Australia has unique advantages when it comes to pushing the future of protein technology forward, argues independent alternative protein think tank Food Frontier CEO Dr Simon Eassom.

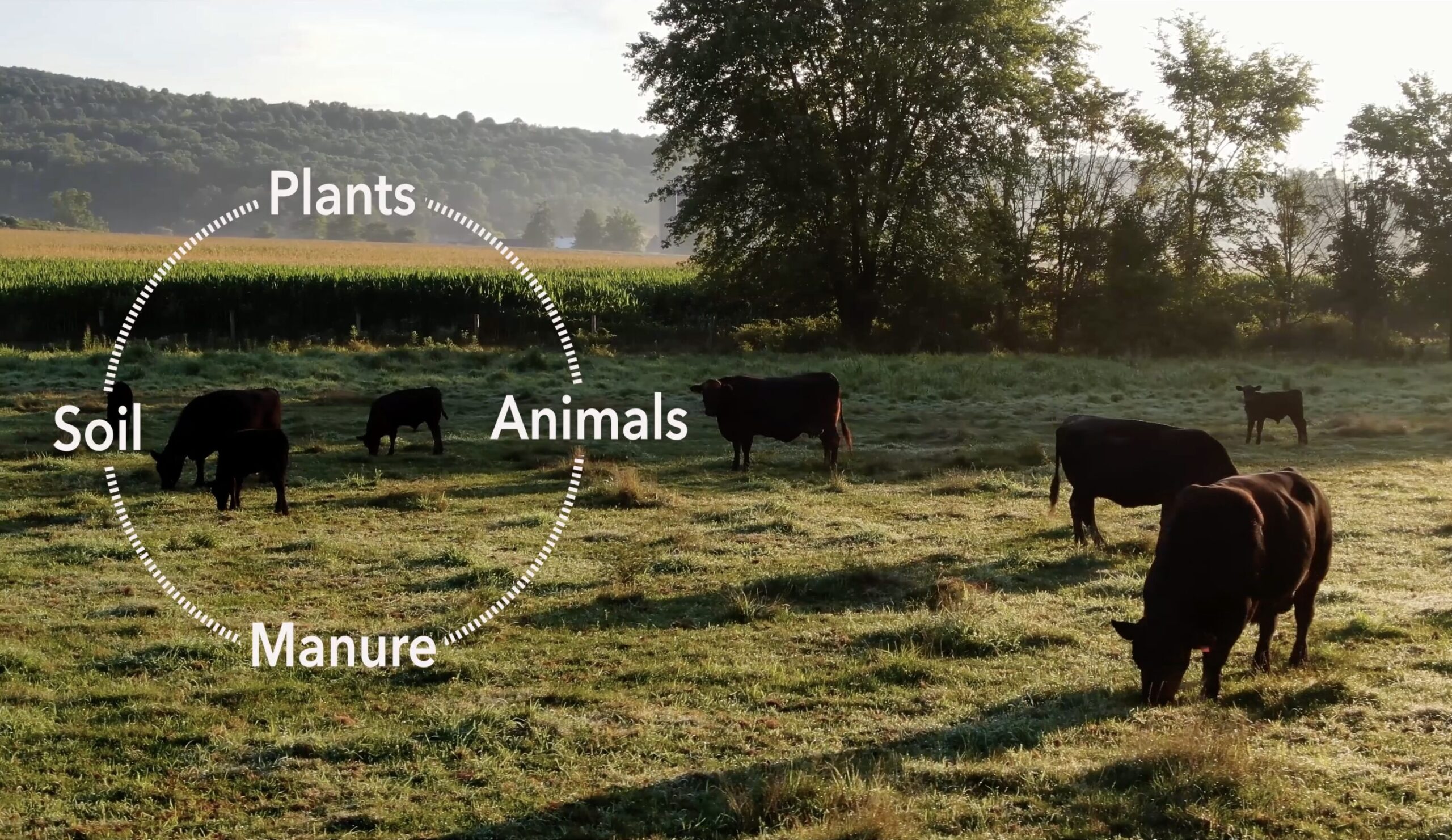

Food systems transformation is increasingly being seen as essential; not just desirable. The pressures created by the need to increase the food supply for a global population – set to grow by nearly two billion people in the next quarter-century – and the growing recognition of current industrial agricultural practices’ effect on the environment, are leading to the rapid development of new technologies focused on food production without the enormous burden it has traditionally placed on our dwindling land and water resources.

