A bunch of headlines have been knocking plant-based meat for causing heart disease, but these are deliberate misinterpretations to discredit the industry further.

Did you hear that plant-based meat can now apparently kill you?

That is the consensus of media outlets like the Daily Telegraph, the New York Post and the Daily Mail. Citing a study by Sao Paulo University and Imperial College London published in the Lancet journal, headline writers have decided – in a classic case of misinformation – that plant-based meat and veganism will increase your risk of heart disease.

Backed by the World Cancer Research Fund, the study used the health data of nearly 118,400 Brits between 2009 and 2012, and assessed ultra-processed foods (UPFs). These foods are defined by the Nova classification as those produced via industrial formulations and techniques like extrusion or pre-frying, combined with cosmetic additives and substances of little culinary use.

Think ice creams, sugary cereals, fizzy drinks, packaged breads and cakes, sausages and other ‘reconstituted meats’, and – yes – plant-based meat analogues.

“Replacing meat and dairy with plant-based swaps might not be the simple health hack you think it is,” wrote the Daily Mail.

“Fake meats and vegan food not as good for you as you might think,” read the headline for the Metro newspaper.

“Full transparency would expose the myth that vegan foods are good for you – I am not talking here about whole grains, fruits, nuts and vegetables, which are perfectly healthy in a balanced diet with meat, fish, eggs and dairy products – but highly processed compounds of them, often laden with colourings, emulsifiers and flavourings,” wrote the Telegraph columnist Jamie Blackett, a beef farmer who regularly appears on GB News, the most unreliable and untrustworthy broadcaster in the UK.

The way these stories are written is dangerous, because not only are they misleading, but they’re deliberately so. These news outlets aren’t stupid, they know exactly what they’re doing – slapping ‘vegan’ in your headline will get you clicks, as would ‘meat’. But objectivity and balance? Who gives a shit.

