Florida governor Ron DeSantis has signed a bill to ban the sale and production of cultivated meat in the state, in a news conference that poked fun at the World Economic Forum. The alternative protein industry says it’s “reckless” and sends a “terrible message”.

All it took was 24 hours. Ron DeSantis couldn’t wait to sign the much-debated SB 1084, a bill that was headlined by a ban on cultivated meat in Florida.

“Some people think Florida is theme parks, South Beach and maybe some oranges, but they don’t understand that we have one of the top cattle industries in the country,” the governor said in a press conference surrounded by cattle ranchers in Hardee County. “What we’re protecting here is the industry against acts of man, against an ideological agenda that wants to finger agriculture as the problem, that views things like raising cattle as destroying our climate.”

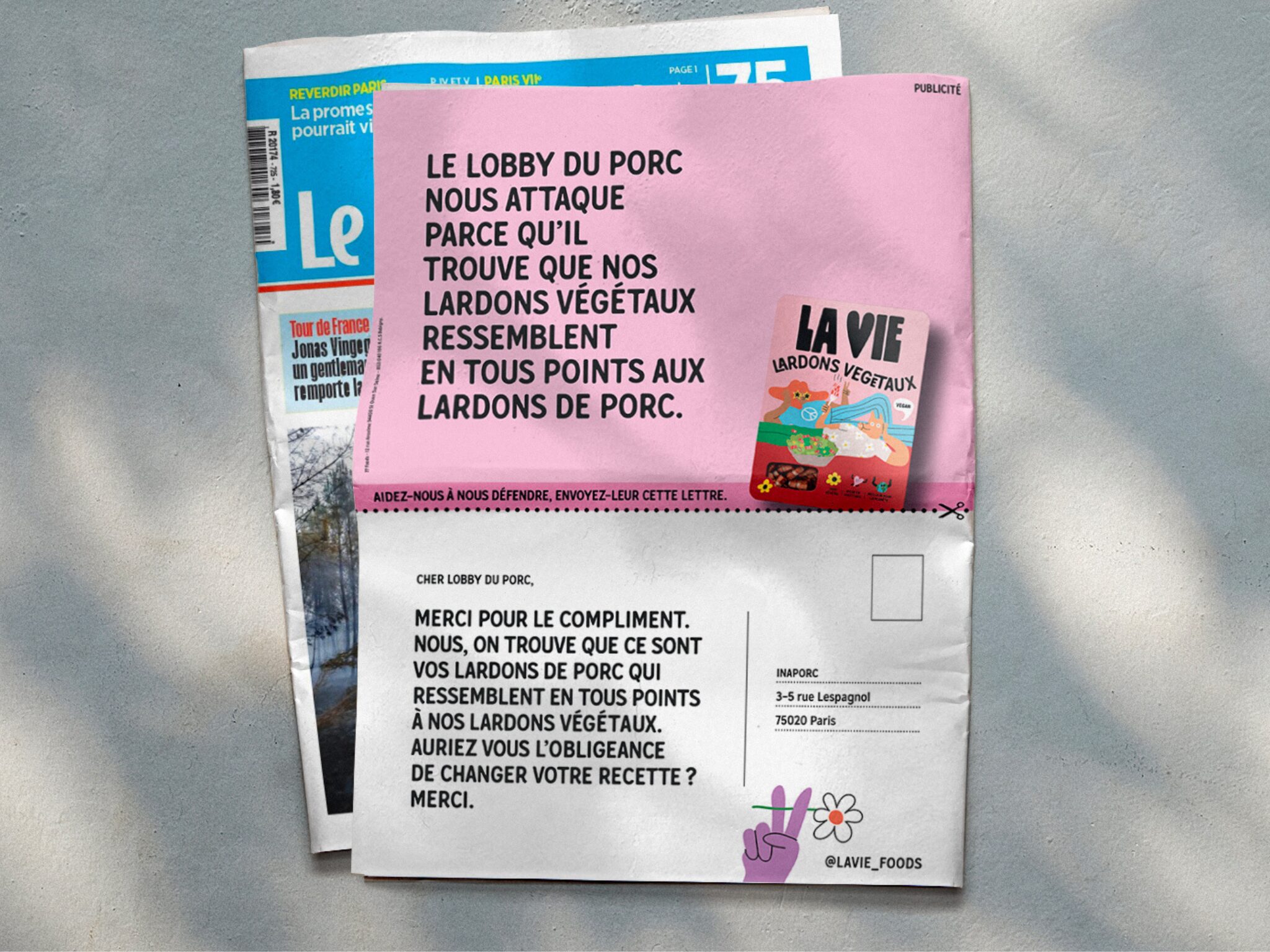

DeSantis was stood behind a banner that read ‘Save Our Beef’ in the style of the World Economic Forum’s logo. The organisation has previously outlined the importance of alternative proteins to meet the needs of a population that will reach 10 billion in 2050 and combat the changing climate. “I’m sure they’ll say: ‘Hey, wait a minute, just hear us out before you say yuck,’” said DeSantis. “I say Florida has heard enough on that.”

Taking aim at the “liberal elite”, he added: “Take your fake lab-grown meat elsewhere. We’re not doing that in the state of Florida.”

The bill makes it a second-degree misdemeanour to manufacture, transport, commercialise or sell cultivated meat. Businesses can have their licences revoked and receive an immediate stop-sale order. All in a state where meat production continues to rise, with half of its land set aside for cattle farming.

Pointing to these regulatory approvals, Pepin Tuma, legislative director at alternative protein think tank the Good Food Institute (GFI), said: “Why are politicians with no experience in food safety interfering where they don’t belong?” In doing so, he argued that these lawmakers are “foreclosing innovative investments that would actually create opportunities for Florida farmers”.

It’s a “reckless” move that “ignores food safety experts and science, stifles consumer choice, and hinders American innovation”, according to Sean Edgett, chief legal officer at UPSIDE Foods, the other company approved to sell cultivated meat in the US.

Why Florida decided to ban cultivated meat

SB 1084 was introduced by Republican state representative Jay Collins in the Senate at the end of last year. “There are many concerns right here and, until we have those studies and there’s proof positive that this process is going to work, we want to ban this in the state of Florida because it’s just not there quite yet,” said Collins.

The bill has gradually moved through both chambers of the Florida government, with the Senate voting 29-10 in favour in late February, followed by an 86-27 vote in the house a week later. It reached DeSantis on Tuesday, who could either sign or veto the bill within 15 days, though he was widely expected to do the former.