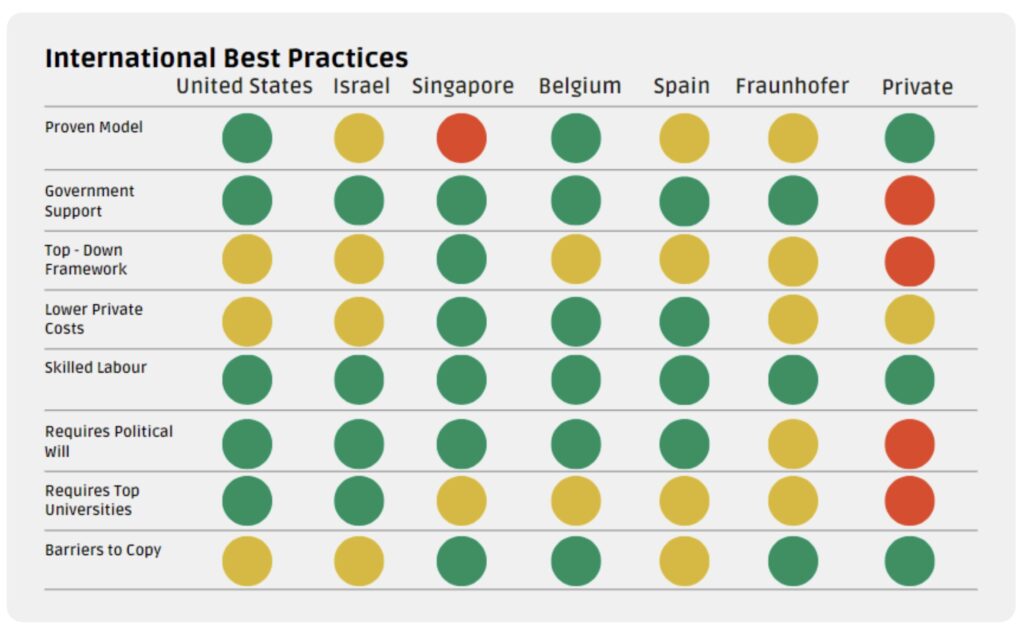

In the race for market leadership in this new frontier of food production, Australia is contesting for first-mover advantage with the powerhouses of Europe and the US. Despite being the minnow in the pond, it is strongly positioned to service the growing demand for alternative proteins internationally, especially in Asia, helping to secure a long-term economic outlook through diversified and value-added exports. This is true not just for final products, but also for ingredients, technological IP, equipment, and skills.

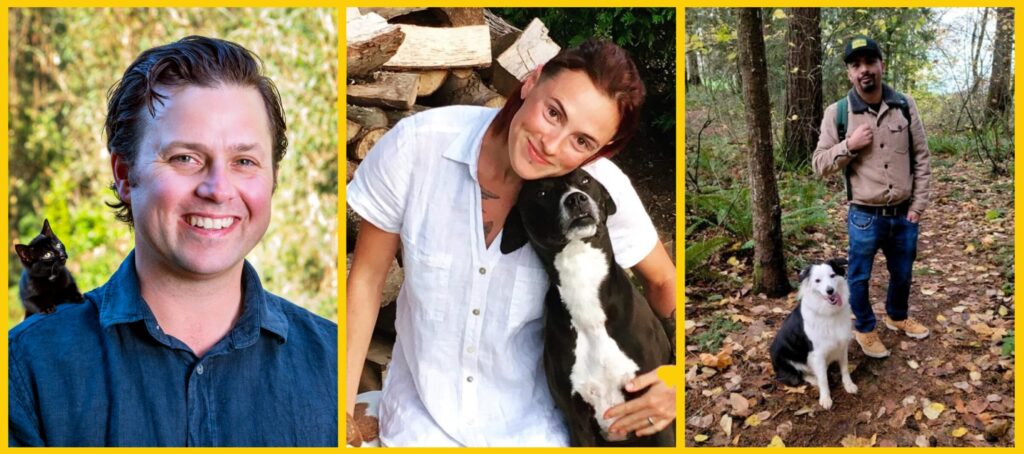

The visionaries driving Australia’s cultivated meat sector forward

Australia’s strengths lie in the convergence of several necessary conditions required to accelerate change. Not least, the requirements for raw materials, R&D of new technologies, investment dollars, and favourable market opportunities present a significant exploitable advantage for Australia.