What the Lancet study really said

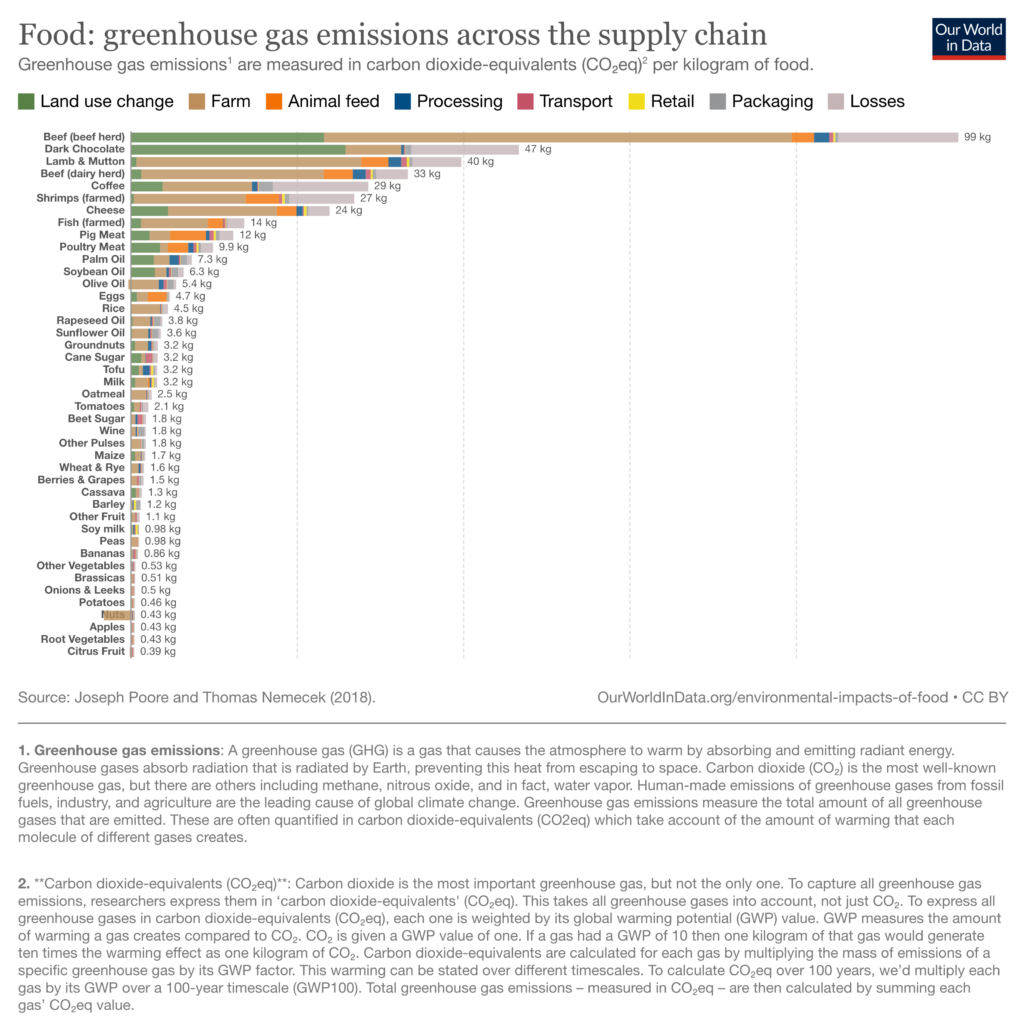

So here’s what happened. The study analysed an array of animal- and plant-based foods – both non-UPFs and UPFs – and aimed to find the difference in disease risks if 10% of the diet was shifted to non-UPF plant-based foods.

What do plant-sourced non-UPFs include? Fruits and vegetables, legumes, nuts and seeds, of course, but also, beer and wine, processed bread, pasta, cereals, and table sugar.

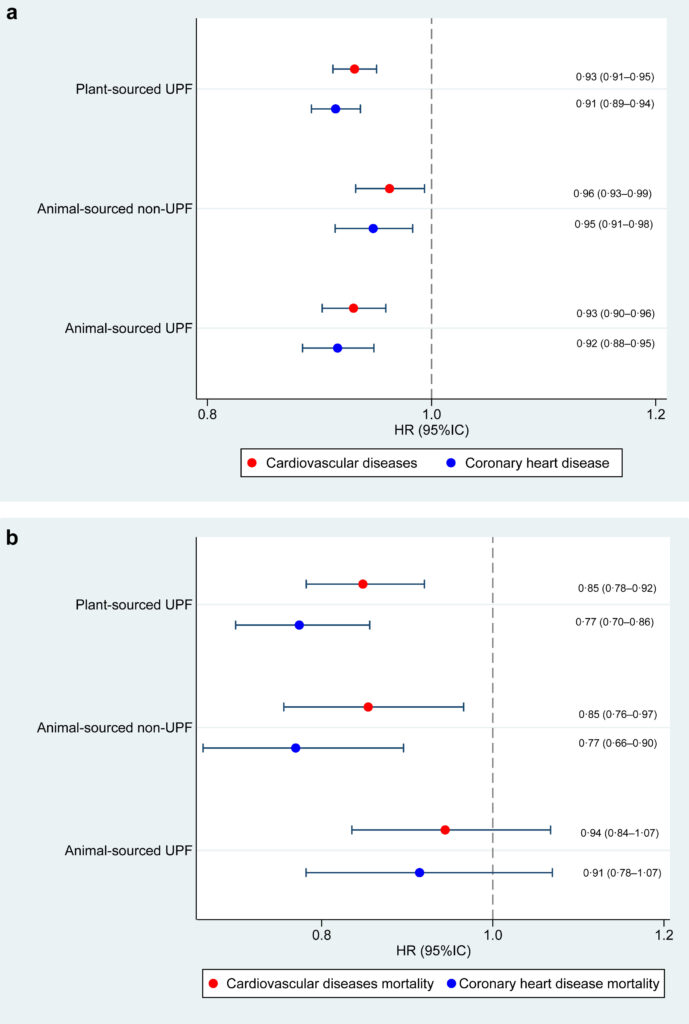

The researchers found that with every 10% increase in energy from non-UPF plant-based foods, there was a 7% lower risk of developing cardiovascular disease, and an 8% decrease in risk of coronary heart disease.

But when you increase your share of plant-based UPFs by 10%, it’s associated with a 5% greater risk of cardiovascular disease, and a 6% risk of cardiovascular disease.

