US pea milk leader Ripple Foods has secured $17M in fresh funding ahead of launching an organic range and driving growth of its high-protein offerings.

California’s Ripple Foods is targeting the market for organic, protein-rich, and minimally processed plant-based milks with new funding and leadership.

The pea milk producer has closed a $17M financing round, welcoming new backers in Material Impact and Rich Products Ventures, which joined return investors S2G Ventures, Prelude Ventures, Fall Line Capital, Euclidean Capital, Tao Capital Partners, and Tim Koogle.

It takes Ripple Foods’s total raised to over $291M, and comes just under a year after the appointment of longtime board member Becky O’Grady as CEO.

“This is a pivotal moment for Ripple,” said O’Grady, a former General Mills and Yoplait executive. “Harnessing the power of our brand and the strength of our team, we are poised to unlock our full potential.”

High-protein pea milks drive double-digit revenue growth

Founded by Adam Lowry and Neil Renninger in 2014, Ripple Foods has become synonymous with the pea milk category in the US, positioning itself as a high-protein, allergen-friendly option.

It offers a range of pea-protein-based milks for adults and children, alongside coffee creamers and protein shakes, each made without the nine top allergens (such as nuts, soy or lactose). The company claims that its pea milk is the only nut-free non-dairy option with a better nutritional profile than cow’s milk.

Each cup of its original pea milk contains 8g of protein (on par with dairy), but with 50% more calcium, half as much sugar, and 33% fewer calories than full-fat cow’s milk. It also has zero cholesterol and a fraction of the saturated fat content.

Ripple Foods’s kid-focused line, suitable for one- to -five-year-olds, boasts 8g of protein per serving too, alongside 2g of prebiotic fibre from corn and essential nutrients like omega-3, vitamin D, vitamin B12 and iron.

The company also sells protein shakes in several flavours for both adults and kids, boasting 20g and 13g of protein each, respectively. These attributes will appeal to a country currently obsessed with protein –70% of Americans have been looking to consume the macroingredient in 2025, after one in three increased their intake in the previous year.