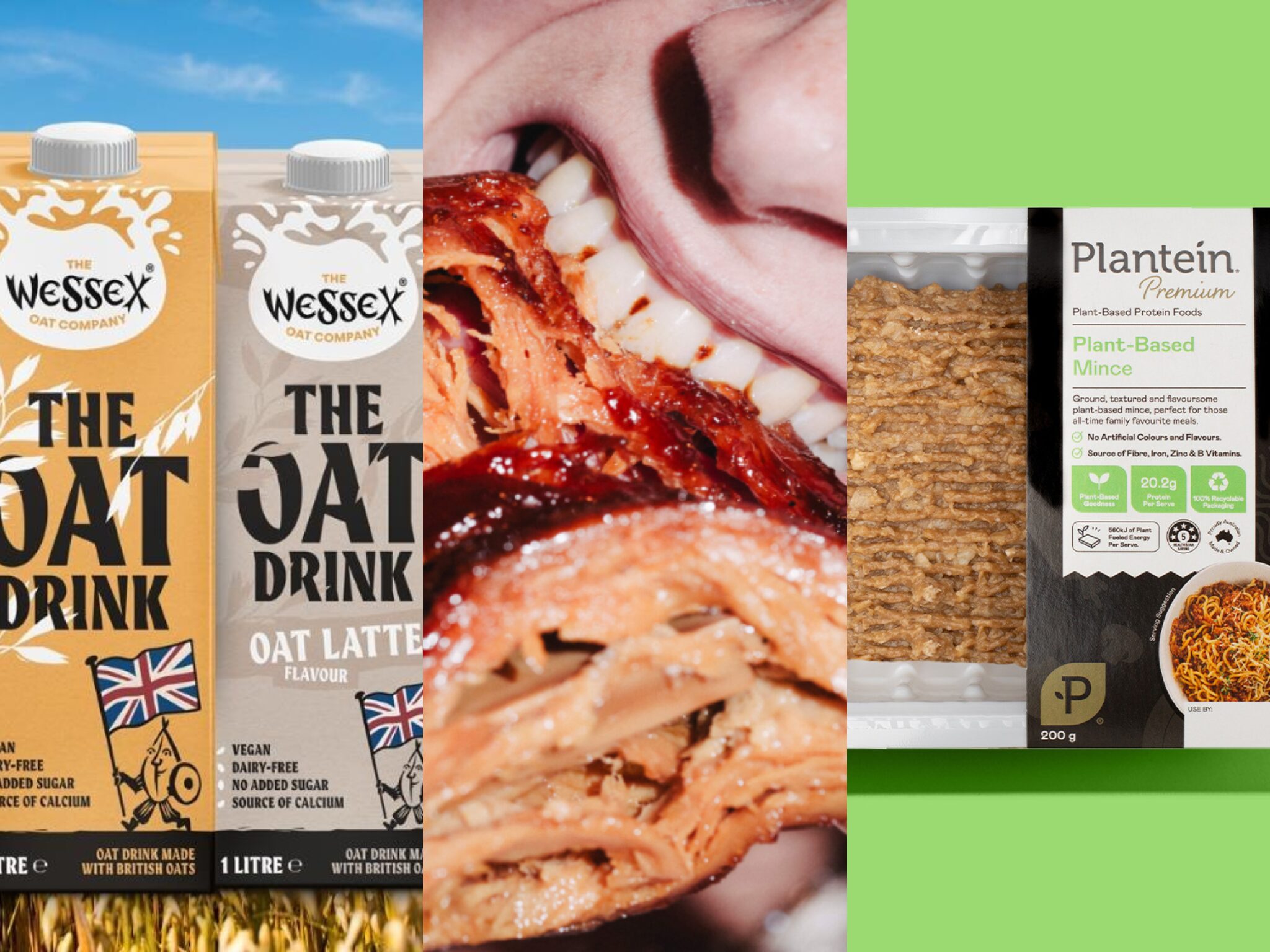

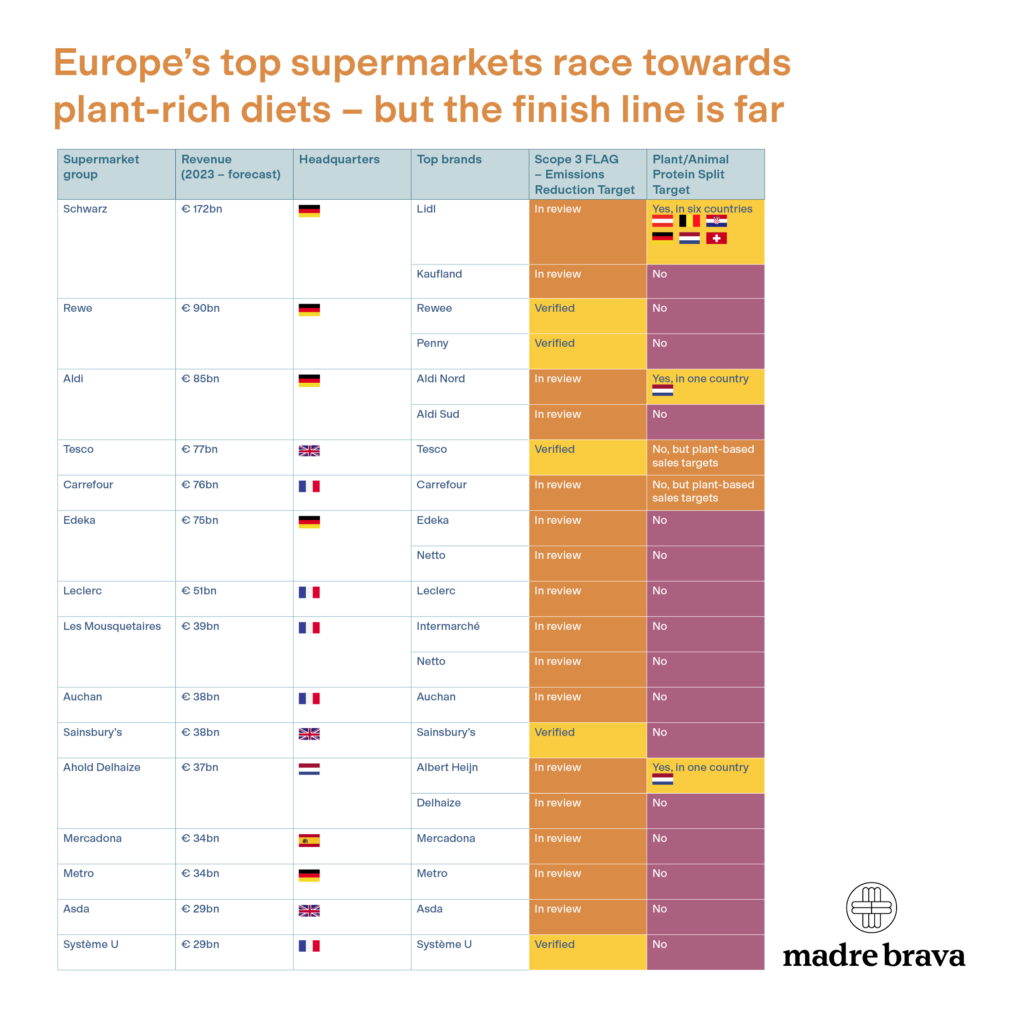

Recent data collected by Deloitte Access Economics and presented by Food Frontier in its 2023 State of the Industry report for the plant-based meat sector highlighted how (on a per capita basis) Australia’s alternative protein sector is bucking the trend apparent in the US and Europe, especially in foodservice, where the incorporation of plant-based meat into catering options has grown by 53% year-on-year since 2020.