The problem with most of these headlines and interpretations, though, is that this means plant-based meat is bad too. However, meat analogues only made up 0.2% of the participants’ diets in the study. Plant-based UPFs accounted for 39.4% overall, but nearly 10% of these were industrialised packaged breads, almost 7% were pastries, buns and cakes, and about 4% were biscuits.

Plant-based meat represented the lowest-consumed category across both plant-based and animal-souced foods. The latter included things like reconstituted meats (such as nuggets and sausages), milk-based drinks and desserts, and mayo and spreadable cheese.

What none of these articles – or even the study text in the Lancet for that matter – is the impact of increasing your intake of animal-sourced foods by 10%. Only when you dig into the supplemental data do you find that if you eat 10% more animal-based UPFs, you increase the risk of both cardiovascular and coronary heart diseases by 4%.

And when you consider the impact of replacing foods with plant-sourced non-UPFs, the impact is similar across the board. Substituting 10% of plant-based UPFs with non-UPFs has the same effect on cardiovascular disease risk (a 7% decrease) as doing so for animal-based UPFs.

In fact, replacing both ultra-processed vegan food and animal-derived non-UPFs with plant-sourced non-UPFs has an identical impact on death risks from these diseases.

Research doesn’t show full picture of meat

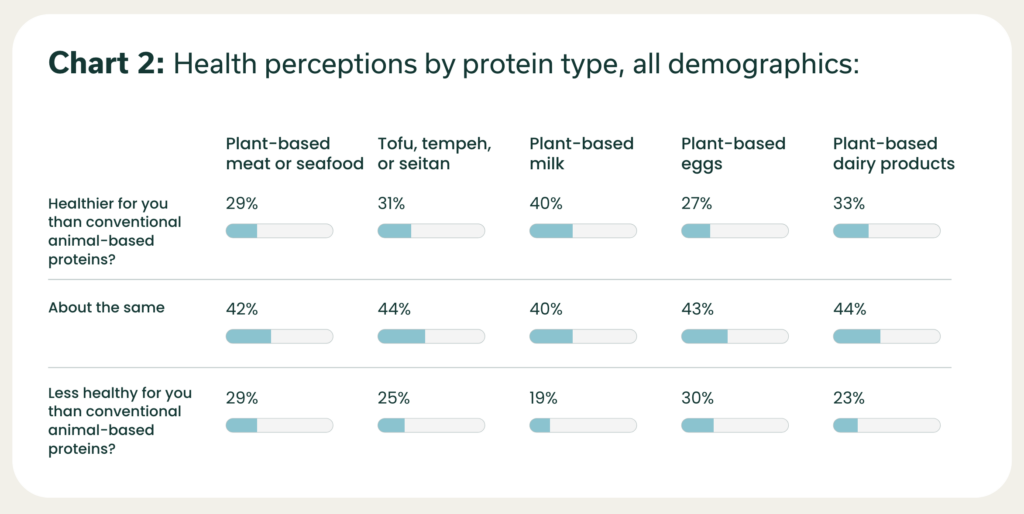

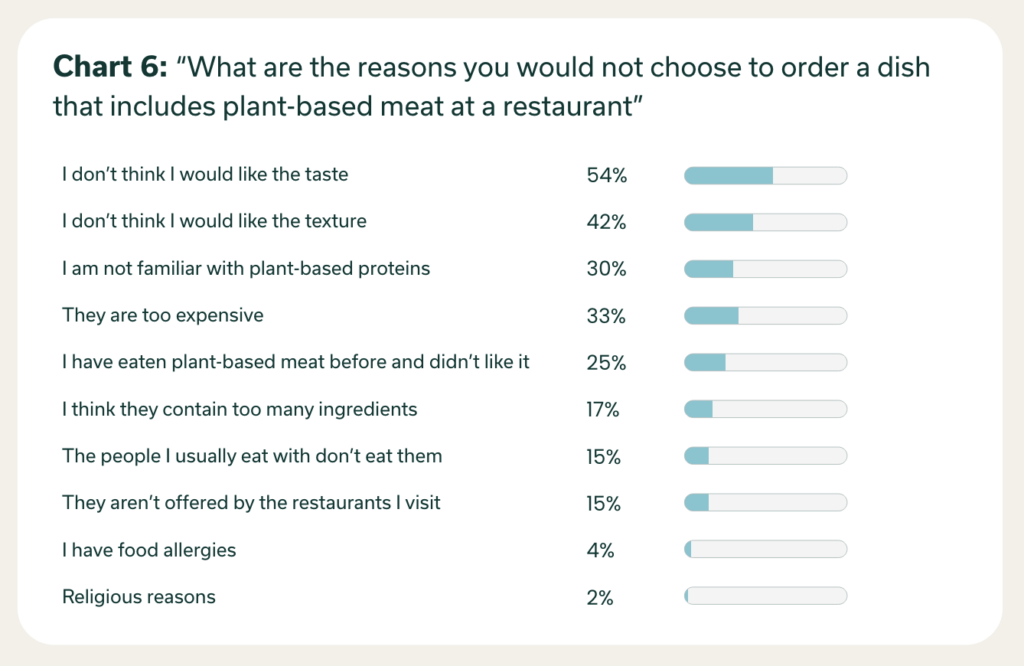

The core problem with the research and the way it’s been reported is the idea that all vegan UPFs are bad, which is not true. Sure, breads and cakes and biscuits and fizzy drinks aren’t exactly health foods, but they just happen to be vegan. It’s not what you necessarily think of when you think of ‘plant-based food’ – most people’s minds go to either whole foods (which the study shows are great for you), or meat and dairy analogues.

It feels very convenient to just bundle everything into the vegan umbrella when it suits these news outlets’ narratives. And some blame lies with the authors too: they didn’t include much data about animal-derived meat, and sidestepped its effects in the findings in the actual study. I’d wager the number of people who actually go through to analyse the supplementary data is under 0.2% – you know, the amount of meat analogues that actually featured in the entire study.