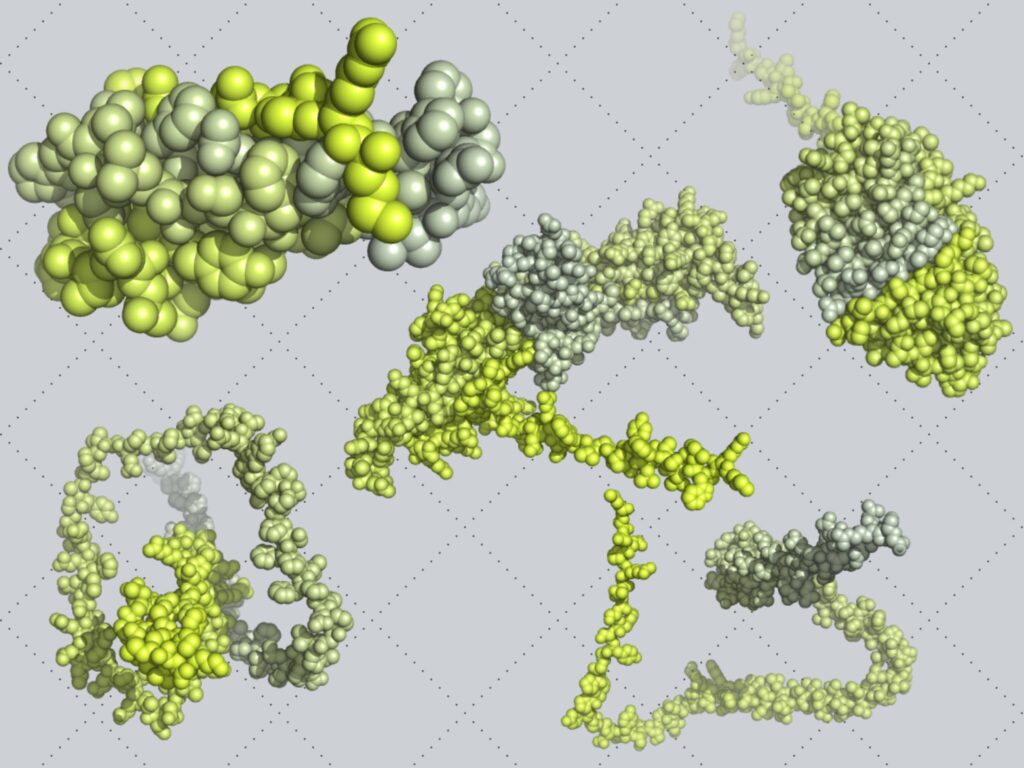

“Today, Florida is fighting back against the global elite’s plan to force the world to eat meat grown in a petri dish or bugs to achieve their authoritarian goals,” he said, painting a misrepresentation picture of how cultivated meat is produced. At a scale large enough to sell to consumers, these proteins are grown in bioreactors, not petri dishes. “Our administration will continue to focus on investing in our local farmers and ranchers, and we will save our beef,” added DeSantis.

Florida’s agricultural commissioner, Wilton Simpson, called cultivated meat a “disgraceful attempt” that undermined “authentic agriculture”. “Who wants to have a biomass shipped to their house, put into a tank, grown in a lab, and then put it through a 3D printer to make it look like a steak you want to eat?” he said at the conference, seemingly bundling three different processes of making alternative proteins into one.

As GFI’s Pepin underlined, politicians have a lack of expertise on these subjects. But they’re playing food police instead of choosing innovation, economic growth and consumer choice. This is echoed by Edgett. “This is a protectionist policy for entrenched interests, violates free market principles, and limits consumer choice,” he said, adding that Florida was “choosing winners and losers when they should let consumers make their own decisions about what to eat”.

Pepin agreed that Floridians should not be limited by government overreach: “The Sunshine State’s eccentric decision casts a long shadow on its laudable ambition to keep the state open for business.”