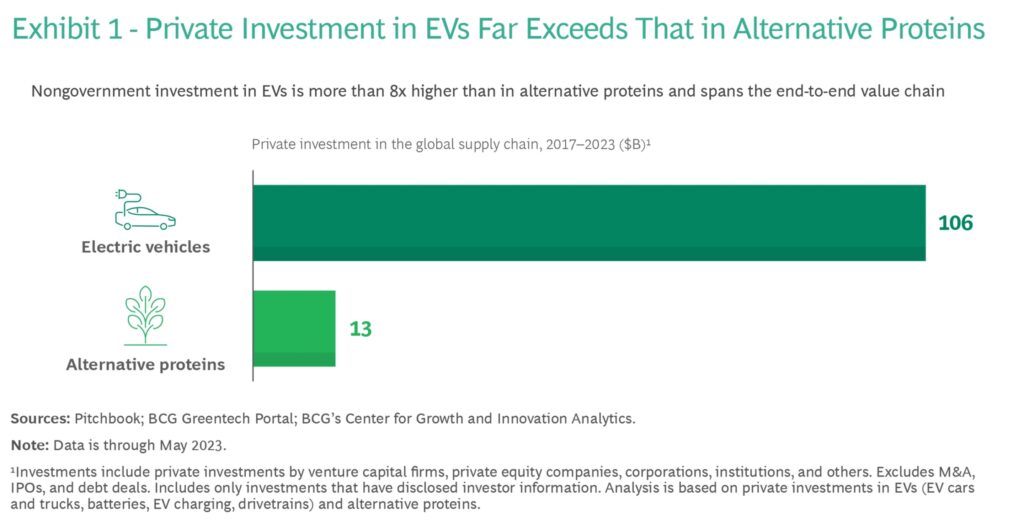

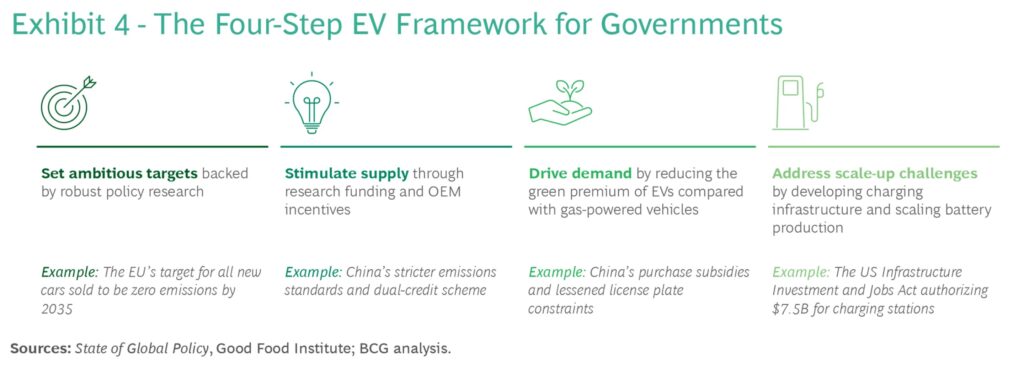

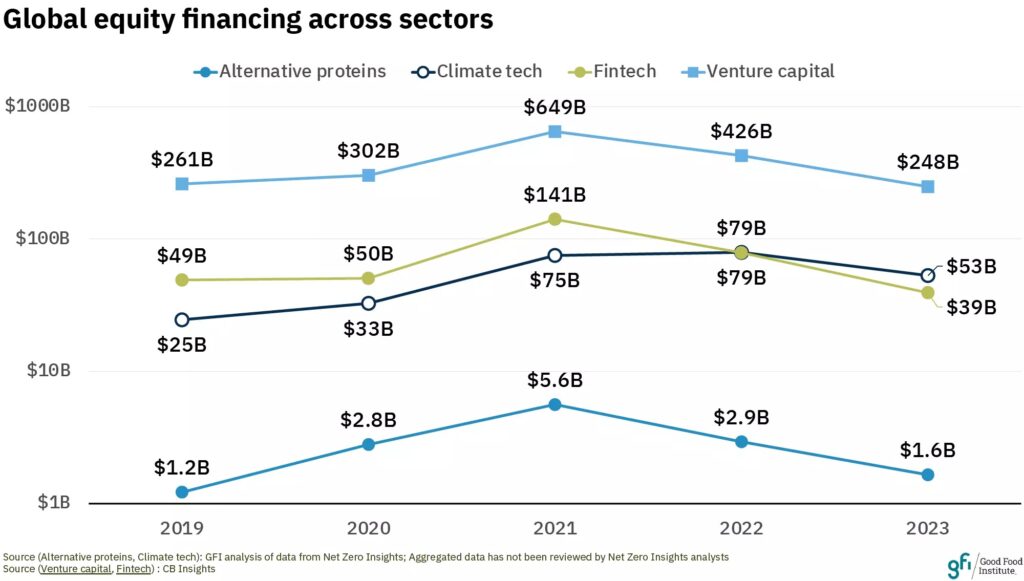

But beyond plant-based meat, the diversification of plant-based ingredient supply, the relatively high levels of investment into the Australian sector – ranked fourth highest in the world for cellular agriculture deal count in recent research published by Nicholas Dahl’s Alternative Proteins Global and receiving the lion’s share of both public sector and $1.2B of private sector investment into alternative proteins generally, according to the Good Food Institute APAC – and the R&D advances made into precision fermentation and cultivated meat technologies highlight Australia’s growing capability.