Imperial College didn’t do any favours either. The main image in its press release is a very commonly used photograph to depict plant-based meat, which magnifies the focus on these products. Its text takes a further dig: “Many plant-based foods, including meat-free alternatives such as some sausages, burgers and nuggets, can be classified as ultra-processed foods (UPFs), despite often being marketed as healthy options.”

As Marlana Malerich, co-founder at the Rooted Research Collective and a food systems researcher with expertise in UPFs, points out: “Plant-based meat and ultra-processing have become topics of contention, and their inclusion in these headlines is likely to garner attention.”

Like Malerich, a number of other health experts have criticised the coverage of the study. “This study may lead to more confusion in the real world,” said a group of experts from the London School of Hygiene & Tropical Medicine. “Emerging evidence has shown positive outcomes for plant-based meat alternatives and studies that do not segregate health outcomes from different UPF categories become misleading.”

Consider this: practically everybody eats bread and biscuits – no matter if you’re a meat-eater, pescetarian or vegetarian. The study is saying that if you increase the amount of bread and biscuits (and cakes and pastries) by 10% in your diet, this is not good for you. It’s fair to assume that most people know that. Again, plant-based meats made for less than a hundredth of participants’ diets in the study – so it’s not really the UPF group people should be focusing on with respect to these results.

Experts disagree with UPFs and Nova classification

Hilda Mulrooney, reader in nutrition and health at London Metropolitan University, pointed out how the study relies entirely on the Nova classification system, over which a number of concerns have been raised, “particularly that it assumes that the health implications of a foodstuff are based only on the degree of processing, rather than their nutritional content”.

The Nova classification was always meant to be used as a yardstick for the processing of a food product, not its health implications. But more and more people are doing the latter, despite warnings from multiple scientists.