Cultivated meat ban closes off investors and jobs

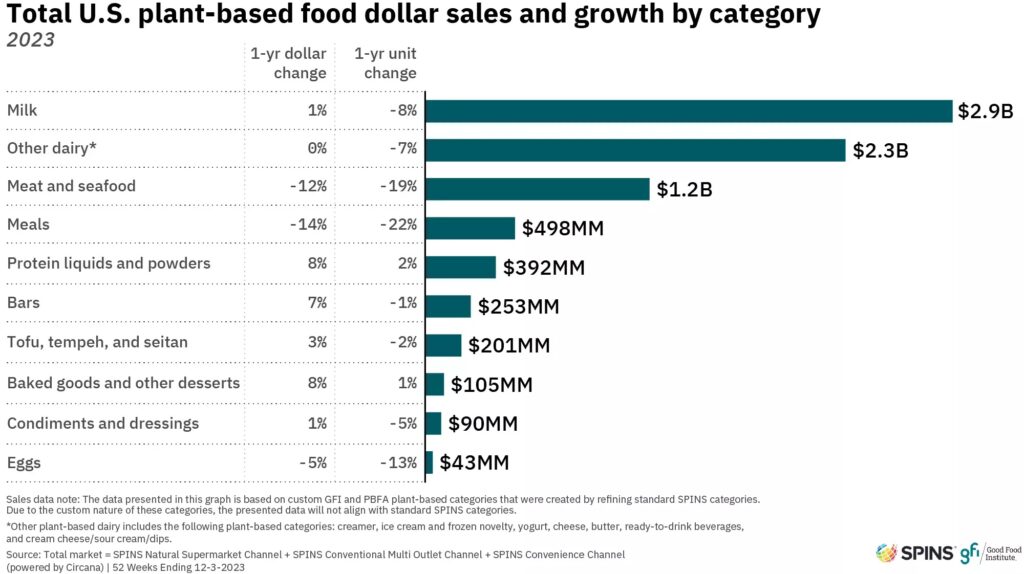

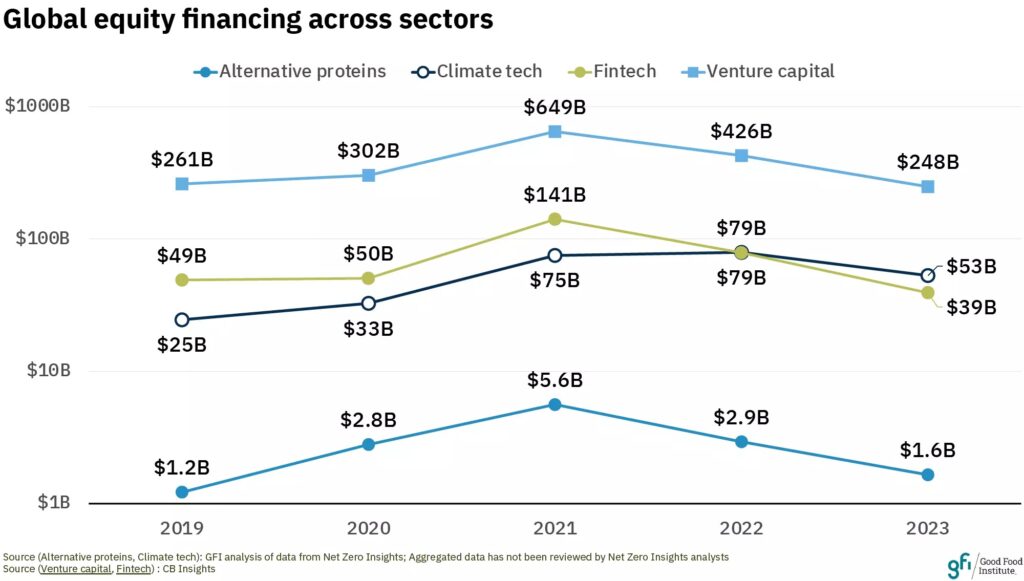

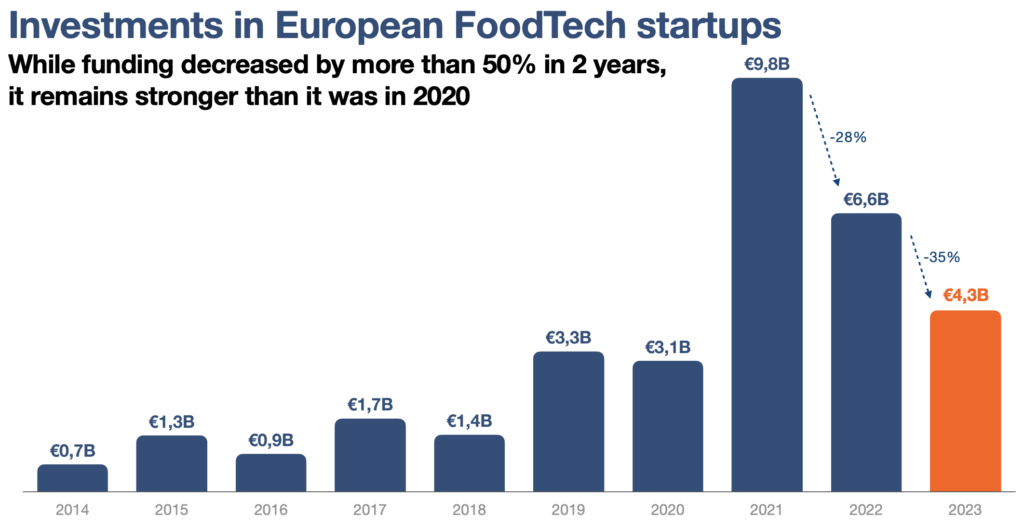

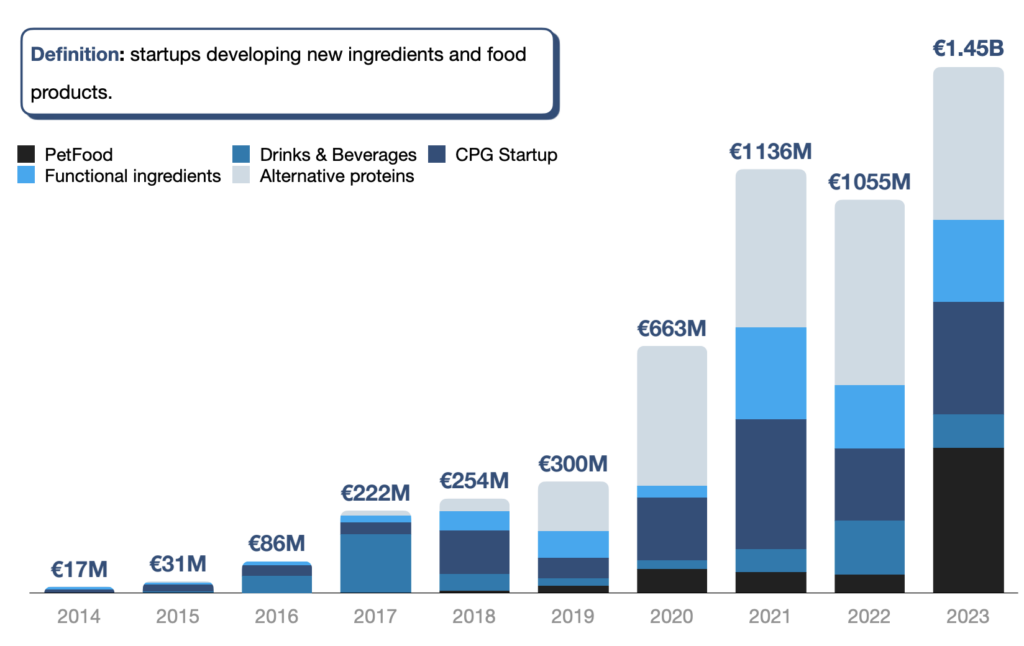

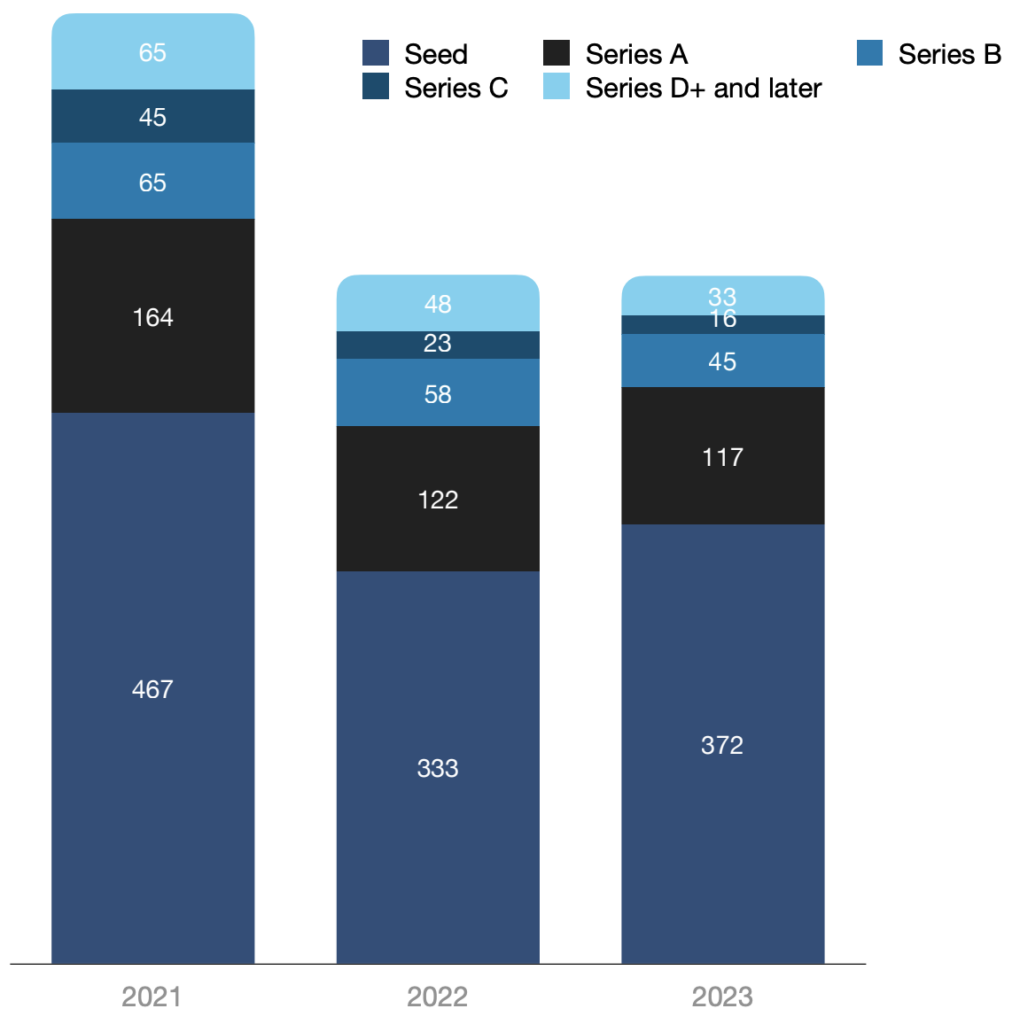

