In our weekly column, we round up the latest news and developments in the alternative protein and sustainable food industry. This week, Future Food Quick Bites covers a new vegan nail brand by Nicki Minaj, cocoa-free easter eggs, and next-gen plant-based fur.

New products and launches

Rapper Nicki Minaj has launched a luxurious vegan press-on nail brand, Pink Friday Nails, which can be customised for shapes and lengths. The products retail between $19.99 and $24.99, and are available both in the US and internationally through the e-commerce site.

US animal-free dairy brand Bored Cow has rolled out a line of drinkable yoghurts made from Perfect Day’s precision-fermented whey protein. Coming in vanilla, passionfruit-mango and strawberry flavours, these will be on shelves in New York City this month, priced at $2.99 to $3.99 per 7oz bottle.

Also in the US, cream cheese giant Franklin Foods’ vegan SimplyV range has entered retail stores in original, strawberry, and onion and chive flavours, starting with independent grocers nationwide.

After announcing the deal during its Q4 earnings call, Oatly has partnered with fitness company Barry’s, whose Fuel Bars will carry the oat milk maker’s Unsweetened Oatmilk across the US until April 22.

Fellow Swedish plant-based milk maker Sproud is sponsoring the Latte Art Live competition at this year’s London Coffee Festival (April 11-14), where baristas will pour latte art with its barista pea milk.

Baby oat milk, anyone? New Zealand nutrition brand Haven has unveiled what it claims is the world’s first oat milk for toddlers. Comprising the same amount of protein, carbohydrates, fats, vitamins and minerals as its other A2 cow and goat milk protein formulations, the product will roll out in Australia this month, and in the US in Q3 2024.

Meanwhile, discount retailer Aldi has introduced its own-label My Vay brand of plant-based dairy products to the Netherlands, unveiling them during the country’s Week Without Meat and Dairy (March 4-10).

In Finland, vegan dairy brand Ilo has rolled out high-protein versions of its cashew pudding in chocolate-caramel and vanilla flavours, with each 200g boasting nearly 20g of protein.

Following the launch of its vegan Snickers- and Milky Way-inspired chocolate bars in January, Harken Sweets has rolled out a high-fibre, better-for-you oat milk chocolate with salted pretzels, called The Crunchy One. It’s available on its e-commerce sites and retailers including ShopRite and Fairway, with a “significant national retailer launch” slated for Q2 2024.

Speaking of chocolate, Italian cocoa-free chocolate brand Foreverland has launched its carob-based Freecao Easter Eggs in hazelnut and pistachio flavours, alongside a collaboration with local startup Nebra Skay Studios on a 3D-printed, low-waste pouch called Beggs. Get it?

Eleven Madison Park‘s Daniel Humm is reuniting with his former chef de cuisine James Kent with a one-night-only vegan menu at the latter’s Michelin-starred Crown Shy eatery in New York City on March 25.

The UK, meanwhile, just witnessed the opening of its first vegan theatre on an organic farm near Canterbury. Only plant-based food will be available at the 300-capacity Garlinge Theatre, where firs productions will start next month.

German urban farming startup Tupu has partnered with the Rewe Group, which will stock its mushrooms across several retail stores in Berlin.

Belgian biomimetic vegan collagen maker VeCollal has entered the functional snacking sector with a white-label, high-protein bar for the beauty and active nutrition markets, made in partnership with Dutch health startup CollaVegan and German manufacturer Alphacaps.

French materials startup Ecopel has launched a 100% plant-based, chemical-free fur called Flur, which uses natural dyes and is being positioned as an evolution out of the traditional faux fur category.

And in India, pharmaceutical giant Mankind has introduced a vegan and cruelty-free condom range as part of its new Manforce Epic brand

Finance and company updates

In Germany, conventional and plant-based meat manufacturer Rügenwalder Mühle has inked a sponsorship deal with the Hamburg SV, following its partnership with another Bundesliga club, Borussia Dortmund, in January.

Barcelona-based food tech startup Poisedona has secured over €1M in pre-seed funding led by Faber, which will help advance the development of its protein ingredients made from algal sidestreams and invasive seaweeds.

California’s Tierra Biosciences, which develops AI-led cell-free technology for high-throughput custom protein synthesis, has raised $11.4M in a Series A round.