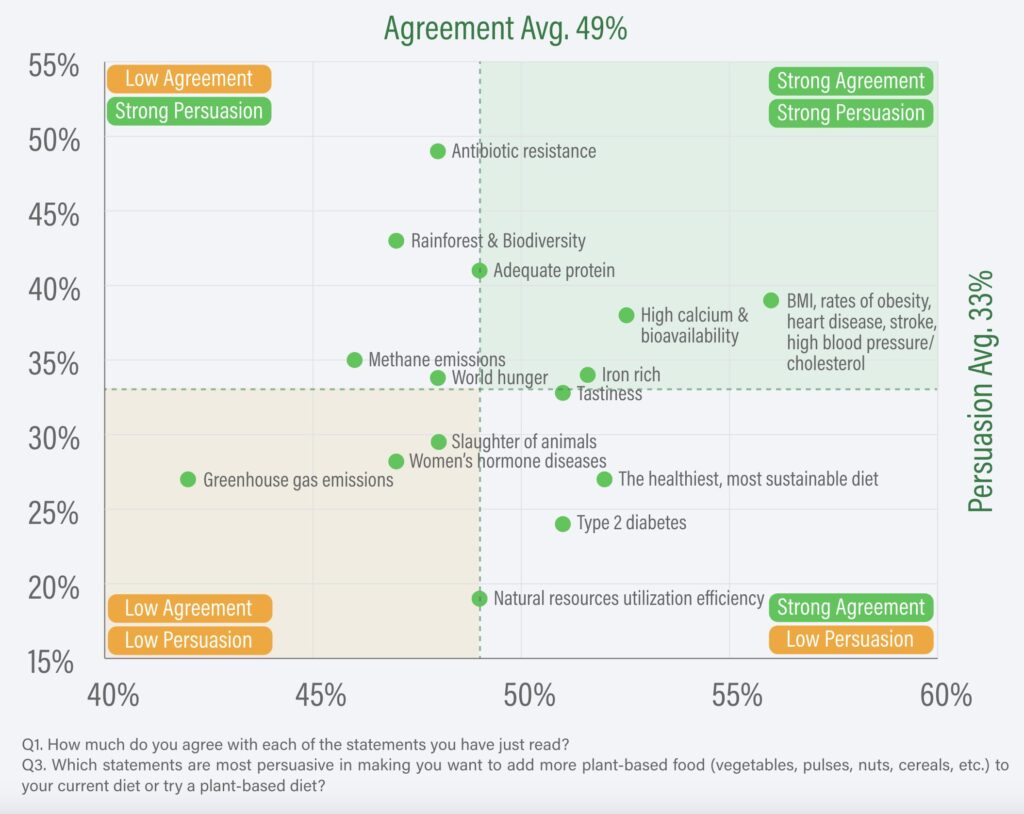

“Even experts do not agree on the Nova categorisation – a study found only around 30% agreement on the placement of foods within Nova categories among food experts, suggesting the food categorisations used across studies almost certainly use different criteria for different foodstuffs,” Malerich tells Green Queen.

For example, beer, wine and cereals are considered non-UPFs, but tofu is considered ultra-processed. “This suggests to me a lack of understanding of principles of food production and nutrition in the classification system, as essentially tofu – here classified as ultra-processed – can be made in a way similar to cheese, which the researchers said was non-ultra-processed,” said Duane Mellor, dietitian and spokesperson for British Dietetic Association.

Most of the coverage of this study also excludes the researchers’ conclusion, which states that dietary guidelines promoting a plant-sourced diet should emphasise the reduction of meat, red meat, or animal-sourced foods, alongside the “need to avoid all UPFs”. Malerich takes issue with that last bit, given the disagreement over the Nova classification.

“There are alternatives to Nova that are actually quantifiable, such as NutriScore and a new hyper-palatability categorisation based on ratios of fat, salt, sugar, and carbs. Why do we persist in using Nova when it is not a quantifiable nutrition metric?” she outlines.