Like the larger food tech and venture capital space, cultivated meat has already been suffering from a dip in investments globally. According to GFI, funding in this category dropped by 75% in 2023. And so far, the first quarter of this year has seen merely 5% of the $226M invested in the sector in the previous 12 months. It’s why VC firm AgFunder has earmarked cultivated meat as a “category to watch” this year.

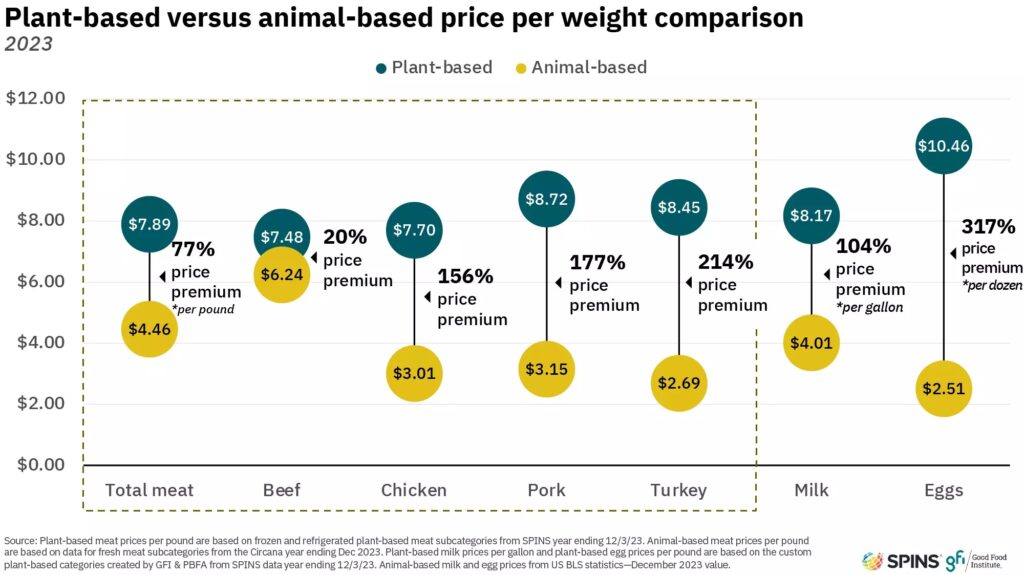

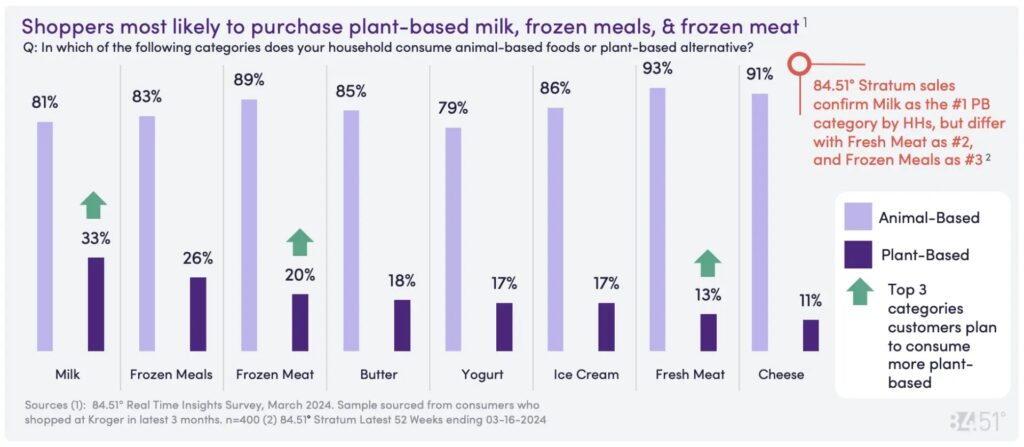

Florida’s ban has raised concerns over how investors will see this industry. “This bill sends a terrible message to the investors, scientists, and entrepreneurs that have built America’s global leadership in alternative proteins,” said Eat JUST’s Rossmeissl, noting that the law is a setback to consumer choice, as well as “Florida’s technology sector, innovators and entrepreneurs, and all those working to stop the worst impacts of climate change”.