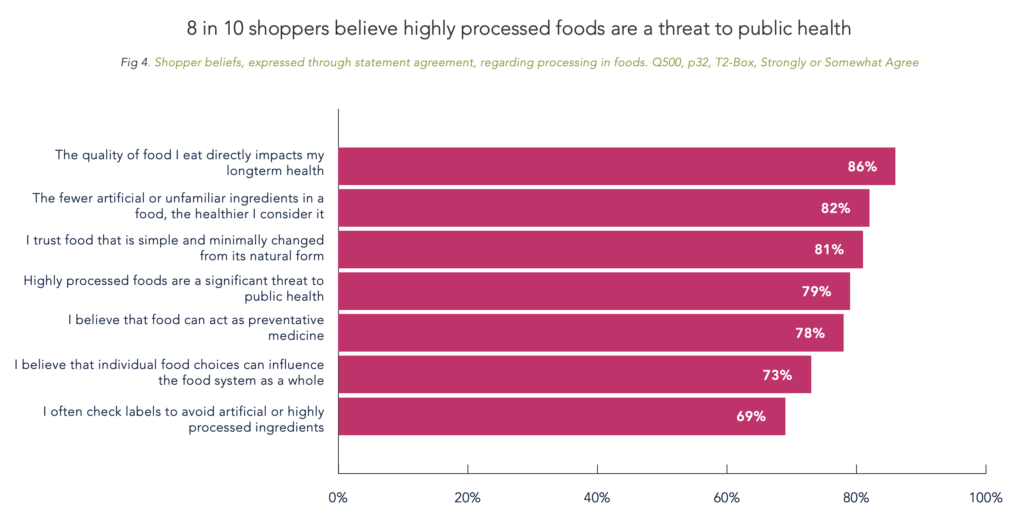

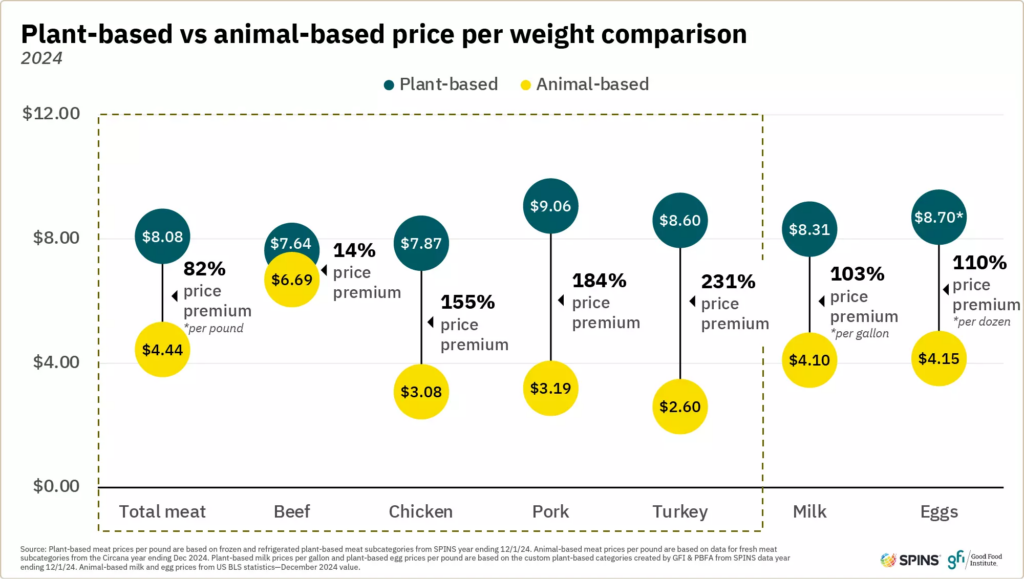

But most get their protein from animal products. Only 18% rely on plant-based milk, compared to around two in five who prefer dairy as a protein source. That has contributed to a decline in sales for non-dairy milk, which fell by 3% in the 52 weeks to July 19, against a 5% growth for cow’s milk, according to SPINS. The share of households buying these vegan alternatives has also slimmed by 1.6%.

Ripple Foods, however, is hedging its bets on its protein-rich products to expand its growth, outlining its “successful track record” of capitalising on consumer momentum and driving “consistent, double-digit top-line growth”.

Ripple Foods to launch organic pea milk line in 2026

The plant-based market has witnessed a sharp drop-off in funding in recent years. And while there have been signs of recovery in 2025, with the segment attracting $322M in the first nine months and surpassing 2024’s total, a large chunk of this came from Beyond Meat’s $100M debt financing.

So Ripple Foods’s $17M raise goes against the investment currents of the industry. For Material Impact’s Melissa Fensterstock, there couldn’t be a “more exciting time” to back the company.

“With Becky at the helm and a sharp focus on growing top-line revenue and achieving profitability, the company is poised to deliver strong results in the plant-based protein market,” she said. “On a human note, Ripple’s products provide a wonderful solution for the millions of families struggling to find a nutritious, tasty, and clean alternative to dairy.”

The company will use the capital to expand its product line and footprint. In Q1 2026, it will introduce a range of organic plant-based milks to meet the demand for “nutrient-dense, plant-based protein options over ultra-processed alternatives”.

This is a shrewd move. SPINS data shows that while overall purchases of non-dairy milks have suffered, organic plant-based milks actually saw an 18% increase in year-on-year sales, growing their dollar share in the category by three percentage points.

Ripple Foods is also doubling down on its high-protein kid and core offerings by increasing brand differentiation and visibility, and driving expanded retail distribution. Plus, it’s expanding into foodservice channels and building on strong momentum with retailers like Target, Whole Foods, and Walmart, where it claims to have established a “loyal customer base”.

“We are launching innovative new products, driving consumer penetration and customer expansion, and opening new growth horizons through transformative partnerships and capabilities,” said O’Grady.

The tools and leadership are there. Can the new funding help the brand create a new ripple in the plant-based category?

The post Pea Milk Pioneer Ripple Foods Raises $17M to Meet Organic, High-Protein Demand appeared first on Green Queen.

This post was originally published on Green Queen.