Much has been made of the success of Australia’s Vow’s launch into the luxury dining market in Singapore and its status as the only company in the world currently offering a cultured meat dining experience. Having navigated the requirements of Singapore’s novel food regulator, Vow’s founder George Peppou is now working with regulators around the world, including Australia and New Zealand’s food safety standards body, FSANZ, to take its cultured Japanese quail worldwide.

Peppou believes that the early obstacles of the necessary investment to overcome technical difficulties and the unavoidable cost of large-scale cell cultures used in the pharmaceutical sector have largely been resolved, and is on a mission to tackle the final hurdle: getting product in front of consumers and growing their acceptance of novel food technology’s ability to produce delicious meat experiences.

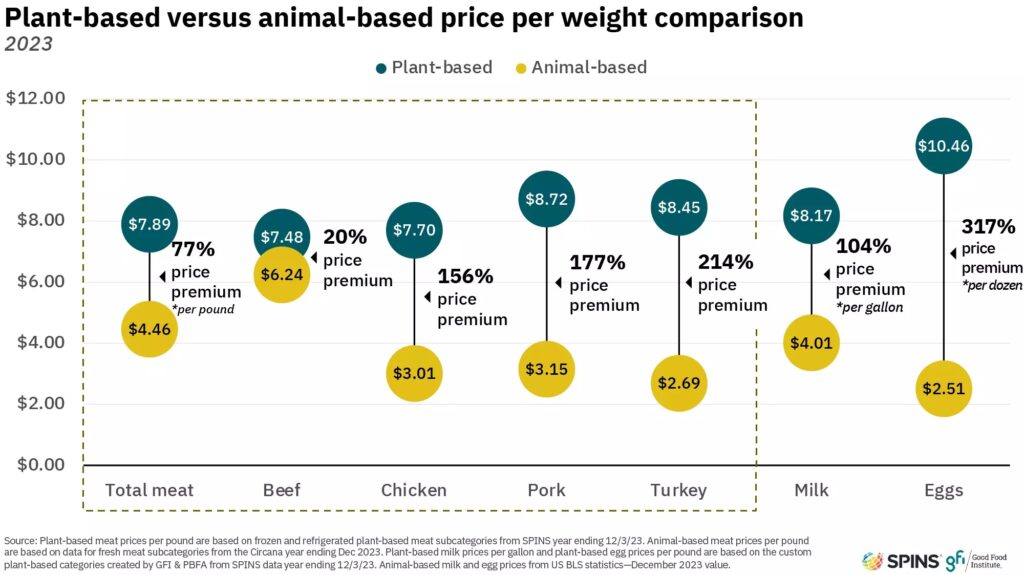

It’s a mission shared by Victoria’s Magic Valley, led by founder and CEO Paul Bevan. Magic Valley’s quest is to provide familiar food products such as pork mince and lamb mince into the retail sector at prices at least comparable to traditional animal products but with the added value of not involving either the slaughter of an animal or the environmental cost of animal farming.

Bevan believes that Magic Valley’s technology can provide a product that matches its conventional pork peer in taste and texture for AU$8 per kilo. The startup will be taking its portfolio of evidence to FSANZ for approval very soon. Certainly, public tastings of its pork and lamb meatballs, including a televised tasting on Australia’s Channel 7 network, have substantiated the “real meat” claims of Bevan and team.

Precision fermentation brews up more sustainable food system

Elsewhere, New South Wales’s Cauldron Ferm is leading the way in establishing a scalable, repeatable, continuous process that will unlock the full potential of precision fermentation. Its proprietary hyper-fermentation technology unlocks significant gains in productivity compared to fed-batch methods.

Currently operating a 25,000-litre demo facility, it expects to open two 100,000-litre industrial-scale hyper-fermentation facilities by the end of 2025. Compared to 500,000-litre fed-batch processers, Cauldron Ferm’s technology promises a 50% reduction in manufacturing costs, greater than 275% more volume of product compared to fed-batch methods, and 4x better payback.