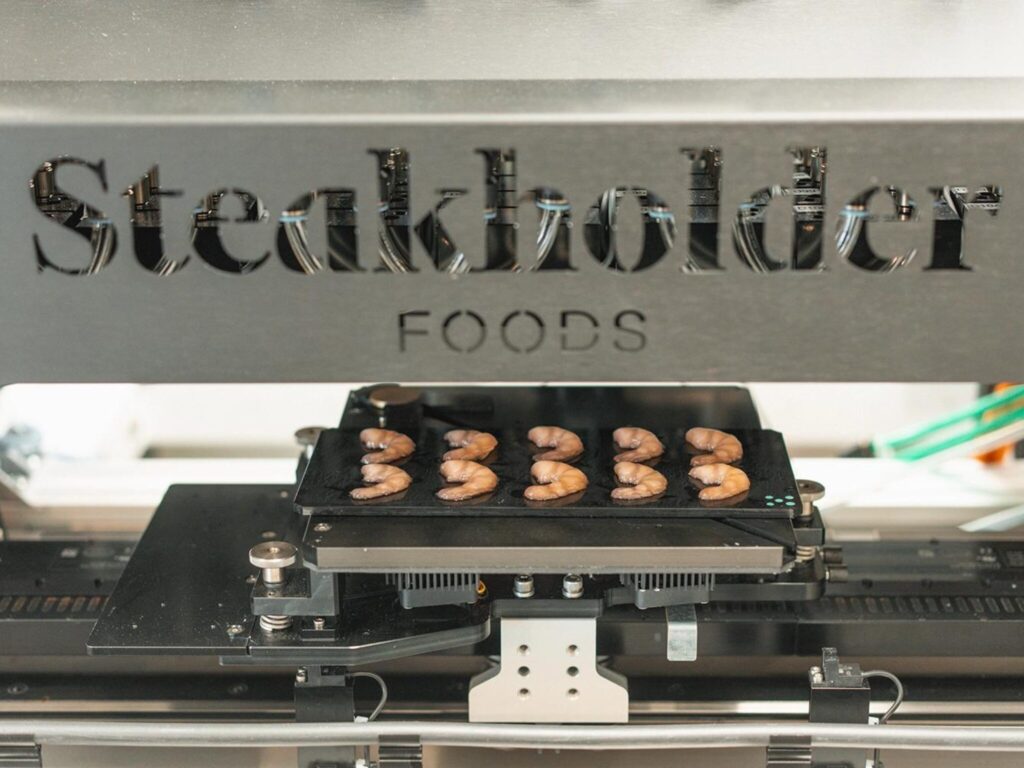

Israeli 3D-printed meat producer Steakholder Foods has received a payment of $220,000 from the Singapore-Israel Industrial R&D Foundation (SIIRD), the first phase of a maximum $1M SIIRD grant.

In New Zealand, Andfoods – a spinout from Massey University and the Riddet Institute – has raised $2.7M in a seed financing round to accelerate R&D and market launch plans for its fermentation-derived dairy alternatives made from legume seeds.

Andfoods will also be part of Future Food Aotearoa‘s delegation at the Future Food-Tech Conference in San Francisco this week (March 21-22), alongside fellow New Zealand companies Daisy Lab, Opo Bio, NewFish, Mirüku and Ārepa.

In some sad news, popular San Francisco vegan eatery Baia will be closing its doors on March 30, but the company hasn’t yet provided an explanation why.

Danone says that last year, it discontinued the Silk Nextmilk and So Delicious Wondermilk lines it introduced in North America in 2021, although the products have been spotted in stores this year.

Meanwhile, Belgian brand Nomet, which makes seaweed-based croquettes, has brought in An-Sofie Geerardyn as a co-founder.

Policy, manufacturing and awards

The students’ council at Newcastle University has voted to move towards 100% plant-based catering, starting with at least half of all food at ticketed events being vegan. It’s part of the Plant-Based Universities campaign, which has seen 10 other institutes make similar moves.

The governments of Northern Ireland and the Republic of Ireland have announced the Shared Island Bioeconomy Demonstration Initiative, a €9M funding scheme to support bioeconomy innovation and solutions in the agriculture and marine sectors.

At the Green Horizons Summit 2024, government body Innovation Agency Lithuania signed an MoU with trade association Cellular Agriculture Europe to support the Baltic country’s efforts to build a “robust complementary protein ecosystem”.

Scientists at California’s Lawrence Berkeley National Laboratory have developed a way to genetically modify koji mould to produce compounds that recreate the taste and texture of meat.

Speaking of which, Prime Roots, which makes charcuterie and deli meats from koji, has won a National Restaurant Association FABI Favorite Award for its Prime Roots + Fabrique Delices Black Truffle and Harvest Apple Koji-Pates, as well as a second recognition for its Koji-Foie Gras.

Finally, Crafty Counter’s WunderEggs range of plant-based eggs has won the first prize at the 2024 Albertsons Companies Innovation Launchpad competition, beating out 59 other companies and receiving a $163,000 cheque in the process.

Check out last week’s Future Food Quick Bites.

The post Future Food Quick Bites: Nicki Minaj’s Nails, Vegan Condoms & Animal-Free Yoghurt appeared first on Green Queen.

This post was originally published on Green Queen.