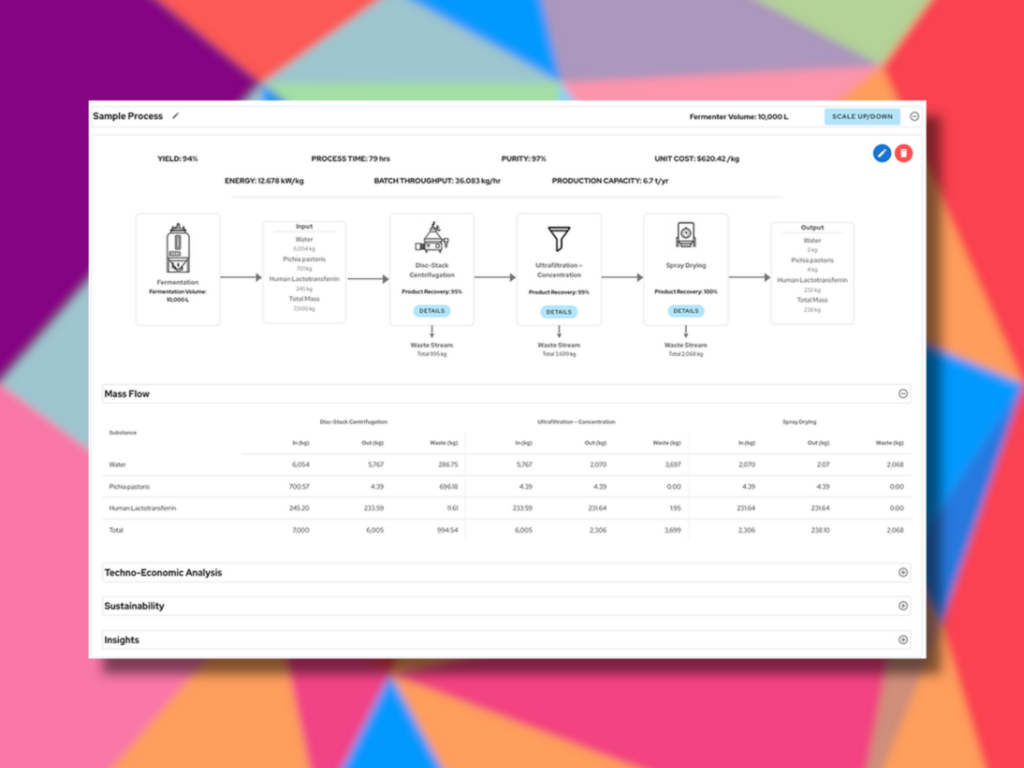

The study also investigated the impact of cultivated meat, arguing that its emissions and health impact would be as high as beef with current technologies, and is five to 40,000 times more expensive. On the overall scale, cultivated meat ranked similarly to other meat products, but the researchers stressed that these estimates were based on “high uncertainty”.

These findings appear contrary to several life-cycle assessments conducted by organisations and companies that show cultivated meat to have a much lower climate footprint than animal proteins, and several startups claim to have reached close to price parity too.

“Suitable alternatives to meat and milk exist and are available and affordable without necessarily requiring new technologies or product development,” the researchers stated. “This contrasts with discussions in high-income countries on the needs to develop novel replacement foods, especially those that would completely mimic meat and dairy.”

What’s required, however, are “prudent public policies”, which could include awareness campaigns, an overhaul of national dietary guidelines, the redirecting of farm subisides, and a ‘true cost’ approach to incorporate the climate and health detriments of animal proteins (like meat taxes).

“However, political economy issues could arise as the livestock sector holds considerable political influence in many markets and various interest groups aim to influence the political debate,” read the study.

The post No Longer A Has-Bean: Scientists Hail Legumes As the Best Meat & Dairy Alternatives appeared first on Green Queen.

This post was originally published on Green Queen.