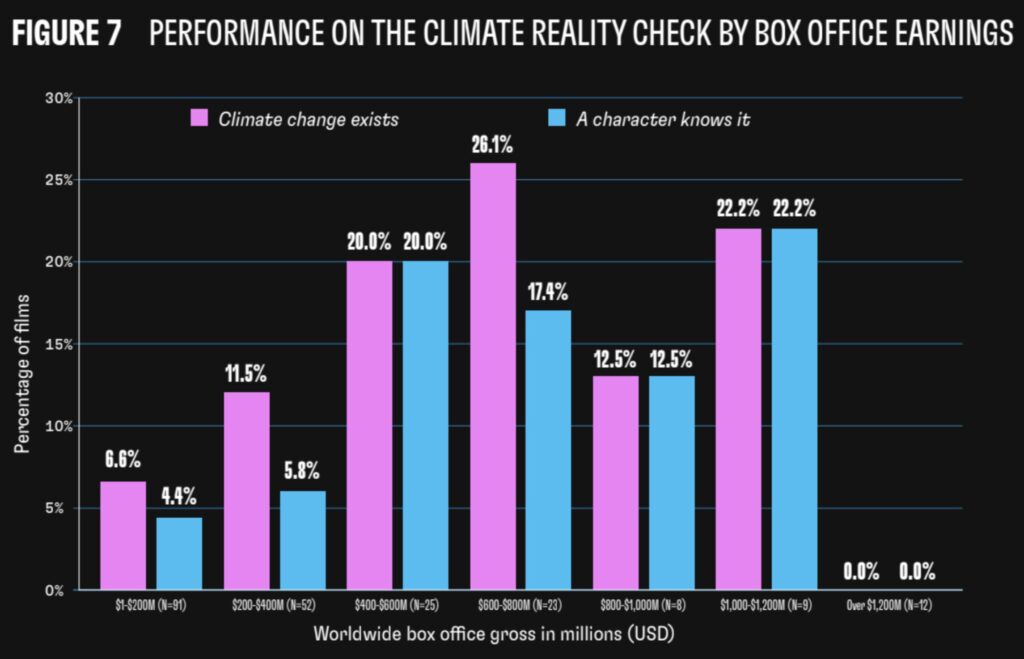

Media amplifies culture wars despite focus on outdated plant-based meat

Let’s focus on the plant-based meat bit for a second. The UK Biobank’s data was collected between 2007 and 2010, with participants interviewed about what they ate in the last 24 hours at least twice between 2009 and 2012. Their hospital and mortality records were then monitored, and researchers followed up with them nine years later on average.

So for anyone still perturbed about the 0.2% of meat analogues – these are products that existed in 2010. The plant-based industry has had more than a few transformations since then. In 2010, Beyond Meat was still two years away from the market (and eight years from entering the UK), Impossible Foods didn’t exist, and Quorn and Linda McCartney’s were really the only major meat analogue makers in Britain.

Startups like THIS and VFC – which are going from strength to strength – only launched towards the end of the follow-up period. Plant-based meat makers are increasingly reformulating their products to be healthier, cleaner-label and more nutritious. They’re doing that now, in 2024. You cannot apply the results of a study analysing products from 2010 today – that makes no sense.

But of course, publications like the Telegraph will continue the pile-on on these products, exacerbating the culture wars between the right and the left that outlets like it brewed up in the first place.

Platforming people like Blackett is on brand. This is a man who has previously been accused of harassing campaigner Chris Packham at a time when he was receiving death threats for speaking out against bird shooting. Blackett has a tendency to associate meat-free eating with death.

Last month, he wrote a column titled “Vegetarians must have a death wish – for themselves and the planet”, where he called out “pea protein gloop burgers” and “oat juice lattes”. “I refuse to call them ‘meat’ or oat ‘milk’,” he wrote. He’s cool like that.

Following the study, he penned an article headlined: “Vegans are slowly killing themselves.” Here, he said he didn’t “subscribe to the NHS-in-crisis narrative”, completely choosing to ignore the peak waiting lists and lack of supplies at the cash-strapped National Health Service. Which, incidentally, could save a lot of money if people went plant-based, according to another study.

“There’s nothing healthy about ultra-highly processed fake ‘meat’ products,” the introduction to the latter column read. It sums up the problem. 1. Ultra-processed doesn’t automatically mean unhealthy, 2. A lot of plant-based meat products are actually healthier than conventional meat, and 3. With this logic, why are we ignoring ultra-processed animal-derived meats? You know, the ones that the WHO has called carcinogenic?

London Met’s Mulrooney hit the nail on the head, saying: “Although some may assume the message of this study is that all ultra-processed plant-based foods are bad for health, I think that in fact what the evidence in the study actually shows is that poor diets are associated with increased risk of chronic diseases.”

The post Those Headlines Linking Plant-Based Meat to Heart Disease are Deliberately Misleading appeared first on Green Queen.

This post was originally published on Green Queen.