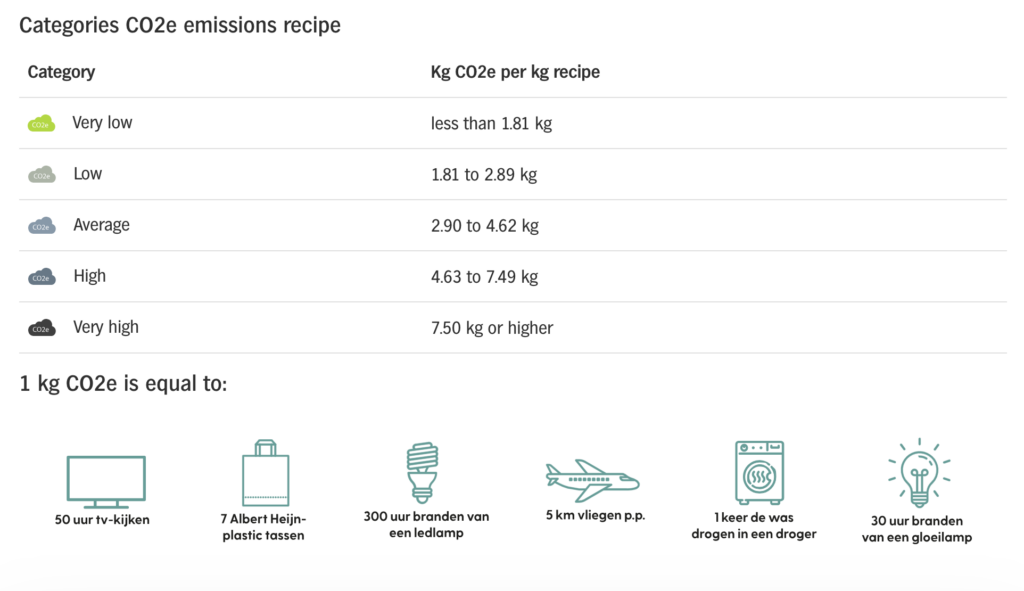

Meat production alone accounts for 60% of the food system’s total emissions globally, which itself make up a third of all human-caused emissions. Peer-reviewed studies have shown that cultivated meat is drastically better for the environment, with a life-cycle assessment (LCA) from 2023 revealing that cultivated meat is three times more adept at turning crops into meat than even the “most efficient” livestock. A similar LCA by GFI in 2021 suggested that cultivated meat produced via renewable energy can have a 92% lower impact on global heating, needs 95% less land, and uses 78% less water compared to conventionally farmed beef.

“A ban like this threatens a free market and sets a dangerous precedent for government interference,” Emily Bogan, head of business opportunities at cultivated meat company Fork & Good, told a House panel in February. “We want to ensure that affordable meat is available for generations to come.”

For all of DeSantis’s rhetoric about protecting American farmers and saving American jobs, industry members say this will have the opposite effect. Rossmeissl believes China will be celebrating, “as they are closer to overcoming our nation’s lead in this emerging sector”. This chimes with the comments of Justin Kolbeck, co-founder of cultivated seafood company Wildtype, who told the House panel that the ban “will deepen our country’s dependence on imports from countries like China” and “create Chinese jobs at the expense of small businesses like mine”.

And far from taking jobs, analysis from the ClimateWorks Foundation and the Global Methane Hub has found that the continued openings of cultivated meat facilities around the world could support up to 83 million jobs by 2050.