One company already benefiting from a partnership with Cauldron Ferm is Victoria’s precision-fermentation dairy company Eden Brew. CEO Jim Fader argues that previous scale-up and supply chain issues have now been solved and that precision fermentation dairy is delivering industry-mature costs with little capital investment, hinting that Eden Brew will be at price parity with the dairy industry by 2029.

Fader’s bullishness reflects the convergence of requirements for success that he finds in Australia, particularly with the move of his business to Victoria. Apart from Eden Brew’s partnership with Australia’s national research agency, CSIRO, and support from Australia’s leading early-stage tech venture capital fund management group, Main Sequence, it has been supported from the outset by Australia’s 100% farmer-owned dairy co-operative, Norco, which currently has 191 dairy farms producing over 200 million litres of milk annually, with a turnover crossing AU$650M. Norco’s support reflects the growing concern in the dairy sector of the continuous long-term decline of the conventional milk-production industry.

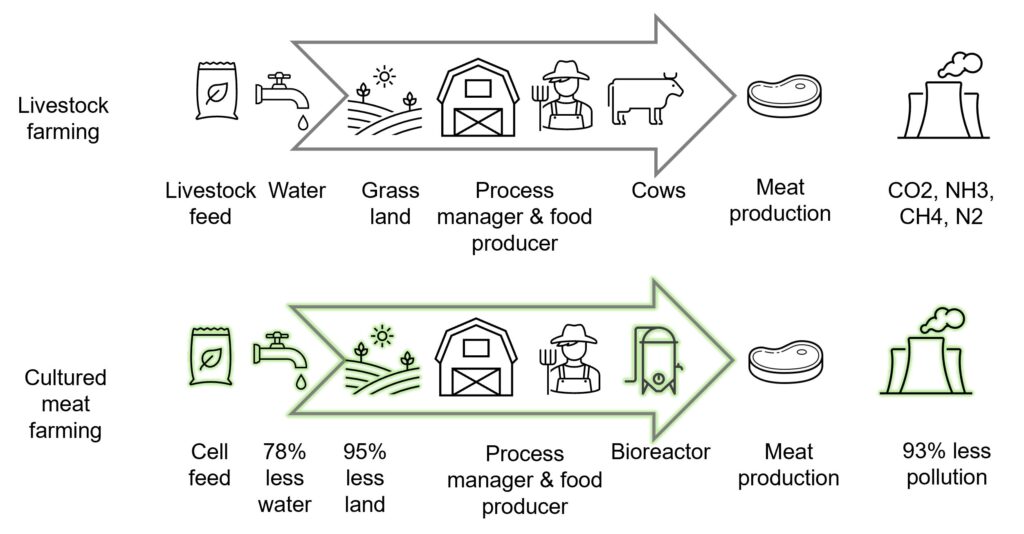

Whilst leading with the economic case, Fader (and other precision fermentation advocates) don’t shy away from showcasing their environmental credentials. Eden Brew claims that per litre of milk produced by its methods, its proteins produce 70% less emissions, use only 5% of the land required for cow-derived dairy, reduce water consumption by 99% (less than 99.9% of the water used to produce almond milk), emit no methane, and cause no eutrophication of waterways.

UK and New Zealand-based think-tank, RethinkX agrees that the cost of creating dairy proteins via precision fermentation is quickly approaching price parity. In combination with evolving technological capabilities and the maturity of regulatory frameworks, Australia and New Zealand are well-placed to take advantage of these major breakthroughs.

Recently, New Zealand dairy protein precision fermentation start-up, Daisy Lab, received approval from its Environmental Protection Agency (EPA) to use genetically modified organisms for the growth of dairy-identical proteins. This follows Cauldron Ferm’s groundbreaking approval from the Office of the Gene Technology Regulator (OGTR) for its controlled use of GM yeast.

Opportunities are being accelerated by some unique and exciting collaborations across the sector. Australia’s deep-tech food innovator, Nourish Ingredients, uses precision-fermented fats to reproduce the taste and mouthfeel that make chocolate and meat so delicious to eat. Focusing on the precision fermentation of a dairy-type lipid solution (called Creamilux), Nourish Ingredients is partnering with New Zealand’s global dairy co-operative, Fonterra, to push into adjacent food product segments, such as bakery, that traditionally rely on dairy fats in their production.