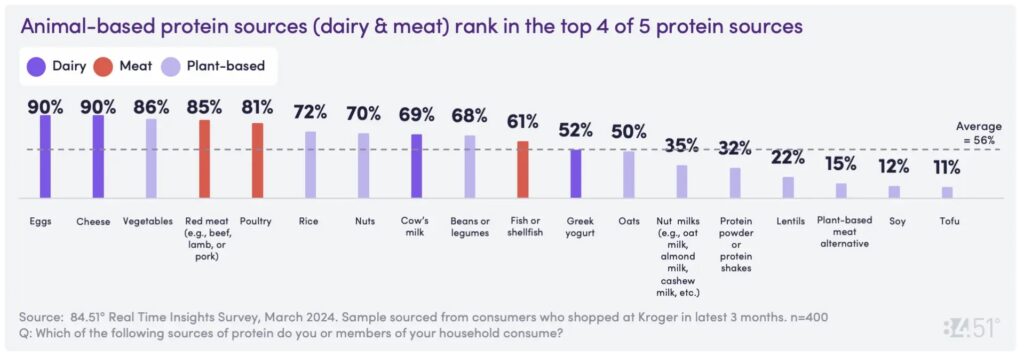

“Some of America’s largest meat companies have been early investors in cultivated meat,” said UPSIDE Foods’ Edgett. “They recognise cultivated meat’s potential to complement conventional meat production, improve supply chain resilience, and ensure American’s access to meat as global demand for animal protein is projected to double by 2050. Florida’s ban is an affront to progress and job creation. Florida should embrace scientific and technological innovation.”

Despite fears of a domino effect, startups remain positive

Before passing the ban, Florida’s lawmakers did make one amendment. They removed a stipulation that would have prohibited research on cultivated meat from being carried out in the state, out of concerns that this could affect the space industry, which is looking at cultivated meat for long-term journeys.

However, it’s the first state to officially prohibit the sale of cultivated meat in the US, and after Italy, only the second government globally to do so. It’s far from the only American state to have attempted this in the first place, though: Alabama, Arizona, Wisconsin, Texas, Nebraska, Tennessee and Florida have all proposed various types of bans on cultivated meat. In fact, just last week, the Alabama House passed a bill similar to Florida’s, and its counterpart in Arizona did so for a restriction on product labelling (no cultivated meat has made it to retail so far, anywhere in the world).

Florida itself has had two other attempts. Tyler Sirois’s HB 435 died before it reached the Senate, but Danny Alvarez’s HB 1071 is being contemplated in the House. The fear is that the passing of SB 1084 could create a ripple effect across America, where other states could use it almost as a precedent to introduce their own bans. DeSantis himself said so at the press conference, noting: “There have been other countries… that have said no, I think there’s going to be more states that are increasingly going to say no.”

But you only need to look at the response from the North American Meat Institute, the country’s oldest and largest trade association (representing 95% of the US’s meat output), to gauge that this is not a good idea. In a letter sent to DeSantis in March, the group called the ban “bad public policy”. “These bills establish a precedent for adopting policies and regulatory requirements that could one day adversely affect the bills’ supporters,” it said, emphasising the importance of consumer choice.

“Cultivated meat has been deemed safe to eat by experts from the USDA and FDA, so this is not a move to protect Florida’s consumers,” said Edgett. “We’re ready to build a better food future together.”

Like UPSIDE Foods, other cultivated meat companies remain positive. Rossmeissl said that while Eat JUST was disappointed about the ban, it would not stop the development of cultivated meat. This was echoed by Wildtype’s marketing VP, Jenny Berien, and fellow cultivated seafood company BlueNalu’s associate director of corporate communications, Mia Montanile.

They are co-chairs of US cellular agriculture alliance the Association of Meat, Poultry and Seafood (AMPS) Innovation. In a joint statement, they noted that despite the ban, there “continues to be widespread recognition” of cultivated meat’s benefits, including protein supply consistency and enhanced food security. “Recognising the need to diversify our protein sources in the face of growing demand and finite resources, many nations around the world and leaders in the incumbent agricultural industry are supporters and even investors in the cultivated meat and seafood industry,” they noted.

“Bringing new, innovative sources of protein production to the table is critical to bridge the gap between global supply and demand,” they continued. “With its deep roots in agricultural innovation, the United States is well-positioned to lead this next chapter in sustainable protein production – a chapter powered by a diverse community that includes regenerative farmers, ranchers and fishers, as well as innovators in animal cell cultivation. To feed a growing world using fewer resources, we’ll need more agricultural innovation, not less.”

The post Florida Officially Bans Cultivated Meat as Governor Mocks World Economic Forum appeared first on Green Queen.

This post was originally published on Green Queen.