Focus on manufacturing sector and native plant proteins

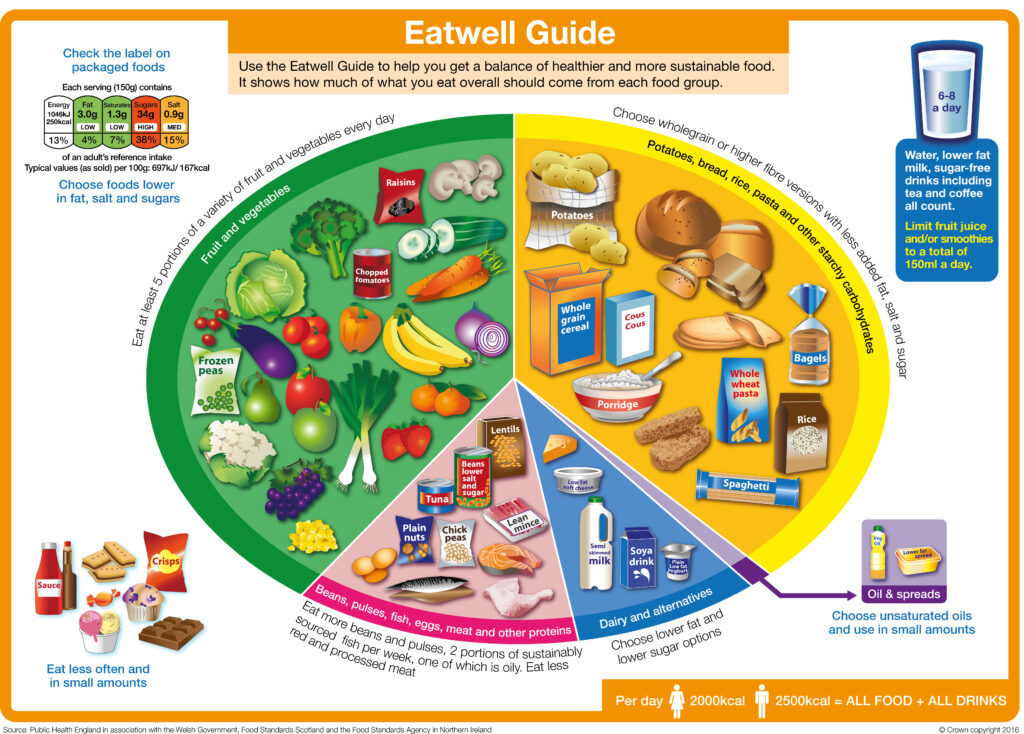

This rapidly accelerating push into the ingredient space is fuelling great excitement around Australia and New Zealand’s alternative protein development potential. Plant processing companies such as Essantis, Integra Foods, and Australian Plant Proteins are exploiting Australia’s legume production to produce concentrates and isolates providing anything up to 80% protein by volume.

In a country that produces 85% of the world’s lupin seeds, the technology now exists to provide plant-based proteins with comparable or better amino acid profiles to traditional meat and dairy sources at a fraction of the cost to the consumer and the environment.

It’s an approach pursued by companies like Roquette that recognise the need to produce a “complete” protein while mimicking the functionality of dairy and meat proteins. They are investing heavily in finessing the bioavailability of quality proteins whilst lauding the environmental credentials of pulses such as pea and fava bean with carbon footprints 70% lower than soy and boosting the economic opportunities for local agriculture.

Similarly, Grainstone is using biorefinery technology to revolutionise the value chain for barley producers, converting millions of tonnes of spent grain from the beer brewing industry to lift it from comparatively low-value animal feedstock to high protein, high fibre premium baking flour with 25% of the carbohydrates of traditional flour, 10 times the fibre content, and more than double the protein by weight (26% compared to most baking flour at 9%-13%).

The opportunity for radical food systems transformation has never been greater as hype fast approaches reality. All of these industry players will be participating in Food Frontier’s AltProteins ’24 conference in Melbourne this October.

The day will begin with an engaging keynote address delivered by Satya Tripathi, Secretary-General of the Global Alliance for a Sustainable Planet, who served with the United Nations for more than two decades in key positions across the globe and was most recently as the UN Assistant Secretary-General, Head of New York Office at UN Environment and Secretary of the UN Environment Management Group.

Tickets for Food Frontier’s AltProteins 24 Conference are available here.

The post Why Australia Is Ideally Positioned to Play A Leading Role in the Global Smart Protein Industry’s Success appeared first on Green Queen.

This post was originally published on Green Queen.